On especially all matters CBDCs - all roads leads to Basel.

-

The BIS has always been of interest to me, ever since I learned of their existence. Primarily in the early days, as it was specifically mentioned by Carroll Quigley’s “Tragedy and Hope”, but more recently, because the IMF and World Bank were supposed to replace it in 1944. In fact, all of their assets were transferred to the IMF as the International Monetary Fund was launched. Yet, they’re still around. Why? And how?

The reason for the interest? Because of their role in the hierarchy wrt institutional power. And in that regard, I’m not talking about the Rothschild, JP Morgan or Rockefeller here - I think power comes and goes, though obviously some faster and slower than others. I am specifically talking about a power as an institutional stronghold. Some organisations issue orders, others take them. Most fall in between. But I’m not sure who gives orders to the BIS. As to whether it’s a Rothschild, Morgan or Rockefeller in charge matters less in this regard. It’s about locating the onus of the system.

-

The more you dive into CBDCs, you notice a name ever-present. Never dominant, but always there. Like the teacher standing guard in the school break, ready to separate fights.

The Bank for International Settlements.

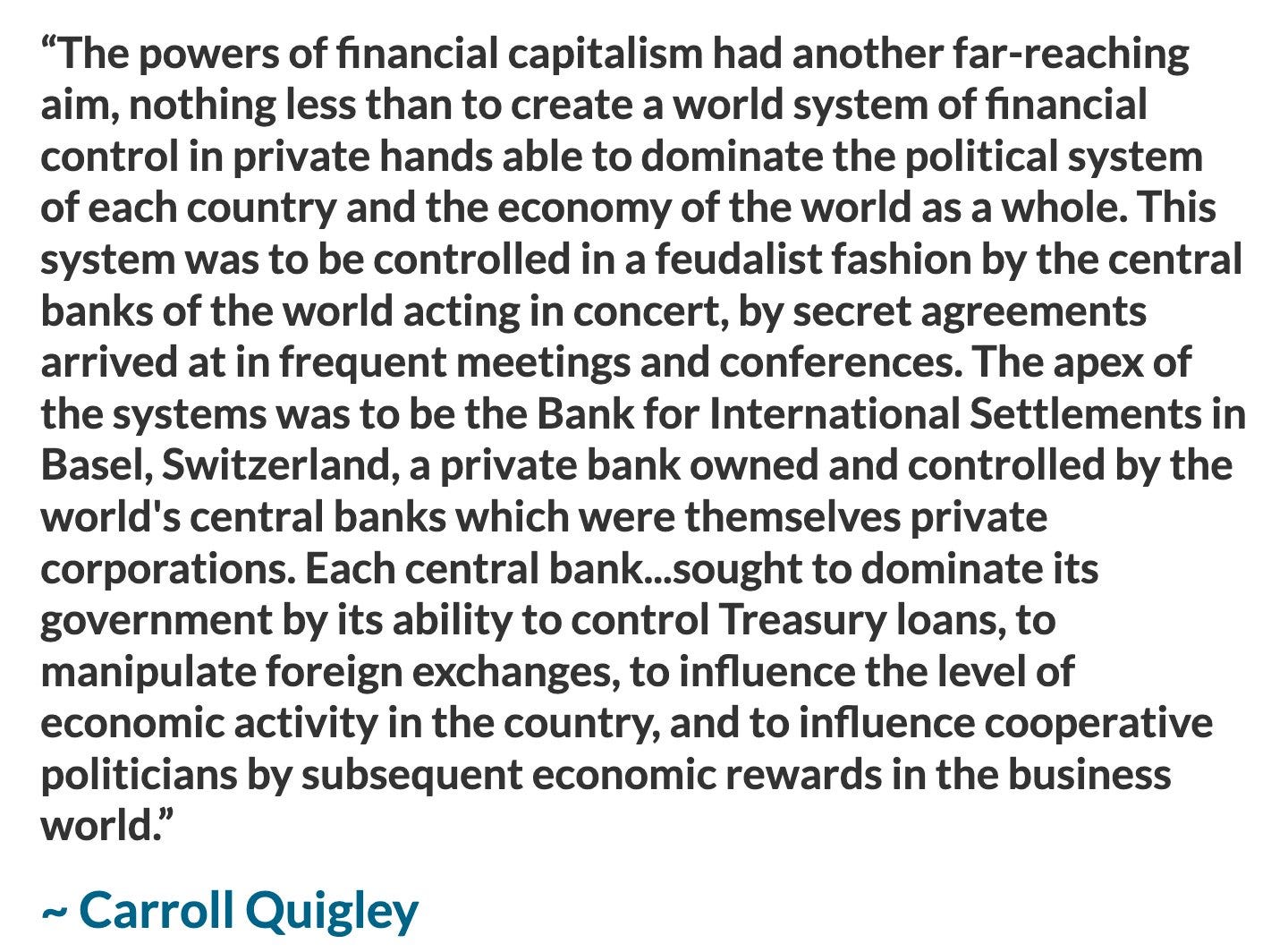

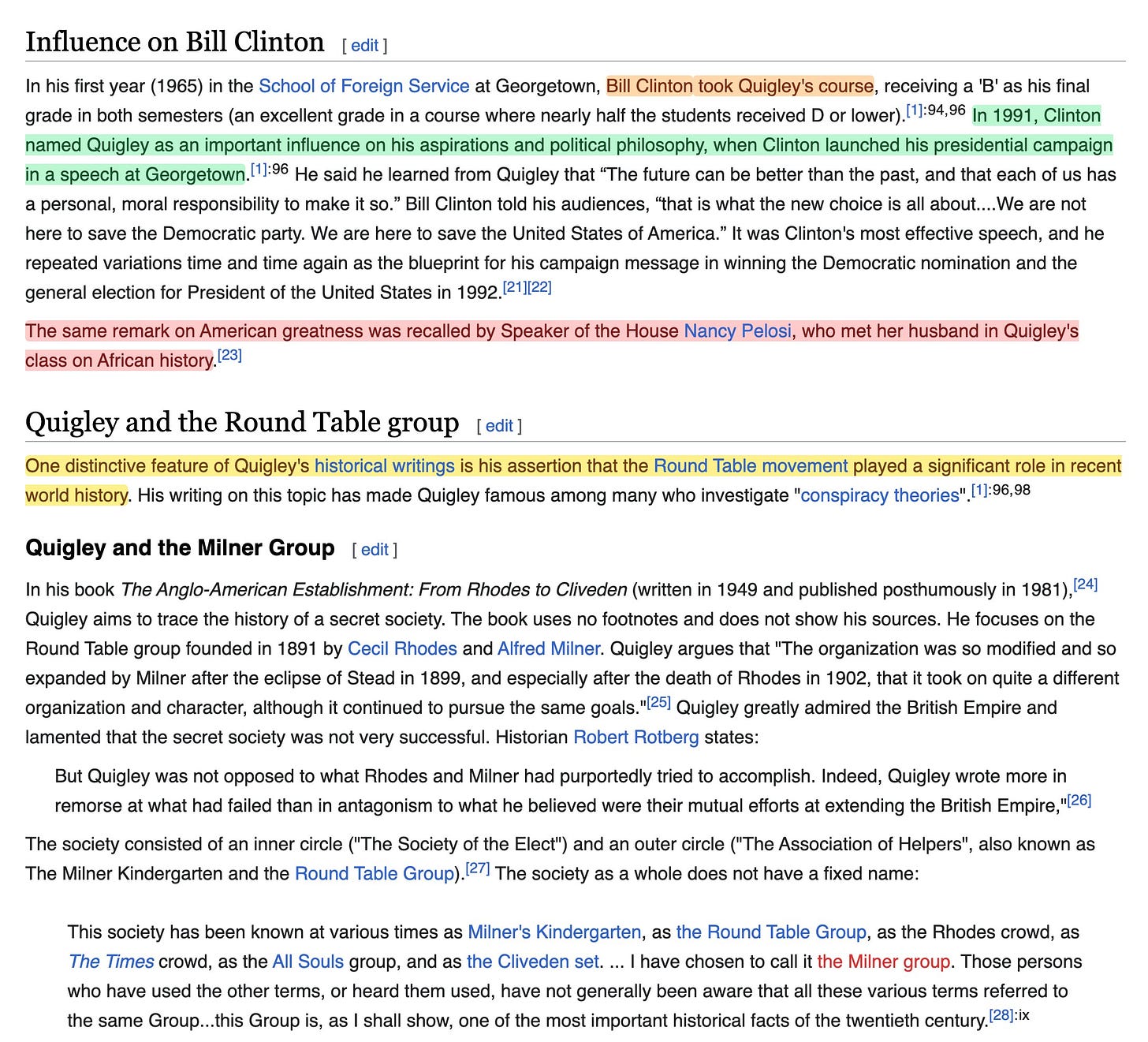

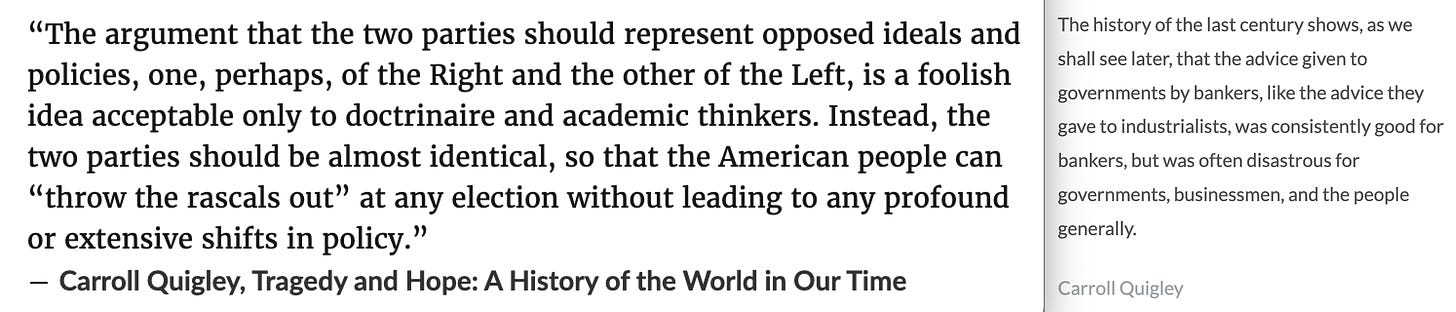

Probably the most infamous quote is one taken from “Tragedy and Hope”, by Carroll Quigley. Quigley was a Georgetown University professor, who lays out that he’s had access to the papers of Cecil Rhodes’ round table.

I’m won’t spend much time on this, because Quigley himself is probably most famous for his impact on Bill Clinton as a young student in Georgetown. He furthermore was clearly extremely well connected, and furthermore also educated Nancy Pelosi.

‘Tragedy and Hope’ is worthy of mention - it’s a tome of 1,348 pages. It’s been a decade since I read it, but the above quote isn’t the only controversial one, in fact, a number of them appear so obviously correct, viewed through lens of contemporary politics. The first edition of the book was released in 1966. For a while, it sat idly, collecting dust on the shelves of bookstores. Then, out of nowhere, a mystery entity would suddenly attempt to buy every single copy.

These are just two quotes, was this a substack on the book itself, I could add many more. One interesting part however relates to the think tank, Chatham House - also known as the Royal Institution on International Affair, the RIIA, which is one of the most senior think tanks on the planet.

A number of books have confirmed the existence of Rhodes’s round table group. This is another. And no, this book is not considered ‘conspiracy theory’, though frankly, this typically means it’s legit these days.

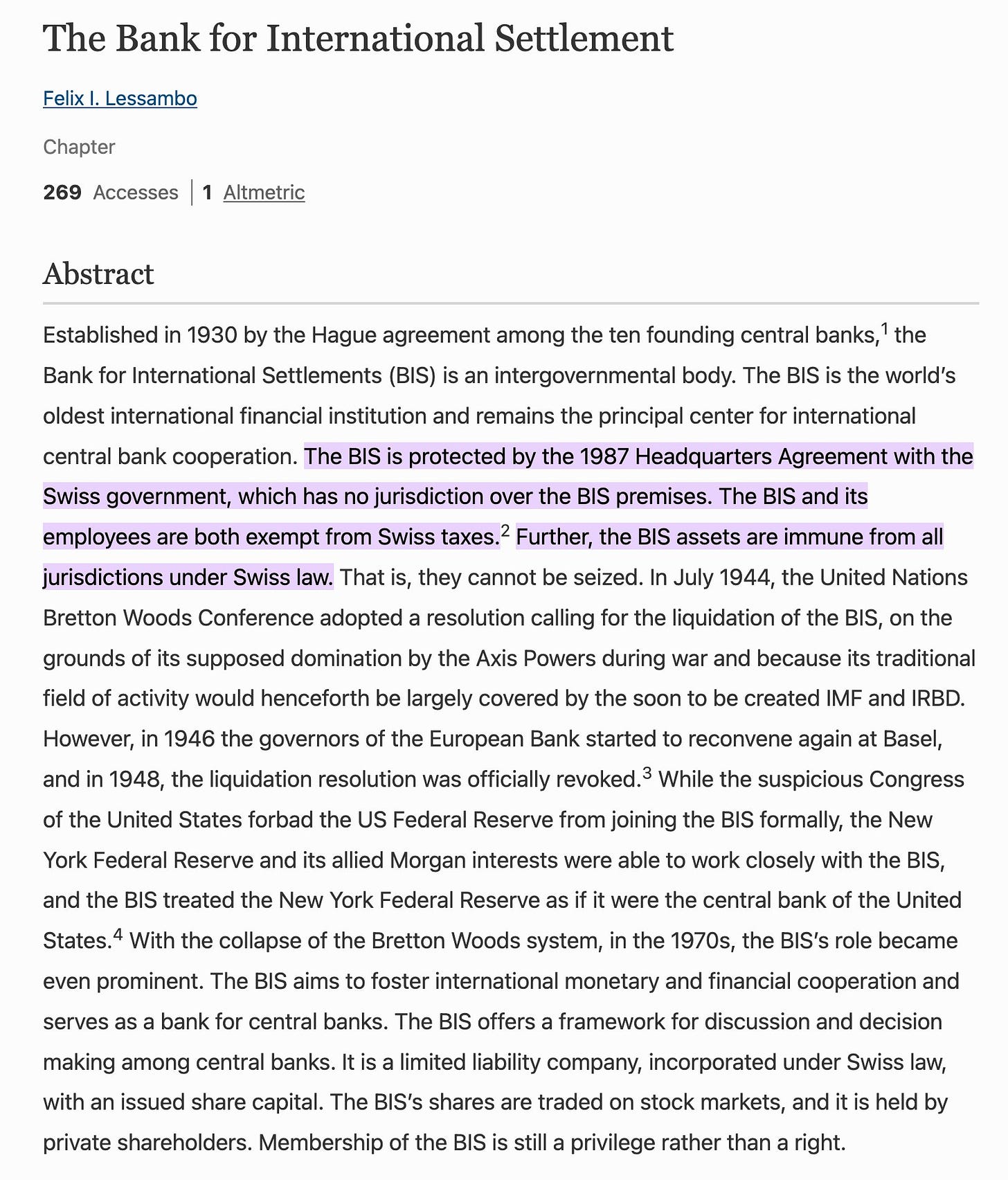

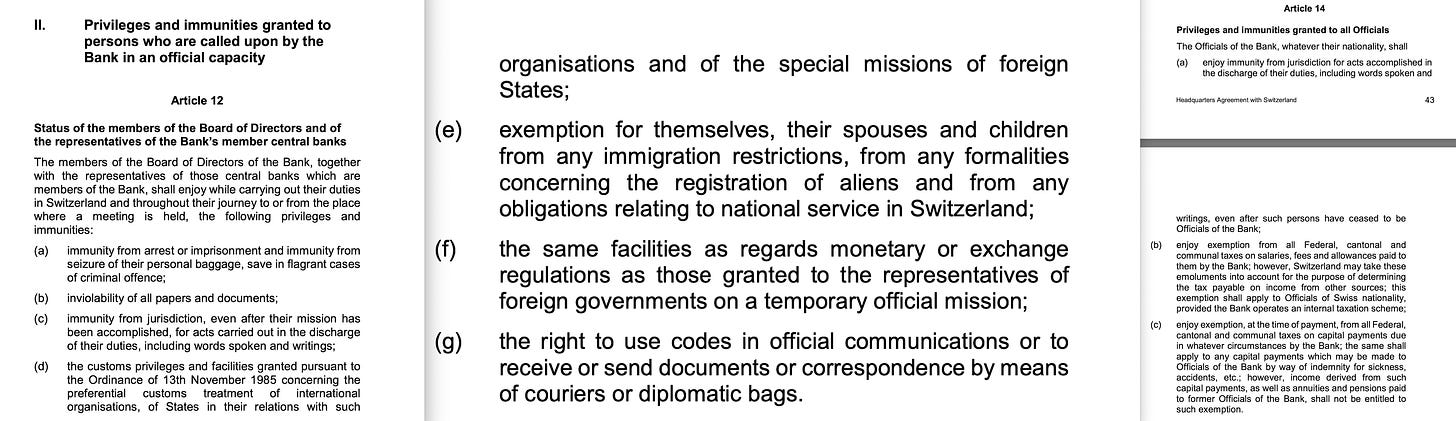

But this isn’t about Cecil Rhodes, or the RIIA, or Carroll Quigley. This is about the BIS; the Bank for International Settlements - the central banks of central banks. Based in Basel, Switzerland, their agreement with the Swiss government sets out exemptions. Here’s from a paper on the topic, all the material can be found here.

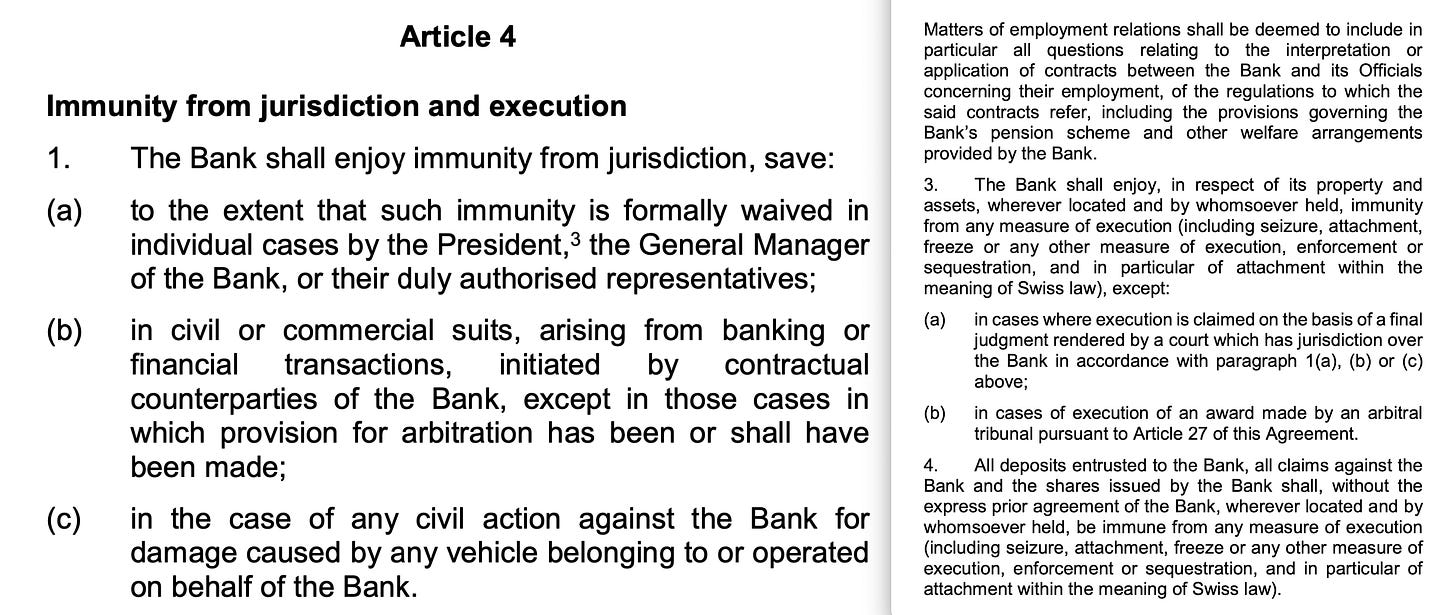

Their agreement with Switzerland is, frankly, ludicrous.

In short, the BIS is immune from jurisdiction & execution. They are tax exempt, free of oversight, and can dispose of funds as they see fit. Employees on duty are immune from prosecution, and exempt from Swiss tax laws.

Same applies for non-Swiss nationals - yes, the bank supercedes Swiss laws.

Special rules furthermore apply to military drafts and other calls of duty. Even that they’re beyond.

Any - possibly my favourite - disputes between Switzerland and the BIS are referred to the international courts, ie, not Swiss, but the one in Hague.

And this sweetheart deal came into force in 1987. The same year as the 'Black Monday' in the markets, and the year after the UK had executed their ‘Big Bang’ legislation revolution.

In other words - in spite of being situated on Swiss soil, in spite of being under the protection of Swiss services, and gaining the use of any facility that Switzerland can provide, the BIS sits above it all. Rules simply do not apply, and if you wish to complain, then you need one hell of a complaint, because the only legal recourse is to submit the complaint directly in Hague.

-

In terms of the contemporary landscape, the issue number one in the central banking community is the introduction of Central Bank Digital Currencies - CBDCs in short.

And before we work our way to the BIS, let’s establish a few things.

All the world’s major think tanks are in on it. Here’s Chatham, the Council on Foreign Relations, the Atlantic Council, …

Beyond that, we also see supranational instututonal global buy-in. Here’s the UN, the IMF, the World Bank, …

Then we have a range of central banks, all hierarchycally below the BIS - the Bank of England, the European Central Bank, the Bank of Japan, the Federal Reserve, along with Australia, China, Nigeria, South Africa, Brazil, Algeria, Norway, and even Russia.

Everyone, in short, is introducing CBDCs, and amusingly, they all appear to do so at the very same time.

Of course, it’s not enough for central banks to introduce their CBDCs, we need institutional buy-in, and in this case, that’s the role of governments. What are they up to?

Naturally, kicked off with the BIS giving governments their full blessing.

So here are statements from the UK, the US Treasury, Biden’s White House, Japan, the EC, Xi Jinping’s China, Canada, Singapore, and India.

There are many more.

What Central Bank Digital Currencies enable is the topic of the next thread. It’s a large concept, and even China has an interesting story to tell in that regard. And all of this will also need to be linked up with Clare Sullivan and Digital IDs.

Back soon.

Clare Sullivan

No, this is not a repeat from 2006, when she with Tony Blair’s full cooperation attempted to push through National IDs. Since that ill-fated attempt, Clare has been busy. But this time, covertly so. Because when you want to get things done, better not involve democratic principles.

Thank you, this is a good fit to my piece entitled “A hill to die on”, which is about how cashless CBDC & digital ID form a mesh of entrapment from which there is no escape.

I cannot think of any other reason why the Useless Eliters are pursuing these objectives with such fervency.

It’s an evil objective.

I sense it struck a chord with many readers, because I’ve had more comments below it than on anything else I’ve ever written or said since 2020.

And I’ve written some inflammatory things since then!

https://open.substack.com/pub/drmikeyeadon/p/the-hill-to-die-on