In The Hague, on the 16th of October, 2018, the Global Commission on Adaptation was launched by Ban Ki-moon.

And that, too, has remarkably escaped attention.

Let me just head straight to quoting their first report, titled ‘Adapt Now: A Global Call for Leadership on Climate Resilience‘ -

‘This report focuses on making the case for climate adaptation, providing specific insights and recommendations in key sectors: food security, the natural environment, water, cities and urban areas, infrastructure, disaster risk management, and finance. It is designed to inspire action among decision-makers, including heads of state and government officials, mayors, business executives, investors, and community leaders‘

See, the report is not for you. It’s meant for your masters, aka ‘representative’.

‘The Commission is led by Ban Ki-moon, 8th Secretary-General of the United Nations, Bill Gates, Co-chair of the Bill & Melinda Gates Foundation, and Kristalina Georgieva, CEO, World Bank.‘

And this is then followed by a star-studded panel, including Chief Executives from UNEP, UNHCR, UNFCCC, the GEF, UNDP, WRI, and… well, it would be kind of rude not to mention the Gates Foundation.

And the timing of the initiative is… impeccable. Astonishing. Miraculous. I’ll get to why in a minute. First, let’s run through the executive summary -

We kick off with the typical lies about climate change, a request to consider what MAY or COULD happen if we don’t do as we’re told, as the cost… yes, of course this is about money… would spiral should we not take action.

We carry on with the fake appeal to women, to children (though ‘future generations’ is preferred contemporary terminology), loop in the natural environment (wait for it), the economic imperative (theirs), and all sorts of ridiculous financial estimates… which ultimately, highlight why all of this is a scam -

‘… our research finds that investing $1.8 trillion globally in five areas from 2020 to 2030 could generate $7.1 trillion in total net benefits‘

Setting aside the mandatory ‘could’ - which serves as a convenient get-out clause when it fails to materialise - if the legit return here was anything of the sorts, why even bother the public? Why wouldn’t the billionaire class go it alone on this ‘sure thing’?

The answer here is obvious.

It carries on outlining all the money we need to spend, even loops in early warning systems, which I’m sure is primarily for their protection, not ours.

We carry on with the ‘triple dividend’, which in short outlines their ‘calculations’ all being future loss avoidance, which in other words mean total guesswork as the truth is no-one has the faintest idea what the climate will look like in 10 years, never mind 75. But, without the shadow of a doubt, those ‘philanthropes’ will front-run said ‘investment' areas, ensuring their yield is just dandy.

We move onto a required ‘revolution in understanding’ which means more manipulative lies in the MSM by social scientists, a call to ‘price risk’ better, which in reality needs manipulating because all of this is heinously risky and present models expose the robber barons, a revolution in planning, which translates to getting taxpayer money involved, and a revolution in finance…

… and before moving to the next pages, I quote from box ES.1 - ‘With $60 trillion in projected infrastructure investments between 2020 and 2030, the potential benefits of early adaptation are enormous.‘

60……… trillion.

How many plots, sorry, landscapes of agroforestry will that finance?

But continuing on with their proposed ‘revolution in finance’ -

‘The public sector, first, is an essential provider of finance…; and second, is an enabler of increased private sector finance through disclosure requirements, metrics, and incentives, like buying down the risk of providing financial services to small-holder producers.‘

I’ve gone through this quite a lot by now, so let me translate what they actually say.

The taxpayer should bring lots of money, which in turn will enable the billionaire class to profit off incentives like being entirely protected from losses in the event of default, and enable the yield they want as opposed to the one on offer by the free market.

It’s blended finance, in other words.

It continues -

‘The private sector will increase investments on its own account, but it should also increasingly complement the public sector in sharing the costs and benefits of adaptation investments, such as for infrastructure, contingency finance, and insurance. Finally, there is a critical need for higher levels of international financial support for adaptation in developing countries.‘

The private, in other words, should not be coerced into making undesireable investments in, say, risky propositions like Middle East and Africa, but should be allowed to capitalise on potential returns.

What this basically means is that they can cherry pick the best parts of the investment portfolio, while the taxpayer bears the absolute brunt of the risk. It’s a transfer, a subsidy, to the billionaire class in other words.

And finally, the call for further financial support for adaptation means we need to hand the World Bank more money for being so awesome. They will then take that money, and use as they see fit with absolute impunity.

A broad outline follows; it’s about investments in food, which claim up to an absurd 17:1 return on investments, making it even more puzzling why the billionaire class doesn’t capitalise on the returns themselves… unless calculations are fraudulent, of course.

We continue with ‘Nature-based Solutions’, which in short are investments in ‘Natural Capital’ which produce ‘Ecosystem Services’, which can then be IPO’ed off as Natural Asset Companies.

… and naturally - and this was obvious at the point I added ‘wait for it‘ above - this is all about the Convention on Biological Diversity, which is the biggest scam in recorded history.

More disaster porn follows through ridiculous temperature projections - more demand for public ‘investments’, more false claims of high returns, and very, very subversive suggestions of even more surveillance in cities. Let me decipher -

‘To plan and deliver more resilient urban services, cities everywhere need to invest in better climate risk information and technical capacity, drawing on credible topographic and community-level data‘

When you hear of ‘resilience’ think ‘central planning’. Really. Their entire ideology is based around top-down governance, consequently, the system we have needs ‘strengthening’ to become more ‘resilient’ as present arrangements still have some fraction of public influence, regardless of how small that is. Strengthening, in this context, means less democratic influence.

As for the climate risk information and technical capacity, well, that’s where the global surveillance enters the frame. It further loops in ‘better topography’, and what better topography but real-time satellite feeds. Finally, ‘community-level data’ could be taken to mean IoT sensors, or even ‘citizen science’ aka spying through your mobile phone and/or social media websites.

This is where GEOSS enters the stage, which also is used to feed data into the Convention on Bioligical Diversity framework.

The section on infrastructure somewhat hints at transferring ownership (along with more surveillance, of course), but rather than focus on that, somewhat more interesting is the inclusion of blended public-private approaches, which of course means blended finance structures, and -

‘we need to go beyond protecting individual assets to ensuring that whole systems are more resilient by making the right choices about where and what to build, which existing assets to upgrade, prioritizing green infrastructure‘

Get it? Your personal ownership rights count for nothing. What matters is the central, top-down approach. You will have no right to decide, no impact on the decisions on what to build, or where. All those rights will be transferred… to the stakeholders of course. Remains unsaid, of course, but that’s the intent.

We then have the part on Disaster Risk Management, which I personally struggled to connect to the narrative, but the below section makes that painstakingly clear -

‘We need to proactively yet voluntarily move people and assets out of harm’s way through better planning and investment decisions.’

Again, your individual liberties count for nothing, as you will be taken out of your home as they see fit. We saw exactly how they dealth with the topic of ‘voluntarily’ during the scamdemic, as all those prople in reality were forced to take the vaccine, or lose their ability to provide for their children.

’At the same time, we need to scale up efforts to warn and prepare people ahead of disasters, actions that can dramatically reduce the loss of life, and exhibit very high returns on investment‘

That’s where fake claims of pandemics enter the frame. Call a pandemic, force people through financial means, move them out of their homes. Perhaps they’ll return. Or perhaps the United Nations will level the ground on which they lived, for sakes of ‘restoring the ecosystem’.

Hey, the CBD did outline the 30% by 2030 mark, you know.

Finally, this is a major transition, and we need to start right away,

It’s at this stage I invite you to go back and notice when the initiative was launched (October, 2018), and the date of release of this report (September, 2019).

What an extraordinary coincidence.

Golly, what else took place in September, 2019? Why, this, of course -

To wrap up the executive summary -

‘The next 15 months are critical to mobilizing action on climate change and support global development. The Commission will champion the Action Tracks at the UN Climate Action Summit in September 2019 and throughout the coming year, including importantly at the Climate Adaptation Summit in the Netherlands in October 2020‘

Two references. I like references.

I won’t cover in full here, but let’s just have a quick look at the first of the two. Oh golly, the Decade of Action is right there!

But jokes aside, it’s a remarkable report, primarily because it includes an appendix outlining exactly which organisations are presently front-running policy initiatives. Two which certainly deserve attention are the -

‘… Net-Zero Asset Owner Alliance which comprises 12 Asset Owners, allocating more than $2.4 trillion USD globally‘

Oh look, so they do have trillions to invest! No need for public involvement at all!

‘One Planet Business for Biodiversity… Implementation of OP2B will be led by WBCSD and follow-up led by the Convention on Biological Diversity (CBD)‘

And there it is again. The Convention on Biological Diversity.

As for the second reference, one of the action tracks relate to blended finance, and the…

Wait, before we get to that, let’s return to the original document, skipping all chapters until 8, because it’s the only which genuinely matters; ‘Financing Adaptation‘

I suppose you’d like to know why I titled this article as such? Well, the latter part is because of the below -

‘While investments in adaptation have clear economic benefits, they may require large upfront payments before reaping medium- and longer-term benefits‘

That’s right. It’s an advance fee scam. It’s a Nigeria 419.

I will be somewhat more brief here, because I’ve covered most of this in prior articles already. We’re talking blended finance. We’re talking public sector puts up the money, and takes the risk. We’re talking private sector reaps the rewards.

But where it becomes interesting is in matters of risk-pooling, ensuring that investment decisions are climate enformed - a strategy, which should become standard for all projects - and “no regrets” resilience measures, which are new to me. More on these in a minute.

We further need to incorporate climate risks into both public and private finance, this should be forced through oversight and pushed through by central banks and finance ministries. And the funding flows, oh those funding flows. They should of course massively increase, and should now target adaptation rather than mitigation.

And then we have another instrument allowing us to arrive at 30% by 2030 - debt-for-climate-finance swaps.

Finally, we’re woefully behind on ‘providing incentives for the philanthropes’, as ‘investments’ are far short of the up to $300bn/yr mark we need to hit or we’ll all die in a lake of fire. Of course, in order to get that pushed through, we need a pretty good red herring… oh look, there’s a Gain-of-Function.

Risk-pooling essentially just mean pay into an insurance premium, and if something blows up, then it pays out. Of course, we all saw how that worked out for AIG as everything blew up simultaneously, forcing the taxpayer to bail out Goldman Sachs and JP Morgan, etc to the tune of $200bn.

The incorporation of climate risks mean that the likes of green bonds should be mandatory, as in, traditional financial accounting methods should be discarded. This, of course, will enable corruption beyond what you can possibly imagine.

Targeting adaptation finance means investing in guesswork, because there’s no way to realistically predict even the path of a tornado, let alone what global climate will look like in a decade. The entire field is flawed through-and-through, but as SCOPE fabricated the science, the UNFCCC was pushed through, who progressively will invent the incoming disaster, which can be solved only through the Convention on Bioligical Diversity’s Ecosystem Approach, aka stakeholder feudalism.

Debt-for-climate swaps likely mean creating ‘nature reserves’ in return for sovereign debt cancellation. The correct action here would rather be to simultaneously declare bankruptcy, because all investments come with risk, but those who sit on said bonds appear to think defaults are not something with which they should be concerned.

The final item is the ‘no regrets’ resilience measures… I’ll get back to that.

The following pages provide further clarity on concessional finance, adaptation finance, and climate flow, all of which need to massively increase on the back of taxpayer funds, our need to employ more fiscal modeling of the sorts which definitely has never led to crashes before, and mainstream climate change risk, which is again where those social scientists blasting you with lies about armageddon enters the stage.

The topic of insurance completes with the following -

‘While insurance has limitations and cannot, by itself, protect resource-strapped communities and countries from the full range of climate-related risk they face, there is considerable room to foster adoption of disaster risk finance packages that include insurance and other disaster risk finance tools‘

Yet no mention of where said ‘room’ exists. It continues -

‘Since most developing countries lack the data and market maturity in the private sector to develop risk finance instruments by themselves, the public sector will need to lead‘

Oh, so the ‘room’ is with the taxpayers yet again. Golly!

‘To address moral hazard, the competent authorities to consider leading national dialogues to clarify and codify the conditions under which their government will and will not cover private losses from extreme climate events‘

Remind me again, what did the competent authorities do in the face of widespread fraud and corruption in 2008? How many did end up in jail in the end?

‘In all countries, the role of the government as insurer of last resort must be clarified, both to protect countries’ national accounts and to incentivize climate-smart choices. … While politically difficult, the limits of the government’s role as insurer need to be addressed‘

Ah no worries. The private will be made whole, and that’s all that matters.

I can carry on here, because all of this is just continuous demands for more taxpayer bailouts, but let’s finish this begging letter on this note -

‘Greater incentives need to be created for the private sector to join with the public sector in investing more broadly in resilient infrastructure or nature-based solutions… governments have committed to exploring mandatory disclosure‘

… forcing disclosure of these absurd, arbitrary rules, favouring insiders yet again. It does however leave another reference -

‘To better jump-start the disclosure process worldwide, the appropriate regulatory authorities in the world’s largest developed economies to consider, within 5 years, requiring the disclosure of climate risks. This requirement should be in line with the TCFD, …‘

I’ll return to the TCFD, who will become an immensely powerful institution, in short, allowing it to pick winners and losers, you know, to protect us.

Let’s consider it a Social License to Operate, when it eventually filters through to SME.

It continues -

‘The public sector will need to build the policy, regulatory and legal scaffolding for blended finance that is efficient, generates suitable revenue streams, and shares both costs and benefits‘

Ie, the private will receive the benefits, and the public the costs.

And finally, a reference to ‘Land Value Capture’. I need to read up on that, but I’m sure that too is to protect you, through a global framework.

The TCFD is the Task Force on Climate-Related Financial Disclosures… which disbanded in October, 2023. Hence its responsibilities have been passed to the IFRS Foundation, and do try to contain your shock…

… in fact, to clarify, the Financial Stability Board has requested the IFRS Foundation take over the monitoring of progress…

… and who are the Financial Stability Board? Well, let’s just skip straight to their article of association. Yes, really - funded by the Bank for International Settlements, located in Basel, and the chair is…

Mark Carney.

Former Bank of Canada and Bank of England governor. One man. Two central banks.

You couldn’t possibly find someone closer aligned with the BIS.

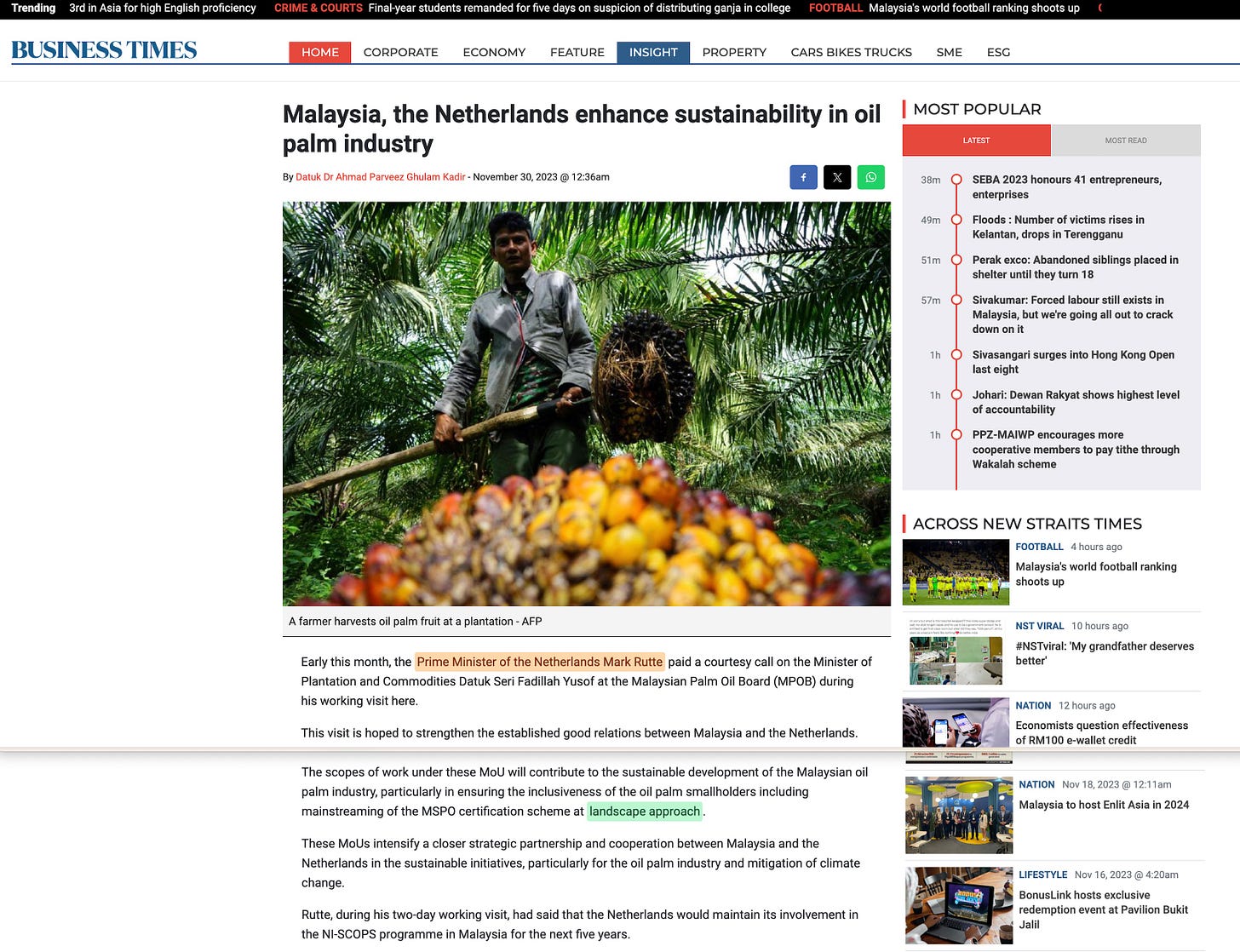

In closing remarks, I suppose you want to know why ‘Mark Rutte’ is in that title as well? It really is very simple. Mark Rutte established the Global Commission on Adaptation.

He’s in fact very much around in the context of the ‘Landscape Approach’. And what is that, you may ask. Simple.

The Landscape Approach relates to a spatial scale used by the Ecosystem Approach. It relates to environmental management, and… oh look, there he is again.

In fact, Mark Rutte is here, there and everywhere. Even here -

And let’s just address the topic of the ‘Landscape Approach’ aka ‘Integrated Landscape Management’. The below should clear it right up - along with stating how it integrates with the Ecosystem Approach, how the stakeholders may not necessarily include women, as their participation could not be desireable.

The questions to ask here of course relates to relative participation - ie, is it one man, one vote (lol, some hope), and… exactly who decides whose participation is necessary?

I can tell you right now. That’s up for the stakeholders to decide. The real ones, ie, those who get to decide whether to participate in events.

The bottom line is this -

It’s as deeply undemocratic as it can be. And that’s by design.

-

I leave as a final comment - I’m more than happy to be challenged. But if you do, your opinion needs to be actually backed by source documents. I explicitly source everything I do, and I expect you to do the same.

I do not accept appeals to authority.

Since a long time it's the same game: Restrict or limit the financial ressources of UN-initiative, for example through exit out of WHO, UNESCO as the U.S. did several time and you have garanteed the excess for global foundations or companies.

https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(14)60079-9/abstract?rss=yes=

The track goes back to 1984 and the withdrawal https://time.com/4980034/unesco-trump-us-leaving-history/

The Council for Inclusive Capitalism is now at 10,5 trillions under asset. https://www.inclusivecapitalism.com/about/

Marc Carney's (Bank of England) speech about "Inclusive Capitalism" in 2014, one year before the agreement to the SDG's in 2015:

Financial reform and rebuilding social capital

Central banks’ greatest contribution to inclusive capitalism may be driving financial reforms that are helping

to re-build the necessary social capital.

In doing so, we need to recognise the tension between pure free market capitalism, which reinforces the

primacy of the individual at the expense of the system, and social capital which requires from individuals a broader sense of responsibility for the system. A sense of self must be accompanied by a sense of the

systemic. All speeches are available online at www.bankofengland.co.uk/publications/Pages/speeches/default.aspx

Consider four financial reforms that are helping to create this sense of the systemic and thereby rebuild trust in the system.

https://www.bankofengland.co.uk/speech/2014/inclusive-capitalism-creating-a-sense-of-the-systemic