ESG: Farage

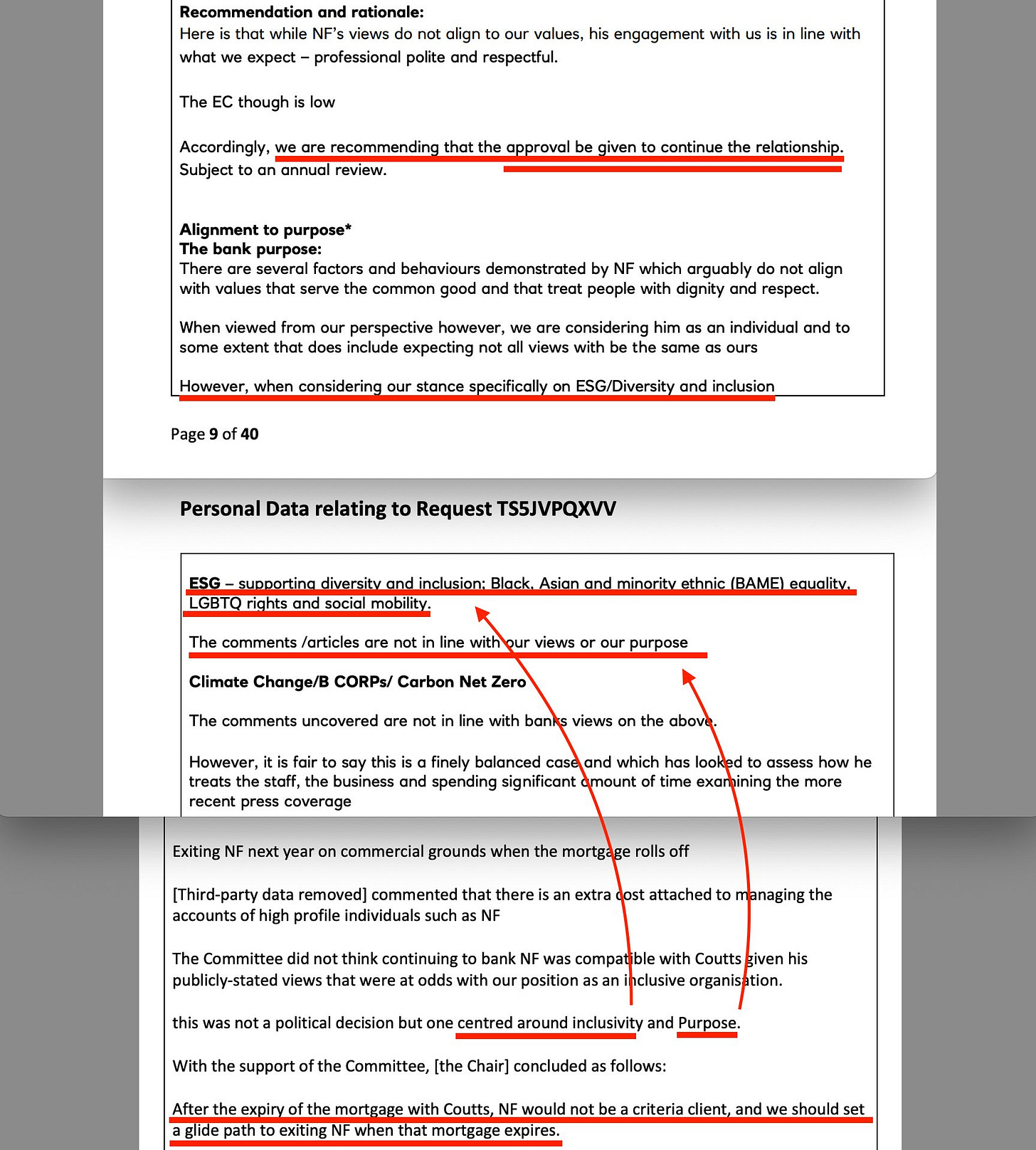

So why was Farage actually binned by Coutt’s? I’ve seen a number of absurd mental gymnastics performances on Twitter, jumping from paragraph to paragraph, in order to perform a cherry picked, liberal understanding of the worst sort. In reality, it really is very, very simple, and the lines below states as much -

I’ve seen some militantly ignorant arguments, that the below unilaterally stated that it was a business decision due to him dropping below the threshold.

Simply not true. This line isn’t the qualifier in this regard, the above is. The mortgage was the justification, but the stated reason was that he was incompatible with Coutt’s values, and that this incompatibility was centred around inclusivity and purpose.

I could spend a while going through the detail here - an example here would be Coutt’s detailing claimed offenses, which are not offenses. Or, absurdly, making spurious claims about Russia, which are then absolutely not backed by any actual evidence. But I won’t bother, because there’s no point. The entire 40 page document details a desperate search for a reason - any reason - to get rid of him.

But as said, it really is very, very simple. All you need to read to understand the ruling spans two pages only beyond the first.

Pages 9 and 10, specifically.

In no uncertain term, the recommendation on financial reason was to continue the relationship. There is absolutely no question in this regard, they are very, very explicit here (above).

His problem, specifically, is that the ESG requirements fall short - again, this is even expressly stated. The ‘purpose’ stated relates to the comment about Coutt’s own purpose, and the ‘inclusivity’ relates to BAME and LGBT values in short, and Farage’s supposed comments. That was why he didn’t qualify, the mortgage was merely the excuse.

Because apparently, ‘free speech’ is no longer free, even when it’s legal, because although he did not breach any specific law in this regard, the bank took it upon itself to judge him either way, in complete parallel to the government you voted on (or not).

In other words, an ESG consortion rules on banking industry practices, and there is nothing you can do about it, because this process never has nor never will be debated in Westminster. It’s an absolute bloody outrage, and this could just as well affect you. NatWest should absolutely not be able to get away with this, and mind you, although you may consider yourself ‘morally superior’, eventually they will come for you. That’s what history should have taught you.

This should be through and through illegal.

Had this been an internal discussion, it would have been a different matter, but this specifically pertains to a corporate set of values which you have absolutely no influence on nor control over. Whoever dictates said ESG values can dictate terms in absolutes, and kick you should you fall short of their arbitrary measure. There is nothing democratic about this, it’s corporate collusion and calls for immediate antitrust action.

Our forefathers did absolutely NOT build our nations, fighting for democratic principles in exchange for blood along the way - only to hand them over to a set of unelected bankers, with absolutely no oversight in any regard. Wait, that description fits central banks as well.

It should be an open and shut case for a monopoly commission, and the UK does in fact have one of those.

However, even that gives an impression of exactly how corrupt the system is through and through. Because it’s a ‘Non-ministerial government department‘, which essentially means that there’s no public oversight, and consequently, no way for the public to hold the responsible to account.

In short, that these exist in itself is a travesty of justice. But that they refuse to look into what is blatantly monopolistic practices by the banks compunds this. The reason for this, of course, could be considered regulatory capture, or perhaps collusion.

But either way, it is definitely to protect you.

-

So the genuine question here is - who imposes said rules, and why?

That’s up next.