Beyond the Law - Part 2

Liquidity as Sovereign: The Capital Stack That Routes Policy

The real rules of global finance aren’t written in laws. They’re written in technical standards set by the Bank for International Settlements (BIS) and its partner bodies1. These groups quietly decide what counts as risky2, what companies must disclose3, and what assets banks can use as collateral4.

Those decisions steer trillions of dollars. Not through votes or laws, but through financial ‘plumbing’ — the way credit and liquidity flow, like water through pipes.

That plumbing is the true enforcement system. If accreditation decides whose information can be trusted, liquidity balances competing demands for capital. Together, they show how today’s governance works less through politics and more through infrastructure.

The Capital Stack as Governance

Most ESG debates focus on whether investors ‘should’ consider sustainability factors. But this misses where the real power lies: in the capital stack itself — the prudential standards that decide what counts as risk, what gets disclosed, and what qualifies as safe collateral.

The true financial governance happens in technical committees that write risk-weight tables, stress-test scenarios5, and disclosure templates. These bodies determine which firms pay more for credit, which projects qualify for bond indices6, and which assets central banks accept as collateral. No votes required — just plumbing adjustments that route capital as precisely as any central plan. Yet these adjustments are never presented as control — they are framed as prudent balance between competing values: stability and growth, present needs and future sustainability.

If accreditation is the 'trust of trust' layer that determines whose certificates count, liquidity is the harmonising layer that balances competing demands for capital. The mechanism is elegantly indirect: instead of banning activities, it makes some more expensive than others through capital requirements and collateral frameworks.

This system is becoming increasingly automated. As digitisation advances, these mechanisms operate with reduced human intervention, making technical standard-setting more directly consequential for capital allocation.

The Architecture of Financial Governance

The Basel Foundation

At the foundation sits the Bank for International Settlements (BIS) in Basel, Switzerland — the ‘central bank of central banks’. Through its Basel Committee on Banking Supervision (BCBS), it sets the global standards for bank capital adequacy. These aren't suggestions; they're implemented as law in virtually every major financial jurisdiction7.

Basel III8 establishes how much capital banks must hold against different types of risk. A loan classified as ‘high risk’ requires more capital backing, making it costlier for banks to extend. This cost gets passed through to borrowers in higher interest rates. The Basel Committee doesn't need to ban any particular activity — it simply makes some activities more expensive than others through capital requirements.

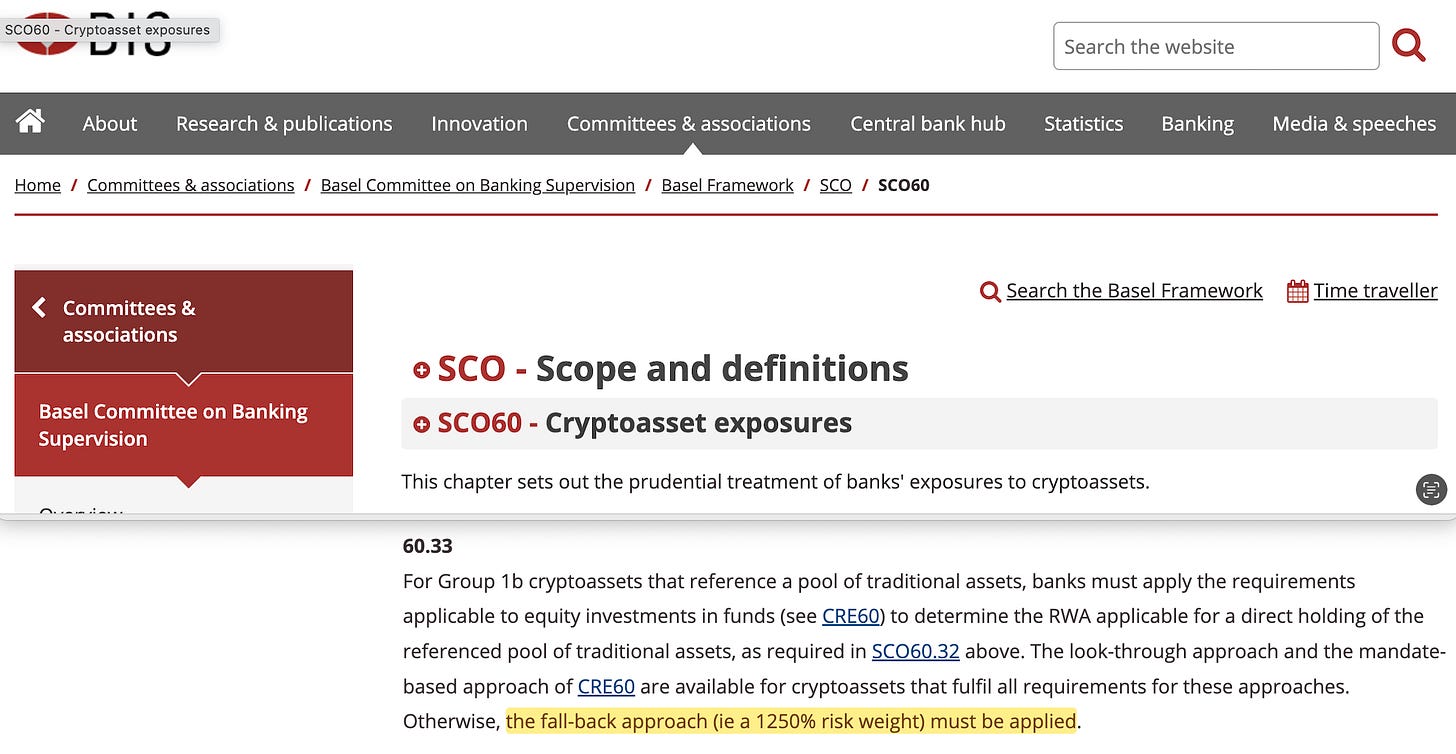

This classification process reveals how technical decisions acquire moral authority. Risk categories become ethical categories — crypto assets are deemed 'speculative,' green assets 'responsible', high-carbon exposures 'unsustainable'. In other words, the plumbing doubles as a moral economy. What appears as neutral prudence is already a coded hierarchy of values, assigning virtue and vice through capital costs. When the Basel Committee designates crypto assets as carrying a 1,250% risk weight9 (meaning banks must hold capital equal to 125% of the exposure), it effectively prices most banks out of crypto lending. When it creates preferential risk weights for ‘green’ assets, it channels capital toward sustainability projects10.

The Coordination Layer

Above Basel sits the Financial Stability Board11 (FSB), established by the G20 to coordinate financial regulation globally. The FSB doesn't write detailed rules — it provides the framework that national regulators implement. Its real power lies in defining what constitutes a systemic risk to the global financial system.

When the FSB designates climate change as a systemic financial risk, that determination cascades through the entire regulatory apparatus. This designation rests on modelled projections from bodies such as IIASA and the IPCC, which quantify climate’s long-term economic impacts. Once classified, central banks begin incorporating climate factors into stress tests; prudential regulators adjust capital requirements; disclosure bodies mandate climate reporting. With higher modelled risk comes higher requirements, and capital thus becomes more expensive.

Modelled projections → systemic risk designation → regulatory cascade → cost of capital.

This designation transforms technical assessment into moral imperative. Climate risk becomes not just financial concern but ethical obligation, sustainability not just preference but prudential necessity.

IOSCO12 (International Organisation of Securities Commissions) performs a similar coordinating function for securities markets, whilst IAIS13 (International Association of Insurance Supervisors) does the same for insurance. Together, these institutions coordinate risk definitions and disclosure requirements across all financial sectors globally — a harmonisation that is effectively grounded in frameworks such as Planetary Boundaries14.

The Disclosure Machinery

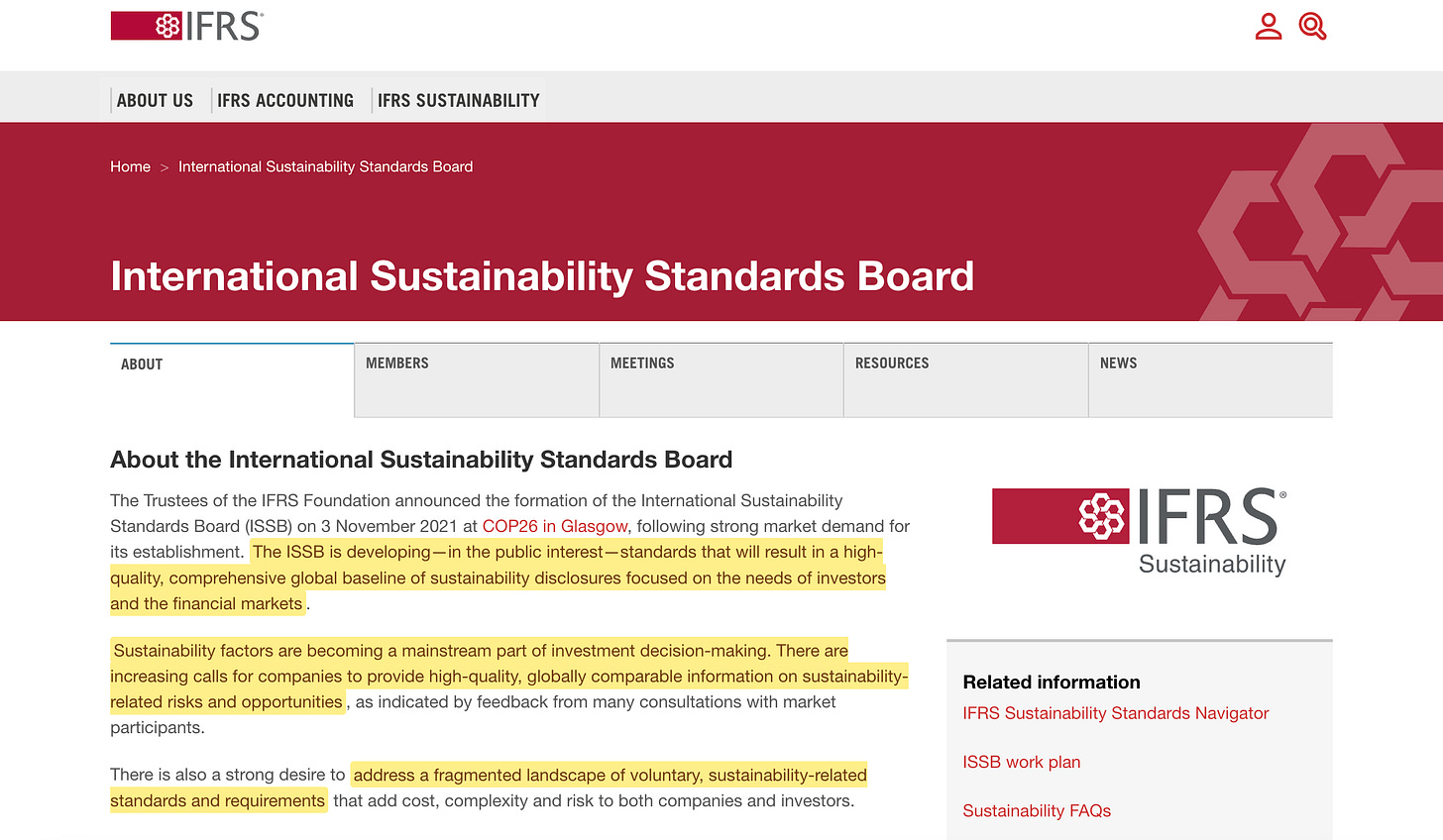

The International Financial Reporting Standards15 (IFRS) Foundation and its International Sustainability Standards Board16 (ISSB) write the templates that determine how companies must disclose financial and sustainability information. When IOSCO endorses ISSB standards, they become the global baseline for disclosure.

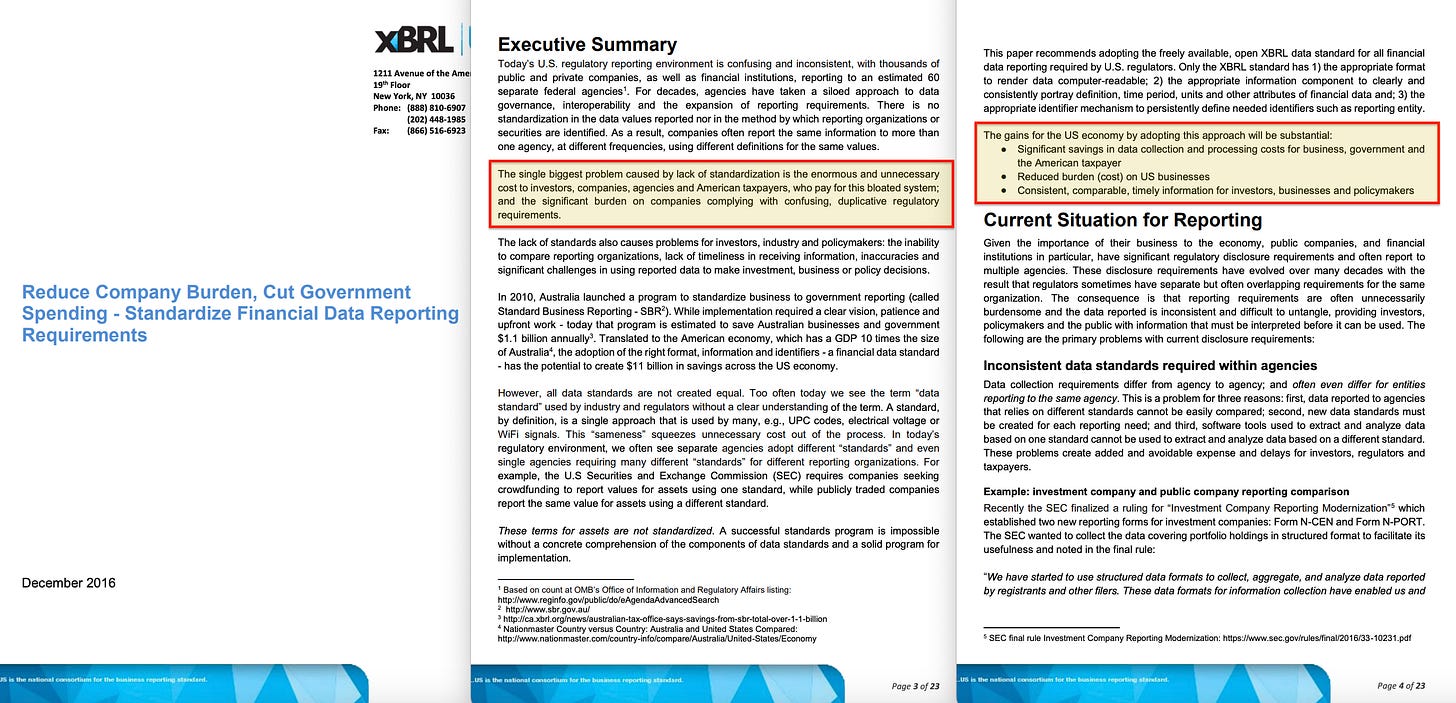

This isn't merely about transparency. Disclosure templates determine what information flows into risk models, credit ratings, and index methodologies17. If a piece of information isn't captured in the ISSB template, it effectively doesn't exist for financial markets.

The power of standardisation becomes clear when companies face different disclosure regimes. A firm reporting under ISSB standards can access global capital markets seamlessly18. One using non-standard disclosure frameworks faces higher costs as investors and lenders struggle to assess comparability and risk19.

How Models Become Market Discipline

The enforcement follows a precise sequence:

Model Output → ‘Risk’:

NGFS climate scenarios20 or Basel stress tests21 assess exposures. The assessment: ‘this is risky’.‘Risk’ → Disclosure Template:

ISSB standards mandate how firms report that risk. Non-compliant disclosure means ‘data unavailable’ in rating systems22.Disclosure → Rating/Index Methodology:

MSCI, S&P, FTSE Russell use ISSB data to adjust scores and eligibility2324. Poor disclosure = rating downgrades or index exclusion.Rating → Capital Routing:

Basel capital charges increase for poorly-rated exposures25. Index exclusions trigger automatic divestment by passive funds. Central bank collateral frameworks determine whether bonds can be monetised26.

What began as a model output becomes a funding penalty or market lockout.

Case Studies

ECB Climate Collateral: Haircuts as Policy

In 2021-2022, the European Central Bank began adjusting collateral haircuts based on climate risk27. Bonds from companies with poor climate disclosure faced larger discounts, reducing their value as collateral28. Since ECB collateral frameworks anchor the entire repo market, this immediately affected funding costs for non-compliant companies.

The mechanism was elegantly indirect: the ECB claimed it was managing its own risk, but the market pricing effects were immediate and broad.

Index Exclusions and Automatic Divestment

When index providers such as MSCI adjust their methodologies to include disclosure standards like those outlined by the ISSB, companies that fail to meet the criteria risk being excluded from ESG-linked indices. Because passive funds — which now manage over $15 trillion globally29 — must track these indices mechanically, they are forced to divest affected companies automatically, without any active ESG decision by fund managers30.

The power lies in methodology committees that determine rules passive capital must follow. These quantitative analysts effectively make allocation decisions for trillions in investment.

NGFS Stress Tests as Credit Policy

Bank of England climate stress tests using NGFS scenarios test how banks' balance sheets perform under climate transition pathways31. Banks showing excessive vulnerability face supervisory restrictions. The result: banks adjust lending practices, embedding climate considerations into credit allocation across the economy.

Climate science becomes credit policy without requiring legislation or democratic approval32.

The Institutions of Liquidity Sovereignty

The Constitutional Convention of Finance

The Bank for International Settlements functions as the constitutional convention of global finance, but one that never adjourns. Its Basel Committee33 continuously updates the fundamental rules that govern bank capital, liquidity, and risk management. These updates don't require ratification by parliaments — they're implemented through national banking regulators as technical adjustments.

The Basel framework's power lies in its universality. Banks operating internationally must comply with Basel standards regardless of their home jurisdiction34. A Chinese bank lending in London must meet the same capital requirements as a British bank, creating global harmonisation through technical standards rather than treaties.

The Coordination Centre

The Financial Stability Board serves as the coordination centre for global financial regulation, identifying systemic risks and recommending policy responses. When the FSB designates something as a systemic risk — whether climate change35, cyber threats, or crypto assets — it triggers regulatory responses across all member jurisdictions.

The FSB's recommendations carry enormous weight because they're backed by the G20 and implemented by national authorities36. A FSB recommendation on climate risk disclosure becomes policy in dozens of countries simultaneously, creating global standards through coordinated technical implementation.

The Climate Central Bank Network

The Network for Greening the Financial System represents central banks' collective response to climate risk. By developing shared stress-test scenarios and supervisory practices, the NGFS ensures that climate considerations are embedded consistently across global monetary policy37.

The NGFS doesn't set interest rates or conduct monetary policy directly. Instead, it shapes how central banks assess risk, what they accept as collateral, and how they supervise financial institutions. These technical decisions have significant effects on capital allocation across the global economy.

IOSCO and the Disclosure Infrastructure

IOSCO's endorsement of ISSB standards transforms sustainability disclosure from voluntary best practice into market infrastructure38. When IOSCO recommends that securities regulators adopt ISSB standards, those standards become the global baseline for market access.

The mechanism is indirect but powerful. Companies that don't report according to ISSB standards find themselves excluded from increasingly important data feeds, rating methodologies, and index construction processes. Market access depends on compliance with disclosure infrastructure that was never subject to democratic debate.

Why Liquidity Harmonises

Above Democratic Authority

Prudential standards transcend partisan politics because they balance universal concerns: financial stability against economic growth, present prudence against future prosperity. A parliament can pass any sustainability law it likes — but if Basel risk-weight tables mark an exposure as high-risk, capital costs increase regardless. Markets respond to liquidity conditions, not political speeches.

This creates governance that harmonises values that democratic institutions struggle to balance simultaneously — local interests versus global stability, short-term growth versus long-term sustainability. National parliaments debate ESG policy, but the real constraints come from Basel technical committees, ISSB working groups, and central bank stress-test frameworks. These bodies determine the financial landscape within which democracy operates.

Financial Hydraulics as Governance

The system governs through financial hydraulics rather than direct command. Instead of banning activities, it makes some more expensive through capital requirements and collateral haircuts. Instead of mandating investments, it creates pricing signals that guide capital allocation.

Central banks claim they're managing risk, not setting policy. But thousands of technical decisions about risk weights, disclosure requirements, and collateral frameworks shape economic activity as powerfully as any planning system — with the advantage of operating through ‘market’ mechanisms39.

Infrastructure as Ideology

The liquidity system reveals how governance happens through infrastructure rather than ideology. The debate about whether investors should consider ESG factors misses the point entirely. The infrastructure already channels capital toward particular outcomes through risk definitions, disclosure requirements, and prudential standards.

Companies and countries that align with these infrastructure requirements access capital cheaply. Those that don't face higher costs, rating downgrades, and potential exclusion from funding markets. The ideology is embedded in the technical specifications, not in mission statements or policy debates.

This makes resistance much more difficult than traditional regulatory approaches. Companies can lobby against specific laws or regulations. But they can't easily lobby against risk-weight tables, stress-test scenarios, or disclosure templates that are presented as technical necessities rather than policy choices.

The system presents itself as moral necessity rather than ideological choice. Risk weights embody prudential wisdom; disclosure templates represent transparency imperatives; collateral frameworks reflect responsible stewardship.

The Accelerating Trajectory

This infrastructure is rapidly becoming self-reinforcing. As financial systems digitise, risk models and compliance frameworks execute automatically without human intervention, making governance-by-algorithm the default rather than the exception40.

Each institution that adopts these standards increases the switching costs for everyone else — creating network effects that lock in the technical governance model. The infrastructure investments required to participate in global markets become too expensive to duplicate or replace.

The Harmonising Rail

This liquidity harmonisation shows how governance operates through financial infrastructure that balances competing values rather than through democratic mandate. By defining risk and disclosure at the global level, the prudential system routes capital as precisely as any central planner — but through market mechanisms that maintain the fiction of private choice.

Companies, banks, and even sovereign governments find themselves disciplined not by new laws but by spreads, ratings, and collateral access. When disclosure requirements become funding costs, compliance transforms from a reporting exercise into a survival mechanism.

This is the second enforcement rail of the global indicator regime. Accreditation decides whose verification counts; liquidity decides who gets financed. Together, they create a system where technical standards shape economic reality more powerfully than democratic institutions41.

The next question is how this financial governance connects to the digital infrastructure that increasingly mediates all economic activity. If liquidity harmonises capital allocation, what governs access to the digital systems through which all modern finance flows?

Addressing Common Objections

'Central banks are just managing financial risk'

Risk management has expanded beyond traditional banking stability to encompass climate, social, and governance factors. When the ECB adjusts collateral haircuts based on ESG disclosure, it's making policy choices about which economic activities deserve easier funding access.'Basel standards prevent another 2008 crisis'

Basel III addressed specific weaknesses in bank capital and liquidity. The concern is mission creep — using prudential authority to shape economic outcomes beyond financial stability through preferential risk weights for ‘sustainable’ activities.'This is just boring banking regulation'

Banking regulation that channels trillions in capital allocation decisions isn't boring — it's economic policy implemented through technical committees rather than democratic processes. Risk weights determine which industries get cheaper credit.'Markets would price these risks anyway'

Markets often ignore long-term risks that regulators model. The issue isn't whether climate or ESG factors matter, but whether unelected technical bodies should embed particular risk assessments into mandatory capital frameworks.'Banks can use their own risk models'

Only within Basel-approved methodologies and subject to supervisory override. When regulators stress-test banks using specific climate scenarios, they're effectively mandating particular risk assumptions about future economic conditions.'ESG integration reflects investor demand'

Investor preferences are shaped by index methodologies, rating agencies, and disclosure frameworks created by these same institutions. The infrastructure creates the demand it claims to serve.'Central bank independence is essential'

Independence from political interference in monetary policy doesn't justify independence from democratic accountability when shaping broader economic allocation through prudential standards.'This promotes financial system stability'

Channeling capital away from entire sectors based on long-term transition scenarios may create new concentration risks while serving non-financial policy objectives through financial regulation.