In Tandem

In 2023, Michael Jacobs authored a report that hints at the predictable direction they intend to take us. Unsurprisingly, it received no media attention - a deafening silence conveniently benefiting a primary actor aligns with the very recommendations laid out in the report. And the primary beneficiary of this?

The Bank of England.

There are few organisations I truly despise, but the pathological ‘Ethical Socialist’ liars - the Fabian Society - are one of them. And as we approach the final act, their presence seems to surface everywhere.

In a previous post on that society, we encountered Michael Jacobs, who penned the concept of ‘Progressive Globalisation - Towards an International social democracy’1. And though I could quote his vision for a ‘global social democracy’ at length, it’s broadly outside the scope of this article - and, in any case, I already did in the post attached below. But it does end on this note -

‘Ultimately if a new global constitution is to be built, a new sense of global citizenship will have to be constructed with it. The increasing awareness of global interdependence among ordinary people throughout the world, promoted by new communications and media, is already apparent. A vibrant form of global civil society is developing in response‘

Incidentally, did you know that the members of the Bolshevik Party (ie Lenin and Bogdanov) split out from the Russian Social Democratic Marxist Workers’2 party?

The worst part about that organisation is how greatly and readily they lie through omission, quite simply refusing to tell you what’s behind their wall of opaque terminology. So allow me to tell you - ‘Cosmopolitanism’ is outright global communism, ‘Subsidiarity’ though claiming to ‘decentralise to the lowest appropriate extent’, in terms of global matters it actually centralises, and ‘The Third Way’… is wholly aligned Lenin’s New Economic Policy in drag.

But this post isn’t about any of those though it does drag the Fabian Society onto centre stage yet again - along with Michael Jacobs.

Because in 2023, Michael Jacobs, Robert Calvert Jump, Jo Mitchell and Frank van Lerven co-authored the ‘Fabian Idea’, ‘In Tandem - The Case for Coordinated Economic Policymaking‘, and of all Aesopian works out of those ‘Ethical Socialists’, this quite possibly is the very worst3. And while I originally planned to title this post ‘Crisis Economics’, in which I’d explain how the central banks fit into this scheme, it’ll have to wait for the next post, as this would otherwise become too long.

The summary outlines a future of less growth, the need to ‘decarbonise our environment’, to eliminate our ‘siloed approach’ and to this end coordinate macroeconomic policy decisionmaking where the UK Treasury and the Bank of England respectively are in charge of fiscal and monetary policy.

Obligatory shaming of Liz Truss and Kwarteng follows - a common theme. The Fabian Society have found space to do this a total of six times through an otherwise fairly brief report. Clearly, her crimes were quite simply intolerable.

In the spirit of coordination, a new ‘requirement’ is placed on the Bank of England - though this (as usual) is not quite what it appears on first glance. Alongside, a new fiscal rule is proposed for the treasury - and I’m sure you’ll be shocked to discover that these two are related. The common theme is treasury borrowing, which now shifts away from Gordon Brown’s ‘golden rule’ of borrowing only to ‘invest’ (and never mind that this really only led to Brown rebranding ‘spending’ as ‘investing’). And in context of the subsequent section on ‘decarbonisation’, it becomes evident that the long-term objective here revolves around this agenda, justified by the argument of ‘the lower bound’ (zero percent base interest rates).

And this coordination should be facilitated by a new ‘Economic Policy Coordination Committee’ (‘EPCC’), to which a surprisingly large amount of ‘stakeholders’ should contribute, including not only the treasury and the Bank of England, but further various business organisations, the Climate Change Committee, and the Low Pay Commission. There are more, but let’s stick to these as the principle applies in general.

The introduction treats us to a a brief history on macroeconomic policy since 2008, when Gordon Brown/Alistair Darling’s Keynesian policies were matched by the BoE’s monetary equivalents, a time when the Bank of England (BoE) ownership of the gilt (UK government bond) market surged, comprising 25% of the entire market within a historically short timeframe. By the end of 2012, the BoE still commanded 25% of the UK Gilts market - at which stage this position had a cash value of around £300bn.

Shockingly, it finds that austerity didn’t magically fix anything4, as the outgoing Labour government left with a budget deficit of 10%5 which would always take a while to get back under control, regardless. Anyone capable of logical deduction could have told you this, thus clearly demonstrating that the co-authors of this study either are grossly incompetent, or more likely - see this as a vehicle of political expedience.

But as the UK is readying herself for a future of ‘climate change’, the ‘investment’ needs in this area predictably needs stepping up, as the UK - allegedly - trail even posterboy China, widely known as a pinnacle of environmentalism. Consequently, we here have a serious issue, for which a new approach is warranted - especially given the complex situation involving ‘multiple economic objectives’, which require ‘multiple policy instruments‘. And to ensure… no lessons can possibly be learned from this non-linear equation… these policies must simply be integrated… though we disappointingly aren’t treated to an inclusion of the term, ‘holistic’ here. But given the complexity of blending multiple policy objectives and multiple policy instruments, formal coordination is called for, involving all those undemocratic economic institutions ‘advicing’. However, this could well lead to a modification of policy, which in essence means other agencies will now be able to influence fiscal policy decisions taken by the democratically elected treasury. And this should all be accompanied by a change to the mandate of the Bank of England, plus the creation of new institutions.

And we’re really just getting started.

Chapter 1 outlines the division of labour related to macroeconomic policy, where the Bank of England is responsibile for setting monetary policy, which historically focused primarily on adjusting base interest rates. However, following the ‘Great Recession’ of 2008, quantitative easing became a standardised policy tool, and this broadly can be understood as an expansion of the monetary base by having the Bank of England (and other central banks) purchase large quantities of government bonds on the open market. While historically this type of action has been associated with inflation, the modern approach often involves intermediaries - such as primary dealers in the United States - although the mechanism remains largely the same.

The treasury, by contrast, is responsible for fiscal policy (taxation and spending). Following World War 2 the world adopted the Bretton Woods agreement6 which lasted until the early 1970s when Nixon shut the gold window7. During the era of Bretton Woods - spanning several decades - the treasury controlled the Bank of England and thus, the government was in a position to control both monetary and fiscal policy, but as this led to high levels of inflation in the 1970s, it convinced the ‘New Labour’ government of the 90s to sever this link, officially granting the Bank of England its independence in 1997 (somewhat oddly included in Blair’s Third Way), and along with this came the right to set monetary policy outside of government interference8.

Consequently, following 2008 we’re in a position where government controls -

Taxation policy (how much money is collected from the public, through what means, and for what purpose)

Spending policy (how this money should be allocated and spent)

Deficit management (managing the gap between taxation and spending)

Public debt (the cumulative deficit over time)

While the Bank of England controls -

Base interest rates (setting the cost of borrowing money)

Quantitative easing (bond purchasing; regulating the money supply by determing how how money should circulate in the economy)

The size of the monetary base and accompanying interest rates are key factors influencing inflation. Consequently, the Bank of England was tasked with the responsibility of keeping inflation under control9. If this target is missed, the BoE must write a letter to the Chancellor, the head of the treasury a letter, explaining why this objective was missed.

But how did that 2% target come to be?

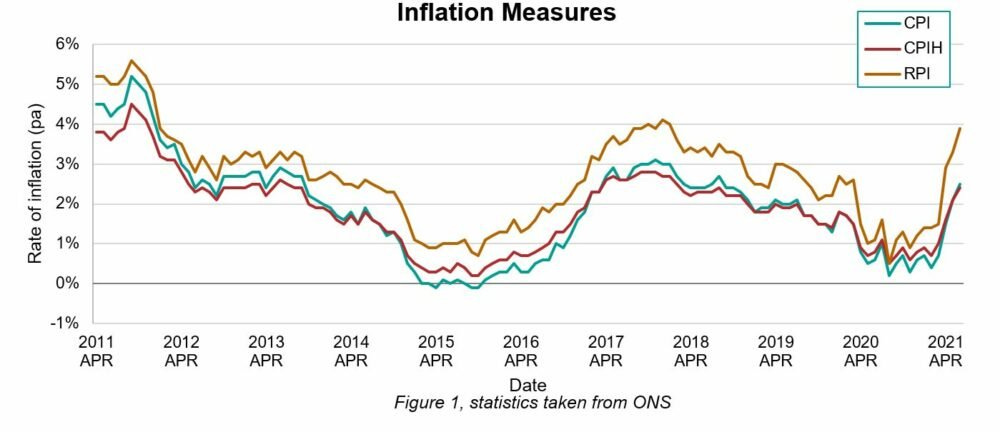

Initially, the target was set at 2.5% based on the Retail Price Index (RPI).

In 2004, this was revised to 2.0% using the Consumer Price Index (CPI). While described as ‘largely identical’, there are substantial differences between the two measures, with a delta of 1.0% commonly the average.

Additionally, a secondary target requires that this 2.0% inflation rate be projected to be achieved within two years.

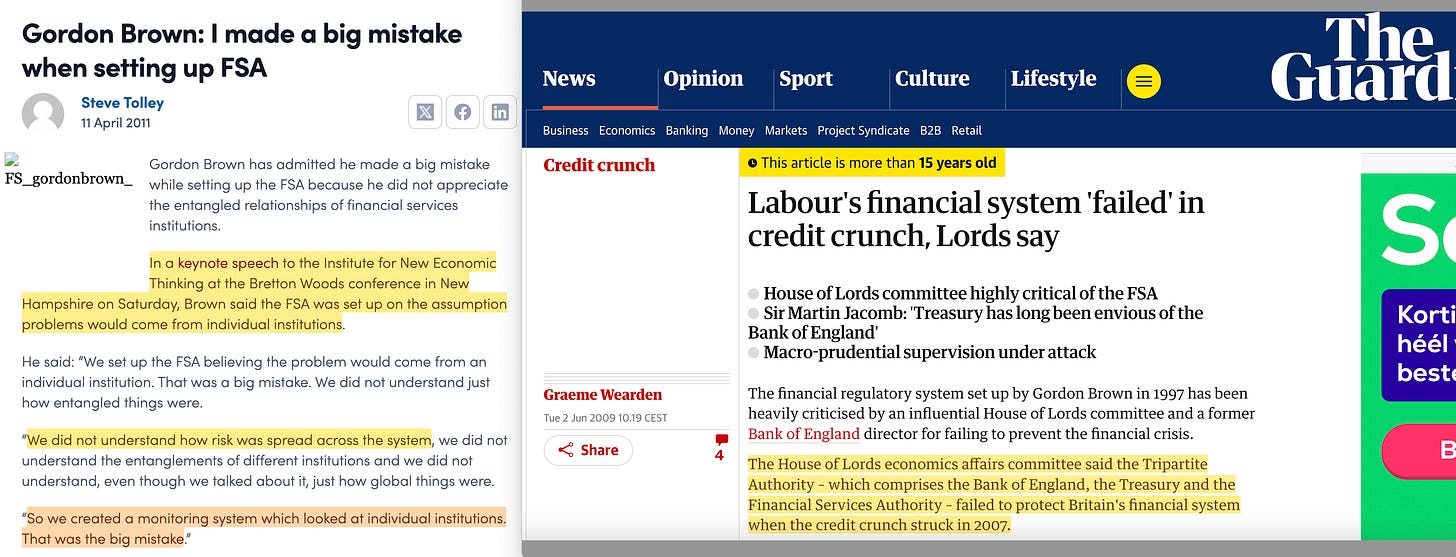

Over time, the rules were gradually relaxed, with each change primarily benefiting the Bank of England. While this arrangement was claimed to be effective (their claim, not mine), it also led to the gradual builduo of a massive debt bubble, particularly in riskier forms of credit (ie, in housing), and thus, this period of time allegedly demonstrated the problem of a lack of coordination raising the question… what exactly was Brown’s ‘Tripartite Authority’ doing during this time10?

‘The House of Lords economics affairs committee said the Tripartite Authority – which comprises the Bank of England, the Treasury and the Financial Services Authority – failed to protect Britain's financial system when the credit crunch struck in 2007.‘

But true to form, as soon as he was voted out, he owned up11 -

See, the alleged issue wasn’t with the Tripartite System itself, no, rather it was that sufficient power hadn’t been vested with the Bank of England already.

All roads lead to the central banks.

Chapter 2 begins by examining policy response following the ‘Great Recession’ of 2008. It highlights the Keynesian stimulus packages, before opening a criticism of alleged Tory austerity - yet neglects to detail the scale of Darling/Brown’s fiscal intervention which amounted to approximately… £20bn12. By contrast, the monetary response warrants attention, as the BoE QE programmes amounted to £200bn13, with base rates slashed to an all-time low of 0.5% by 200914.

Consequently, fiscal stimulus in 2008 was a mere pimple on the back of monetary stimulus. Yet, the report conveniently ‘forgets’ to inform you thusly, somewhat convenient from the perspective of the Bank of England. And that’s really only the start in terms of deceit by omission -

‘These policies were directly at odds with one another. The government’s public spending cuts pulled demand out of the economy: between 2010 and 2019 by a cumulative £540bn relative to the pre-2010 trend of public spending‘

That is a projection. In fact, not only is it a projection, but it’s a projection made by the Progressive Economy Forum15 on which Guido Fawkes in 2022 commented16 -

‘The Progressive Economy Forum website shows their council members, including the likes of Faiza Shaheen, James Meadway and Danny Dorling, who wouldn’t be out of place at a Momentum rally. As for the authors quoted directly in the article, Rob Calvert Jump publicly endorsed Corbyn’s 2017 election manifesto, whilst Jo Churchill has a history of pro-Corbyn tweets‘

And this in (yet another) article related to obvious hyper-partisan BBC cronyism.

Let’s take a brief look at this no doubt impeccable report17… in which we immediately see… ‘exploitative austerity‘… hyper-partisan language… in a supposedly credible report?

‘Economic policy after 2010 did not need to be this way.’

This is amateur hour. Even if a budget is disastrous, it’s the job of credible economists to report on matters objectively and - most of all - professionally.

’If public spending had increased by 3% a year as part of a balanced budget expansion (meaning that spending increases were matched by increased tax revenues), it would have been over £91bn higher by the end of 2019 - equivalent to the entire education budget in that year‘

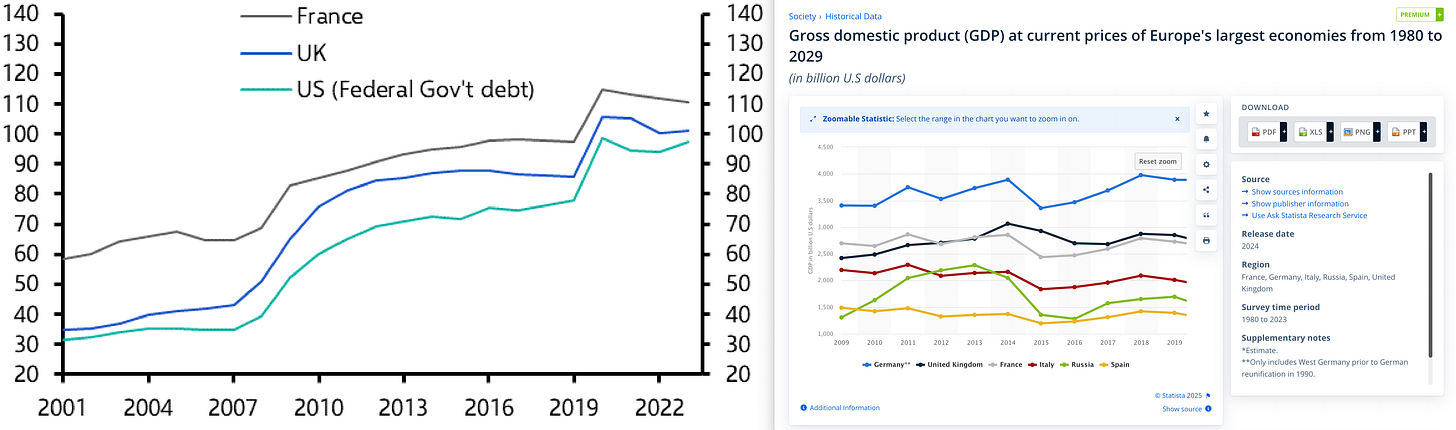

Yeah, I call bullshit. First off, because this is a model which can be tortured to confess any day of the week, but secondly, because the UK didn’t materially underperform other leading European countries during this period18. It’s the same, old, biased trash economic modelling, always fabricated for political expedience. However, what these activist ‘economists’ neglect to tell you is that 9 years of increased spending would have added to the debt pile - though their fairytales models will naturally project unicorns and rainbows of exactly the type which didn’t materialise elsewhere. Sure, you can point at faster growth elsewhere, but do make sure to contrast that with the public debt pile. These crooks NEVER do.

And in terms of debt loads - the odd one out is Germany. Everyone else increased public debt levels - pretty much in line with one another. Of course, these same crooks will insist that Brexit also took a colossal toll, and thus when compounded, The United Kingdom would have seen triple the growth of France and Germany during this same period - regardless of how absurd that truly is. But I’m sure you’ll find a few with absolutely no sense of reality who will buy it.

It’s trash. That’s what it is. It’s utter lies and display of incomprehensive bias, yet ultimately… solid evidence of Michael Jacobs being an agent, working to a different agenda that what is portrayed in public, especially considering he included this report as evidence of anything but… er… gross levels of incompetence, or fraud through statistics. Which in fairness I suppose is entirely apt, considering this all is expressly in line with the Fabian Society as a whole.

This PEF report truly is the worst pile of amateurish trash I’ve just about ever seen, delivering ‘zingers’ to impressionable socialists (but no-one else) such as this one -

‘… some academics have argued that austerity was an important cause of the voting patterns that delivered the Brexit referendum result in 2016…‘

Not only are comments (and report) such as these deeply unprofessional, but it genuinely speaks volumes that the Fabian Society use it as a source, when reality is the whole report should have been written in crayon or printed in the Comic Sans font. In fact, the report drops off a cliff to such an extent that - just to amuse myself - I decided to separately underscore (in blue) whenever I would spot deeply unprofessional, obviously partisan, petty, and completely unnecessary commentry.

But it does clarify OBR influence of the Treasury since 2010 - but given the quality of analysis on display here, I’d posit that the issue likely was caused by this inclusion, rather than their fantasy figures. Either way, let’s quickly go through their ‘recommendations’, from which a clear motive is easily discovered.

‘For a new government, this would ideally take the form of a clear manifesto statement against spending cuts, setting the direction for the party and the civil service, and expectations for wider society‘

Right. They want to kneecap the treasury. Got it.

‘Control of the Treasury is critical… requirement for credible, functioning fiscal rules…‘

Next follows a number of suggestions which almost certainly would result in higher debt levels, fiscal rigidity, and increased tax burdens. But don’t worry. This ‘institute’ would rapidly fabricate more charts showing that all mispredictions were caused by alleged ‘austerity’, and thus, the solution being further expenditure by the treasury. And ultimately, when this all fails to materialise, they will predictably claim they merely are a ‘think tank’, and that the treasury’s should have performed their own due digiligence. And why not - it’s hardly as though anyone will hold them - or similar technocratic organisations - to account for their deeply unprofessional projections, or catastrophic long-term outcomes of their advice, right?

‘The Office for Budget Responsibility should become more independent‘

Yeah, just what we need - more undemocratic technocratic organisations running riot. Wait, I get ahead of myself.

But let’s return to the Fabian report, because it’s starting to show real ‘bite’ -

‘When interest rates are at their ‘lower bound’ (close to zero), this interdependence becomes critical, since there is nowhere left for conventional monetary policy to go. In such conditions, it is counterproductive for the Treasury to operate under fiscal rules aimed simply at controlling the budget deficit and overall public debt‘

Ie, when the economy encounters issues caused by the Bank of England failing to control inflation - the solution will be more spending through fiscal policy.

‘Had the UK government done so in 2010–13, by sustaining a higher level of borrowing, as the US government did, it would have generated a much stronger recovery. And faster growth would have offset the effects of higher borrowing on the debt to GDP ratio‘

That sounds… similar to that obnoxious, deeply amateurish report we encountered before… wait, let’s check out the related reference 26… oh - that’s because that references DOES source that very same deeply amateurish report.

‘… if the Treasury and the Bank of England had coordinated with one another…‘

Ah right, so the democratically elected Treasury should be gradually stripped of their powers, you mean? Next follows yet another hugely questionable recount of the alleged pandemic. While it does highlight fiscal and monetary policy practically becoming one, as the BoE monetised practically the entire deficit in 2020.

Ergo, what they in effect tell you is that it was the Bank of England who enabled the worst downturn in 300 years19, through which furloughs catastrophically added to the debt pile - yet, it still attempts to assign blame relating to inflation to the global recovery, and the energy supply chain issues following Russia’s invasion of Ukraine.

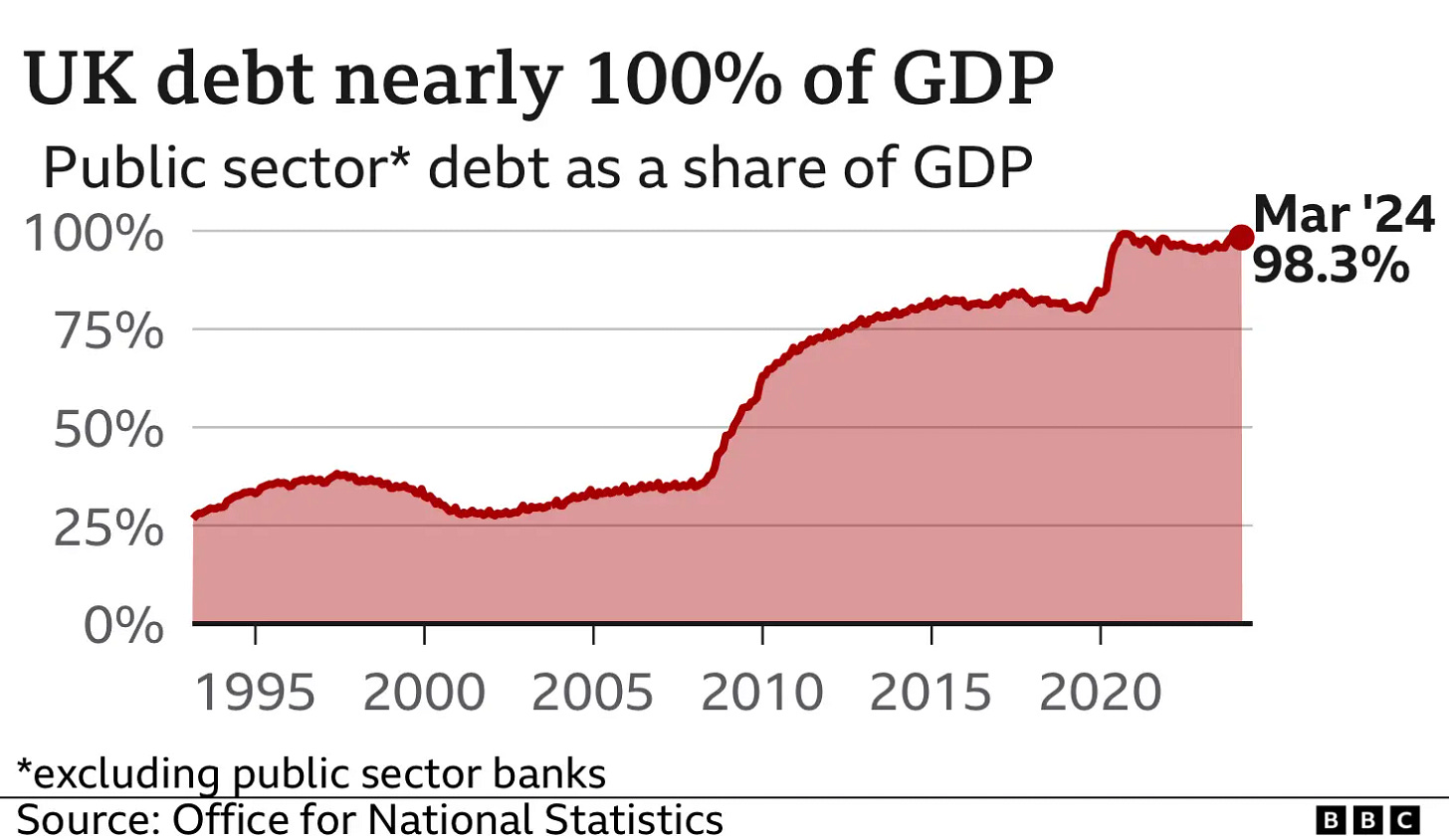

But allow me to point out a fairly critical issue in this argument. UK public debt surged by 20% during the alleged pandemic. As did that of… practically every other nation. And why? Because they all sent people home, while they would still be paid. Consequently, this would always lead to more money (see below) chasing fewer goods (as no-one did any work). And that leads to inflation.

Oh, but don’t take my word for it. Here’s Mervyn King, ex-Governor of the Bank of England stating expressly this a few years back.

Of course, he went even further, stating that not only were central banks were to blame… but that ‘all central banks in the west interestingly made the same mistake’.

And there’s really only one way that could have happened. Through coordination. And there’s an organisation, expressly setup to facilitate such coordination.

The Bank for International Settlements.

What I say is that the global central banks coordinated behind the scenes, enabling the monstrous increase of debt piles practically throughout the entire West. And that naturally prompts the question… but why?

And that question will be answered by the next substack post; ‘Crisis Economics’.

The next few pages set aside much space, outlining how Liz Truss and Kwarteng were, for all sakes of purposes, subordinate to the Bank of England, given that it absolutely should be not the government who reports tothe BoE, but rather the express opposite way around.

‘… some commentators argued that the Bank had effectively staged a coup against an elected government.‘

Allow me to postpone addressing this because yes; yes they absolutely did. And not only do those crooks continuously attempt to offset blame, but they even have their Fabian Parasite lapdogs run errands in this regard.

But at least we know which organisations need to be investigated for communist activity by McCarthy when he rises from the grave.

But before we close out chapter two, let’s address a final section -

‘After a decade of ultra-low interest rates, many banks and pension funds in the developed world have become heavily invested in sovereign and corporate bonds. But as central banks (in pursuit of their price stability responsibilities) have raised interest rates over 2022 and 2023, the value of these has inevitably fallen, leaving many in a financially precarious position‘

When Gordon Brown’s ‘Tripartite’ agreement failed20, it led to the The Financial Services Act 201221, which significantly restructured financial regulation in the UK and transferred considerable powers of financial oversight to the Bank of England. The Act abolished the Financial Services Authority (FSA) and replaced it with a ‘twin peaks’ regulatory structure22. In fact, not only did it lead to a ‘Prudential Regulation Authority‘ tasked with overseeking the prudential regulation of banks, insurers, and major investment firms, but it further led to the formation of the ‘Financial Conduct Authority‘ tasked with overseeing conduct.

Consequently, what happened in 2022 was entirely the fault of the Bank of England. It was their responsibility to ensure this didn’t happen - yet it did.

Consequently…

‘While financial meltdown was avoided during the Truss debacle, the collapse of Silicon Valley Bank in March 2023, which necessitated a huge bailout of larger banks in the US and a forced sale of SVB’s subsidiary in the UK, highlighted the deepening tension between central banks’ monetary policy and financial stability responsibilities.‘

What Michael Jacobs is proposing here is that the Bank of England’s no less than complete incompetence (or more likely, malfeasance) should be used as a reason to grant them even more powers.

Michael Jacobs, please disclose ALL ties you have with the BIS, BoE and other central banks, or organisations under their control.

So let’s quickly summarise -

The combination of both fiscal and monetary policy under the control of government led to inflation in the 70s.

This led to Brown and Blair granting the BoE its independence in 1997, and with it, control over monetary policy (primarily comprising control over base interest rates), with the ‘tripartite agreement’ tasked with supervision.

However, the alleged relative calm produced by this arrangement led to a consumer credit bubble, consequently leading to Quantitative Easing normalised as a monetary policy tool, along with calls for ‘tripartite’ reform.

This reform arrived in 2012, with the abolishment of the Financial Services Authority through the Financial Services Act of 2012, granting the BoE banking supervision regulatory rights.

But this arrangement yet again failed in 2022, as Liz Truss and Kwarteng had the nerve to conduct government policy without first clearing said with the Bank of England… as you’d otherwise expect a democratic society to work.

And strangely, the complete failure of this arrangement was not the fault of the Bank of England - in spite of them expressly having been assigned this responsibility in 2012.

I told you this report was explosive, and Chapter 3 steps that up a notch. In fact, it establishes that this yet again calls for reform…

‘One is to say that the Bank of England should no longer be independent…‘

But we cannot have that, due to the ‘experience in the 70s’ of high inflation. The second option is… er… for ‘governments to stop making bad policy’, which then directly feeds into the third option of having the government first clear policy with the central bank. But how do you do that, without making it obvious who’s really in charge? Simple -

‘For example, it might have been harder for the Chancellor to impose austerity if the Bank of England’s mandate had included a requirement for the governor to write to the Chancellor when the Bank believed that monetary policy was no longer effective and fiscal policy was required to do any further demand stimulation…‘

In the event it’s not clear - that letter sent to the treasury by the BoE can be used to force the hand of a government, through the use of a complicit MSM drumming up an expedient narrative, thus leading to public calls for a change in policy… or even for the government to step down… exactly as the case was wrt Liz Truss.

‘So the third approach to the Bank-Treasury relationship would be to say that the two institutions should be encouraged to more effectively coordinate their policies through their individual mandates and rules. Coordination should not mean joint policymaking; it should simply be a more economically sophisticated understanding of each institution’s separate role‘

And that is yet another manipulative lie, because they are for all extents and purposes the same thing. The MSM will enflame tension, and the treasury and/or government will be forced to back down and agree to whatever grossly self-serving policy recommendatins the Bank of England predictably trots out.

A description of the Federal Reserve ‘dual mandate’ follows, before the report details that the Bank of England implicitly already follow this template, or have the capacity to already - though finally adding that there ‘is a case for making this secondary mandate more formal‘, which - again - would benefit the Bank of England.

‘Revisions to the Treasury’s fiscal rules and to the mandate of the Bank of England are sensible reforms. We propose that the governor of the Bank should be required to write to the Chancellor when the Bank believes that monetary policy is no longer able to manage aggregate demand sufficiently, and that fiscal policy should therefore become more active. And the fiscal rules should include a provision to allow governments to borrow for current spending when interest rates are too low to allow monetary policy to remain in the lead‘

Get it? Michael Jacobs is expressly stating that -

The BoE should ‘write a letter’ which can - and will - be used to blackmail a sitting government to conduct fiscal policy.

That letter should (through MSM pressure) dictate that fiscal policy should be stepped up - through further state spending, leading to higher public debt levels.

As this isn’t compliant with the existing ‘golden rule’, this should be scrapped and governments should be allowed to pile on debts… for any reason, provided inflation is too low.

And this advice is to be directed by the Bank of England, and certainly not by anyone elected in democratic capacity.

Next is repeated how Kwarteng and Truss dared to stand up to our central banker overlords, and thus logically had to be taken down. Yet - of course - future discussions between the central bank and the treasury should remain private, as that’s of benefit to… well, the Bank of England, silly.

And the fourth option discussed then further builds on the third, but loops in the climate narrative - though this really is just the opening salvo. Finally, an outline of how Michael Jacobs can’t tell that a colossal monetary expansion would ever influence inflation.

Cool story, bro.

‘Accordingly, an unavoidable implication of the current fiscal and monetary set-up is that the Bank of England may have to artificially engineer an economic slowdown – if not a recession – in order to bring down inflation‘

Thus, if inflation hits the lower bound, the BoE simply must be able to dictate fiscal policy. And if inflation overheats, the same goes.

‘Is there an alternative policy approach? There is, and it involves better policy coordination between the Bank of England and the Treasury.‘

In order to avoid the BoE engineering recesions, the BoE must be transferred influence over fiscal policy. Top notch stuff, there. But the scheming liar sees the need for another push, and it immediately comes through -

‘The policy response to the energy price spike which followed the invasion of Ukraine… the UK government used a fiscal measure to protect households, and this measure also acted to reduce the official rate of inflation‘

It’s totally happening already, and it totally fixed all issues… caused by the central bank.

‘The government set a maximum price for gas and electricity which the energy retailers could charge their customers, and then compensated them for the difference between this and the costs the retailers were actually paying in the energy market‘

We are leaning up against hardcore socialist territory, with price fixing being a regular occourance in this regard. Yet, to ensure shelves don’t go empty -

‘The fiscal cost to the government was partially offset by the levying of a windfall tax on the profits of UK-based oil and gas producers.‘

… a windfall tax is imposed, which along with higher taxation will make large enterprise whole in this regard. This, technically, resonates with Nazi Germany, where a windfall tax on large enterprise hit 95% during WW2.

‘This approach of combining fiscal and monetary policy in response to inflation could be applied more widely. For example, a reduction in VAT… could be introduced without affecting the overall position of the public finances if taxes were simultaneously raised on those benefiting from inflation. This could include raising the rates of tax on savings, dividends and capital gains, or a windfall tax on the profits earned by banks from higher interest rates‘

In short - this is a gish gallop. The objective here is to overwhelm you with arguments, enduring you don’t stop to realise that by agreeing with this, you’d in effect transfer a lot of power to the central planners in this equation - the BoE, given all the different policies thrown into the mix.

‘These kinds of targeted increases in taxation can also serve to constrain aggregate demand. If it is judged that inflation is the result of excessive domestic demand, targeted tax increases on higher income households offer a much more precise means of constraining demand than the distributionally blunt instrument of interest rate rises. In this way, fiscal policy can be used to manage the distributional effects of inflation while also limiting the need for Bank Rate hikes to dampen demand‘

Jacobs here describes a mechanism for the systematic wealth stripping of, first, the upper class then the upper middle class, and then the middle class. His words may fail to be this honest, but that would be the net result - precisely because anyone with rational sense (or money) would leave in an instant.

‘Coordination with fiscal policy would thus provide greater room for manoeuvre for monetary policy‘

And there you go - this is about making monetary policy more flexible. The Bank of England will be the master in that relationship, should any doubt remain. And at this stage, the environmentalist argument is gradually worked into the narrative - but let’s speed past that part, and get the point -

‘A low carbon transition necessitates a move away from energy infrastructure with low upfront costs but high operating costs (fossil fuels and labour) to renewable infrastructure with significant upfront capital costs but low operating costs (no fuel and very little labour). This makes low carbon energy investments much more sensitive to interest rate rises.‘

… oh wait, yes, our ‘green transition’ will of course require monetary stability, and -

‘Mitigating the ‘green collateral damage’ from rate rises will require enhanced macro-economic coordination. Likewise, taxation and interest rate policy will require greater coordination. The climate transition will require a major and rapid mobilisation of private and public sector resources – probably the largest ever in peacetime‘

… lots and lots of blended finance deals. Expressly the ones ripping off the taxpayer.

‘In these circumstances, as discussed above, governments may well need to use taxes to manage aggregate demand and prices, and not simply rely on rising interest rates.‘

… and there you go. To support the ‘green transition’ at gunpoint, the BoE will quite simply have to raises your taxes and hand these over to foundations.

‘An apparently innocuous change to the Bank’s monetary policy framework in 2009 means that the reserves which commercial banks hold at the Bank are now remunerated at the Bank’s policy rate. This approach looked practical and fair at the time, when interest rates were near zero and reserve holdings relatively small.‘

Gee - it’s yet another ‘mistake’ by the Bank of England - with catastrophic outcome. Either way, regardless of these many ‘errors’ -

‘In any of these cases, the unavoidable interactions between monetary and fiscal policy will require much closer coordination between the Treasury and Bank than has been the case in the recent past‘

Chapter 4 is where the ‘Civil Society Organisations’ are fused into the ‘trisectoral network’ further comprising the Bank of England and the UK Treasury -

‘THE NEW ECONOMIC INSTITUTIONS - The Treasury and the Bank of England remain the UK’s paramount economic policymakers. But they are not the only ones‘

Yes, it’s yet another public-private-partnership, cooperating for the common good. And this common good… will be dictated by those ‘New Economic (Policy) Institutions’.

‘We recommend that the Climate Change Committee‘s remit is expanded to encompass a wider set of environmental targets and guidance beyond just climate. And we propose that the Low Pay Commission should become an Inequalities Commission…‘

And - et voila. Climate is no longer about just climate, and Low Pay is now about inequality. Incidentally, we saw the latter discussed in context of ‘relative poverty’ in Jeff Sachs’ book, ‘Ethics in Action’.

Incidentally, did you know that in the Soviet Union, a threshold for compensation relative to the average income applied to everyone - explicitly aligning with Sachs’ recommendations?

‘Academic economics has acknowledged the problem of multiple objectives. It is widely accepted that, when governments have multiple policy targets, they need multiple policy instruments… Instead of the ‘one instrument per target’ approach, it is now accepted that policy packages are required, with instruments analysed not in isolation but in combination.‘

Thus, a ‘coordination’ is required, and -

‘Governments today have multiple economic objectives… falling geographical disparities, falling greenhouse gas emissions and improving environmental conditions. They may also seek falling income and/or wealth inequality and falling poverty, and even rising wellbeing‘

… a ‘holistic approach’ is called for, and to that extent -

‘But there can be little doubt that they are unlikely to be achieved unless the different policy instruments with which governments seek to achieve them are in some way coordinated.‘

… this all needs coordination. A place for the ‘stakeholders’ to meet, coordinating fiscal policy - completely outside of democratic oversight.

And should the government refuse, those ‘letters’ which the BoE would write to the treasury would become useful - drumming up anger up through the mainstream media for maximum effect. The report then fabricates more self-serving arguments before settling upon a ‘solution’ -

‘To mitigate these costs, while retaining the benefits of separate policy institutions, we propose a mechanism by which policy can be coordinated between them. Specifically, we propose the creation of an Economic Policy Coordination Committee (EPCC).‘

… where the public-private-partnership can cooperate for the common good.

Corporatism, but under the thumb of the principles of ‘Good Governance’ aka ethics.

‘The principal meetings of the full committee would need to take place in advance of the Treasury’s two major fiscal events, the spring statement and autumn budget.‘

And golly gee whiz - their primary meetings are to be held prior to government budgets - because the intent obviously is to apply pressure to any sitting government.

‘It would be wise to place these meetings on a statutory footing, so they could not be bypassed by the government of the day without new legislation.’

This is a coup d’etat, and the Bank of England and Fabian Society needs to be investigated. In fact, the independence of the BoE needs to be eliminated, because it’s clearly being used to persue an ulterior agenda.

’The EPCC would subsequently present a report to the Cabinet and to the devolved governments. As with the Bank of England, the EPCC’s minutes would be published to ensure that experts, market actors and civil society organisations are able to understand (and criticise) its deliberations.‘

… and also used to smear any government refusing to comply, with bonus mention of ‘Civil Society Organisations’. This is a trisectoral network. That’s what it is.

And they even admit it next -

‘As key institutions in the ‘corporatist’ approach to economic policy making practised by both Conservative and Labour governments in the 1960s and 1970s, the aim of the Neddies was to improve economic performance, particularly industrial productivity and growth, initially using a type of indicative planning.’

Communists quite simply love planning. It never works, but this time is different.

’But they were unable to overcome the deep structural problems of the post-colonial British economy, and have generally been regarded as a failure – if not the cause of Britain’s inability to modernise its economy in this period, then at least unable to arrest the decline.‘

They were failures. There’s no ‘generally’ about it. And they always were, regardless of whether ‘colonialism’ ever was... anything but an excuse in this context.

‘But the Economic Policy Coordination Committee we propose would not be a Neddy Mark 2. Its aim would be more modest. Today we have devolved government, …’

No, really - THIS TIME IS DIFFERENT, because this time -

‘… with new economic policy responsibilities, …’

… it would carry responsibilities of a… ‘New Economic Policy’.

And though this would have been an excellent final remark, there are a few further tidbits which are of pivotal importance -

‘We hope that this would improve the quality of public debate on economic policy, which would in turn increase the accountability of the government and other policy makers to the electorate…‘

They will use those ‘Bank of England letters’ (along with EPCC minutes) to apply pressure on any dissenting government. That’s how Truss was taken down. That should be absolutely clear in contemporary settings23. Funny, how the MSM and BoE are not going after the present government, but then, they clearly already collaborate, given practically everyone in Keir’s government being a Fabian Socialist - regardless of the almost comedic levels of statistical likelihood of that organically taking place.

But to ensure the BoE has an exit clause when this spectacularly fails at… absolutely everything… but transferring power to the unelected -

‘Would an Economic Policy Coordination Committee… improve UK economic policymaking? There can of course be no guarantee.‘

And, incredibly, we can even link this dynamic up with Leontief, and ultimately Bogdanov through IO Analysis.

‘These activities are intended to complement the overall macroeconomic stance taken by the Treasury and the Bank of England… Along with government policies… they can be regarded as covering the supply side of economic policymaking, where the Treasury and Bank of England are responsible for the demand side‘

The objective here is to become the administrator, the controller of that supply-demand pipe. That’s ultimately what Bogdanov is suggesting. That’s why he doesn’t care about who owns the productive capacity - because they administration, they can choke any producer off within a minute.

The appendix further adds a number of ‘ideas’, including merging national investments banks - meaning that the intent here was to seize control of fiscal policy. And the report further calls for accelerated spending relating to ‘biodiversity restoration’, and so forth. It’s how they seek to drain every penny out of the West - their ‘Grand Plan’, so to speak.

‘… the medium-term targets which parliament should adopt to ensure that the UK is on course towards its statutory long-term goal of net zero emissions by 2050 (originally an 80 per cent reduction on 1990 levels), and to report on the government’s achievements and shortfalls against those targets.‘

… and when those targets are missed, those governments will suitably be dragged through the mud by a complicit mainstream media.

‘The Low Pay Commission (LPC) was also established by the last Labour government, alongside the introduction of the national minimum wage (NMW) in 1998… Its reports include detailed analysis of UK labour markets. Its specific task is to advise the government every year on the appropriate level of the minimum wage and its age and geographical variants. Since 2020 it has been asked to make its recommendations with an overall goal of having the NMW reach two-thirds of median earnings by 2024‘

… and there’s Jeff Sachs’ ‘relative poverty’ being addressed.

‘Second, there is a strong case for the Climate Change Committee’s remit to be broadened. Under the 2021 Environment Act, the UK government is empowered to adopt medium- and long-term environmental targets in fields such as air and water pollution and biodiversity… The CCC could be given this task. It would provide government with the means both to integrate its environmental objectives into its wider economic (and climate) policies, and to avoid the latter running directly counter to them.‘

… and there’s the call for the broadening of ‘climate change’ to also include air and water pollution, along with biodiversity… infinities… and so forth.

‘… the Taylor Review of Modern Working Practices observed in 2017, the Low Pay Commission’s remit needs to be broadened to take account of these changes…‘

… and now ‘low pay’ isn’t about low pay at all, but -

‘Beyond this, there are wider sources of inequality in gender and racial pay gaps, in other forms of discrimination on the basis of disability, sexual orientation and so on, and in the distribution of wealth as well as income.‘

… racism, sexuality, disability… and every other Frankfurt School Critical Theory topic, to be ultimately used to justify the dictation of highly specific fiscal policy.

‘In each case the government could adopt targets, in law and/or policy, on which the commissions would advise, both in terms of what the targets should be, and how they could best be met. In turn, both bodies would report to parliament on government performance. In the 15 years since it was established, the Climate Change Committee has proved an invaluable institution, not merely for its expert (and almost universally accepted) advice, but for holding governments’ feet to the fire when it fails to live up to its own commitments.‘

In Michael Jacobs’s ideal society, government should do little else but sign the dotted line - and be removed for refusing to follow orders.

Gee, isn’t that exactly what happened to…

Liz Truss and Kwarteng proved a nuisance to the Bank of England, and for that, they had to go. It really is that simple. And to ensure future politicians get the picture, Michael Jacobs’ report dedicates space to Truss… on six occasions.

Gordon Brown, of course, presided over much of this. And much to… nobody’s surprise, 9 months back he joined the Rockefeller Foundation board24.

As for Michael Jacobs… well, his CV25 is certainly interesting reading.

And with the above report completed it’s time to revisit the Georgetown University mentor of Bill Clinton, Carroll Quigley, and specifically, ‘Tragedy and Hope’26. Because the below quote really isn’t ‘conspiracy theory’ after all… is it?

Time to set sights squarely on the central banks.

‘Crisis Economics’ is up next.