Monetising UNESCO Biosphere Reserves

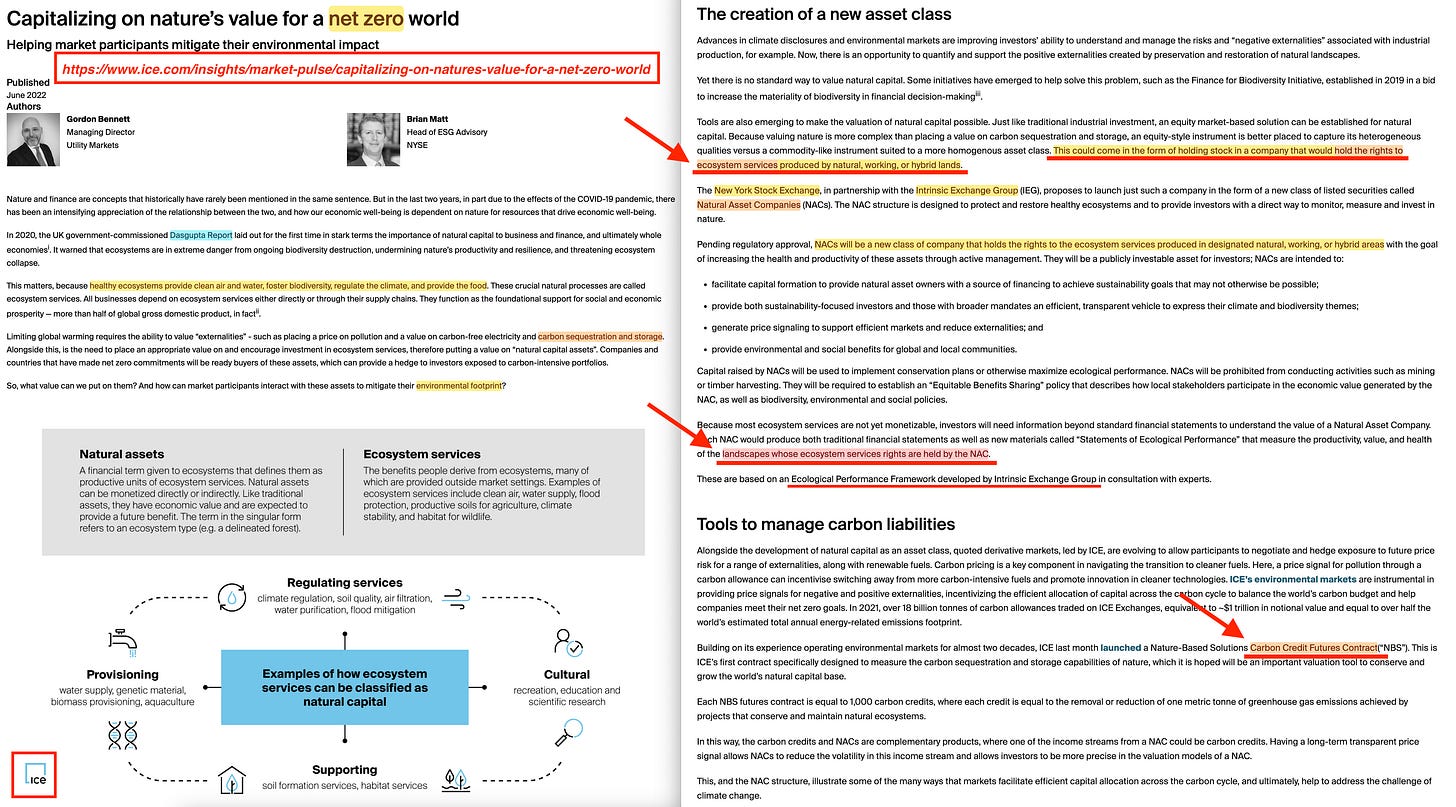

The eventual conclusion I came to in yesterday’s article was that UNESCO’s Biosphere Reserves, through the Global Environment Facility, was using a ‘Landscape Approach’ to monetise the output of ‘Natural Assets’ - ie ‘Ecosystem Services’ - and these would be routed into ‘Natural Asset Companies’ and floated on ie the New York Stock Exchange.

And as I was working on drumming up material for yet another article cementing this claim, I realised that the Intercontinential Exchange had already done the work for me.

Thanks, ICE1!

Yesterday’s article is here -

The article to which I refer can be found here - ‘Capitalizing on nature’s value for a net zero world‘2. I’ll add it here and again at the bottom, because there are a range of links which need to be squeezed in.

I won’t go through this in-depth. Instead, I’ll add links to prior articles as appropriate, as I’ve covered pretty much everything in detail before. Yesterday’s article was meant as the glue, putting together past work, but I probably should have taken inspiration from Buzzfeed, as it’s not a particularly exciting title.

Keep reading with a 7-day free trial

Subscribe to The price of freedom is eternal vigilance. to keep reading this post and get 7 days of free access to the full post archives.