Blended Finance

This is a longer read. But please do stick with it, as it’s important - especially if this thesis is correct, which I at this stage see no serious reason to call into question.

If you’re already well versed in what took place in 2008, you can skip the first part, provided you’re aware of the role CDOs played in the crash. I would however request you start from the ‘executive summary of above’, which you can find about halfway down.

-

It’s been only 15 years. But in some ways, the biggest lessons of the ‘Great Recession’ appears to have been already forgotten. Consequently - and also for the benefit of those too young to have lived through it - let’s briefly recap -

In 2001, the world experienced a sharp contraction following the dot-com bubble bursting. It was a time where the likes of pets dot com would lose money on a sale, but ‘make it up through volume’. And Swedish clothes retailer, boo dot com, burned through $135m in 18 months. The contraction ended around 2002, with Krugman suggesting the Fed should blow up a housing bubble to taper the dot-com.

And yes, Krugman really did say that, regardless oh how much he doth protest.

‘Financial alchemy’ was a term commonly heard during those days, describing a number of financial inventions of which one in particular managed to create triple-A rated securities on basis of odious, stinking piles of subprime mortgages. See, not only is ‘AAA’ the highest investment grade, but that rating is also a prerequisite for pension funds to enter. In other words, with triple A you get whales like CalPERS buying.

First off, subprime really was trash. In general, those taking out said mortgages would receive a cheap, initial teaser rate, after which the interest rate would balloon, and the home owner would be required to remortgage.

But as long as the market was good, what could possibly go wrong?

However, said mortgates were risky. Very risky. Consequently, the market for said was small. So to fix this issue, they came up with a solution - they pooled a large quantity of terrible subprime mortgages, and this became a CDO - a collaterised debt obligation - which would further be tranched into several pools, arranged in a way where the least risky pool would receive their interest payments first, and then the second least risky, all the way down to the very bottom - a tranch, which would also be the first to take losses.

To compensate, the bottom tranch received higher yields - interest rates - to compensate for higher levels of risk taking. The more risk, the higher reward. That’s generally how it all works.

The genius here was that the top pools would receive a triple-A rating by complicit ratings agencies, competing for business - and consequently, pension funds would buy. And amazingly — upwards of 65% of CDOs tranches were rated triple-A!

There was just one problem.

See, the market started creaking as two Bear Sterns hedge funds collapsed in May, 2007, along with a later, rushed bailout of Northern Rock in the UK. And as interest rates eventually increased, subprime mortgage owners failed to refinance, payments ballooned, and they defaulted en masse. And first to take losses were the bottom tranches, but eventually, even those rated triple-A proved to be anything but.

Eventually, the shock reached Wall Street itself, with Lehman Brothers - founded in 1850 - outright collapsing, and the likes of Bear Sterns and Merrill Lynch forced into shotgun marriages with JP Morgan and Bank of America.

Ultimately, Ben Bernanke - Chairman of the Federal Reserve, who in the run-up repeatedly denied a problem even existed - and Hank Paulson went to Capitol Hill, demanding $700bn in bailout funds, which naturally they received -

I could further dive into credit default swaps, which in effect serve as insurance policies on said assets, but they’re not really of interest to this story. Read up on AIG, with a particular focus on their London office. Their bailout quickly rose to just short of $200bn, with the taxpayer on the hook for every penny.

And finally, the role of synthetic CDOs or CDOs squared - though all very interesting - ultimately are also not relevant in this context. But I would recommend ‘The Big Short’ which covers the essentials, ‘Inside Job’ if you prefer documentaries, and finally ‘Margin Call’ if thrillers are more your thing. All three are exceptional movies, though as the latter stars Kevin Spacey, it might not be to everyone’s liking.

But the scariest thing about all of this is not so much that no-one ever went to jail, regardless of the obvious criminality on display. It’s that not only does history appear to repeat - it appears to have become weaponised as well.

-

In 2022, a blog post on none other than IMF’s very own website appeared which described in two words only was shockingly honest. Titled ‘How Blended Finance Can Support Climate Transition in Emerging and Developing Economies‘, it was meant as a primer, letting you in on how the climate transition of the third world will be financed, and I quote -

‘Unfortunately, private climate finance faces multiple constraints, from future policy uncertainty and technological costs that raise the cost of capital to other barriers such as data limitations and unattractive risk-return profiles. Despite these challenges, private climate finance can help emerging economies meet Paris Agreement goals.‘

In short, the risk to reward scenario is terrible. High risk - low reward. They would rather invest their money elsewhere.

‘Innovative financing instruments can attract investors with different risk profiles and investment horizons,‘

In order to attract private climate finance, they have to bend the rules slightly…

‘Multilateral development banks and international financial institutions have a crucial role to play to attract much larger sums of private capital‘

The development banks have a role to play here, think World Bank, and the various International Development and Reconstruction banks - all of which are funded through taxpayer funding.

Now, are you ready for the shockingly honest part?

‘By agreeing to be first to endure losses in green funding vehicles and securitizations development banks can increase the expected risk-adjusted return for private investors.’

Per CDO description above, in short it means that the development banks take the riskier tranches… which should lead to higher reward through interest rate.

’With appropriate governance, public backing can help avoid moral hazard associated with guarantees, which involve risk that gains are privatized while losses socialized.’

We heard that a lot in 2008; Heads, I win, tails, you lose.

’Advanced economies could back public equity as a wav of delivering on their annual $100 billion commitment to emerging and developing economies.‘

In other words, the wealthy nations pay.

‘…, equity investment can effectively leverage public money. Commitments by development banks are matched by less than a third of the amount from private sources for emerging and developing economies, on average.‘

… aaand cut. We have been repeatedly told that we need private sector investments, due to the scale of financing required. But right here, this expressly states that less than 25% of the total pie is financed by the private sector.

In reality, not only is this percentage far lower, but it is also highly location specific, meaning the riskiest propositions - generally those in MENA - go ignored. Well, apart from the incredibly dumb taxpayer.

Oh wait — that’s me through proxy!

And to address specifics here, MENA really is not in favour with private investors - meaning the vast majority of capital comes courtesy of the Western taxpayer -

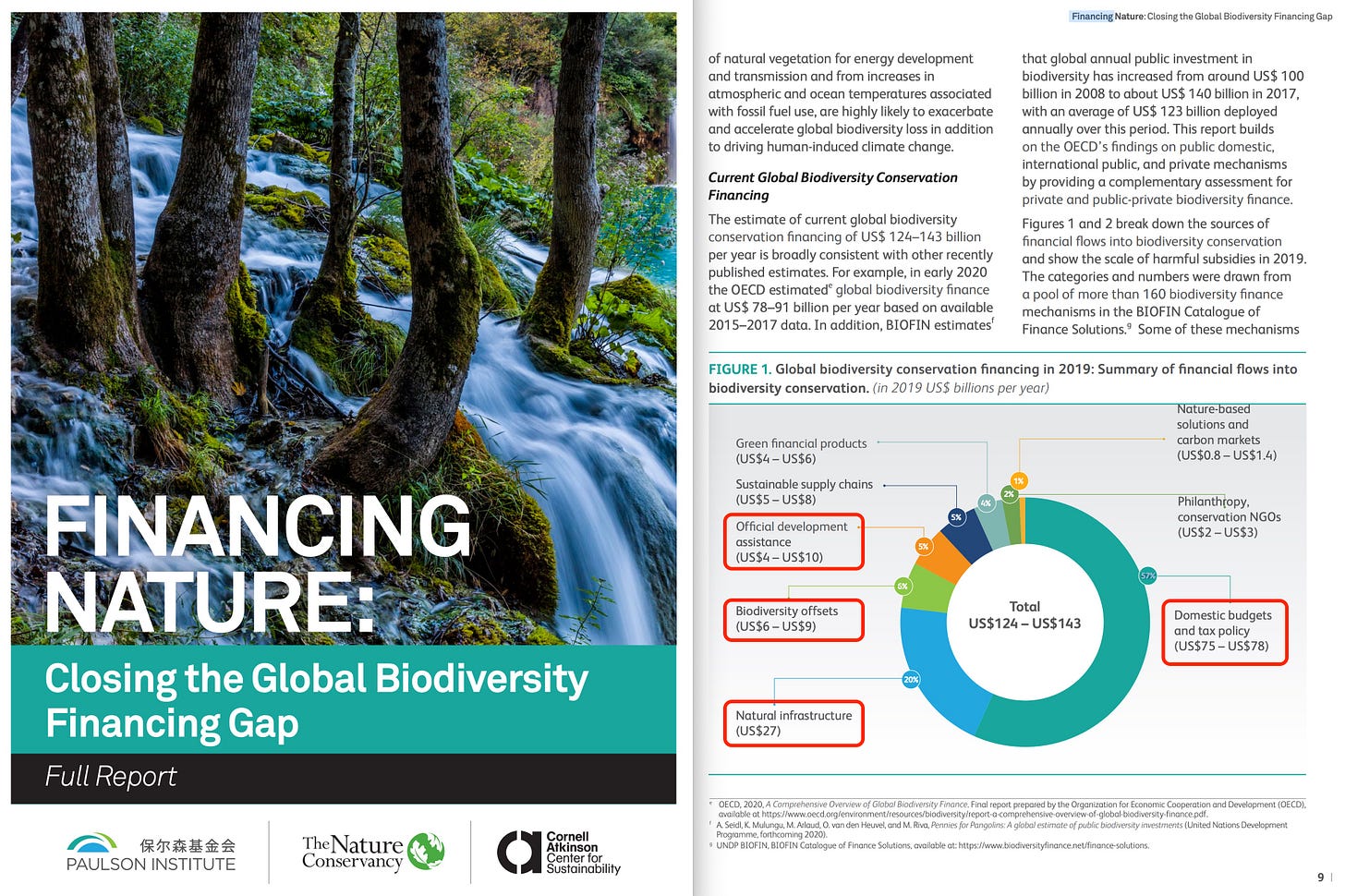

Next, let’s have a look at the scale of financing. Conveniently, Hank Paulson - who demanded the $700bn bailout - did the hard work already, via his institute’s 2020 report; ‘Financing Nature - Closing the Global Biodiversity Financing Gap‘. I’ve sourced this report before in the context of sources of subsidy, but this time, we’ll look into sources of financial flow.

We see -

57% — Domestic budgets and tax policy

20% — Natural infrastructure

8% — Biodiversity offsets

5% — Official development assistance

5% — Sustainable supply chains

4% — Green financial products

2% — Philanthropy, conservation NGOs

1% — Nature-based solutions and carbon markets

Now, let’s find out who actually sponsors said.

The public wholesale sponsors domestic budgets (57%), natural infrastructure (20%), and official development assistance (5%). Total: 82%.

The private sponsors… Green financial products (4%), Philanthropy (2%) - though this obviously relies on tax credits, and I will give them the Nature-based solutions (1%) because it’s not worth my time diving into. Total: 7%, likely less.

As for the rest - biodiversity offsets are an estimate, and consequently not reliable (but would also likely be paid to other private interests, meaning these should be net figures, not gross), and the sustainable supply chains again are a total stab in the dark.

What this means is that, likely, the genuine public subsidy is 82 out of 89, or 92%. And this would then make the private sector’s contribution 8%.

Now, if the private sector would like to furnish me with detail that biodiversity offsets and sustainable supply chains truly represent 13%, and cost is exclusively borne by said private sector (including evidence of the offsets being net figures), I’ll be happy to correct — but I seriously doubt they’ll take me up on that offer.

But this all sounds a tad odd, because that’s certainly not the message conveyed by the media. But rather than operate from faulty memory, let’s find a document on the matter, courtesy of the development finance institute in the world; the World Bank.

To sum up, the public sector is needed because… effective incentives, and concessional finance. Oh yeah, and a ‘supportive enabling environment’, though that relates to the incentives mentioned… but possibly more…?

As for the private sector, they are needed because… er… they might ‘encourage more sustainable operation’. Oh yeah, and then there’s that attractive risk-return profile.

In other words, the private needs the public, because they need a ‘sophisticated investor’ to rip off, much like they did in 2008.

And I don’t wish to single out Bank of America in this regard, as they were all guilty of said behaviour. This is just one of many, many stories on the matter.

And upon completing this, I found the confirmation I was looking for, courtesy of the International Finance Corporation.

‘We need the private sector, as the public can’t finance it all themselves’ — which is demonstrably a lie.

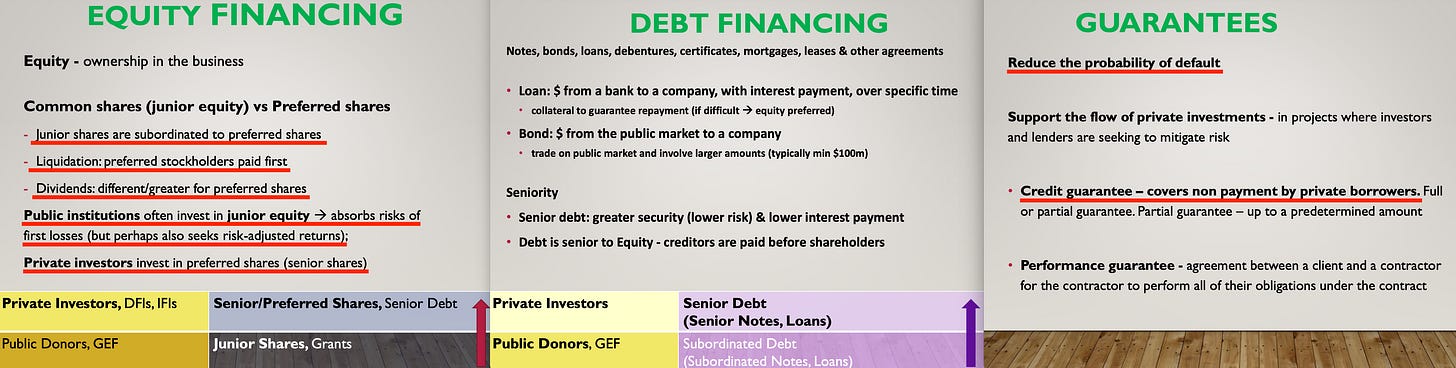

The next matter to deal with is that of yields. Because while we saw above that the riskier tranches are typically rewarded with higher interest rates, this clearly wouldn’t suit the private investors and their stellar 8% investment. And that’s where the next document, courtesy of none other than the GEF appears. This document was released in 2017, and is titled ‘Introduction to Green Finance’, and not only does it clear up the structure of investments, but it also deals with my next issue — that of bankruptcy.

First off, the lie about private capital being the biggest part is repeated - of course - the need to ‘attract’ even more stressed, and the two common types of asset classes are briefly outlined; equity (shares), and debt.

Now, in order for this to be beneficial, the private sector simply demands a return of 7%, or else the public will have to finance the remaining 8% all by themselves. However, there’s a problem - the project can only generate 6%.

Helpfully, the GEF outlines the solution for us - they will simply rob the public to pay the private - keeping a chunk for themselves of course. Ultimately, the private receives a 7% yield, the public will have to do with 2%, and there’s even a cherry on top for the GEF itself. Job done, what a super-great deal for the public, no?

But, wait - the issue still remains. Because riskier tranches of the CDO should yield a higher return. So how do we structure around this?

Tell you what, if instead the private invests in shares, then that problem should be overcome as share divideds are higher than debt interest payments, and by investing in senior tranches, the probability of default is also lower. Brilliant - risk has been transferred to the taxpayer, and the private even receives a higher interest rate for its hard work.

But just to make sure, the private of course would expect to be compensated regardless. Consequently, the public must provide a guarantee, ensuring the private does not suffer loss of interest income. It’s only fair.

Heads, I win, tails, you lose.

In short - the taxpayer receives a lower interest on investment, and bears the absolute brunt of risk just as well.

Now, there’s an issue, however, because the scale of financing required actually is large. Very large. So to compensate, meet our old friend, Mr Leverage. In short, for every dollar of investment, they propose to borrow another four, per this document.

Of course, leverage adds risk, especially during hardship. Where normally on of an investment of $100 with this sort of tranched structure, the public sector would have to take 92 dollars of losses before the private would feel the pain, with a 4:1 leverage ratio, that’s now down to $18.40 of losses, which is probably when the stop-losses would kick in. Or is it?

A potential alternative here is - the private would ride the investment down to 0, and then take ownership of the underlying asset. In fact, with an 8% investment, and a 4:1 leverage ratio, it’s hypothetically possible that the private would seize the $100 asset for $1.6, though it of course would take a bit of financial alchemy to make work in practise. But as I unfortunately do not have access to the documents on the GEF site, I can’t say for sure.

And I spent a fair few hours attempting to track down documentation which could provide a conclusive answer, but failed. Everything is hidden, and this time not by opaque wording and terminology, but through login prompts and the likes. Public availability of the financing agreements, legal documents, and general project documentation is… minimal, to say the least.

So much for their claims of transparency.

So as a last option I went on ChatGPT, seeing how I didn’t feel like spending thousands of dollars on appropriate legal advice on the matter. And I would argue my suspicions are indeed valid — ChatGPT outlines several paths for the private, senior equity holder to take ownership of the underlying collateral indeed.

Now, this of course is not conclusive, but rather just confirmation that it is indeed hypothetically possible, because it comes down to the terms of negotiation, which may be confidential. The next step would be to contact the GEF, requesting the details for specific blended finance deals — but I very much doubt they’ll furnish me the precise detail that I’m after.

-

Executive summary of above

Blended finance is structured - much like CDOs in 2008.

The much smaller private partner takes a senior equity stake.

The much larger public takes junior debt, and offers grants.

These two ensure much higher yield for the private sector.

They also ensure much higher levels of risk-taking for the public.

Leverage compound risk during hardships.

Private, senior equity could take security interest in underlying asset.

If so, this could lead to transfer of said asset to private during default.

Impossible to say; lack of transparency and access to critical documents.

The bottom line here is this -

Everything conceivable here is stacked in favour of the private sector. It’s a public subsidy, nothing short thereof, benefiting the very same banks that brought us close to the abyss only 15 years ago.

And should a deal collapse, it’s entirely within the realm of possibility, that the private, senior equity holder takes ownership of the underlying collateral, which would include the ownership of land, including - say - forests.

And should a legal framework be pushed through, allowing the owners of forests to collect tradable biodiversity or carbon credits, these credits could then be sold to developers, enabling owners of forests to collect revenue in return for simply owning a forest… or the general right of exploitation to said forests could be transferred to a Natural Asset Company, and floated through an IPO.

And who would ultimately pay? You.

-

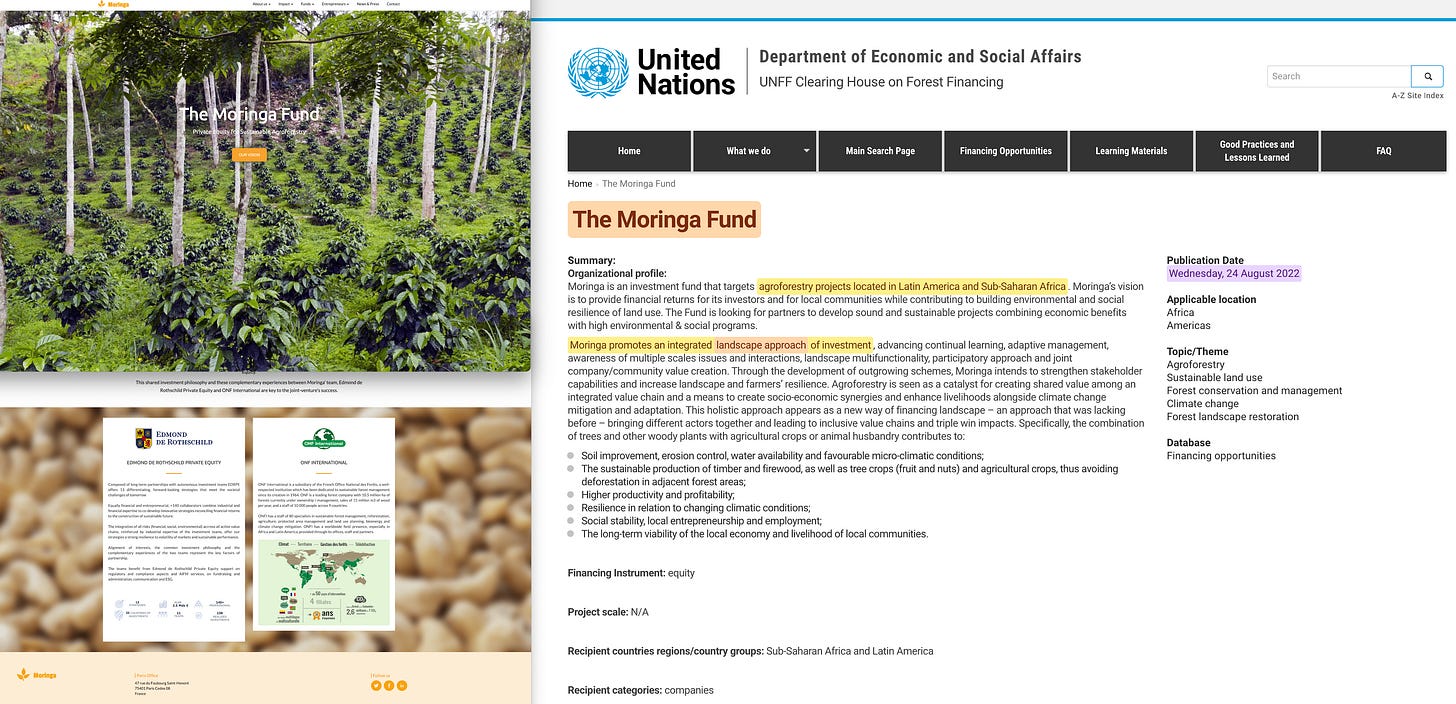

Now, let’s take a look at a real-life example. We move across to the United Nations, because they do in fact promote Blended Finance funds - here’s one; The Moringa Fund.

‘Moringa promotes an integrated landscape approach of investment.‘ - which essentially is the spatial factor continuously mentioned by documents on the Ecosystem Approach, the express scale of which is never explicitly stated, because it’s more convenient this way for the stakeholder. And there’s even an equivalent at sea titled ‘seascape’.

The Moringa fund can be located here and is by… oh, Rothschild. Let’s skip straight to their 2021 whitepaper, which you can find here.

‘In 2010, Edmond de Rothschild launched the first investment fund focused on agroforestry, aiming to reinforce the resilience of our ecosystems and reconnect with a long-term approach to respond to these challenges: Moringa.‘

In 2010? Appears a tad early, no?

‘The integration of “living things’’ (forests, agriculture, natural ecosystems) became a focus of climate discussions‘

‘For this, philanthropy and public grants are evidently insufficient‘

Repeating that old chestnut, nice.

‘The theme was new and the approach appealing. Development Finance Institutions and private investors joined the project. Moringa thus became one of the pioneers of “blended finance” by responding to two major challenges‘

So this could essentially be the trial balloon.

‘Promote the engagement of the private sector on social and environmental themes, alongside public players, to meet growing needs for financing‘

A public-private-partnership, in other words.

‘Reduce the risks inherent in investing in the agricultural and forestry sectors in developing countries thanks to the presence of locally established development banks.‘

NO, NO, NO, NO, NO.

Risk has NOT been materially reduced. What’s taken place is that the private has offloaded its risk onto the taxpayer.

‘Case study 1 - Why agroforestry?‘

Because the Paulson Institute suggested these should receive tradable carbon credits?

‘restoring natural resources. … integrating trees into farms with the overarching goal of improving the social, economic and environmental conditions of all those who live off the land”‘

Oh yeah, sure, and all that too. Totally. Cool story, bro.

‘We would like to thank all the investors who made this project possible, and particularly the Global Environment Facility, the African Development Bank, the Latin American Development Bank, Instituto de Crédito Oficial on behalf of the Spanish government, Proparco, the Netherlands Business Development Bank (FMO) and FinnFund.‘

Those I put in bold are funded via the taxpayer. Oh wai-

‘Investments are generally made through a combination of equity and mezzanine debt, resulting in minority and majority stakes between 20 to 90% of the share capital‘

Mezzanine means junior. And yes, this is using the GEF structure outlined above. Heads, Rothschild win. Tails, the taxpayer lose.

‘Todav. family farmers: Face new constraints and new risks related to climate change such as the rise in fungal and vector-borne diseases on their plantations;‘

They never skip a beat promoting the narrative, do they?

‘25 growers participated in an exchange visit with pilot farmers who are managing innovative and diversified orchards. 1,750 producers were trained in orchard maintenance, irrigation, and surface water collection‘

Two things here. First - who were those ‘pilot farmers’, because those essentially sound like the ‘managers’ we’ve seen referred to repeatedly in the Ecosystem Approach.

Second - with the cold, distant, impersonal way this comes across, I suspect those ‘25 growers’ and ‘1750 producers’ might as well have been metal bolts, footballs, or dressing gowns - or even biodiversity units.

‘Each ton of cashew produced therefore involves a journey of nearly 70,000 km. This fragmented value chain increases the carbon footprint of cashews and prevents the added value from being captured at the local level.‘

There is absolutely no reason why this alleged gain couldn’t already have been capitalised on. None.

The only reason why this is not happening already is because there is no net gain.

‘Lastly, new technologies makes a circular economy possible. Biomass power plants and cogeneration plants use the organic waste from the primary processing to generate electricity.‘

Again, same thing here. This alleged gain through the generation of electricity could easily be captured at present, but it isn’t. And there’s only one reason why that is.

And as for circular economy… we’ll get back to that in a minute.

‘The last pillar of the strategy is to ensure the sale of the products and to obtain premiums on the prices to derive economic value from the services provided by the companies.’

A premium, which local competitors will soon be chasing. The market does not operate in a vacuum.

‘The markets and consumer demand have changed greatly in recent years to favour certified organic products, and for short and more transparent food value chains.’

Yes, they might at present favour organic food, however, should a worldwide recession strike, those consumers will suddenly become far more price conscientious for sure.

’Product characteristics, organoleptic or ethic, and product traceability are in high demand. Between 2008 and 2018, the global organic food market tripled, and experts are expecting further growth of the market in the coming years. The health benefits of food, short value chains or packaging are issues that are gaining public interest. Meeting these new needs provides a differentiating positioning on less competitive, more secure and more profitable markets for farmers.‘

Less competitive, more secure, and more profitable????? Yeah, if that market indeed does exist, it will for certain have competition within a fortnight. This is a patently false claim.

‘Given their high quality ethical and organoleptic standards, these selections are different from conventional products, whose prices are set on extremely volatile stock markets‘

These are either outright lies, or indicative of gross incompetence. Which one do you reckon it is?

‘the small growers integrated into the cluster were able to benefit from the 2019-2020 harvest with prices four times higher than those offered by local intermediaries, representing an estimated 100% rise in their income‘

Which is a single-year generalisation.

‘Moringa’s investment model therefore reaches beyond the concept of agroforestry alone, ... Seven years after its launch, the strategy has supported more than 12,500 smallholder farmers, created or protected jobs in rural areas for 2,300 people, and sustainably managed 15,400 hectares of land‘

… here’s the thing.

Feel free to prove me wrong here, but I suspect those 12,500 farmers don’t actually own the lands on which they live. No, what Rothschild invested in, was the tracts of land and the forests, with a long-term plan of coining it through selling carbon credits.

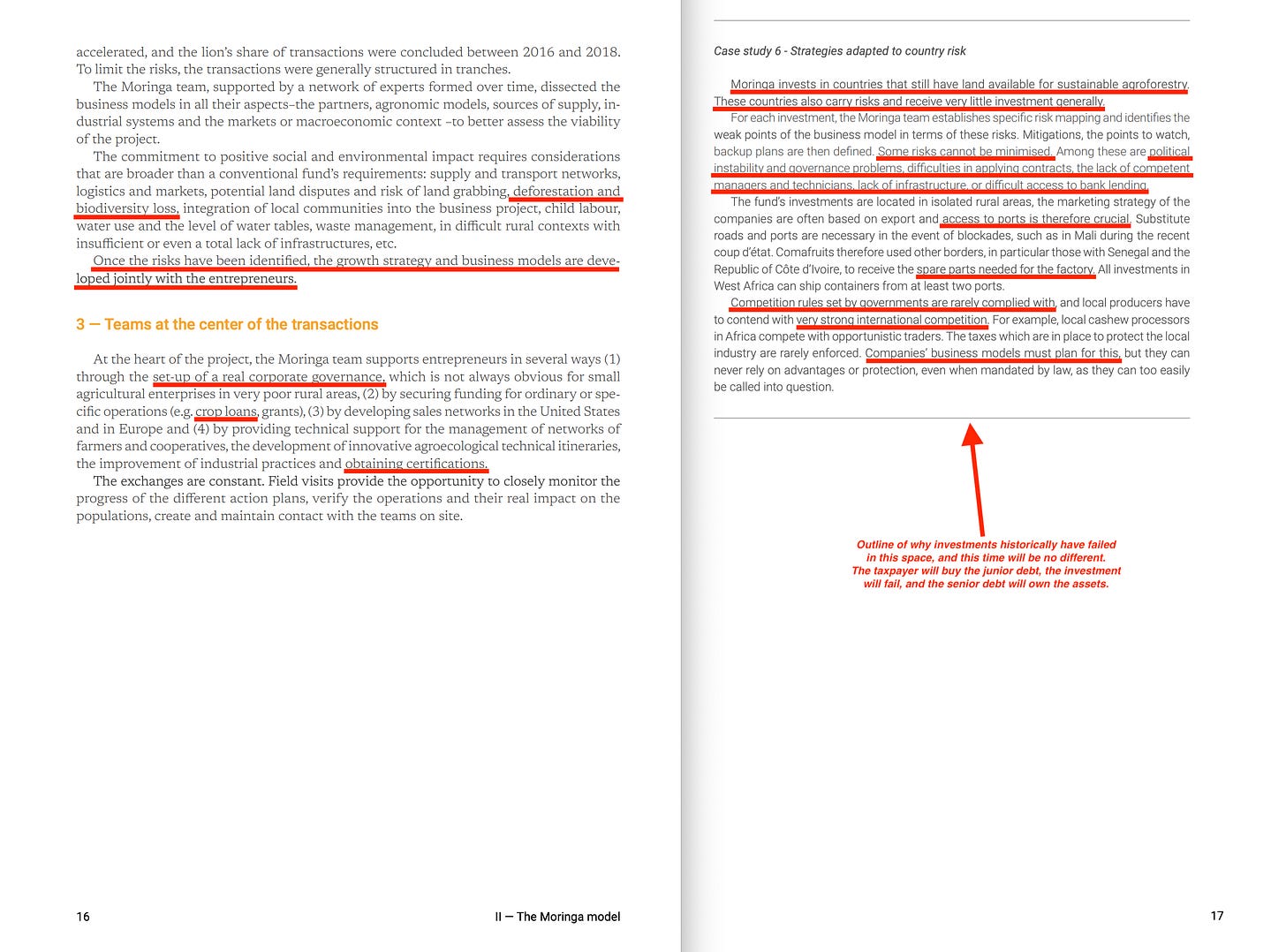

‘The commitment to positive social and environmental impact requires considerations that are broader than a conventional fund’s requirements: supply and transport networks, logistics and markets, potential land disputes and risk of land grabbing, deforestation and biodiversity loss, integration of local communities into the business project, child labour, water use and the level of water tables, waste management, in difficult rural contexts with insufficient or even a total lack of infrastructures, etc.’

In other words, these lands provide ecosystem services like water and timber, and the Rothschild need to ensure the water use is sustainable, and hence the water table stays static. Of course, if the peasants use too much water… we’ll that their problem, no?

‘Once the risks have been identified, the growth strategy and business models are developed jointly with the entrepreneurs.‘

With the peasants living on the land, you mean. Also, you are the manager of the land, and a stakeholder, correct?

And also — the (easily replaceable) peasants will never own that land.

‘Moringa invests in countries that still have land available for sustainable agroforestry. These countries also carry risks and receive very little investment generally‘

They are buying up forests, in other words, using primarily public capital. Oh, and also - they are cheap, because there are no competitors.

‘Since the beginning of investment activities in 2015, Moringa has operated within highly volatile agricultural markets, with significant price fluctuations‘

Really? Let me just quote your above statement - ‘Meeting these new needs provides a differentiating positioning on less competitive, more secure and more profitable markets for farmers‘. Which of the two is true?

‘At the time of the fundraising, between 2010 and 2013, the prices of agricultural commodities were at peak levels–the highest in over 30 years… Prices then collapsed starting in 2015‘

So your above statement was in fact not true?

‘The premiums on quality coffee that Moringa and its partners target enabled them to mitigate the shock. But they are fixed and could not compensate for this huge gap‘

Definitely not true.

‘Among the factors highlighted to explain this drop in prices was the political instability in Brazil, the biggest coffee producer in the world…‘

Bro, it wasn’t my fault. It was the Brazilians. Serious, bro.

Also, there is no way this apology would be accepted by higher ups inside Rothschild. Or Goldman or JPM for that matter.

‘The volatility of agricultural prices is also an ongoing problem for countries that depend on the export of their agricultural raw materials. In a context where these countries also have to find additional resources to adapt to climate change or to a pandemic like Covid-19, human disasters can be severe.‘

Literally every excuse their focus group managed to cook up. In other words, their prior statement… wait, wait, as Hillary Clinton would say; “I misspoke”, right?

‘The team has often had to fill the gap from Paris, not able to find a financial manager, technical director, or experienced agronomist locally.‘

Which will drive up prices significantly.

‘Some of these partners have invested a significant portion of their assets to engage in a development adventure, sacrificing a brilliant career path, salary, and comfort to live in a place where life is precarious‘

Yeah, they might find one or two ideologists. But once said are married and have children they’ll want the money. It’s just non-stop excuses.

‘Their motivations are nevertheless very diverse… Some also work for a very low salary‘

Regardless of their motivations, you just made yours pretty clear.

‘Electricity shortages are frequent and can damage the electrical equipment‘

This ‘investment’ is increasingly coming across like a complete disaster zone. Good thing that Rothschild found a willing patsy, no?

‘The entrepreneurs have to become “super-entrepreneurs” with various skills. They must know how to do everything! The most successful teams are the ones with a successful multicultural balance. Dual partnerships in which the power is shared between local and international expertise are generally better able to react to crises‘

In other words, the lack of specialists mean that the farmers now have to waste their time away from their core competencies, to put out continuous fires elsewhere. Had this been a regular investment prospectus - ie, not ‘green’ - it would have been in the bin by now for sure.

‘The most important thing when developing a value chain is to have end-markets for the products. As soon as we have that security, we can start to develop a supplier network.”‘

… which doesn’t really describe the position from the perspective of the farmer, now does it? It describes the position from the middle-man, the stakeholder, who seeks to extract his rent on the patch of land occupied by his serfs… for now, anyway. Once those forest carbon credits have passed into law, they’ll just have to find elsewhere to go. Not our problem.

‘Moringa has therefore established a network of organizations, such as ONF International, Nitidae, Earthworm Foundation, Okan, Technoserve, CIRAD, ICRAF and others. This network supports the portfolio companies by addressing their needs and helping them with issues that arise.‘

Again, while the serfs have to sacrifice their time, working to anything but their core competencies, the stakeholders ensures that they won’t have to suffer a similar consequence.

‘The systems that produce food and fibre, cosmetics and forestry products need to change in order to preserve the ecosystems, increase yields, shorten supply chains and provide farmers with a fair income.‘

So first they buy the land, then they extract their dues, and then they demand the system be even more corrupted in their favour?

‘Their mode of production is largely based on the industrial model: large-scale monoculture, use of chemical products (fertilizers, pesticides) and automation‘

They are gearing up for this. They seek to eliminate chemical fertiliser, mark my words. The Sri Lanka solution is absolutely on the table.

‘This model, combined with the “green revolution”, drove an unprecedented increase in productivity following World War II to address the great famines. Many negative outcomes are attributed to it such as soil erosion and exhaustion, pollution of water sources, greenhouse gas emissions, reduction in biodiversity and land grabbing‘

They know the role of chemical fertiliser in all of this, but it won’t ultimately matter. Because they lead to pollution of water sources, greenhouse gas emissions, and reduction in biodiversity. Eliminating chemical fertiliser makes sense from a business perspective, and never mind those tedious serfs.

‘Consumers are now demanding full transparency of supply chains, ingredients, origin, and production methods. Consumers are now better educated and are changing the industry.‘

No. This is as believable as listening to Bill Gates stating that ‘consumers want a way to prove who they are’. It’s blatant self-interest, and nothing else.

‘Satellite technologies make it possible to map the origin of agricultural products and determine their link to deforestation‘

Yup, through GEOSS, and GBIOS in particular.

‘Borders do not stop viruses, nor do they block global warming‘

‘Health, biodiversity, and global warming are evidently interconnected‘

‘The development of agriculture and the destruction of forests increases the places where man and fauna meet, raising the possibilities for the emergence of zoonosis‘

A bit of narrative injected here at the end.

It’s all connected.

It’s all connected.

IT’S ALL CONNECTED.

‘The Dasgupta report (2021) shows that global economic growth caused a 40% decline in natural capital per person since 1992. The Convention on Biological Diversity (CBD) proposes protecting at least 30% of the planet by 2030 to fight against the accelerated deterioration in nature‘

OH REALLY?

And which Dasgupta review would that be - this one?

Featuring the Ecosystem Approach, the Convention on Biological Diversity, GEO BOM (global surveillance), and so forth... but at least the foreword is by David Attenborough.

And as for the circular economy… I give you the Club of Rome…

… or the G7, even. Same thing, evidently.

Now, it’s at this stage I wish to make clear that I certainly do not accuse anyone of wrongdoing - but rather, I think it’s only fair that the public receives answers to a number of questions relating to Blended Finance; how these are structured, and what happens to the collateral in the event of bankruptcy.

It’s to protect us.

Besides, I can see no reason why anyone would reject these requests - after all, if they have done nothing wrong, they should have nothing to hide.

-

And in the event this all comes across confusing, don’t worry. I will sum it all up in what I really do aim to be my final substack post before taking some time off over Christmas.

Thank you.. I've been trying to work out what they mean by "blended finance", "Innovative finance models", particularly in relation to infrastructure. I have looked at the NAC's over the last year.. so many threads to all of this.