Breakthrough Energy

Breakthrough Energy was founded in 2015 by Bill Gates, it was announced at the United Nations Climate Change Conference. 28 high net-worth investors were on board. A quick peek at their site - yep, investments in Net Zero.

And let’s just hammer this home - this is a venture capital fund. The aim here is to make money.

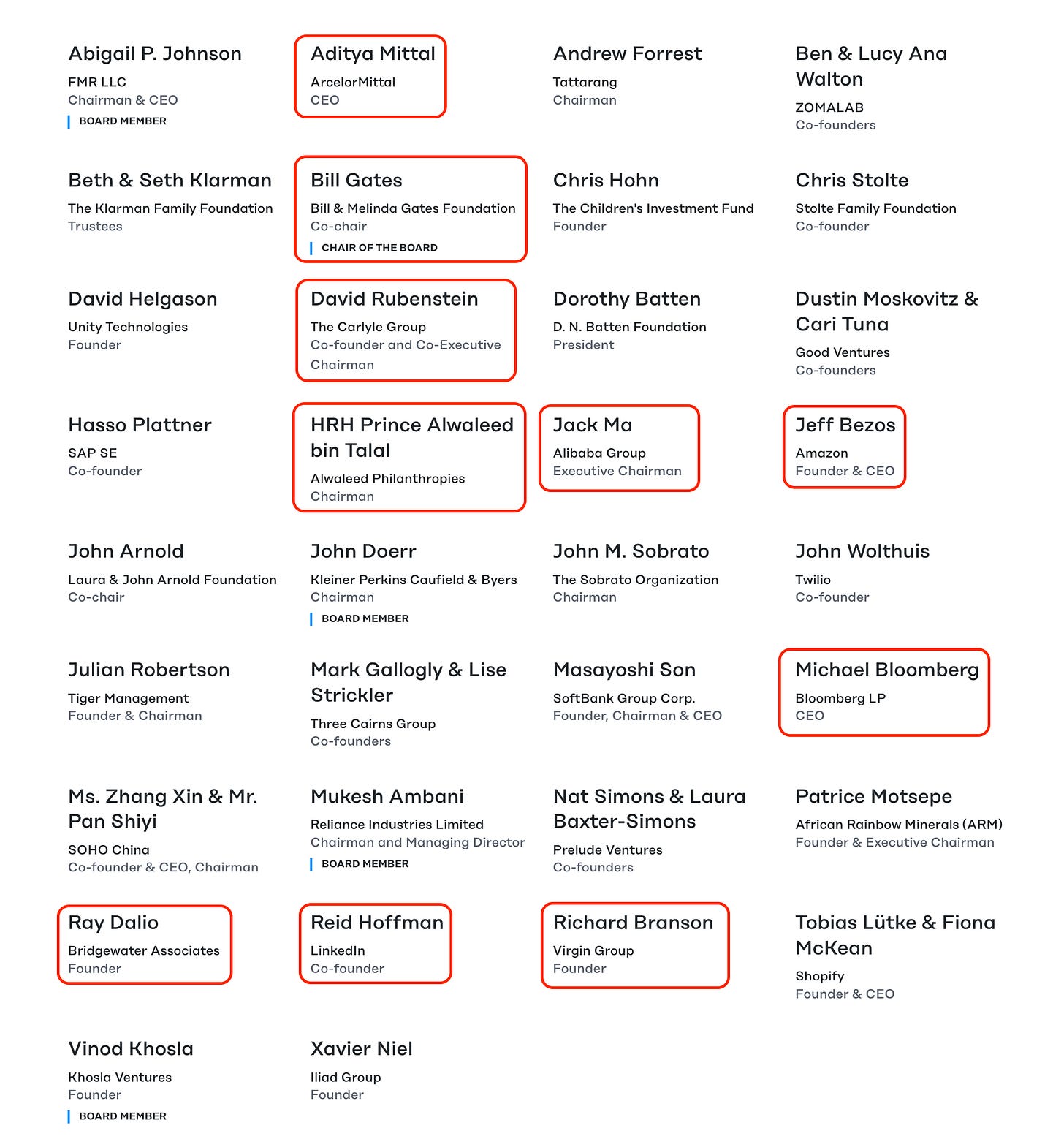

The list of the current board and investors is here. Many, many household names.

What’s of important to any investment is the exit, of couse. Need to ensure it’s profitable. And there are several paths in this regard, but it generally revolves around corrupting public policy - let’s start off with a great example. Michael Chertoff.

Chertoff served under George W Bush. You might be too young to recall, but he presided under 9/11, ie, the event remembered especially by two planes flying into the Twin Towers. There are plenty of irregularities in this regard and during this period of time (underwear bomber, anthrax letters), but I’m not going to go into them. Would take too long time, and deviate from main point. Mother Jones covered this years back.

Anyway, Chertoff was a co-author on the PATRIOT Act. Basically, intrusive surveillance, justified by 9/11. Thin end of the wedge in terms of government spying on citizens.

The PATRIOT act was carried through into law, and Chertoff left government to head the Chertoff Group, ‘making the world safer’ sort of stuff. This group at the time had a financial interest in Rapiscan Systems. But even the Intercept reported on this years later, so this interest is likely ongoing. Basically, corrupt the inside, and ensure you already have the private (solution) ready for the (public) problem - et voila Lots of money. It’s corruption. Through and through - that’s what it is.

So this is one exit. Steer public policy in a direction, in which the private stands to cash in. Another obvious example here is the military-industrial-complex. BAE Systems and Northrup Grummon tend to agree with declarations of war.

Will it happen here? Too early to tell. But the signs are not looking good. Let’s have a peek at their venture portfolio as it stands.

Carbon Capture & Storage: 44.01, Heirloom, Sustaera, TerraCO2, Verdox

Computing: IonQ

Efficiency: AeroSeal, Blue Frontier, C-Zero, CarbonCure, Conduit Tech, Electra, enVerid, H2Site, Mill, Type One Energy

Energy: C16, ClearFlame, CommonWealth Fusion, CubicPV, Electric Hydrogen, Fervo, M2X Energy, Natel Energy, Sierra Energy, Turntide, Zap Energy

Farming: Iron Ox, Motif, Pivot Bio, ReMo, Rumin8

Food: Biomilq, Natures Fynd, Nobell Foods

Home: Dandelion, H2Pro

Infrastructure: Max, Source, WeaveGrid

Industry/Construction: Antora, Brimstone, EcoCem, FleetZero, Heart Aerospace, Prolific Machines, Solidia, Sortera Alloys, Terabase, Vantem, ZeroAvia

Investment: Baseload Capital

Materials: Bloom, Boston Metal, Circ, DMC, LuxWall, Redwood Materials, Stratus, TS Conductor, Veir

Mining: KoBold Material, Lilac Solutions, Mangrove Lithium

Restoration: Kodama

Space: Albedo

Storage/Batteries: Arnergy, Blue World, ESS, Form Energy, Malta, ONE, QuantumScope, QuidNet, Rondo

Surveillance: 75F, Guidewheel, Pachama, Reactive Technologies, Sparkmeter, Stoke, Yard Stick

Synergistics: Mission Zero

Vaccines: Arkea Bio

First off - there are a lot of companies here. I might have mislabelled a few. That’s really not the point here.

-

I will first address a very, very obvious one. One of which is specifically addressed by a Sustainable Development Goal.

Source. They 'perfect water for every person…’ - followed by the SDG specifically addressing making water a ‘right’, SDG 6.

Next up - Carbon Capture has been around for rather a long time now, and whether the technology works (or is worthwhile) is a whole separate discussion in itself, but if you specifically work on the inside to change policies, one of which is to lower the level of CO2 in the atmosphere (as measured by an agency controlled by the UN…), then you could make a lot of money - if only you had the ‘solution’ in advance.

This is SDG 13. It also ties into SDG 15, though the wording is less explicit.

Energy, Efficiency, Storage, Transportation - all SDG 7. Even includes ‘investments’, ah how cute. They have an investment company on board.

And so forth. What I’m getting at here, is that the world’s leading billionaires are now frontrunning the UN SDGs in order to cash in on the policy outcomes of said. Say, for instance, in just a year, policies will be introduced relating to construction companies using certain material types. Oh wait, they have that covered. Same goes for mining.

And then there’s surveillance. We’ll get to that in a later post, because there’s much more on this topic, and it ties back in with covid.

I could go on, but I don’t see the point. The idea is the same. Create the problem. Create the solution. Enforce policies in said direction. Make heaps of money.

The final company I wish to draw attention to in this regard is this - ArkeaBio. They will reduce cow farts by vaccination. Yes, really.

Being a start-up, they are not going to tell you about what, and how. But all of this, at a time where at least one project exists on using mRNA to ‘vaccinate’ livestock.

So, back to the United Nations, and their SDGs. The UN is supposed to be an organisation represented by the public. Not private, public. And in that regard, why is a Microsoft representative on the UN Website? Wait, in fact - according to Microsoft, they have an office at the UN… WHY?

Doesn’t that explicitly announce the merger of state and corporation?

-

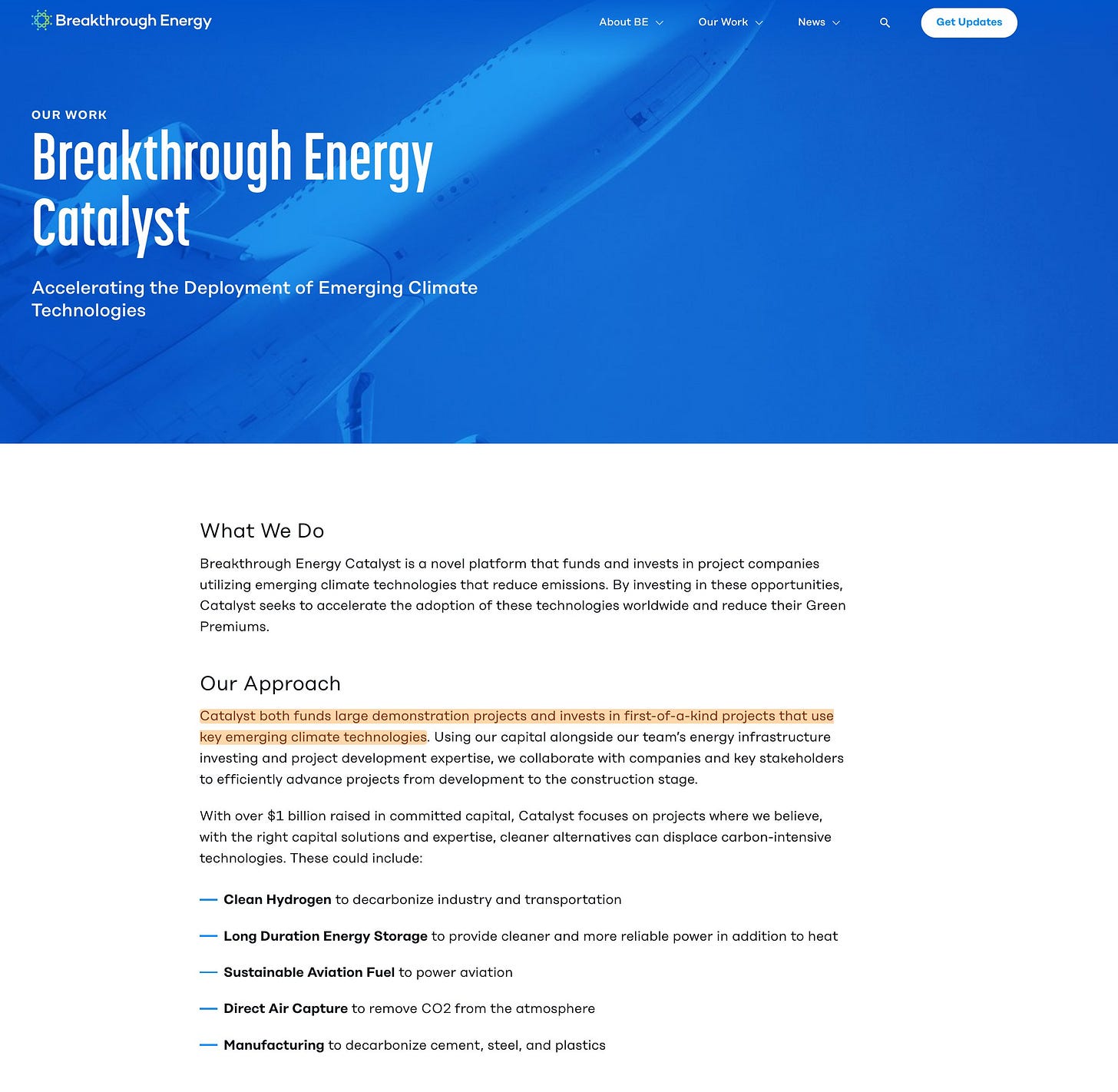

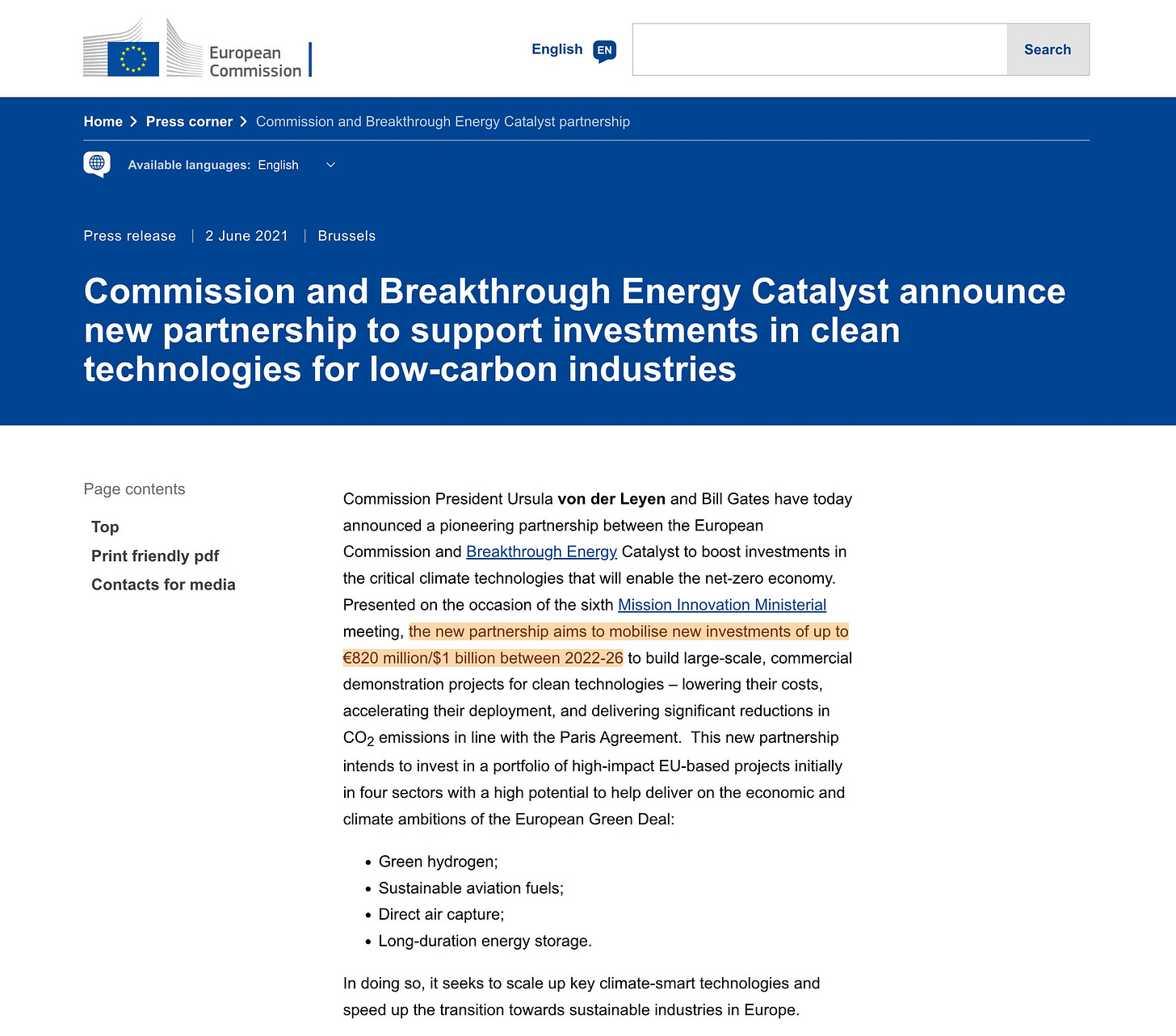

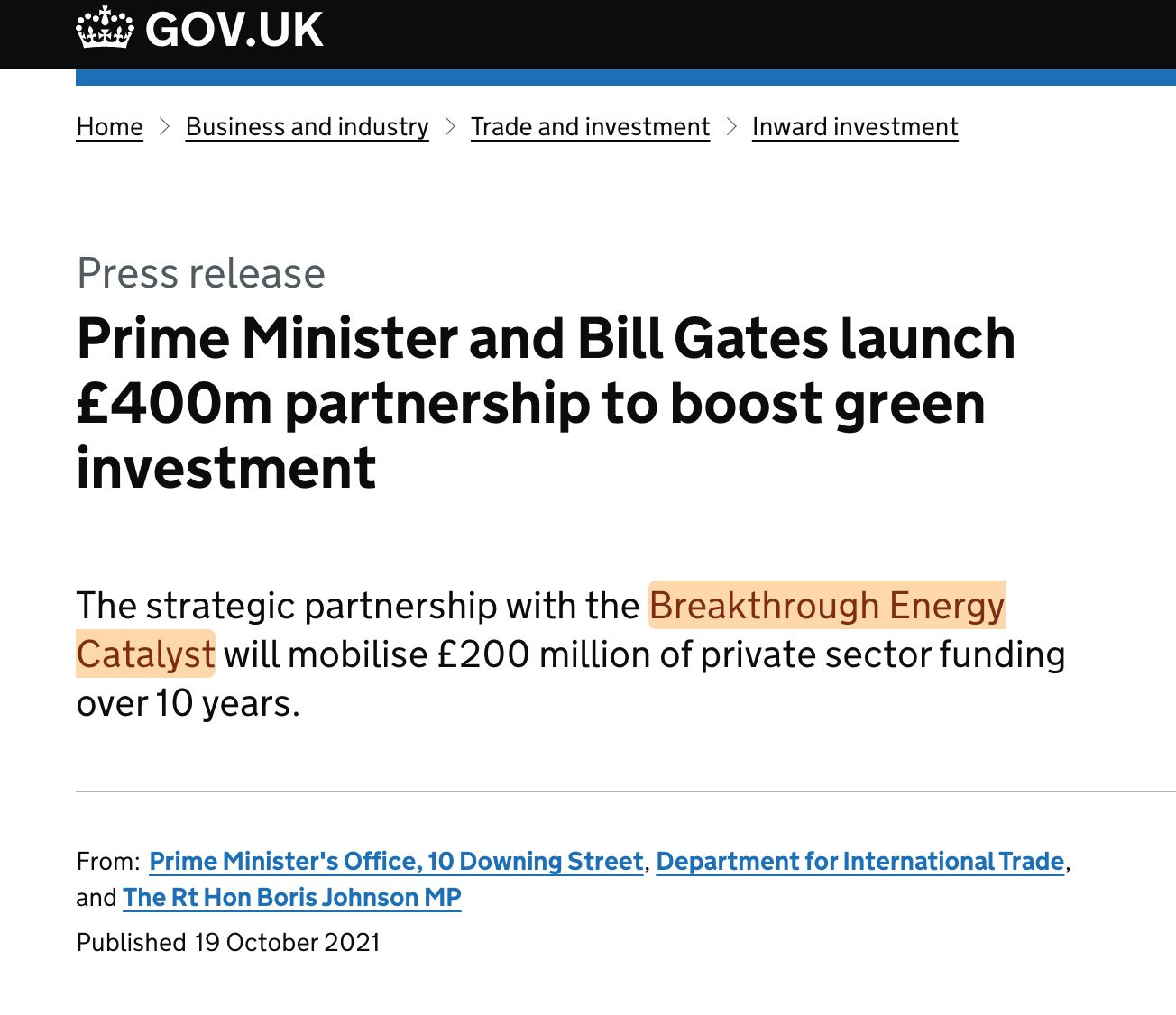

But setting even that aside, at this stage, the gameplan appears fairly obvious. Front-run public policy and cash in. It seems pretty obvious that’s what ‘Breakthrough Catalyst’ is up to. But they have a secondary program, which appears even worse when you take a deep dive. The name is ‘Breakthrough Energy Catalyst’, and stated objective here is to deal in risky propositions. Ie, prepare to lose your money, or make it big-time, sort of propositions.

First thing you might wonder is - exactly who is dumb enough to buy the equivalent of a lottery ticket and hoping it comes in here? Well, the answer to that question is - you and I. Along with every taxpayer in the west. See, the thing is, Gates etc are very smart people. And they realise the likelihood of success here is meagre. So they enlist a range of ‘Government Partners’. ‘Aligned capital’, as they describe it.

And while this may sound like another sick joke, it really isn’t. The joke is you.

The catalyst program recently announced a request for proposals here in the UK. Some of which will be grants, and some of which will be equity investments, with a lower return.

In other words, while ‘Breakthrough Energy’ is a traditional for-profit fund, in which Gates himself has invested $2bn, it has a ‘catalyst’ venture, which is very risk willing, and basically handing out free money. And has signup from governments.

But how do you manage to outsource the risky components to the taxpayer, while reaping the rewards in private capacity?

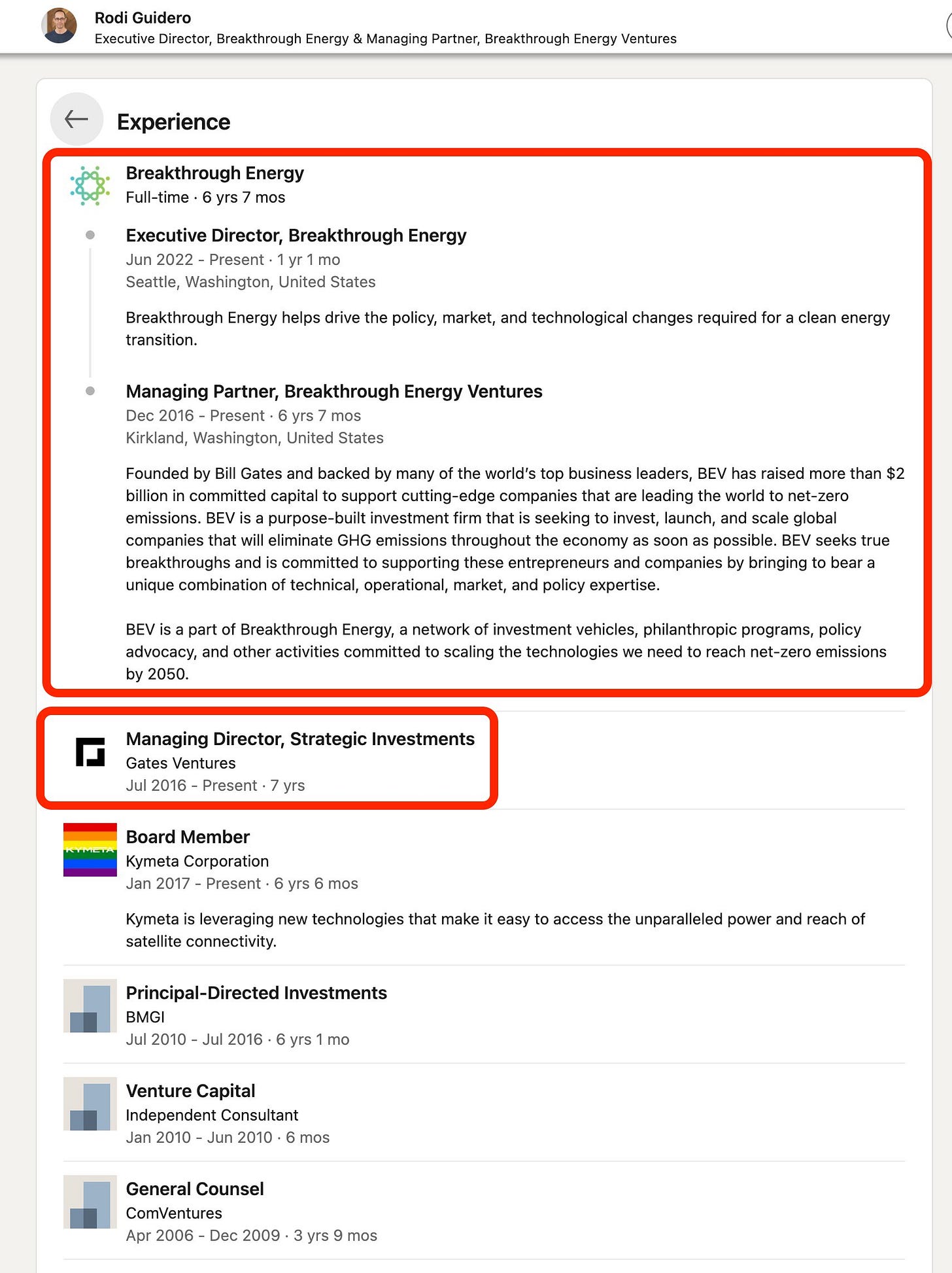

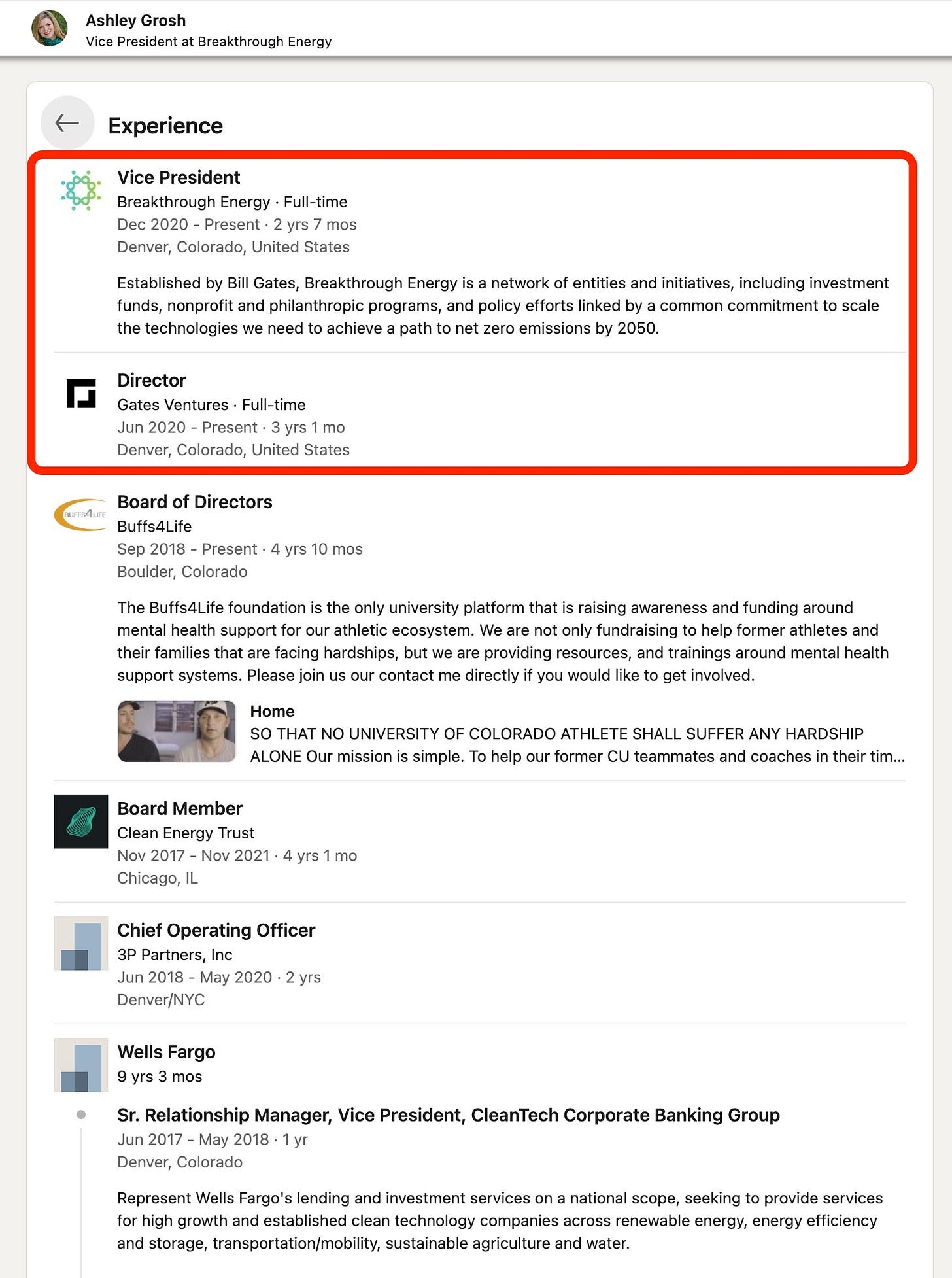

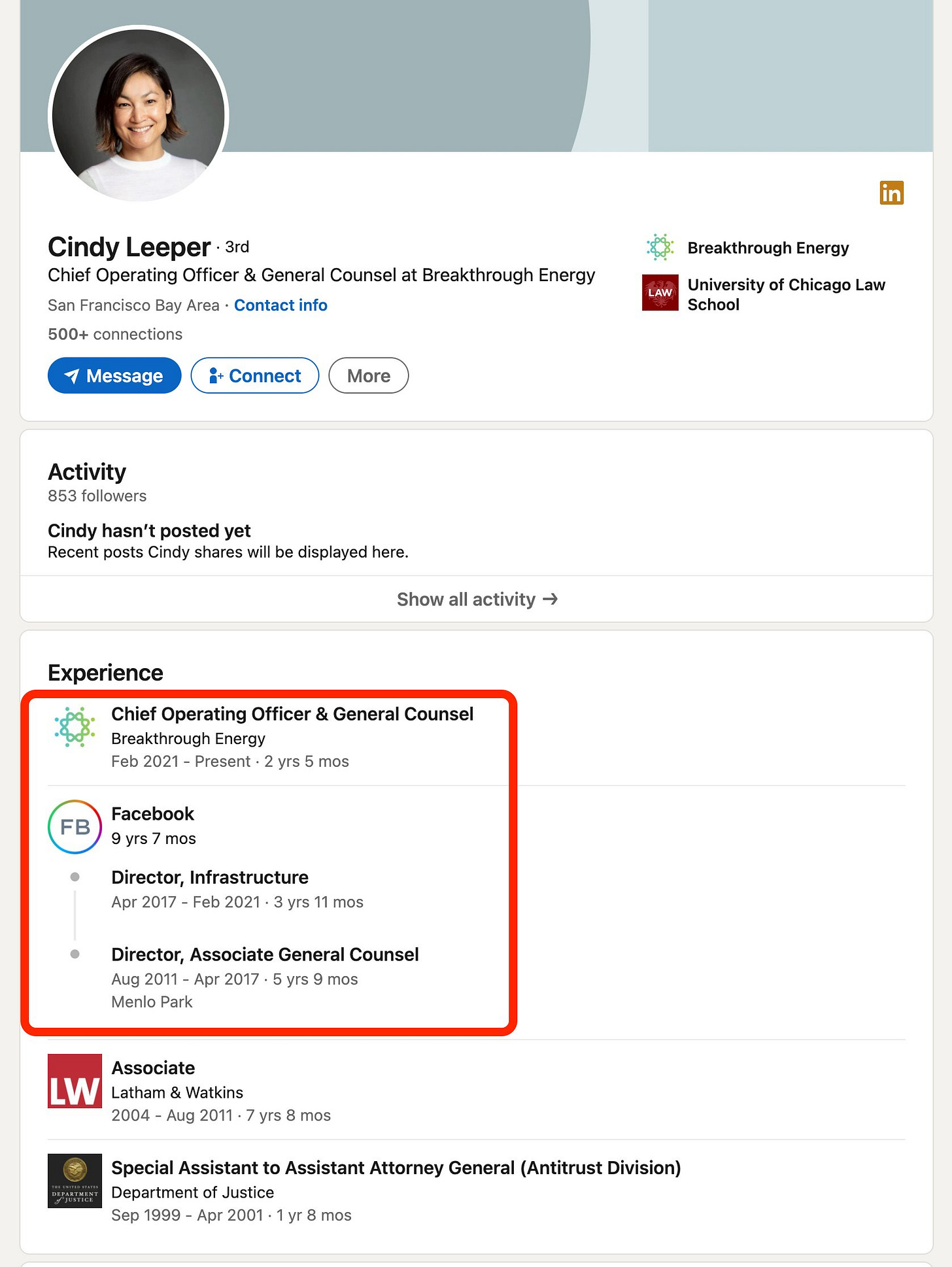

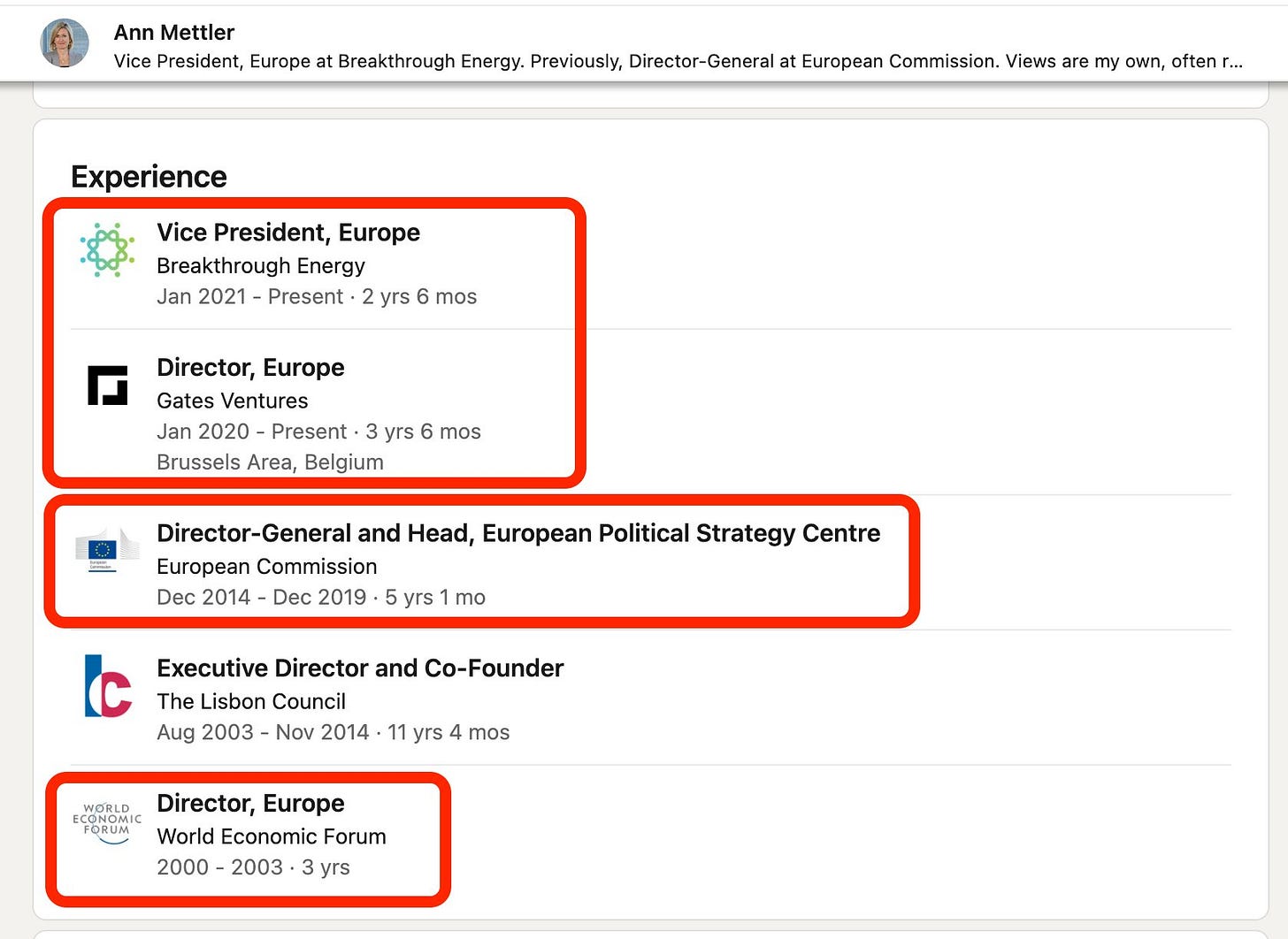

Simple. By ensuring an overlap between Gates Ventures and Breakthrough Energy, thereby guaranteeing a similar direction. And I’m sure this also hints to ‘Breakthrough Energy’ when to make the actual investments, ie, they even get early hints when speculative ventures are at the cusp of becoming interesting.

And the taxpayer coughs up. They have, in other words, reduced their risk in early investments, by sending the taxpayer the bill.

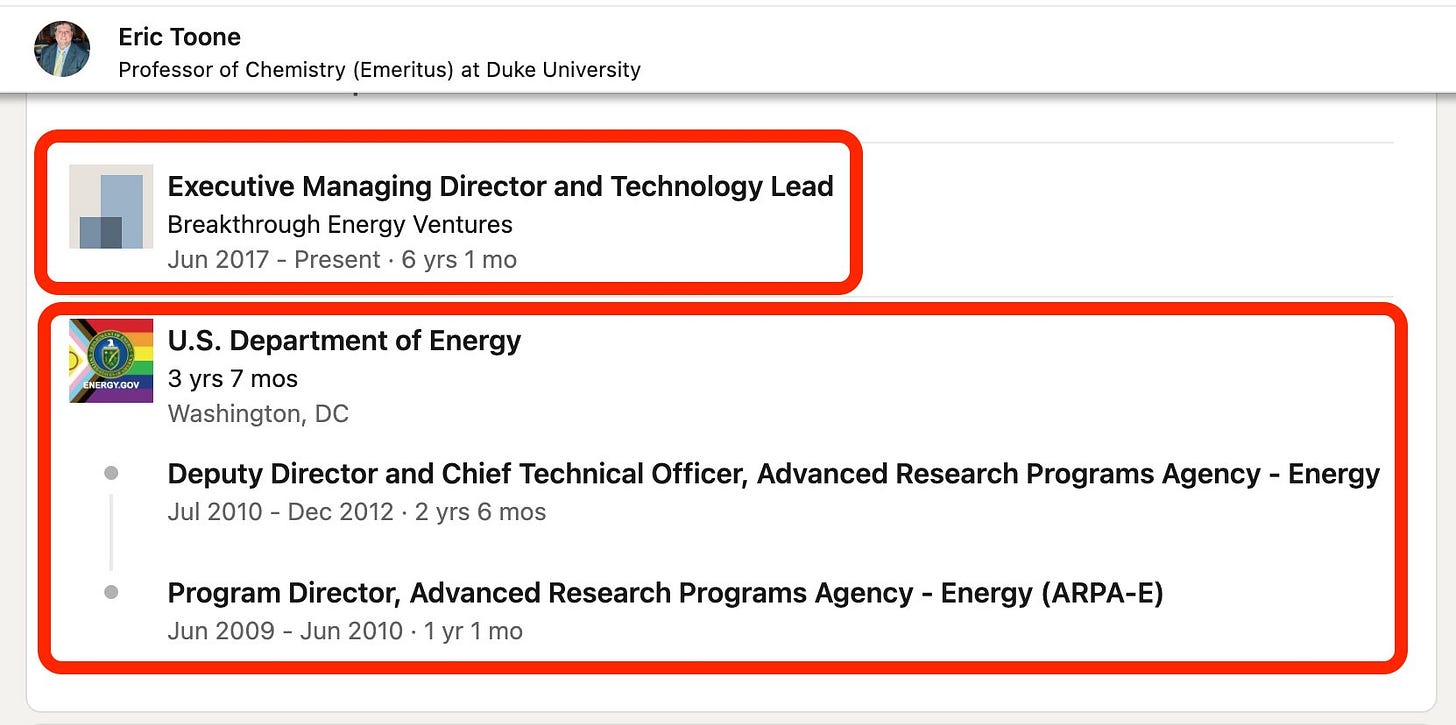

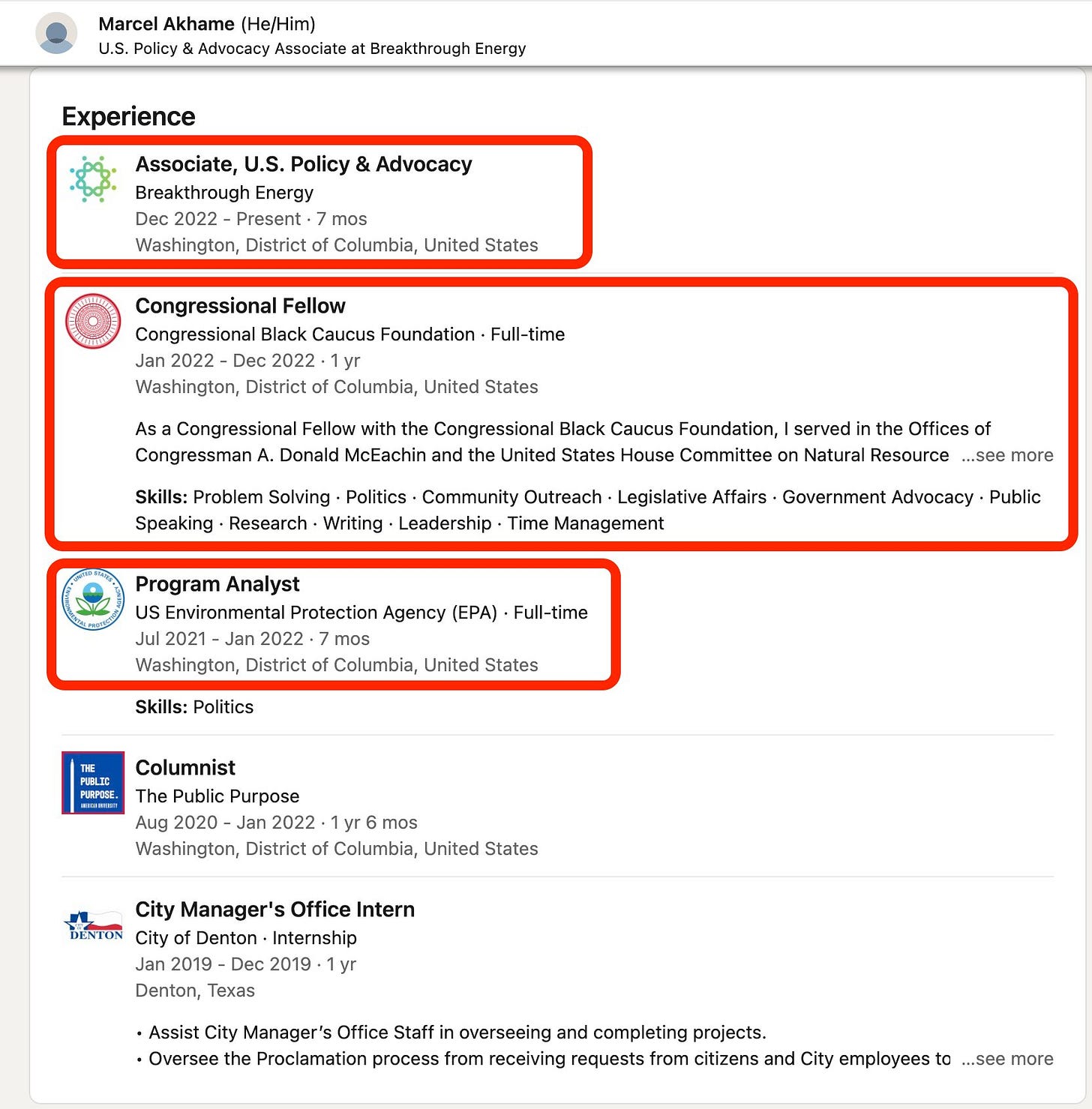

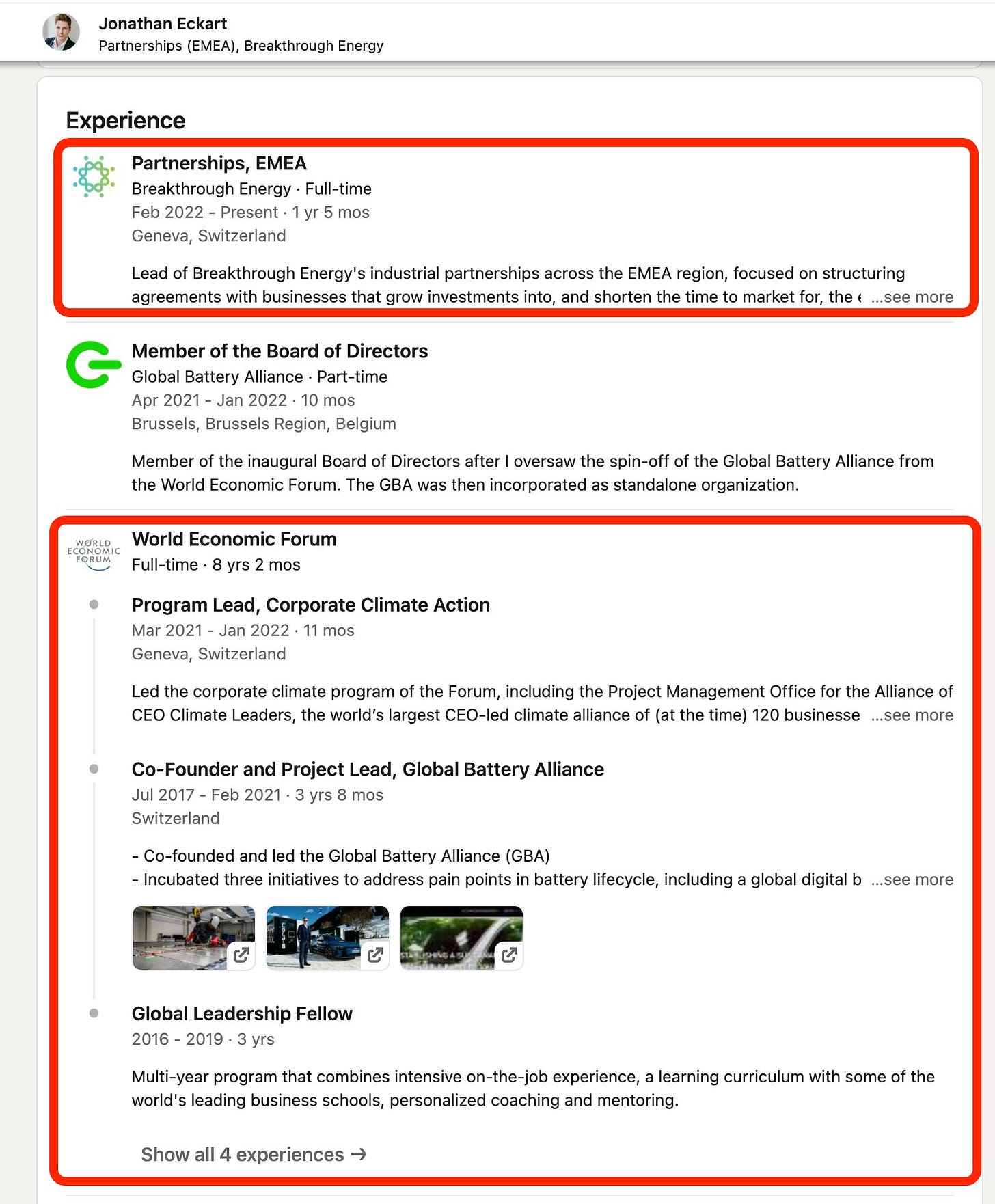

Next, you ensure there’s an overlap with people deeply embedded in the political class - who may furthermore also overlap with your own private interests.

As for people on board, you also make sure you capture people who can sway public opinion, ie, those with social media connections.

And you also do this for international institutions, those guiding policy through ‘science’ which may or may not ultimately be about the science of making money, especially given said science often is funded by the foundations controlled by… yes. You got it.

It’s a big club, and you ain’t in it.

-

And an hour after posting this, another doozy was added.

And why is that another example?