Basel 3.1

The Weaponisation of Risk

If a bank were to fail, you would probably expect it to be due to poor decisions — lending to the wrong people, or investing in assets which went sour.

What you would likely not suspect is that a committee in Switzerland had quietly adjusted numbers in a spreadsheet, and that this adjustment made your bank’s existing assets suddenly require far more capital.

Under banking rules coming into force in January 20271, a single coordinating body — the Basel Committee on Banking Supervision2 — will have effective control over which assets are expensive for banks to hold and which are cheap. And since regulators already know exactly what sits on each bank’s balance sheet, they know precisely which institutions will be hit the hardest.

No public intervention, no headline, no Parliamentary debate. Just a technical recalibration that happens to make one bank’s position untenable while leaving its competitors unscathed.

How Capital Requirements Work

Banks must hold capital against the possibility that their loans and investments go bad. The riskier the asset, the more capital required. In the past, large banks have used their own internal models to make this assessment — examining their portfolios, considering default rates, factoring in underwriting quality, and reaching their own conclusions about how much capital was appropriate.

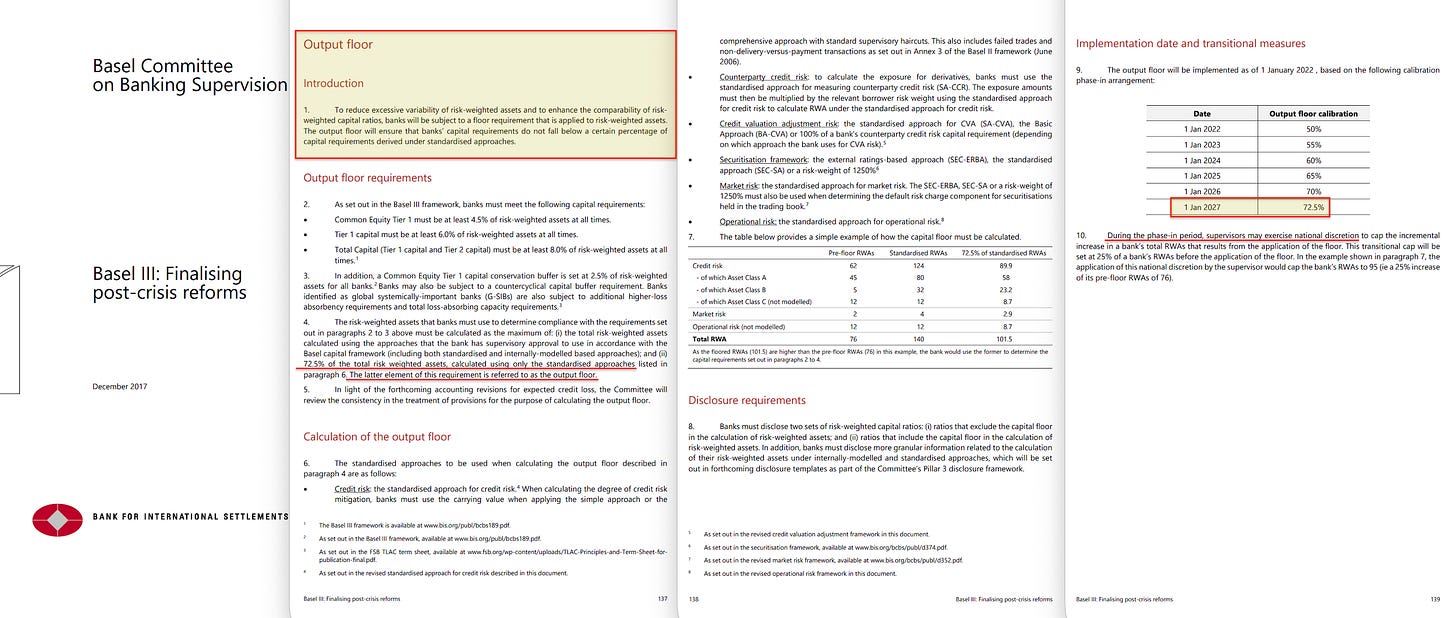

Regulators supposedly grew concerned that banks were gaming these models to minimise requirements. Basel 3.1 addresses this by mandating standardised calculations. The ‘output floor’ requires that capital requirements cannot fall below 72.5 percent of what the standardised approach would produce3. For several major asset classes, internal models have been eliminated entirely.

The standardised approach is a lookup table maintained by the Basel Committee. Commercial real estate carries one risk weight, loans to other banks carry another, corporate bonds rated BBB carry a third. These weights translate directly into capital requirements: a higher weight means the asset is more expensive to own.

The Targeting Mechanism

Banks must report their asset compositions in granular detail through regulatory filings and stress test submissions4. Supervisors know precisely what each institution holds — which sectors, which geographies, which credit ratings, which counterparties.

When risk weights were determined by internal models, this knowledge had limited utility. A bank might justify heavy exposure to commercial property through arguments about underwriting quality or geographic diversification. The standardised approach eliminates this balancing. The lookup table determines the capital charge, and the lookup table is set in Basel.

Suppose the Basel Committee increases the risk weight for commercial real estate from 100 percent to 150 percent. Every bank holding commercial property now requires fifty percent more capital against those positions. But a bank with five percent exposure faces a manageable adjustment, while a bank with thirty percent exposure faces a serious problem. The same supposedly neutral recalibration affects one institution harder than another.

The affected bank must then raise expensive new capital, sell assets at distressed prices, or shrink its balance sheet. And none of this requires any announcement that a particular bank is being targeted — and no institution in Basel have to accept responsibility when outcomes turn negative.

Stress Testing as Reconnaissance

The targeting potential is amplified by stress testing5. Regulators design hypothetical scenarios — interest rate spikes, property market corrections, sovereign debt crises — and require banks to demonstrate they could survive them. The scenarios are chosen by regulators, and the assumptions embedded within them determine which business models appear resilient and which appear fragile.

Stress testing reveals exactly which institutions are vulnerable to which pressures. This information can then inform adjustments to the standardised risk weights that determine ongoing capital requirements.

An unelected committee, operating through technical standards that few voters will ever read, now has effective capacity to determine which financial institutions thrive and which struggle.

The power to define what counts as risky is the power to decide which assets are viable to hold, and therefore which institutions should be even allowed to exist.

And this my friends is why we are seeing precious metals rise at the same time as equity markets. as this has never occurred in history to date. Basel 3.1 started to trigger in 2025, banks (all banks) need to meet their tier 1 asset levels by 2030. I cannot confirm, but there are some references to suggest silver is also going to be considered a tier 1 asset, like gold. It was always considered a commodity due to industrial needs. This would help explain the massive swing in silver, but it may be hearsay.

Silvergate (before Silicon Valley Bank's intentional demise to hide the Big Tech and the Chinese Community's C19 profits), was shut down by the banking regulators when it had $1 Billion in capital and was not insolvent in any way.

We are now past the end of the BIS's "Going Direct Reset" when all nations on Earth were going to be force converted to CBDC... which has now been replaced by Stablecoin based on US debt. Countries are now force converting citizens to biometric digital IDs. We've seen a level of commercial brutality from the zionist community during the genocide in Gaza like never before. Our own president is a real horror show of activities to build out the control grid, keep the fake AI bubble going, and start down UNIMAGINABLE paths... I don't want my country to take over sovereign nations next door. Nobody wants this. This is irrational governance in complete violation of the people's will.

And I know the BIS, the Fed, and every other bank that stands to gain, are behind all of it. Thank you General Smedly Butler. Our illegitimate government continues to destroy us, and people everywhere so the Global Financial Elite can profit.

Check out La Quinta Columna's latest theory. In a few short months, it might all be moot:

01/20/26 THE GLOBAL FINANCIAL ELITE (GFE) PLAN COMES TOGETHER. GET READY FOR THE 2026 SOLAR ECLIPSE 08/10/2026 TO 08/12/2026 HUMSN TO TRANSHUMAN HYBRIDIZATION ACTIVATION.

La Quinta Collumna: The Global Hybridization Agenda

https://lys-dor.com/2026/01/18/ricardo-delgado-martin-presente-lagenda-dhybridation-globale-prevue-pour-2026/

My research going back to 2008, supports everything he is saying. Now let's see if possible CIA plant, Ben Davidson of Suspicious Observers (YT) will say anything about this...