For every transaction, you have two parties; a seller - representing supply, and a buyer - who represents demand. This very simple concept applies regardless of to what the transaction relates.

And that principle applied to even money itself. Sure, the seller and buyer might be somewhat different, as these relate to governments and central banks, but the principle applies here just as well.

-

I have in the past commented on the Bank for International Settlements. In short, they represent the pinnacle of the supply side of money, the central bank of central banks, for lack of a better description.

The Bank for International Settlements

On especially all matters CBDCs - all roads leads to Basel. - The BIS has always been of interest to me, ever since I learned of their existence. Primarily in the early days, as it was specifically mentioned by Carroll Quigley’s “Tragedy and Hope”, but more recently, because the IMF and World Bank were supposed to replace it in 1944. In fact, all of their…

I will not launch into a long description of how our banking paradigm works, but simply put - when a government wants to spend money, they can raise it in one of two ways;

They can raise it through taxation, which obviously is very unpopular with voters, or they can sell bonds on the open market. But as with any object, the more availability, the lower the prices, and in regards to bonds- this will cause yields to increase - meaning that debt financing will become progressively far too expensive to tolerate, and that, fairly rapidly. To stop this explosion in yields, they can request their respective central banks buy said bonds through Quantitative Easing. This, generally, leads to inflation, but that’ll set in down the road, and thus is far more palatable to the voter - and besides, in the long run we are all dead anyway.

In general, money supply tends to increase over time, in part because with compound interest, it has to. But we have on occasion seen colossal increases over a short period of time - in 2008, for instance, when the $700bn rescue package went through in the States.

The above is the monthly released M2 money supply in the states. You see the massive bump following 2020? I wonder what that might have been.

For the record, we a saw similar pattern in the Eurozone (ECB), UK (BoE), Canada (BoC), and so forth. But rather than guess what drove this, why not have Mervyn King (former governor of the Bank of England) explain to us mere proles?

In case it wasn’t bloody obvious, it was central banks rubberstamping the ludicrous policies run by the various governments, enabling the hyperexpensive lockdown policies. King goes on to explain that this drove inflation, and - most illuminating - that ‘all central banks in the West, interestingly, made the same mistake’.

He goes on to detail that this was a mistake, as the economy was contracting because of Covid, this led to too much money chasing fewer goods, and hence inflation.

Finally, he admits this was predictable - yet, it didn’t stop all those people labelling me a ‘conspiracy theorist’ when I stated that back in early 2020 - because already back then, this was bloody obvious to those of us who paid attention.

From this, a few key observations -

Raising the money via further taxation would have been downright impossible, very simply because the lockdowns actively stopped people from working, thereby reducing economic output. This wasn’t an option.

If the central banks had not played ball, governments would have been forced to raise the money via the markets alone, and this would have driven up yields, and hence the cost of borrowing to pay for the lockdowns would have been prohibitively expensive. Ludicrously so, in fact, because all western governments (with very few exceptions) went all in on these crazy policies at the same time.

It was easily predictable, and the central banks obviously knew them backstopping the response would drive inflation. Yet, they did it regardless. And as for the ‘all made the same mistake’ - i call bullshit. The Bank for International Settlements’ primary purpose is to deal in these matters. The policy response was obviously coordinated. The BIS facilitated the lockdowns via the local central banks.

Simply put - without central bank action, there would have been no lockdowns. They would have been found too expensive almost immediately, as governments would have run out of cash, and the markets would have responded by rapidly appreciating interest rates. It would have been deemed inaffordable within weeks, if that.

-

And again, to ensure it’s all fully sourced - the ‘primary purpose of the BIS is to foster international monetary and financial cooperation’.

-

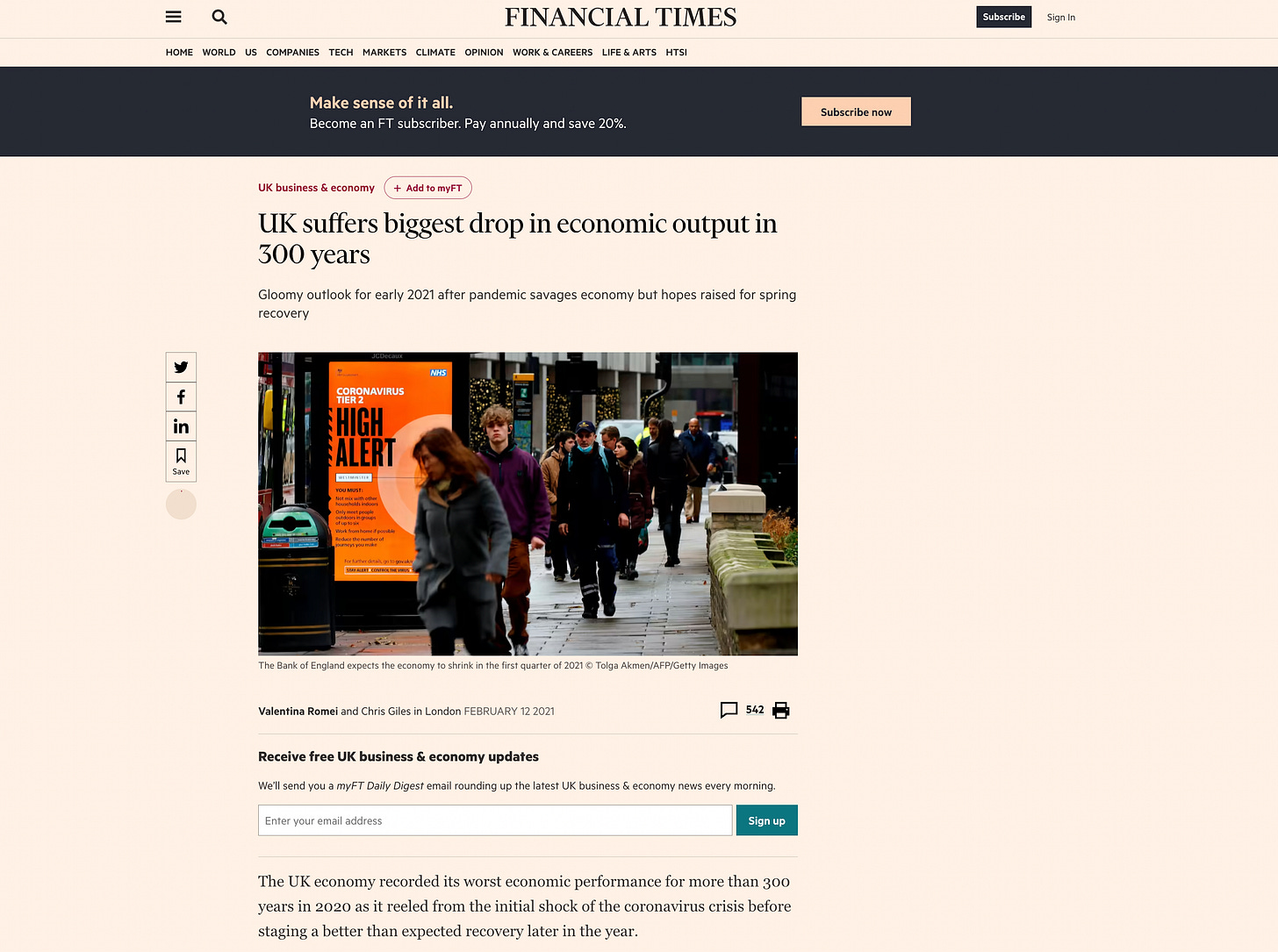

And to source the relative cost of these crazy policies, here’s the Financial Times reporting in February, 2021. Declines varied from nation to nation, of course, some were hit harder than others - but the impact was felt worldwide. Every nation which implemented these policies saw lower economic activity. And this was, of course, bloody obvious.

So to sum up here, the BIS facilitated the lockdown policies by coordinating action between the various member central banks, in turn not only driving inflation, but also allowing the scamdemic to launch in the first place. And they did this through - in short - coordinating a colossal printing of money, the likes of which has never been observed before in history.

-

I like to call the BIS (and the central banks in general) the private side of money. And this relates to the public-private-partnership which the likes of the UN and the WEF love so much.

Because when we step down through the hierarchy, those two in turn also represent a public-private-partnership; the WEF represents the world’s billionaires, and the UN represents… well, is alleged to represent the mere proles. Reality, of course, is somewhat different.

Within the framework of the United Nations, we have a range of organisations, of course. They are all outlined here.

There are 15 in total, but two stand out. Have a guess. Which ones?

The answer is the World Bank (WBG) and the International Monetary Fund (IMF). And the reason is very subtle.

See the way most UN organisations are drafted, stipulate that each and every nation receive one vote. This means, for instance, to buy power, all you have to do is corrupt a number of poor sovereign states during important elections, and et voila. Incidentally, that’s precisely how Margaret Chan was elected to the WHO top post in 2006.

Her campaign was furthermore controversial for her program, but that’s a story for a rainy day. Tedros, likewise was not expected to win when he ran in 2017, because he ran against a very strong UK/US contender - David Nabarro.

David Nabarro is - in a word - incredibly controversial. Here he is in 2009, promoting ‘One Health’ before, well, anyone had really heard of it. Apart from those in on it, of course.

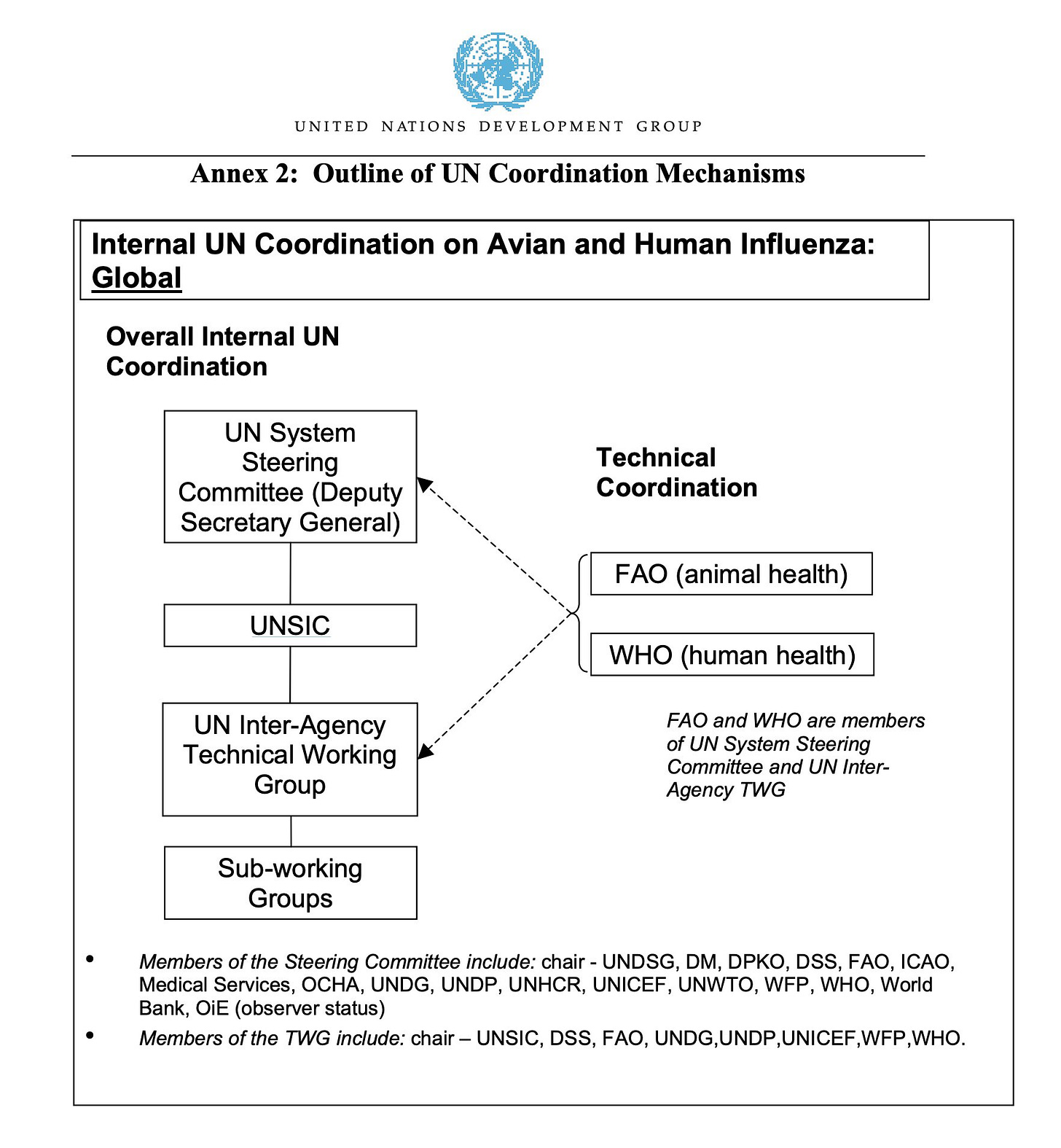

But he around this time also served a rather interesting function - that of the head of the now long gone UNSIC; the ‘United Nations System Influenza Coordination‘.

There was an internal battle over this, because ultimately, the UNSIC was merely a tool in a scheme to wrestle control of finances to the World Bank Group. I wrote a long thread on this on Twitter, which you can find here - I doubt I’ll move this across to substack, but this was instrumental to my understanding of how this power play operates behind the scenes.

The thread initially details how ‘One Health’ discussions progressively included more stringent detail on lockdown policies and surveillance. But it also exposes how real power operates behind the stage. And, in this regard, there is one picture which really sums up exactly what the point of the UNSIC was. Here it is.

The point was that the UNSIC did not take input from the FAO and the WHO. What the UNSIC carried out, was to pass control of Influenza finances from the FAO and the WHO, and to the World Bank.

And, in that regard, the World Bank acts in the capacity of trustee to a LOT of these programs.

In the capacity of trustee, the World Bank has the final say over any spending decision. And as for funds, there’s a separate program here - the ‘Financial Intermediry Funds’, which are basically public-private-partnerships.

Here are a few programs, which are very, very interesting. Specifically two - the ‘Global Environment Facility’, and the ‘Global Fund’.

I won’t go into too much detail in relation to the GEF, but in short, they fund a number of programs, including the ‘Global Platform for Sustainable Cities’, which in turn funds the C40 - who are behind the 15-minute prison camps and Net Zero suicide.

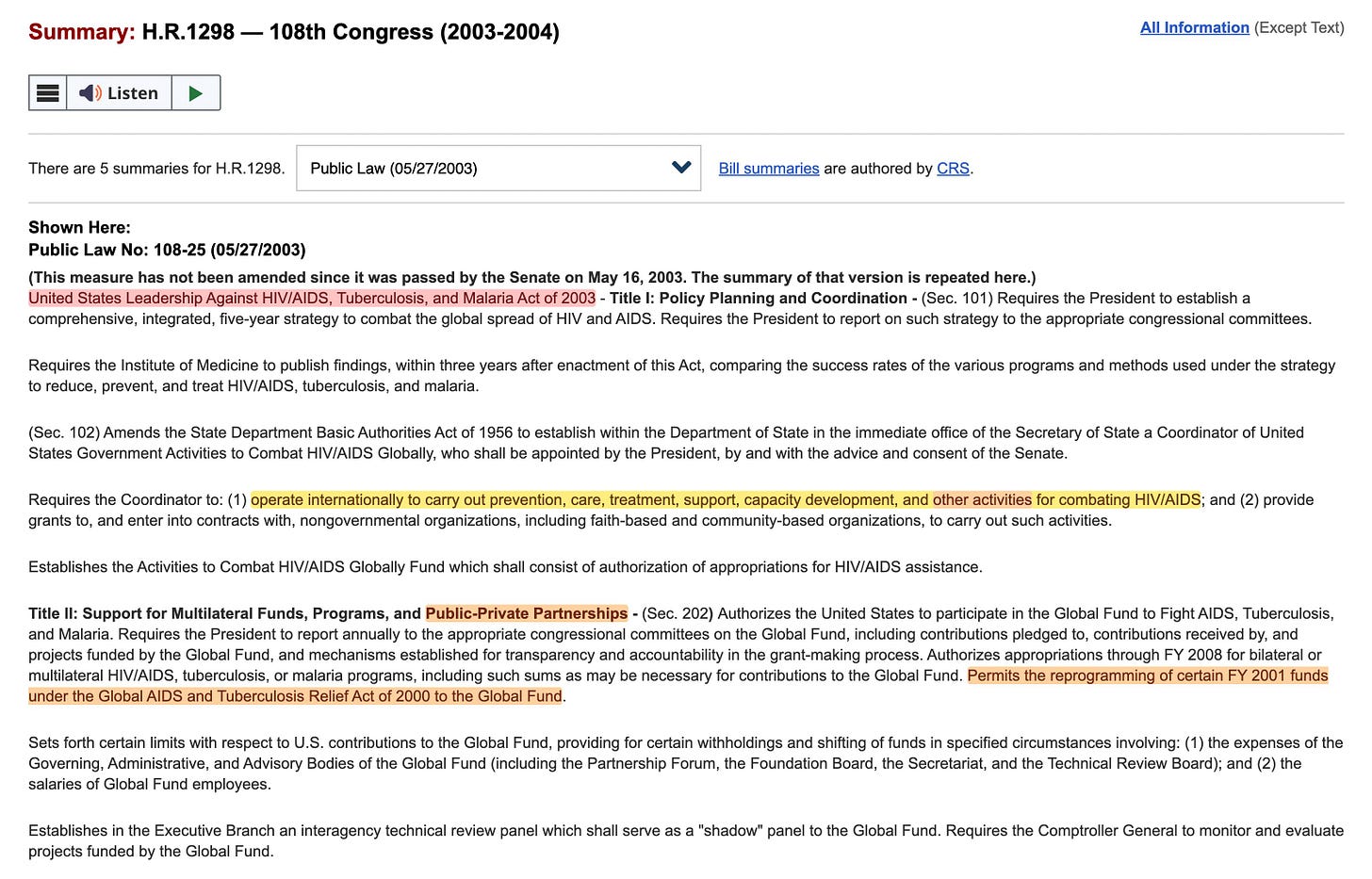

The other one is the Global Fund. And in that regard, here’s a bill which passed congress. It’s the ‘H.R.1298 - United States Leadership Against HIV/AIDS, Tuberculosis, and Malaria Act of 2003‘.

And why that’s of interest is in orange below. It ‘Permits the reprogramming of certain FY 2001 funds under the Global AIDS and Tuberculosis Relief Act of 2000 to the Global Fund‘.

The Global Fund for the record was only launched in 2002. No, really. At this exact time, a fund with no track record suddenly received a colossal budget with no track record whatsoever!

To make a long story short, what this act did, was to transfer power of spending from the US government to the Global Fund, which is a trustee of the World Bank.

And the program in question here? Well, you likely know it as ‘PEPFAR’, or George W Bush’s ‘President's Emergency Plan for AIDS Relief‘ - which also had a secondary purpose in the context of surveillance.

Ah preposterous. Conspiracy theory!

Well, from that very same document comes this. Not only does it detail ‘behavioural change’ (nudge-based manipulation, think SAGE during the scamdemic), ‘behavioural economics’ (bribes, typically), but it also explicitly details ‘robust and timely surveillance tools’, ‘molecular and genomic surveillance tools’, ‘quality monitoring approaches’, ‘integration into local/national/global levels’, all of which can be located in the Pandemic Treaty, but it also finishes off with these clinchers -

‘our investments need to be institutionalised‘ - ie, they will not be switched off, and

’strengthen partner country capabilities in disease surveillance’ - ie, they will carry on investing in and building the grid.

As for the document - when was this from, because surely all of this references ancient information, no?

No. The document is from 2022. References to ‘surveillance’ and ‘institutionalise‘ means in terms of contemporary settings. It’s current.

In short, during George W Bush’s first term, PEPFAR moved control of (a third) of the budget to the World Bank, and with this money, they built a colossal surveillance control grid in primarily Africa, under the guise of the ‘Global Health Secutity Agenda’. Which, incidentally, is ‘One Health’, under a different name.

The benefactor in this equation was the World Bank, just as it was when Nabarro and the UNSIC worked their magic in the late 2000’s.

-

But what’s so special about the World Bank? Why centralise control over finances there, rather than with, say, the WHO?

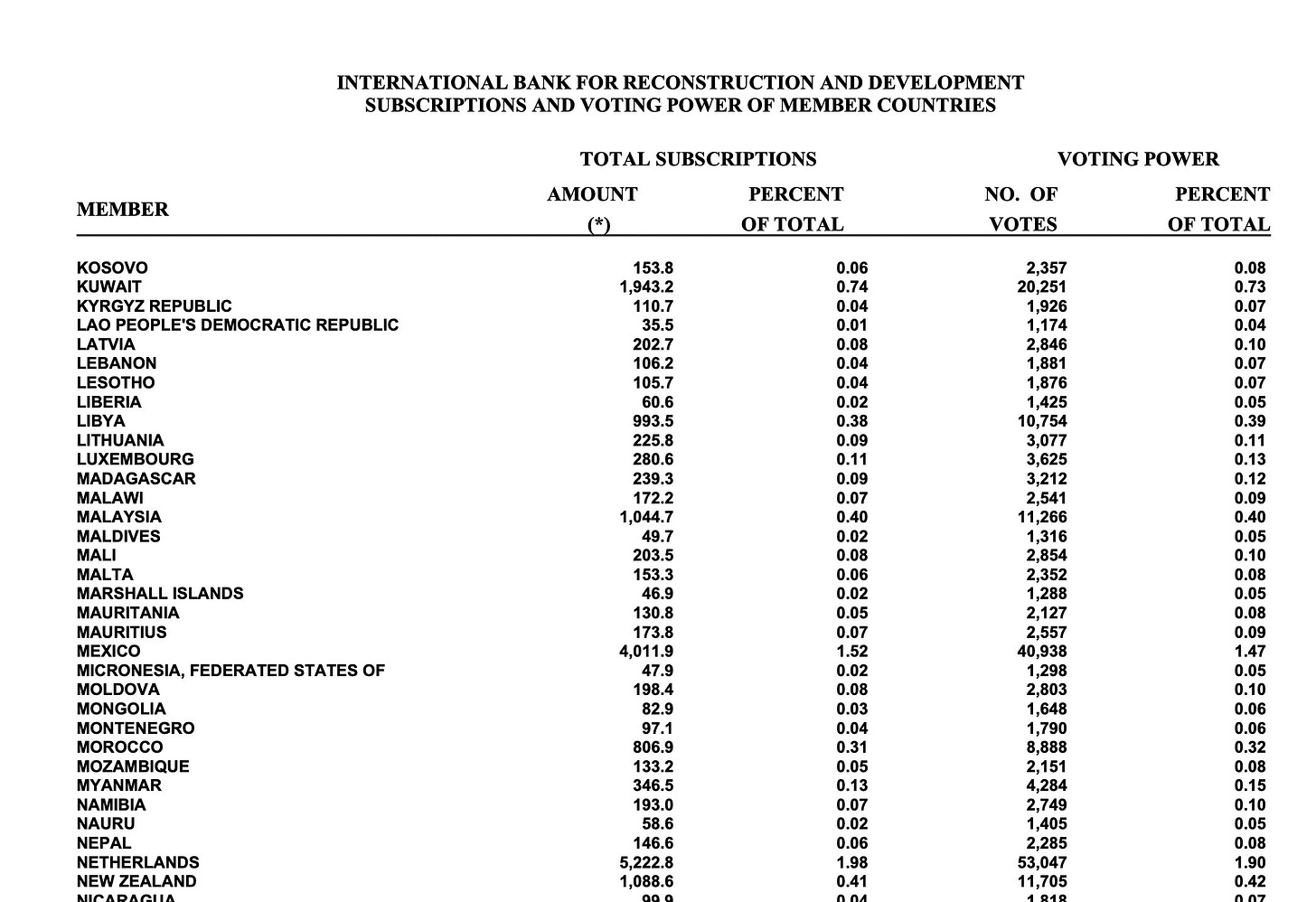

Because of the voting structure. As said, while regular UN institutions utilise a one vote per nation structure, the Bretton Woods institutions (WBG + IMF) instead use weighted voting.

Here, for instance, are the relative voting powers of the various nations in the context of the World Bank. As you can see, it heavily benefits Western nations. IMF is the same, but with slightly different weights.

In fact, should you align the US (15.75% of voting power) + UK + Germany + France (27.87%) + Italy + Netherlands + Spain (34.19%) + Canada + Japan + Australia (45.31%) and then add Scandinavia and a few other European nations you will easily hit 50%.

In other words, there has been a massive concentration of spending power with the World Bank, because they act as trustees for the various public-private-partnership funds, where the public side is funded via the governments of the world. And this will only accelerate, if the Pandemic Treaty and hence One Health is enacted, centralising not only the surveillance and database aspects, but also by taking over 5% of sovereign health funding, globally.

-

In yesterday’s post on the Berlin and the Manhattan principles, we saw how the Berlin Principles referred to the ‘international funding mechanism‘, rather than NGOs or the public. Well, that sounds rather a lot to me like the World Bank.

The Berlin and Manhattan Principles

In 2004, The Manhattan Principles were released. These are, in short, the 12 rules making up ‘One Health’. They go as per below - I’ve spent a fair amount of time trying to decipher their legit meaning. In general, some concepts encapsulate a number of these components; One Health is the ecosystem, which is what all life live within; humans, domestic ani…

And as the masses are indoctrinated with calls for ‘global citizenship’ as per Berlin Principles, this rapid concentration of spending power will only accelerate. The World Bank will command an increasing amount of the public side of the business of money.

And the governments rely to a heavy extent on not only taxation, but also central banks - the private side of money - who enable spending via bond purchases, and under special circumstances, quantitative easing programmes.

What this means is that the BIS will control the private side of the equation of money, and the World Bank will progressive increase its influence over public spending.

And in that regard, the World Bank represents us, no? After all, it’s an institution of the United Nations, specifically setup to represent us, the common garden variety prole, no?

Isn’t that what they tell us?

-

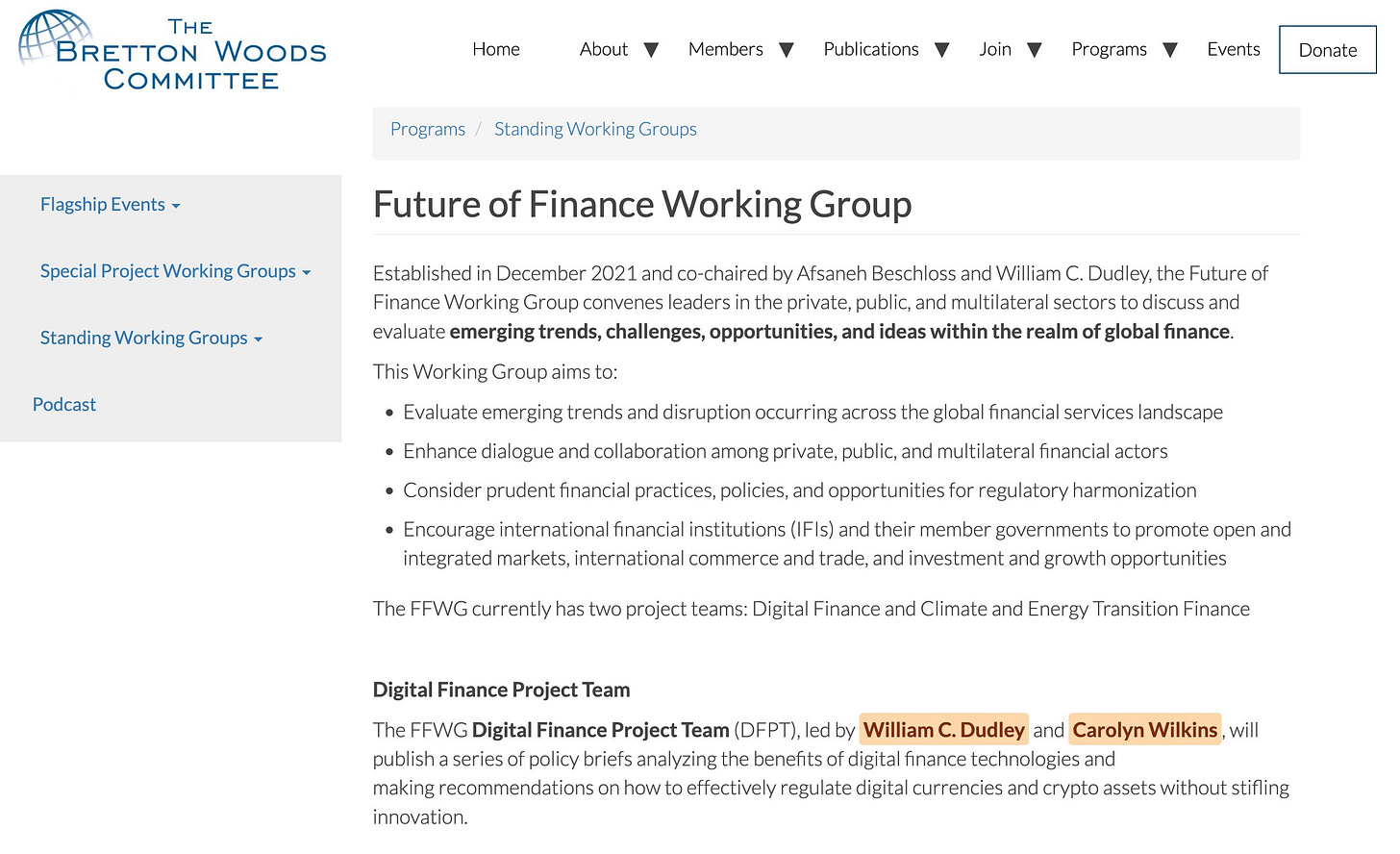

Well, if that’s so, then please explain why two central bankers lead the Bretton Woods’ committe on the Digital Finance Project?

Yes, really. The two people more than any in charge of policies relating to central bank digital currencies literally represent the private side of money, yet are employed in public capacity.

Who do they genuinely work for?

William Dudley, in fact, has not only served on the FRB of New York (which - by far - is the most powerful of the Federal Reserve System; in fact, it’s the only which matters). But he furthermore is also one of the elusive class of people who have worked at the Bank for International Settlements, and let it be publicly known.

And Wilkins? Well, same applies to her. Yes, while it’s usually a struggle to find a single person who’s directly working with the BIS, here we have not one but TWO of those elusive creatures. These are two very, very influential titans of central banking - and they both work to represent us, hammering out the digital finance project.

Lucky us!

-

So what am I saying?

Money is rapidly concentrating upwards in society, and that is definitely not to protect you. And - unless stopped - this will only continue to accelerate, because it’s by design.

Central banks facilitated the Covid-19 scam by printing an odious amount of money, which would always result in inflation.

The Covid-19 scam created a demand for a vaccination passport, which is Digital ID by stealth.

Digital ID will enable CBDCs, which are controlled by the central banks, ultimately dominated by the BIS.

The World Bank are the trustees in matters of rolling out the global surveillance state, net zero, and the 15-minute prison camps of tomorrow - all of which benefit greatly by Digital ID.

And the BIS is controlling important work carried out by the Bretton Woods Committee (World Bank + IMF) digital finance team, working on matters such as CBDCs and Digital ID.

-

So here’s the leap of faith. Stick with me for a minute.

You know what else comes up in all of this? ‘The Declaration of Interdependence’. Penned by Henry Steele Commager in 1975. Sourced here via the ‘Global Interdependence Center’ website, an organisation which is located in the building of the Federal Reserve Bank of Philadelphia.

It’s not the first call in this regard. This same call was also issued by self-declared socialist Will Durant in 1945… openly calling for socialism in this regard.

But there was an even earlier call here, by Daniel DeLeon, a leader of the Socialist Labor Party - in 1895. It’s pretty… explicit.

And there’s another interesting aspect to this document. See if you can spot it. I’ll be back later in this regard. It’s a large topic, but very much in line with my other articles… ok, I’ll give you a hint… One Health.

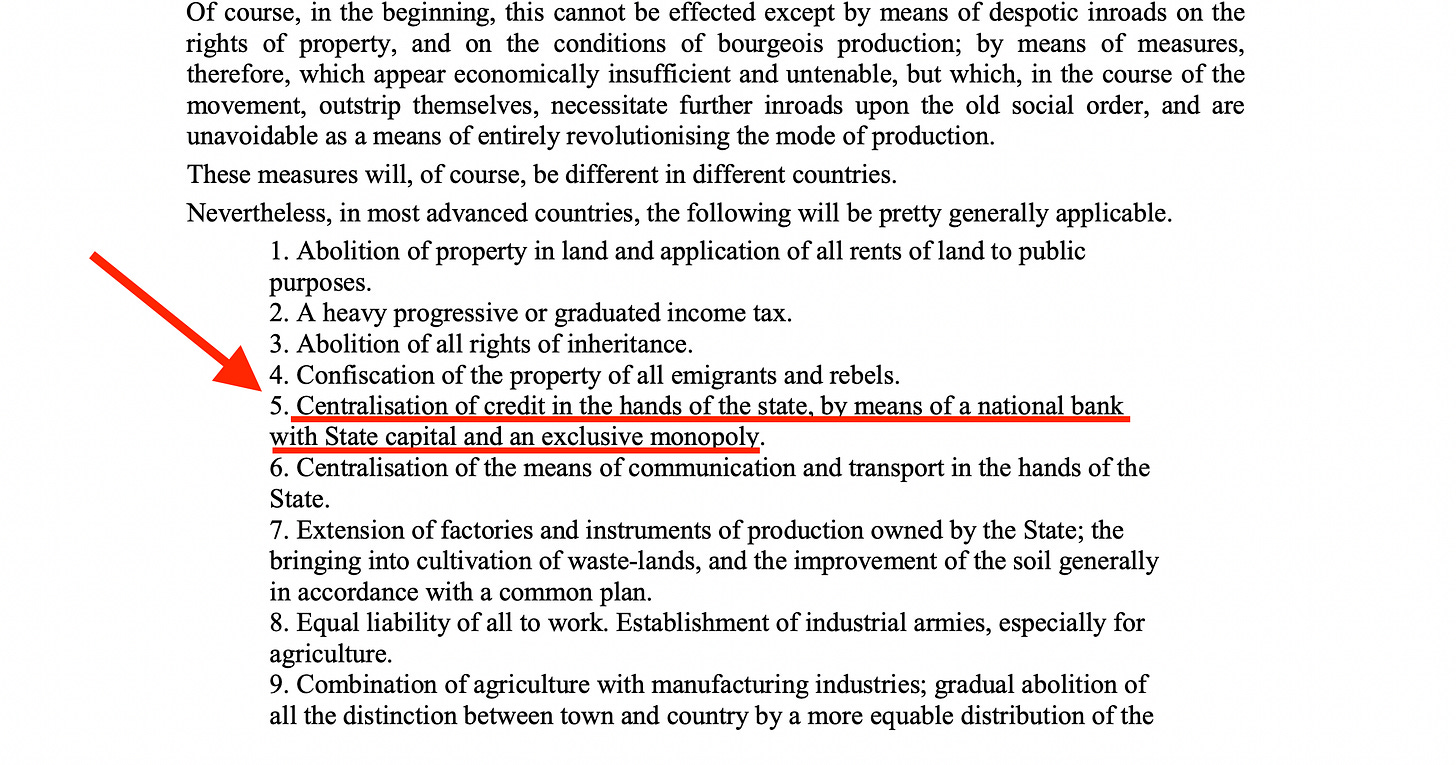

But is even that the root source? Because there is another option. Let’s just review what is currently taking place in relation to the 6 bullet points above, 2-6 especially - where does the BIS end and the World Bank begin?

What if those two in fact were just one, and what we see is a slow, but steady, centralisation of credit with just a single bank, the BIS?

If so, would the below apply?

-

Anyway, I’ll leave that for you to make that decision.

And don’t go all conspiracy theorist, now.