The Enron Code of Ethics

Corporate Social Responsibility (CSR) traces its origins to 19531, began to take shape in the 1970s, was touched upon in Blair’s 1991 article in Marxism Today, and gained momentum through Agenda 21. However, it took a scandal of epic proportions for it to gain major traction. And that disaster occoured in December, 2001, with the largest bankcuptcy in American history at the time: Enron.

By contrast, Bioethics gained prominance globally in the late 20th century, with significant, contemporary advancements in France in 19892. Discussions on ethics in science were further influenced by Agenda 21 in 1992, expanded internally within the scientific community through the ICSU SCRES in 1996, and externally through UNESCO’s establishment of COMEST in 1997. However, it was the 2001 Anthrax Attacks3 that vastly accelerated the initiative, spreading widely through ‘ethics declarations’, eventually leading to fired doctors considered guilty of ‘ethics violations’ during the recent alleged pandemic.

The Anthras attacks followed the events of 9/11 by a week, and while the Twin Towers attack led to sweeping Global Surveillance measures through the Patriot Act, the Public Health Security and Bioterrorism Preparedness and Response Act of 20024 marked a major expansion of public health authority, raising similar concerns about civil liberties. This act - previously touched upon in the post on the Collegium International - served as an input to the 2005 National Strategy for Pandemic Influenza5, which further refined pandemic preparedness, by integrating elements of the 1999 WHO Pandemic Influenza Plan - incidentally penned by the big pharma lobby group, the European Scientific Working Group on Influenza (the ESWI).

But - more importantly - it also led to the 2002 Eubios Declaration for International Bioethics6, which in turn spawned a wave of ‘ethics declarations’, including one on ‘Climate Change’7 in 2009. Yes, this is very real.

And, not quite being done, since 2008, efforts have followed, relating to the ethics of energy technologies8, the ethical worldviews of nature9, ethical frameworks for research agenda and policy10, ethical implications of meat production11, and even water ethics12.

The concept of ‘ethics’ was truly hyper-accelerated after 2001, and on its own, it appears… harmless, no? But the trick lies in coupling an ‘ethics declaration’ with an ‘enforcement mechanism’, enabling individuals to be fired for refusing to carry out egregious acts during an alleged pandemic. And as for the application of a such ‘ethical’ framework to governance13…

‘While governance is often thought of in terms of states and governments, it is also applicable to companies, foundations, and institutions‘

This broader concept of governance extends to the corporate world. Thus, this is where Good Corporate Governance and Corporate Social Responsibility comes into play.

And if you haven’t yet realised that ‘Good Corporate Governance’14 is a defined term, and a subcategory of ‘Good Governance’, then I’ll have to bang that drum yet again, which I will happily do. I just wish people would grasp that this is all fundamentally about ethics.

‘An effective board of directors should maintain the responsibility of overseeing business decisions based on the company’s core business values and ethical principles… responsible organisations follow a top-down approach regarding ethical practices, where leaders act by example to inspire employees to follow suit…‘

… or, should you prefer, here’s an OECD report from 202315. In the context of Good Corporate Governance… the report emphasises the board should uphold high ethical standards.

And in the event you’re still sitting on the fence, have16 another17 418 examples19. If you do not get it by now, I’m not sure I can reach you.

‘Good Corporate Governance’ is a defined term.

The role of ethics in CSR is explicit. In Carroll’s20 pyramid21, ethical responsibility sits above economic responsibility (profitability) and legal responsibility (compliance with the law) - second only to philanthropic responsibility, which… in contemporary context is hard to interpret as anything but an outright scam.

But let’s briefly return to 2001 to summarise, because the events on 9/11 through the Patriot Act led to Global Surveillance, while the 2001 anthrax attacks through the Bioterrorism Defence Act turbocharged discussions on bioethics leading to ‘ethics declarations’ in especially medicine, ultimately cultimating with healthcare professionals being laid off during the recent, alleged pandemic. But these developments further merged with health and pandemic planning, tracing back to the 1978 Pandemic Plan22, as presented by William ‘One Health’ Foege being in charge of the CDC at the time.

But business… that’s a different matter. Because while CSR has a somewhat longer history, its acceleration did not come through bioethics nor anthrax. No, it came through the collapse of Enron, which naturally prompts the question - was there more to the Enron scandal than we were told? Because - sure, it was a major scandal, one which cost many people their jobs and pensions, and it led to a ‘big five’ accounting firm - founded all the way back in 1913 - to close forever; Arthur Andersen. But was there somehow more to it?

And to make absolutely clear upfront - I most certainly do not suggest that this fraud was entirely orchestrated for explicit purpose of capitalising on it through ‘ethics declarations’. But with that said, I do find it entirely within the realms of possibility that it was capitalised on - much like 9/11 and the Anthrax episodes were leveraged to advance surveillance, ethics declarations, and pandemic planning.

So where else to start but with their 2000 document, ‘The Code of Ethics‘23. And this document is… fairly unremarkable. Sure, it’s chock full of lies, and the Enron executives certainly ignored its advice, but the bottom line is that a code of ethics is just that - it’s not law. Something is unethical and still be perfectly legally permissible. In Enron’s case, however there was no shortage of outright illegalities committed.

It repeatedly bangs the drum of morality, ethics, and the principle of ‘do onto others’, with two of the more interesting quotes being -

‘Compliance with the law and ethical standards are conditions of employment, and violations will result in disciplinary action, which may include termination.‘

Compliance with the law, sure, but ethical standards?

‘Laws and regulations affecting the Company will be obeyed. Even though the laws and business practices of foreign nations may differ from those in effect in the United States, the applicability of both foreign and U.S. laws to the Company's operations will be strictly observed.‘

… but ethical standards are just that. Nice rhetoric, and little more.

But these weren’t simply breeches of ethics codes, as -

‘In February 2001, Andersen executives met to discuss whether to drop the Enron account, especially in light of possible conflicts of interest and questionable accounting practices that kept significant Enron debt off the books, according to a report from the WSJ‘

… Arthur Anderson was fully aware of the state of affairs, and -

‘… exchange between Andersen and Enron employee Sherron Watkins in August 2001… a seven-page letter to Enron head Kenneth Lay, Watkins warned that Enron was on the verge of an "accounting scandal" that could expose the firm as an "elaborate accounting hoax,"‘

… by August, 2021, Kenneth Lay was also explicitly warned of the impending ‘accounting scandal’, but chose not to report this trail of illegality to the authorities -

‘Andersen also came under scrutiny last week after the firm's lead Enron auditor, David Duncan, said he began shredding documents related to Enron finances under the advice of an Andersen lawyer‘

… instead, Andersen destroyed related evidence - a clear, criminal offense -

‘Andersen fired Duncan last week for destroying the documents despite the launch of a federal investigation; Duncan said he was simply following directions‘

… only to desperately attempt to shift the blame onto an employee24.

Naturally, this led to a criminal probe25, and it was quickly established -

‘While Justice has formed such taskforces in the past to investigate entire industries or organized crime, this is believed to be the first time such an investigation has been launched against a single company‘

… that the scale of committed fraud was unprecedented, and -

‘Andersen has said its agents have detected possible "illegal acts" by Enron executives, who allegedly hid massive debt and losses in private partnerships left off the company's balance sheets, according to the Washington Post‘

… when cornered, Andersen finally owned up. But even then -

‘Congress's Government Reform Committee and its investigative arm, the General Accounting Office (GAO), have been petitioning for such details for months after being stonewalled by the White House. Last week, the White House reversed course and released limited details of the meeting, prompting demands for fuller disclosure‘

… Dick Cheney, sitting in the White House, refused to cooperate with investigations despite demands for disclosure. Predictably, figures like The View’s Ana Navarro26 is unbothered by this, expressly because she has no standards apart from the party line, and the party line is always right27.

But the scandal sticks even deeper. It wasn’t just a matter of hiding $600m in an off-sheet vehicles, no, the executives also encouraged their employees to go all-in on Enron stock, even as it was collapsing in the markets28.

‘"We had some married couples who both worked [for Enron] who lost as much as $800,000 or $900,000," said Steve Lacey, an Enron subsidiary employee named as a lead plaintiff in one of the lawsuits. "It pretty much wiped out every employee's savings plan."‘

This advice wiped out the savings of many, but not only did they recommending the stock whilst knowing it was on the chopping board -

‘Days before the company declared its first quarterly loss in four years, … the company froze employees' retirement allocations, barring them from selling their Enron holdings for a period of three weeks. During that time, Enron stock dropped from $30.72 to $11.69.‘

… but those crooks actively stopped employees from leaving the sinking ship, through freezing the selling of the stock as it was collapsing in the market, and -

‘"They were promoting Enron as a retirement investment vehicle and matching employees' contributions with Enron stock, when they knew the stock was overvalued, and that's a breach of their fiduciary duties," Seattle lawyer Steve Berman told the Times last week.‘

… straight up lying about it, constituting a breach of fiduciary duty, and -

‘When they locked employees out of their retirement accounts for three weeks in October and November, "they knew the worst news was about to come out, but they froze the stock," Berman said.‘

… that at the express, most pivotal time, maximising losses for the employee -

‘An Enron spokeswoman last week said the timing of the employee lock out was regrettable but coincidental, saying it was a necessary part of the company's planned switch from one account management firm to another.‘

… yet they even put up a flimsy excuse about why that door was shut tight.

Yet, in early 2002, mere weeks after the collapse of Enron, Rushworth M. Kidder29, founder of the Institute for Global Ethics30 from which these articles are sourced, penned the article titled ‘Ethics at Enron‘ -

‘Enron, where ethical issues are so numerous that one hardly knows which thread to pull‘

And whilst that may be, they are ultimately irrelevant in the face of the sheer volume of illegalities committed;

Statements by Kenneth Lay were materially misleading, and should be an open-and-shut case of securities fraud.

Concealed debt in SPVs led to misleading financial statements, which should be another open-and-shut case for the SEC.

Insider trading by executives, especially in light of communication with Arthur Andersen’s Sherron Watkins.

Conflicts of Interest involving Arthur Andersen; audit independence and the certification of falsified information is tantamount of fraudulent certification.

The shredding of documents by Arthur Andersen constitutes obstruction of justice, which is a criminal offense.

The suppression of Sherron Watkins itself could equally amount to obstruction of justice, and thus a criminal offense.

And though I could go on, I hope the point is clear. There was absolutely no reason to pursue this through the lens of ‘ethics’, because it was a smorgasbord of crime.

But it was pursued on the grounds of ethics. In fact, ethics served as a primary driver behind the Sarbanes-Oxley Act of 200231 concerning Corporate Responsibility, which, unsurprisingly, includes numerous references to ‘ethics’ -

And courtesy of the United Kingdom, we saw the ‘Higgs Report’ in 200332, which beyond emphasising ‘ethics’, ‘transparency’, and ‘accountability’, also included concepts such as ‘Good Governance’, as well as ‘Good Corporate Governance’.

And in Germany, the Cromme Code of 200233 similarly spoke of ‘transparency’, ‘accountability’, and ‘Good Corporate Governance’.

And France contributed the Bouton Report, also in 200234. While the overriding message was one of ‘ethics’, it directly addressed the Enron scandal, referenced the Sarbanes-Oxley Act, and even including a note that -

‘All of the issues discussed in this report in relation to French companies are international in scope. The working group is convinced that the globalization of markets will necessarily lead sooner or later to a standardization of rules at the global level.‘

… these rules eventually will become global. And who contributed to this report you may ask? Well, none other but our old friend, adversary of free speech35, and former Rothschild banker36, Thierry Breton37.

We could also include Bill 198 from Canada (2002)38, the Israeli Corporate Governance Code (2002)39, the Corporate Governance Code of Japan (2004)40, the Korea Corporate Governance Service (2002)41, or the Australian CLERP9 (2004)42. All of these appear very similar, and can ultimately be traced back to Enron and the accounting fraud of that era.

And for the puritans, apologies, but I cannot be bothered with tracking down specific lines and quotations from every single one of those, so here’s ChatGPT’s verdict -

And its conclusion is on point to a such extent that I will quote it in full -

‘These reforms represent a global response to similar issues, with each code or legislation adapting to its country's regulatory environment while maintaining the shared goals of increased transparency, accountability, and ethical corporate behavior. The legacy of Enron, therefore, had a lasting and widespread influence on global corporate governance standards, shaping policies that still govern today‘

Enron, in short, triggered a wave of corporate governance legislation, most of which was introduced almost immediately as the company entered bankruptcy. And - though it should be clear from my commentary above - the common theme running through all of this is ‘Good Corporate Governance’.

But that’s not quite all, because the International Federation of Accountants updated their code of ethics… in January, 200243. An update two years in the making which - by an extraordinary coincidence - arrived immediately after the collapse of Enron.

And as for the Institute for Global Ethics whose links were sourced extensively above… well, as it happens, their sponsors comprise… those bloody foundations44. Always those bloody foundations, with Rockefeller among them.

But there’s a name missing. Typically, it’s Carnegie and not Rockefeller funding initiatives related to Global Ethics45. However, predictably, Carnegie funding does appear in the report, ‘Shared Values for a New Century‘46, which claims that ‘ethics is fast becoming the touchstone first-intensity issue on the global agenda‘. And this report also highlights their ‘Ethical Fitness’ program, which ‘grew out of extensive research into shared values that began with Dr. Kidders 1994 hook Shared Values for a Troubled World’. And this, once again, aligns rather impressively with Hans Kung’s 1993 manifesto, ‘Towards a Global Ethic’.

So we have Rockefeller and Carnegie - two of the heavyweights. But the Rothschild connection through Breton is somewhat weak - and we can do better. Much, much better. See, Rothschild is becoming ever the familiar name. Not only will you find that many, many roads lead to them in the context of land tenure, but they are also highly relevant in the realm of business ethics.

And tracing back to 1984, with meetings beginning in 1988 and culminating in its eventual release in 1993, we find ‘An Interfaith Declaration - A Code of Ethics on International Business for Christians, Muslims, and Jews‘47. And this document states that ‘HRH Duke of Edinburgh, HRH Crown Prince El Hassan of Jordan and Sir Evelyn de Rothschild, invited a group of distinguished Jewish, Christian and Muslim thinkers and business leaders to see whether they could agree on some principles which might serve as guidelines for international business behavior‘.

Page 5 continues -

‘Recent consultations discussed an interfaith code of ethics for international business, formulated in the light of the religious traditions of the three monotheistic faiths. Discussions of the terms of the code began in 1988, and were concluded at a meeting held in October 1993 in Amman. The provisions of the guidelines reflect the ethical basis indicated in the teaching of the three religions‘

It’s truly remarkable, as 1993 also marked the release of Hans Kung’s ‘A Global Ethic’, as outlined above.

And on page 9 we further see -

‘What Scripture expresses as love is here rendered as mutual respect or reciprocal regard that exists between two individuals.‘

… reminiscent of Levinas’s concept of ‘the others’, followed by a reference to planetary stewardship which might as well have been lifted directly from the Earth Charter -

‘A third principle which the three faiths have in common is that of stewardship (trusteeship) of God’s creation and all that is in it… the principle is applicable to anyone who is entrusted with the responsibility of managing scarce resources… Ownership is not seen, therefore, to be absolute‘

We then arrive with guidelines -

‘Business is part of the social order. Its primary purpose is to meet human and material needs by producing and distributing goods and services in an efficient manner. How this role is carried out-the means as well as the end-is important to the whole of society.‘

… followed by -

‘Competition between businesses has generally been shown to be the most effective way to ensure that resources are not wasted, costs are minimized and prices fair‘

… and this, seen in context of -

‘All economic systems have flaws; that based on free and open markets is morally neutral and has great potential for good. Private enterprise, sometimes in partnership with the State, has the potential to make efficient and sustainable use of resources, thereby creating wealth which can be used for the benefit of everyone‘

… could be viewed in the context of Blair’s 1991 Marxism Today article, which states that private and public sectors should collaborate for the common good, but all in all -

‘It provides for the maintenance and growth of business, thus expanding employment opportunities and is the means of a rising living standard for all concerned. It also acts as an incentive to work and be enterprising. It is from the profit of companies that society can reasonably levy taxes to finance its wider needs.‘

… this, so far, sounds exceedingly business friendly - even up to the point of portraying business as the most effective way to avoid wasting resources. Consequently, the following inclusion appears somewhat… odd -

‘Business has a responsibility to future generations to improve the quality of goods and service, not to degrade the natural environment in which it operates and seek to enrich the lives of those who work within it…‘

… before going even further with this -

‘Business activity involves human relationships; it is the question of balancing the reasonable interests of those involved in the process: i.e., the stakeholders, that produces moral and ethical problems.‘

Finally to add -

‘The basis of the relationship with the principal stakeholders shall be honesty and fairness, by which is meant integrity‘

In other words - in terms of cutting down on waste, business is exemplary… except for when they’re not. It appears a little bit disjointed.

Stakeholders are discussed on the following pages. And the appendix concludes -

‘This Declaration is offered to business people, business organisations and those who advise companies as a basis for sound ethical business practice.

Relevant sectors of it can be adopted by corporations as an international standard of business ethics and be acknowledged as such in corporate Annual Reports.‘

… and it’s funny, because… isn’t that exactly what took place?

The Interfaith Declaration emphasised an ethical foundation, respect for stakeholders, accountability, transparency, corporate responsibility, social impact, and alignment of business ethics across borders - ie, on an international scale.

All values, reflected through the Sarbanes-Oxley, the Higgs Report, the Cromme Code, the Bouton Report, Bill 198, the Israeli Corporate Governance Code, the Corporate Governance Code of Japan, the Korea Corporate Governance Service, and the Australian CLERP9 - all of which were released within a remarkably small timeframe, following the collapse of Enron. Is that really a coincidence?

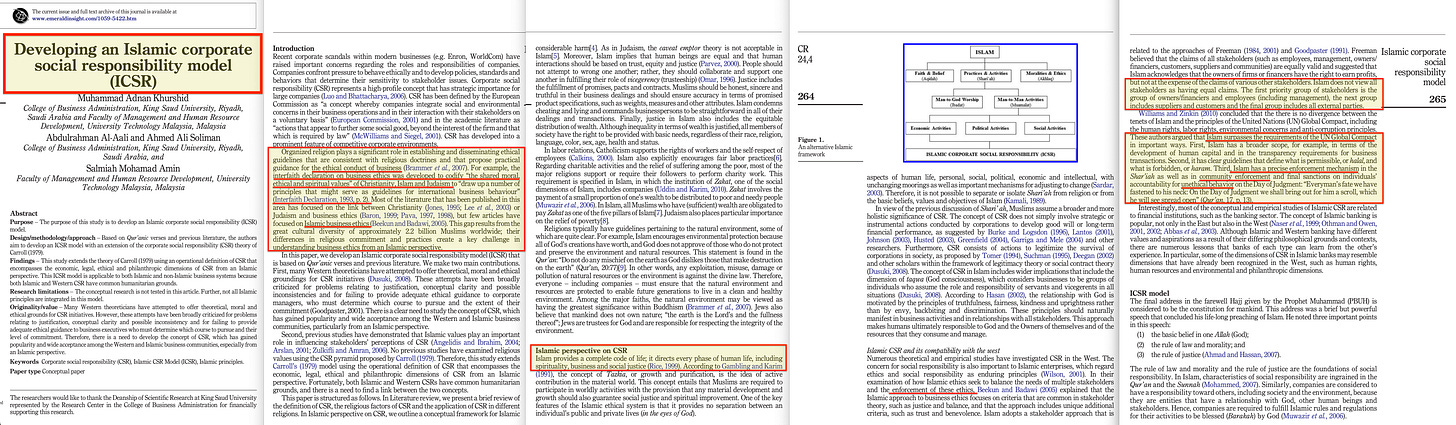

Well, 2014 saw the release of a paper titled ‘Developing an Islamic corporate social responsibility model‘48. From its introduction -

‘Recent corporate scandals within modern businesses (e.g. Enron, WorldCom) have raised important concerns regarding the roles and responsibilities of companies. Companies confront pressure to behave ethically and to develop policies, standards and behaviors that determine their sensitivity to stakeholder issues. Corporate social responsibility (CSR) represents a high-profile concept that has strategic importance for large companies‘

… we have… Enron, CSR, ethics, responsibility…

‘Organized religion plays a significant role in establishing and disseminating ethical guidelines that are consistent with religious doctrines and that propose practical guidance for the ethical conduct of business (Brammer et al., 2007). For example, the interfaith declaration on business ethics was developed to codify “the shared moral, ethical and spiritual values” of Christianity, Islam and Judaism to “draw up a number of principles that might serve as guidelines for international business behaviour” (Interfaith Declaration, 1993, p. 2).‘

… religion, Islam, … and we have the Interfaith Declaration on Business Ethics.

‘… according to Rice (1999), the separation of “Church” and “State” in many Western countries has led to the view that religion is essentially a private matter. In contrast, the Islamic ethical system does not distinguish between public and private lives. Therefore, Islam influences the decision-making of its followers in every facet of their lives‘

… and we have… a remarkable outline of how Christianity and Islam differs -

‘In their examination of how Islamic ethics seek to balance the needs of multiple stakeholders and the enforcement of these ethics, Beekun and Badawi (2005) explained that the Islamic approach to business ethics focuses on criteria that are common in stakeholder theory, such as justice and balance, and that the approach includes unique additional criteria, such as trust and benevolence…‘

… even down to ‘stakeholder’ criteria -

‘Islam acknowledges that the owners of firms or financers have the right to earn profits, but not at the expense of the claims of various other stakeholders. Islam does not view all stakeholders as having equal claims. The first priority group of stakeholders is the group of owners/financiers and employees (including management), the next group includes suppliers and customers and the final group includes all external parties.‘

… which could easily lead to trouble down the road, because that’s not how these operate in Western societies, where all ‘stakeholders’ allegedly are equal. At least, so the claim goes. Reality… differs, of course.

‘These authors argued that Islam surpasses the requirements of the UN Global Compact in important ways. First, Islam has a broader scope, for example, in terms of the development of human capital and in the transparency requirements for business transactions. Second, it has clear guidelines that define what is permissible, or halal, and what is forbidden, or haram. Third, Islam has a precise enforcement mechanism in the Shar’iah as well as in community enforcement and final sanctions on individuals’ accountability for unethical behavior on the Day of Judgment: “Everyman’s fate we have fastened to his neck: On the Day of Judgment we shall bring out for him a scroll, which he will see spread open” (Qur’an, 17, p. 13)‘

And so does that part. In other words, stakeholder theory vastly differs in Islam versus Christianity.

And49 there’s50 no51 shortage52 of material on Enron in the context53 of54 Ethics55. But the final link comes courtesy of… Hans Kung, himself. And it’s one we saw previously, and one which Jeffrey D Sachs in 2009 signed up for - it’s the ‘Global Economic Ethic’56.

‘The fundamental principle of a desirable global economic ethic is humanity: Being human must be the ethical yardstick for all economic action: It becomes concrete in the following guidelines for doing business in a way that creates value and is oriented to values for the common good‘

Because there are certain… phrases… such as -

‘What you do not wish done to yourself, do not do to others. This Golden Rule of reciprocity, which for thousands of years has been acknowledged in all religious and humanist traditions, promotes mutual responsibility, solidarity, fairness, tolerance, and respect for all persons involved. Such attitudes or virtues are the basic pillars of a global economic ethos.‘

… somewhat straddling in the direction of Emmanuel Levinas -

‘To be authentically human in the spirit of our great religious and ethical traditions means that in public as well as in private life we must be concerned for others and ready to help‘

… with perhaps even a touch of Hans Jonas, or even the Earth Charter -

‘Sustainable treatment of the natural environment on the part of all participants in economic life is an uppermost value-norm for economic activity. The waste of natural resources and the pollution of the environment must be minimized by resource-conserving procedures and by environmentally friendly technologies. Sustainable clean energy (with renewable energy sources as far as possible), clean water, and clean air are elementary conditions for life. Every human being on this planet must have access to them.‘

But perhaps that’s not so strange. Among the first signatories we find Jeffrey D Sachs, as well as Leonardo Boff who contributed to the Earth Charter, Mary Robinson of the Collegium International, Hans Kung who authored ‘A Global Ethic’ in 1993 as well as yet another familiar face… someone also credited on the document starting it all back in 1984; ‘An Interfaith Declaration‘, penned in 1988-1993 -

Prince El Hassan bin Talal.

Incidentally, Prince El Hassan bin Talal founded the ‘The Royal Institute for Inter-Faith Studies‘57 in 1994, an organisation that continues its work to this day58. And its mission once again resonates with Emmanuel Levinas’s emphasis -

‘RIIFS focuses on promoting common human and ethical values that contribute to strengthening cooperation and interfaith relations, eliminating mutual misconceptions about the ‘other’ and ultimately expanding these shared commonalities in the hope of promoting peaceful coexistence‘

… on ‘the other’.

In the context of ‘A Global Ethic’, Hans Kung was industrious. Beyond his foundational document in 1993, he tirelessly advocated for the integration of interfaith shared moral values across religious, cultural, business, governance, and even scientific divides. And his work complemented that of Hans Jonas, whose ethical philosophy centered on responsibility - particularly in the context of planetary stewardship.

And we shall return to both later - along with Levinas and Cohen - as their collective contributions have significantly influenced contemporary discussions on… global ethics.