Combating Global Warming

I spent months, months in a fruitless attempt to drum up UNCTAD/RDP/DFP/1, but it was wiped, absolutely wiped off the internet. Fortunately, divine intervention struck, and I ended up with two copies of not just that, but the similarly vanished follow-up document as well - UNCTAD/GID/8.

Let’s see why they went to that extent.

First off - I received both documents courtesy of not one, but two sources. I have not given credit, because I’ve in the past received documents expressly handed on condition of anonymity. Should you desire credit, ping me and I’ll be happy to credit. And second off - thank you, and apologies. I’ve sat on these for months, because more important documents keep getting in the way.

Climate change - real or not - has been covered extensively through a number of posts already. First, via the Keeling Curve, then via the Climate Consensus, the Public-Private Partnership, and finally - and most recently - Climategate, and the UNFCCC/CBD synthesis. I could further drag in a number of posts relating to the financing mechanism - the Global Environment Facility - but I have to stop somewhere.

Before diving in, I could not possibly care less about your alleged offense caused by the examining of the premise. Science isn’t science if you’re not allowed to examine, probe, or express skepticism - and as for those who demand that said ‘sketicism’ should be confined within some predefined threshold… Overton Window… they are not conducting science - but rather quite possibly protecting an agenda. Besides, history is full of people claiming those who even question ‘endanger the collective’, with a strong emphasis on ‘the collective’. And that - very much - was the central narrative relating to the alleged pandemic we experienced only recently just as well.

Something about ‘wanting to kill grannies’, no?

Let’s start with a brief history of what led up to these reports, and air ‘pollutant’ trading in general - to get a sense of the environment (no pun intended) at the time -

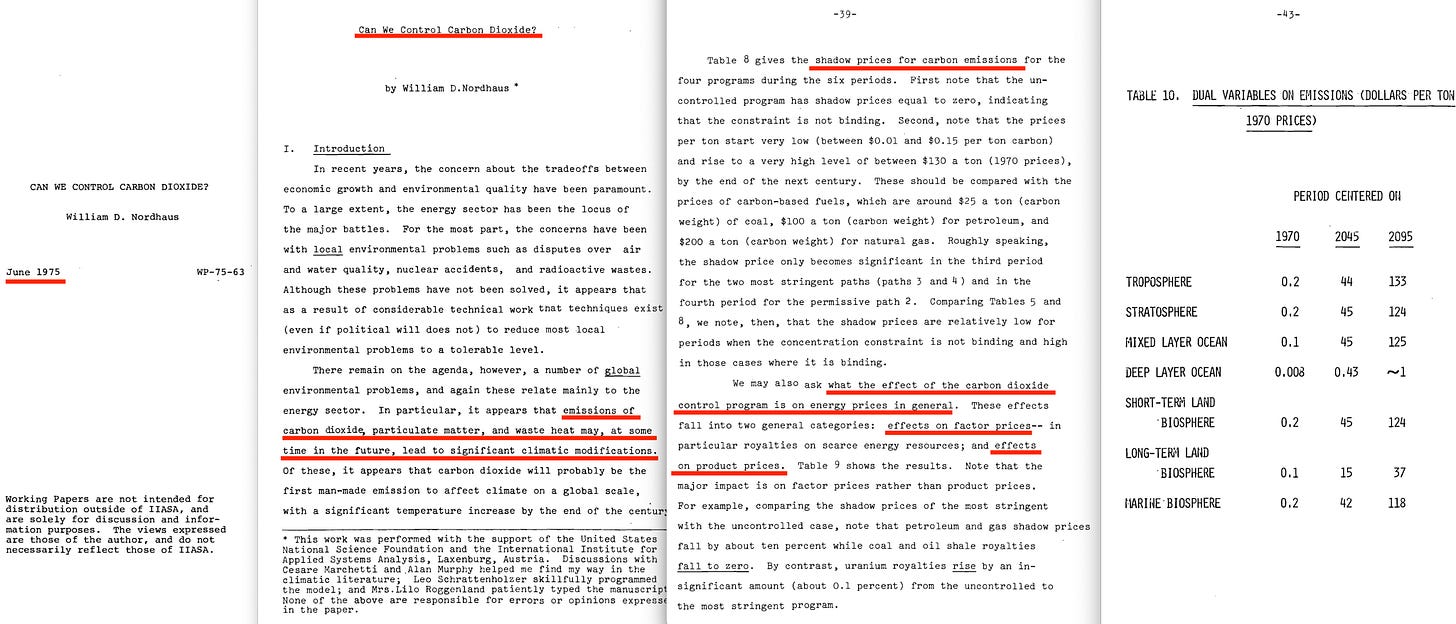

1975 IIASA paper on Carbon Pricing1.

The pivotal, first paper on pricing carbon was released in 1975, courtesy of the International Institute for Applied Systems Analysis.1977 Clean Air Act2.

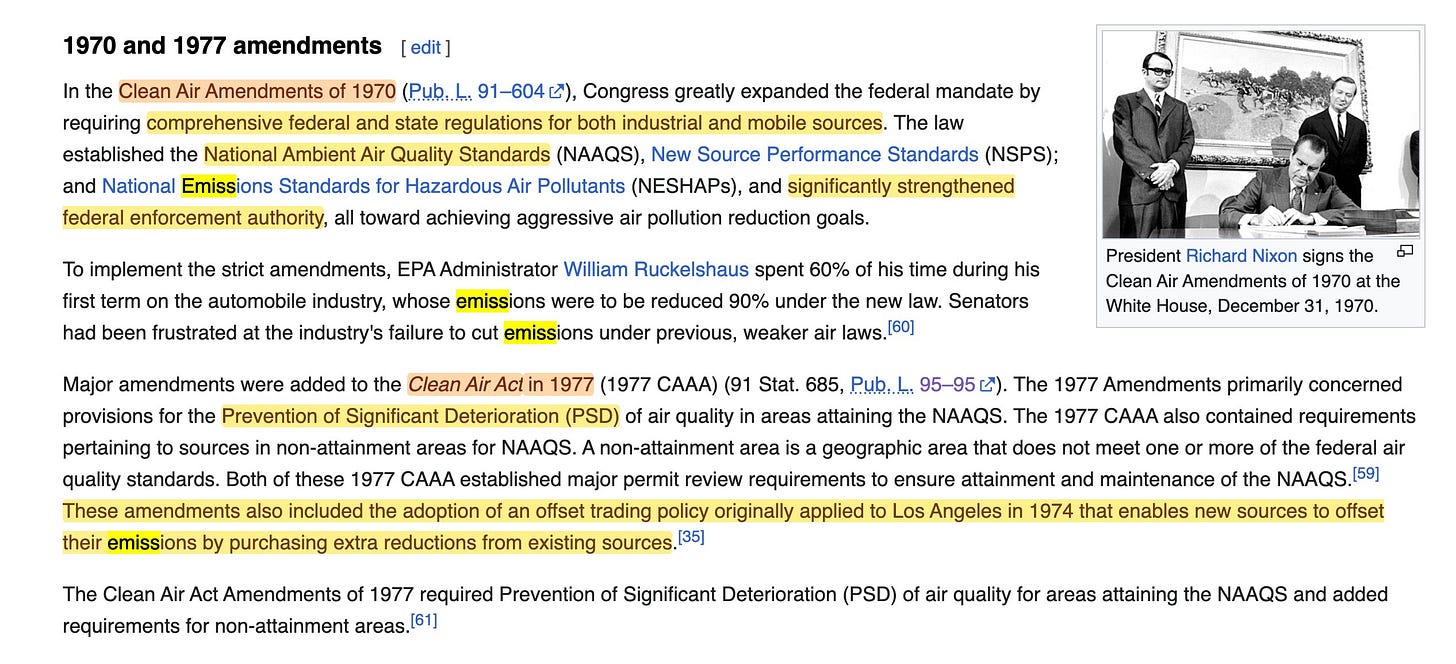

Having completed work on the basic mechanism, detailing the pricing of carbon emissions, the Clean Air Act Amendment included a part on the ‘Prevention of Significant Deterioration‘, with phrasing related to offsetting, banking, and trading of emission.1980 Air Pollution Offsets3.

The Conservation Foundation released a reference book on pollution offsetting, trading, and banking, which furthermore - interestingly - saw Barbara ‘Spaceship Earth’ Ward included in its list of trustees.1982 EPA - Offsetting4.

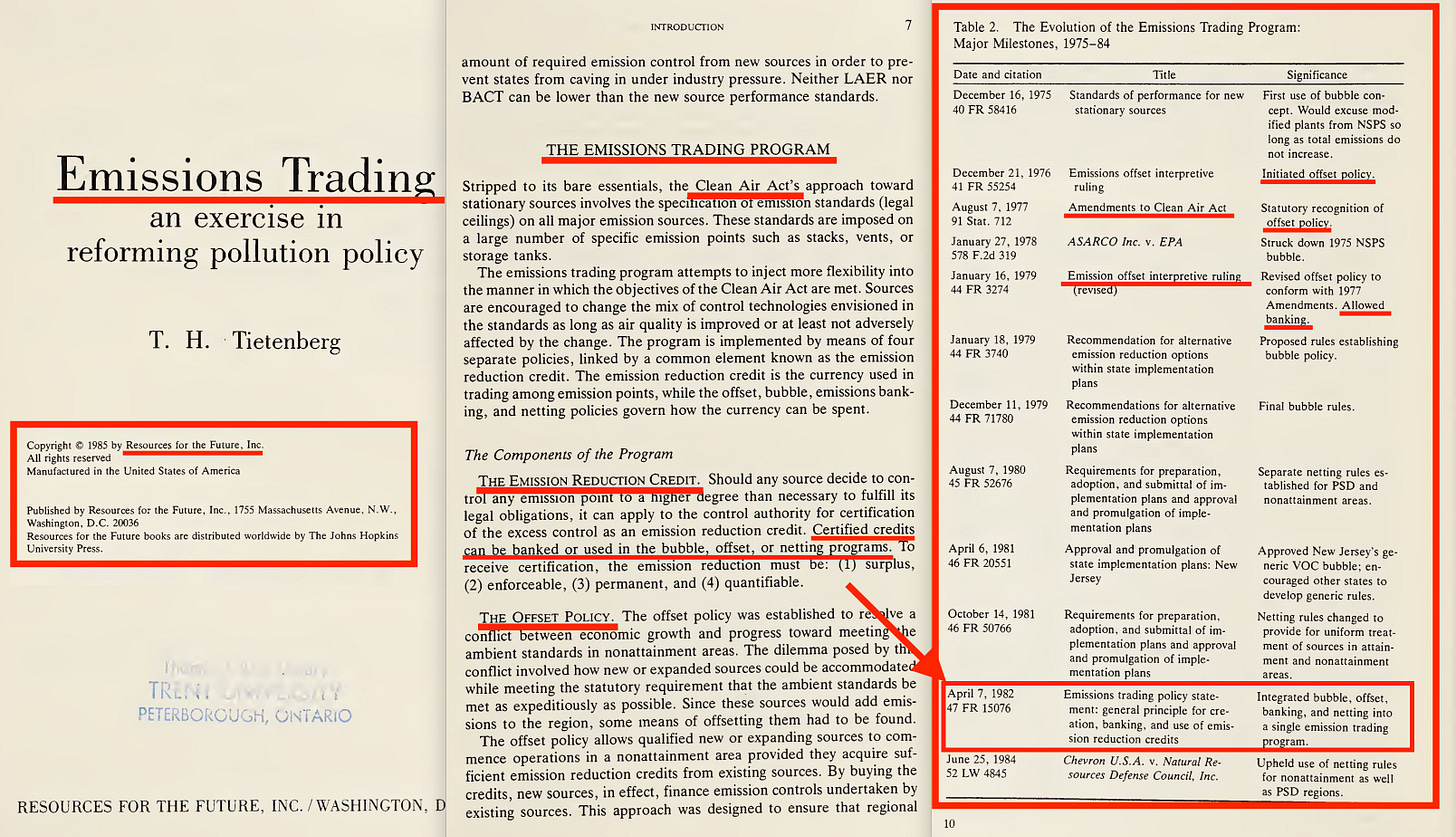

'Between 1981 and 1983, while known as Anne M. Gorsuch, she served under President Ronald Reagan ... Her son is sitting Associate Justice of the Supreme Court of the United States Neil Gorsuch'.1985 Tietenberg - Emissions Trading5.

This was a major step towards the full description of the future carbon dioxide emission trading system. It further is useful from the perspective of historical analysis.1985 Discovery of the Ozone Hole6.

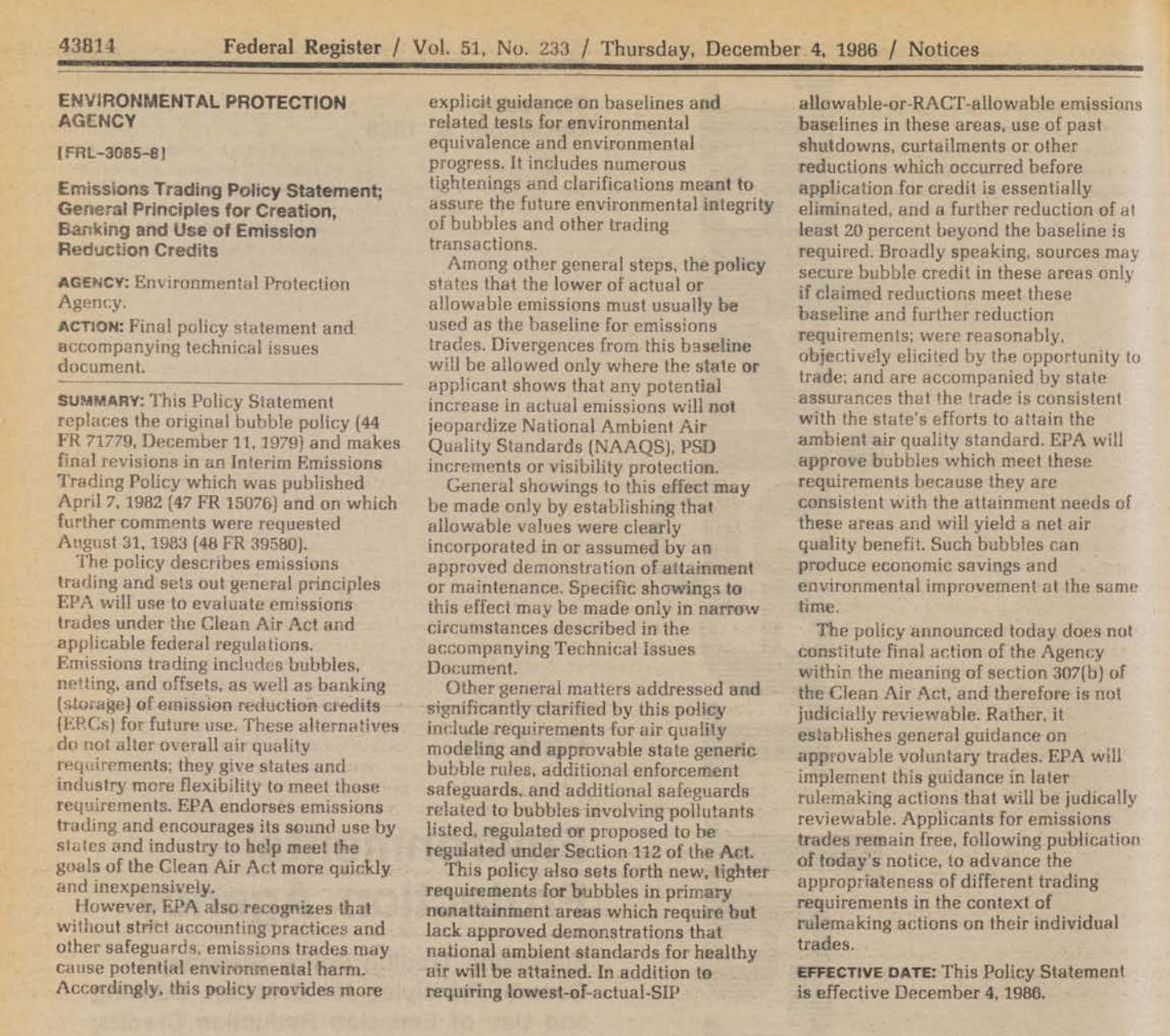

1986 EPA - Offsetting.

Yet another update to the early mechanism.1987 Montreal Protocol - Emission transfers7.

The discovery of the ozone hole led to the Montreal protocol, which included language related to the transferring of emission permits between parties.1990 IPCC WG3 - Emission Trading8.

The very first IPCC assessment included superficial language related to the trading of emission permits. But to discover the detail, you have to dive into the specific output report of working group 3, which spells out the future emission trading system in detail.1992 Rio - United Nations Framework Convention for Climate Change9.

This included specific language related to carbon sinks and sources. The Rio Summit further led to the Convention on Biological Diversity, which similarly is of interest here.1997 Kyoto - Emission Trading10.

This is, largely, the system progressively concocted by the UNCTED as detailed above. But what is less well-addressed is the role of GLOBE behind the scenes.

There are a fair few other events contibuting during this timeline, but these are primary. A future post on the climate narrative will be more verbose.

And to summarise the above - in 1975, the first paper on carbon taxation was published by the IIASA, and 2 years later, the EPA introduced carbon offsetting schemes as part of the Clean Air Act Amendments of 1977. The Conservation Foundation in 1980 detailed air pollution offsetting, before the EPA through first 1982 then 1986 pushed through incremental legislation. Meanwhile, Tom Tietenberg penned early, influential work in 1985, same year in which the Ozone issue was first identified, with a proposed solution following in 1987 through transferable emission permits - then fused with offsetting schemes and carbon taxation in the 1990 IPCC Working Group 3 report, detailing a rough outline of a system in the context of tradeable carbon emission permits.

And though the UNFCCC in 1992 was remarkably light on detail, it did indirectly include the central offsetting mechanism, through specific wording detailing carbon sinks and sources, before the 1997 Kyoto Protocol included very early legally binding legislation, eventually further developed first through the Copenhagen Accord in 2009 to eventually become the Paris Agreement of 2015.

Consequently, these two reports from the perspective of timeline partially overlaps the release of the UNFCCC in 1992, and the Kyoto Protocol in 1997.

The 1992 report is the more generic of the two, as it deals with the what, how, and why’s. It starts off by establishing the case - global warming itself - its considerable uncertainties, the lack of knowledge on… well, pretty much everything, before linking emissions to fossil fuel use, which naturally exploded as the world developed. It further points to the issue of development in the 3rd world, as this will accelerate carbon emissions rapidly. And finally, it points to the Montreal Protocol and the UNECE agreements on sulphur and nitrous oxide being early front runners, relating to emission targets.

Ultimately, the central mechanism we’re homing in on is that of offsetting.

Offsetting is key, but in order to facilitate a few mechanisms are called for, these being monitoring of emissions, the recording of emission transfers, and a credible enforcement mechanism, ensuring compliance. And all of this should be carried out through an international agency, which in effect will be granted substantial powers over global affairs - though this of course goes wholly unmentioned.

Investments should be sought after in the areas with highest global return, which means that conservation of biological diversity in 3rd world nations is a given.

It carries on by adding the obligatory fantasy savings from existing mechanisms, before launching into a discussion relating to the distribution of emission entitlements, which naturally must be equitable and fair, though it is noted that these of course are virtually impossible to define.

Discussion gravitates towards a system of equal entitlements per capita, before detailing that ‘there is no precedent for cross-border trading in greenhouse gas entitlements’, making this truly ‘an innovative endeavour’ - which is a useful inclusion, given the considerable maturity of recommendations in particularly the 1994 report.

The comprehensive approach includes all greenhouse gases, including sources and sinks - though the initial rollout should focus on carbon dioxide. Entitlements can be imposed at any state in the cycle, including extraction, production, consumption, or even emission. But to this end, facilities for clearing and banking are required.

Monitoring and enforcement should be pursued at both domestic and international levels, where the UN would receive and review monitoring reports, maintain an up-to-date accounting system, managing a GHG entitlement bank, and provide technical assistance. And this international agency should ultimately be granted veto power over transactions meaning it will become a very powerful agency down the road.

The first two chapters lays the foundational premise - called for as carbon dioxide emissions (and other gases) are alleged to change the heat balance in the lower atmosphere, and this hypothetically leads to changes in climate. This is followed by a brief outline of how we got here, what a plausible response should be - right down to the inclusion of abatement and climate engineering - the uniqueness of policy issue, thus eventually calling for an international agreement. There are a lot of assumptions in this chapter, and they unsurprisingly all work in the same direction.

Chapter 2 - by noted Chatham House senior, Michael Grubb - outlines that an eventual agreement must be equitable and efficient, likely use a market-based approach… finally to hone in on the issue of initial allocation, before outlining the IPCC Working Group 3 report from 1990 relating to tradeable emission permits.

This chapter is fairly detailed, outlining emission targets, domestic carbon taxes, market-based instruments, international emission taxes, external offsetting, and tradeable emission entitlements which of course is what this is all about.

Chapter 3 we will do in full, because it’s… remarkably detailed. Really is, given the alleged lack of maturity of the issue at the time. It details the Montreal Protocol as an early front-runner of the system which through evolution will eventually lead to the free trading of emissions entitlements between global nations.

The need for an international agency is yet again emphasised, before parallels are dragged in through the Clean Air Act Amendments and other existing mechaisms, finally outlining the need for a clearing house in this regard.

This clearing house should consider all actors having specific emission quotas, and that these should be regulated, and measured relative to national emission targets. An early attempt to push this through congress is detailed (the 1991 COPE Act).

Emissions entitlements should be transferrable, and tracked emissions should initially place emphasis on just one or a few GHGs… well, let’s face it - the heavy emphasis is clearly on carbon dioxide. Sellers in this game are outlined to be countries, but eventually, private sector participation is required as well. And the agency called for should be in charge of monitoring, tracking, recording, and enforcement in regards to said GHGs.

All of this should be pushed through gradually, before adding detail in context of certification and monitoring relating to -

Measurement and verification

Uncertain alternaties

Third-party control

The legal responsibility of governments

Distribution of benefits and environmental risk

Finally, the emphasis on ensuring that no single actor captures the market will of course would be the first parts attempted overturned through corrupt politicians.

The role of a market maker is emphasised before none other but the Global Environment Facility is dragged into the conversation, calling for the GEF to be allowed the initiation of projects relating to GHG emissions. This, of course, relates to alleged biological conservation, which down the line through landscape approach blended finance deals (involving the GEF) output carbon emission permit leases relating to temporal carbon sink leases.

Finally, the conclusion yet again calls for a separate body relating to supervision and organising offsetting at an international level, before mentioning the evolving nature of emission permits, the necessity of private sector participation, finally outlining that these markets will be a true public-private partnership.

We then have a fairly boring chapter by Tom Tietenberg on related experience which outlines 1975 as the year where this all began, before making dubious claims of alleged savings, further adding that a market-based approach allows for maximum opportunities for participation.

Chapter 5 relates to equity considerations, and it’s by and large a long-ish discussion about different criteria relating to the distribution of emission permits, including ‘horisontal’ and ‘vertical equity’ strategies, alog with ‘ability to pay’… which if you ask me cast doubt as to stated environmental premise. Other strategies such as utilitarian ethics (maximum net benefits) and ‘market justice’ are also included, before the ‘vertical equity’ segment includes an explicit inclusion of Aristotle’s Golden Mean.

The discussion relating to allocation carries on through the next chapter, considering what might be an ‘acceptable’ strategy, a chapter which first asks what constitutes ‘equity’ in the first place, before outlining how this meshes with the likes of moral principles, and sustainable development. And defining these principles truly constitute an ethical dilemma… a Kantian one at that, impressively.

The final three chapters first do a shallow analysis of alleged gains by participant 3rd world nations, which - I’m sure you’ll be shocked to find - would allegedly stand to gain tremendously from this mechanism.

The final two outlines potential implementation issues, first is penned by the ever industrious Tom Tietenberg and takes an early look at enforcement and monitoring considerations, along with more general aspects -

The type of entitlement

The duration of said

Global emissions targets

The initial allocation

Domestic policies to complement the international system

The private trading variant

The trading supply

Trading rules

The clearing house and banking function

Leasing… which of course is of particular interest here, as this ultimately is exactly what transpired through GEF blended finance deals.

The chapter finishes off by including mention of particular design issues, including market power, changing control needs, and the potential of hoarding. The authors here really are thorough.

And the final chapter by Richard L Sandor - more on him later - details potential issues relating the market architecture, and the tradeable instrument.

Tom Tietenberg also looks at potential issues relating to the global entitlement system, and he starts off by dragging in precedents, which interestingly include Bretton-Woods itself.

He then details that the system must evolve slowly, that a first step must relate to the establishment of reference levels of entitlements, the necessity of technology transfer, and yet again outlines the role of the external, designated international organisation, responsible for the monitoring of performance, the provision of technical assistance, detailed record keeping, and the facilitation of an entitlement bank. And this chapter, again, makes note of ‘leasing as well as sales, of flow entitlements should be approved’. There are a few repetitions in this report, and this is one of the more noteworthy - especially considering the market wasn’t even established, yet they’re already moving quite far down the line in terms of implementation. Finally, the certification process is outlined, including emission reductions and creation - ie, sinks vs sources. Eventually, a more complete system should be developed which should include -

An expansion of the number of participants

Further inclusion of ‘controlled substances’

Private participation

Monitoring and enforcement procedures

A designated monitoring and enforcement authority.

As for monitoring… this section is remarkably detailed, discussing -

National self-reporting systems

Private monitoring

Electronic monitoring

Direct vs indirect measurements

Record-keeping

Certification

Financing

The establishment of a monitoring authority

… however, the part on enforcement is… lacking. Enforcement, by and large, comes down to negative publicity, which Tietenberg then gives examples of… allegedly working in the past - even on a transboundary basis which is somewhat puzzling. Finally, domestic enforcement is detailed relating to national emission sources.

This part further includes a reference to Chaynes & Chaynes [1991], outlining principles of ‘accountability’ and ‘transparency’, which both resonate with principles of ‘Good Governance’… at the express time the World Bank worked on said.

Finally, Sandor in the final chapter first takes us on a tour of past exchanges, from Osaka and Amsterdam in the 17th Century, to Chicago in the 19th Century, all to establish how to develop an efficient market, comprising the commodity, the organised spot market, the futures market, and an options market - all to apply the same in context of co2 trading.

The chapter finishes on a remarkable note. It details the establishment of spot, futures and options markets with the interesting inclusion of - ‘Although there is no historical evidence of a successful futures market in pollution property rights or in tradeable entitlements for emissions…‘, only for Sandor to include remarkably detailed trading proposals for both - never mind that said futures and options markets didn’t even exist until 2005, but with the even more interesting detail that -

‘If signatories include the United States, Japan or the European Community countries, provisions should be made to transfer their entitlements to the private sector…‘

Awake yet? You should be, because the final paragraph takes the biscuit -

‘Air and water are simply no longer the "free goods" that economists once assumed. They must be redefined as property rights so that they can be efficienily allocated. lt is self-evident that the allocation of these scarce but vitally important resources will be a major problem of the twenty-first century and beyond. Population growth and further industrialization of the planet assure this. These simple facts make it essential for research to continue as rapidly as possible so that we can implement market solutions to the highly critical environmental problems facing us.‘

… the plan is to monetise air and water, via a ‘market-based approach’.

And this, stated already back in 1992!

… of course, the WHO in 1993 released a report titled ‘GEMS/AIR : Global Environmental Monitoring System, a global programme for urban air quality monitoring and assessment‘11. which tracks back its story to 1973…

And as for water… here’s a 1992 report on the ‘GEMS/Water - Operational Guide‘12, identifying the 1974 launch of that particular program.

Both, in fact, were early components of the Global Environmental Monitoring System, originally outlined through SCOPE’s first and third reports from 1971 and 1973. And that, for the record, is genuinely one of the craziest reports I’ve read over the past year and a half - and that’s quite saying something.

Now, let’s take a look at the 1994 report, which is… substantially more targeted in approach. The report is briefly divided into two parts, where the first focuses on possible administrative structure and procedures, and the second on model rules and regulations for a global co2 emissions credit market.

Let’s start by quickly zipping through the conclusions, along with the foreword which details a proposed three-stage process, the key functions of certification, monitoring and enforcement, along with the centrality of monitoring in this regard, which allows a level of control over entitlements, and this effort should be processed by a subsidiary body within the UNFCCC Conference of the Parties.

Compliance is outlined in the conclusion of part 1 as a potential issue, where public opinion alone may be insufficient - which is interesting in itself, because the 1992 report certainly didn’t leave that impression. But it goes to outline domestic enforcement of international standards - which is entirely in line with Gordon Brown’s work relating to alleged human rights - hints at the solution being both political and economic (ie, sanctions), and even includes discussion relating to a channel to sort out dispute resolution, which is timely because ISDS courts were accelerated with NAFTA, which entered force… in 199413… same year as this report… which you can consider yet another extraordinary coincidence, I’m sure.

The conclusion of part 2 then suggests that the United States, European Union and Japan sign this agreement - curiously, exactly in line with Trilateral Commission regions - before drumming up the requirement for an authority relating to international trading of carbon emission credits. In the annex we find a progressed proposal for ‘salient features of proposed commodity “contract”’, which of course did not come into being until… 200514, so it’s very impressively early indeed. Almost as though this was the entire objective… along with those leases outlined by the 1992 report… and the international authority, of course.

Detailing possible administrative structures and procedures, part 1 is authored by the ever-industrious Tom Tietenberg, along with - interestingly - IIASA fellow, David G Victor. And the first objective called for is the reduction of GHG emissions by 2000 compared to 1990, which wouldn’t be particularly hard for the EU to achieve, as the trajectory at this stage already was one of steady decline. But the introduction carries on, outlining that measures should seek to achieve ‘global benefits at the lowest possible cost’ - logically explaining the early focus on biodiversity restoration in 3rd world nations - and to this end, this paper proposes a solution, one even facilitating transboundary cost-sharing!

… and then, it calls for ‘mobilisation of private capital for controlling global warming; private capital is likely to be a critically important component of any effective global warming strategy as long as public capital remains insufficient to do it alone’.

In the 1992 report, they opened up for private capital to be allowed access, but this was emphasised as down the line. Only 2 years later, private capital has become ‘critical’? This is how they do things. Open a minor fracture - a vector of exploitation - then claim it’s ‘critical’ to push through something clearly not in your interest - without debate. The phrasing, further, could be indicative of a ‘public-private partnership’, in effect describing lemon socialism… on steroids.

It carries on, outlining how this initially simple system should evolve to become more complete, and that initial steps of the UNFCCC were ‘comprehensive neither in terms of pollutants, nor participants’. In other words, they’ve only just seen the UNFCCC pass, but already by now they’re pushing for ‘coverage to all greenhouse gases’, and ‘certification, monitoring and enforcement procedures’.

My primary question here is - if these guys worked as used car salesmen, exactly how cheap would their suits be?

Now, the task of administrative procedures and structures ‘presents some considerable challenges’, especially as this will ‘require some subordination of national power to the interests of the global community’. As for the facilitative trading system, this requires the ‘availability of entitlements for purchase’, ‘banking functions’, and defined ‘conditions of transferral’. And the procedures include those of certification, monitoring, and enforcement, where the former ‘is necessary to assure that the homogeneity of the traded entitlements is maintained while allowing the widest possible participation in the system’. Somehow, this wording makes me believe that the objective already at this stage was mapping these right down to the individual; ie the ‘widest possible participation’.

Limited participation is allowed for non-signatories, not just to achieve objectives but also ‘as a means of providing another channel for the transfer of funds and technical assistance’. I’ve read a lot of these documents, and here’s what I see - the transfer of funds relate to the private finance/banking industry, and the latter relates to cherry picked environmental NGOs which will obviously be used to steer in a specific, predetermined direction, in effect working to standardise procedures in nations, which are not yet signed up. This could hypothetically mean that the early drive - Iwokrama, for instance - was actually about building institutional capacity in line with insider interest, so that the eventual system adopted in said 3rd world nations would be entirely in line with the global system.

And the World Bank, the UNDP and the Inter-Parliamentary Union pulled the same trick, relating to third world aid in context of electoral and civil service reform (see ‘Good Governance’).

The certification system will also come in handy should ‘industrialised nations’ seek to ‘acquire offsetting emission reductions from developing countries which had not accepted any responsibility for limiting emissions’. And this could be further put to use ‘to eliminate energy substitutions which signatories do not view as desired outcomes of the trading process’.

These subsidies, for the record, are now openly discussed - and these will result in vastly higher prices for the average Westerner, because they don’t relate to actual subsidies, but rather hypothetical forward projections of alleged long-term ‘environmental damage’ which is chaos theory, and thus absolutely impossible to calculate. It’s fraud - pure and simple - and Mark Rutte is all in on it.

Monitoring is given consideration, as it’s central to assessing compliance, even ensuring compliance. But it further gives an indicator as to whether stronger international action would be necessary. And to this extent, a monitoring authority needs establishing, and the monitoring will likely comprise a mix of self-reporting and inspections, direct and indirect. On this account enforcement can be carried out, and global enforcement should seek to utilise both ‘positive and negative incentives’… which could be described as bribes and fines.

Post-introduction, part 1 starts off by defining the evolutionary stages.

Stage 1 - the joint implementation stage - relates to the initial agreement, stating the goal of stabilisation, along with the obligation of the parties (briefly, reducing emissions by 2000 relative to 1990), but further includes that said obligations ‘might change in response to new scientific evidence or shifting underlying interests and perceptions’.

This stage, in brief, was established through the UNFCCC of 1992.Stage 2 - the initial entitlement stage - immediately pushes for ‘hard targets’ through ‘specific emission requirements for each of the participating countries’, but further opening up for the possibility of ‘scientific evidence suggests the need for more drastic reductions (as was the case with the Montreal Protocol), fewer entitlements could be granted’. Now, do realise the power in the hands of those fabricating the ‘best available scientific consensus’ along with the administration carrying out said enforcement. But this second stage would also ‘offer significant opportunities and incentives for developing countries to join the agreement’ through ‘access to large amounts of private capital as well as to an efficient means of technology transfer’, which is just grand because private capital appears to now go beyond a tentative inclusion through the 1992 report, through ‘critical inclusion’ in the introduction, and now suggestively appears to drive this process - and technology transfer is a further carrot. Of course, who pays for said transfer, and which technology is to be transferred… those are key questions rarely answered.

Finally, the second stage ‘does not presume any particular domestic strategy’, no, ‘the second stage primarily involves trades in carbon entitlements’ and ‘non-participating countries would be allowed to “opt-in”’.

This stage appears roughly in line with the 1997 Kyoto Protocol, which only came into force a decade later.Stage 3 - the culmination stage - will see this system pushed in three dimensions; through an increase in participation, a ‘much larger number of trades conducted privately’ (which of course was always the objective), and ‘coverage of sources of greenhouse gases could expand… ultimately, all greenhouse gases’.

Full monetisation of quack science, in short. We’re not quite there, but we’re certainly heading in that direction.

The next chapter relates to the certification function; the related authority (the CoP, as declared by UNFCCC article 715), but includes that the day-to-day running must be conducted by an operational subsidiary authority, and said should certify entitlements of which there are two types - allocated, and created.

Allocated entitlements refer to those allocated globally, and created refer to those generated through carbon sinks - forests, and the likes. The allocated type can further be delegated to be controlled by a sovereign institute, provided said fully plays ball. And to this end, a national compliance plan should be created and maintained.

Created entitlements must be considered ‘surplus’, and these can be created either through ‘specific actions taken to reduce carbon emissions by sources in non-particupating countries or to increase the absorption of atmospheric carbon by sources in either participating or non-participating countries'. I, personally, spot somewhat of an issue here, but before detailing… the chapter outlines the burden of proof, the certification and programme evolution which asks the key question - ‘how existing offsets should be incorporated into the later stages’ in context of a non-participant, which it helpfully suggests is a problem which should be solved through subtraction ‘against the allocated entitlements’.

And here’s why that’s a problem -

A private actor decides to monetise the creation of carbon emission credits from a rainforest in a non-participating nation.

Down the line said nation decides to participate.

The rainforest is now considered as part of the allocated entitlements.

As this was previously monetised by a private actor, this entitlement will be deducted from the allocated entitlements to be received by the joining nation.

Consequently, activities of a nation prior to participating works against it.

In other words, it’s a free-for-all by private actors - and this goes to explain the early emphasis on ‘biodiversity restoration in the third world’ through GEF Blended Finance deals. It’s a private monetisation of 3rd world natural assets.

The next chapter on monitoring starts of… predictably, stating that offsetting is a question of matching emissions with entitlements, and thus that monitoring also apply to permits, but that this doesn’t constitute an issue as these - through certification - are more aligned with typical instruments such as stock certificates, cargo manifests, and bank transfers.

Monitoring and enforcement are also revealed to be explicitly separated - though this clearly won’t matter much, as the power is invested in the structure determining the monitoring… or at least, will be initially. The three stages of implementation are briefly considered, outlining a gradual development towards a system of considerable administrative burden, and thus, local market operators and exchanges are called for. It might not state this, but that’s clearly where they’re going with this. Monitoring will be achieved through self-reporting with periodic checks, but very interestingly goes on to add that ‘multiple levels of self-reporting along with veracity checks should also allow cross-checking’, before adding a long-ish section on prior art.

But back to the multiple levels of self-reporting… mention of' ‘multiple levels’ suggest a hierarchical approach, and this allowing for cross-checking appears… somewhat at odds with contemporary calls to eliminate ‘duplicate work’ through all strata of international organisations16, precisely - as I previously hypothesied - because this enables corruption through the elimination of effective indirect oversight.

The real ‘meat’ of the chapter relates to the state of science and technology, which adds that ‘direct emissions to the atmosphere are rarely measured; rather proxies… emissions computed on the basis of the proxy using an emission factor… emission factors may vary widely with the conditions’.

In other words, everything is a guesstimate of a guesstimate.

It continues, adding ‘… most countried have elaborate systems for monitoring flows of energy through the economy. Data systems are especially well developed…’, which - yet again - takes us back to Silent Weapons for Quiet Wars…

The next part is… eye-opening, as it states that ‘it is possible to interpret the UNFCCC as comprehensive - that is, it controls all sources and all sinks of all greenhouse gases’, which then brings us to Input-Output Analysis - before adding that ‘… future protocols… may take a comprehensive approach‘.

In other words - the future approach will be total surveillance of the carbon cycle. Oh, wait - already in 1977, Bert Bolin via SCOPE 1317 outlined the need to study something similar… which became 1981’s SCOPE 16; Carbon Modelling18.

A problem related to a comprehensive approach is considered through the development of a multi-gas system which allows for trading between the various gases, ultimately to produce a common index - the global warming potential (GWP) - thus resulting in a singular coefficient… which, frankly, is lunatic as the introduction of an index would primarily reflect contemporary trading, and not generally directly relate to actual pollution of the atmosphere. But the inclusion of multiple gases is also identified through the report as an issue, as ‘these other gases will be extremely complicated to include in a highly quantified mechanism such as the entitlements system envisioned here’.

I could here write a long section deliberately seeking to break this concept (easily done, as specific gas types might be more dangerous to specific environments for starters), but I instead spot that the ‘OECD and GEF are supporting work to develop and harmonise methodologies for reporting emissions’, which… is interesting, as that somewhat appears to operate on the fringe of the GEF’s stated mission at this stage19. Either way, the section completes through acknowledging that ‘a comprehensive system will include many more uncertainties’, which of course is stating the bloody obvious.

Finally, the role of NGOs in monitoring is outlined, and especially environmental NGOs… such as the International Union for the Conservation of Nature…

The reason why that’s of significance is because ‘ENGOs can promote more effective agreements by monitoring the suitability of international agreements to address the problems at hand and setting political agendas’.

And that’s… pretty purposive. That would, in effect, allow the IUCN to conduct a very slow, progressive ‘steering’ of international environmental regulation in a direction more favourable to… them.

A ‘large input from scientists’ is called for (which may or may not be definitely-not-corrupt), that ‘monitoring is a public good’, before establishing that the international agencies continuously called for need do little else but… monitoring domestic monitoring organisations… meaning that all you’d theoretically have to do to control the entire process is control those agencies, because the actual monitoring is carried out domestically, thus outsourcing the bill while keeping methods and procedures under control. The ‘free flow of information should be the rule of law’, of course, but not for your sake, but rather those who control this hierarchical superstructure.

The next chapter deals with enforcement, which… starts off by going through… the obvious… before landing with ‘Roles for non-government actors’. And this states ‘most functions of an enforcement system could be carried out privately, through the legal system, if appropriate incentives are created’. In other words, this is yet another outsourcing of ‘opportunity’ to private actors, while adding ‘the enforcement system could allow private individuals to investigate and prosecute non-compliance by others on the basis that non-compliance has infringed upon the value of their entitlements’. In other words, this is quasi-encouraging a police state, where everyone rats out their neighbour.

The next inclusion is of note - ‘as the number of stakeholders rises, this enforcement function will take on strong public-good characteristics‘. Not only will this be ‘sold’ as for the ‘public good’, but it explicitly refers to ‘stakeholders’ before these really were included in UN capacity. The first document of significance including such language is Agenda 21 itself, after which ‘Our Global Neighbourhood’ carried on in the same vein leading to Kofi Annan introducing said at UN-level in 1997, cultimating with the release of the Global Compact20 in the year 2000.

Not being content, ‘Government activities to monitor… as well as sponsorship of stakeholder associations’ then unbelievably goes on to call for public subsidy of those organisations, meaning the public sector might as well do the job. But the point here, of course, is to shift these rulings to an environment more favourable to the… stakeholders. And it finally carries on by detailing issues of standing, considering looping in permits holders in other countries, even to the point of suggesting that domestic enforcement agencies should allow non-nationals to lodge complaints. This, of course, is the complete elimination of any kind of sovereignty, and ultimately states that ‘cross-national standing could also help promote harmonisation of enforcement systems’. In other words, enforcement will be subject to global rules, not national.

The end of sovereignty, indeed.

And you recall the earlier 1992 emphasis, detailing the alleged reliability of self-reporting, and enforcement not really being an issue? Well, about that -

‘The challenge to a tradeable entitlements system is that, as permit prices increase, incentives to defect will be strong. At the same time, as the permit system evolves, the number of actors in the market will increase, making it unlikely that traditional modes of international enforcement… will be operative‘

In other words, completely discard everything they said only 2 years prior. They then outline that we should ‘rely heavily on domestic enforcement’, and to that extend we should ‘set international standards for domestic enforcement’, perform ‘veracity checks and international adjustments’, ensure ‘proper operation of dispute-resolution procedures’, and ‘push early adoption of institutions and procedures’, and that ‘transparency is crucial’, ‘especially for private enforcement, which is probably very sensitive to incentives’.

In other words, standards should be set and adjusted at the international level, be enforced at the local level, the adjustments should be pushed for early adoption, and dispute resolution procedures be introduced at - let’s face it - international level… and all of this should guided through principles of ‘transparency’, especially as this aids ‘private enforcement’ who naturally are driven by a profit motive.

I cannot imagine a better description of a kangaroo court21 with absolute power vested in those ruling from above with absolute impunity.

Like - say - the IUCN?

But before we move on to part 2, we have a brief section describing ‘key challenges’. No need to spend too much time on this, but there are a few paragraphs of note, including ‘Norway and GEF provide an example of leadership: currently in the form of co-financed experimental projects in joint implementation‘ which could well operate a front-runner for Blended Finance (in GEF context, too), and ‘During the negotiations that produced the Framework Convention on Climate Change, the idea of a "prompt start" gained acceptance… institutions, procedures and capacity necessary for the long-term evolution of the Convention could be put in place early, and allowed to mature, without waiting for the more contentious details‘ - and this, of course, is also incredibly convenient should the detail down the line be… less than palatable, which then feed into -

‘… at the international level, the systern can be designed at the outset for long-term evolution to dense markets, and this would entail creating the institutions needed at the later stages early, so that they can evolve with the market…‘

In other words, create the organisations, rules, procedures, and then progressively institute the binding legislation which will see everyone filled with fury, in the least possible ‘transparent’ manner imaginable. And as for said negotiations, those took place at…

‘"A Prompt Stafi: implementing the Framework Convention on Climate Change", a report from the Bellagio Conference on lnstitutional Aspects of lnternational Cooperation on Climate Change, 28-30 January 1992.‘

… Rockefeller’s Bellagio22. Absolutely unbelievable. Let’s have a quick look at when said discussions were had23… oh, in 1991, before the release of the 1992 document.

And as fully expected, there’s no link to said documents anywhere24. Yet another no doubt incredibly inconvenient document has conveniently gone missing.

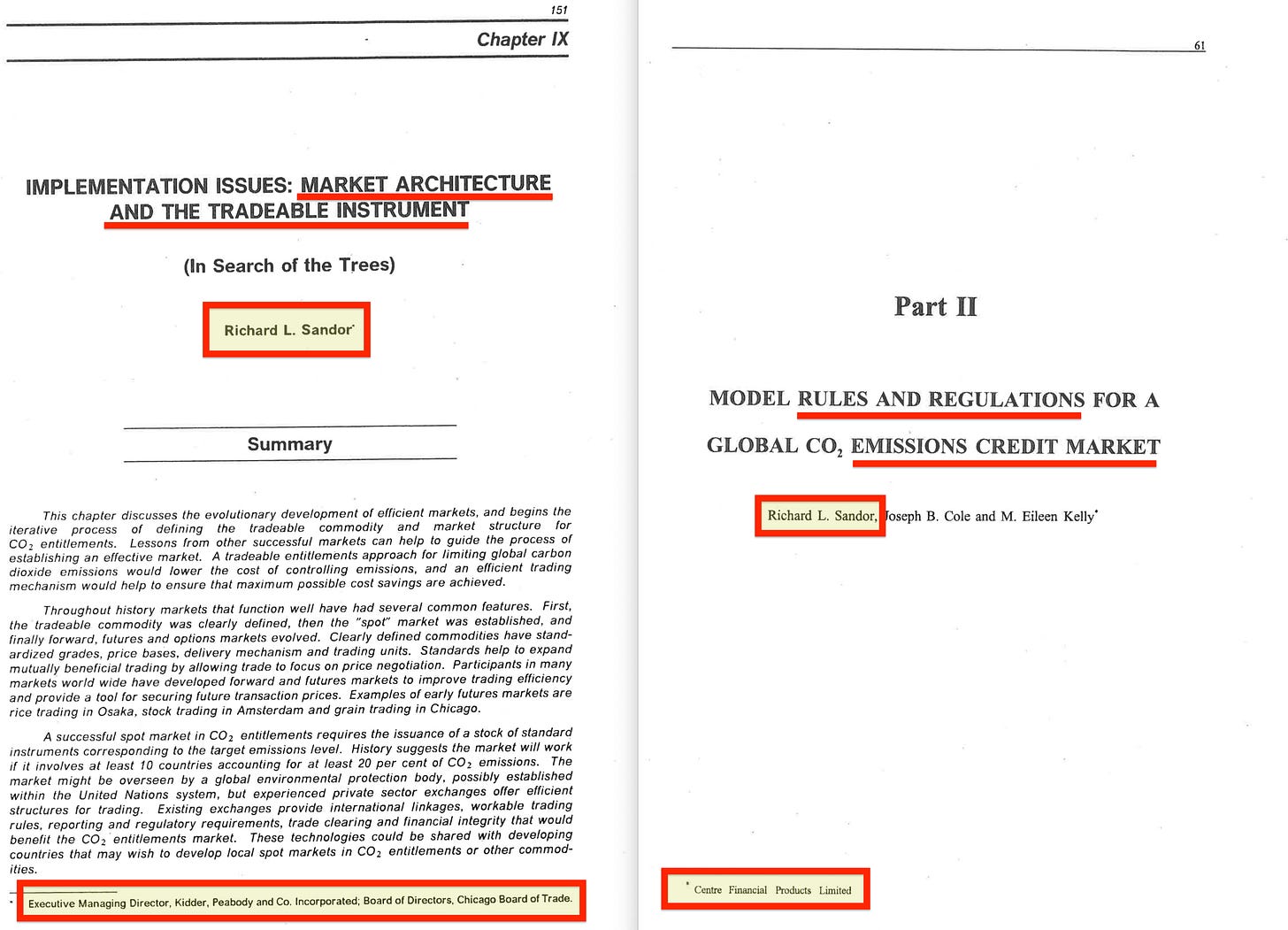

Onto part 2, and we don’t even have to enter the document before an issue appears. And it’s a major one. Are you ready? Well, here it is.

Wait. Let’s back up to the 1992 report, to which Sandor also contributed. It would appear that Richard quit his job with Peabody & Co to join… the ‘Centre Financial Products Ltd’…?

Well, if you (like me) never heard of this organisation… they were founded in 1993 by… Richard L Sandor - here, per March 1993 article in the NY Times25.

Oh, and merely months later they were engaged in a slight controversy. See, as it happens, CFP engaged in26 an ‘executory contract to sell an unspecified number of SO2 emission allowances allocated to the city-owned electric generating plant by the U.S. Environmental Protection Agency ("EPA") for the total amount of $26,850,000‘.

Ie, the very Richard L Sandor who in 1994 penned part 2, relating to emissions trading in detail explicitly engaged in emissions trading prior to this event. How the hell is this not a clear conflict of interest at the very, very least (and never mind insider trading)?

Oh, but we’re not done. No, see in 1997, the UNCTAD issued a press release27 stating ‘Greenhouse Gas Emissions Trading Forum to be Launched by UNCTAD and the Earth Council‘. And that, of course, would be Maurice Strong’s Earth Council, in fact -

‘Convened under the auspices of UNCTAD and the Earth Council, an international NGO established after the 1992 Earth Summit (UNCED) to advance sustainable development, through the empowerment of the civil society, it will be chaired by the Earth Summit´s chairman, Mr. Maurice Strong‘

And as for the CFP -

‘The event will be hosted by the Chicago-based firm Centre Financial Products Limited, headed by Dr. Richard L. Sandor. Professor Ronald Coase, Nobel laureate in economics (1991) will deliver the keynote address‘

With another source28 courtesy of the Inter-American Development Bank.

… oh, but there’s even more. Here’s from 199629.

‘The 1996 annual tripartite conference which was sponsored by the Financial Times focused on the potential roles of joint implementation and emission trading in the international control of carbon and sulphur emissions… Accounts were given of work in hand to develop such a system in UNCTAD, the OECD and the IEA and of proposals for a pilot system of CO, trading from Centre Financial Products Limited, a brokerage company.‘

… and they even proposed a pilot system by 1996!

So let’s do a chronology of events here -

1992. Richard L Sandor pens a chapter in the highly elusive UNCTAD/RDP/DFP/1 on implementation issues relating to the market architecture and the tradeable instrument (in context of co2 entitlement trading).

1993. Sandor leaves Peabody & Co to form Centre Financial Products Ltd.

1993. CFP is engaged in emissions trading, relating to so2 entitlements in Kentucky.

1994. Sandor’s new outfit pens a far more detailed chapter in the similarly hard-to-find UNCTAD/GID/8, detailing model rules and regulations for a global co2 emissions credit market.

1996. CFP Ltd proposes a sulphur/carbon dioxide emission trading system at an annual event in London.

1997. CFP Ltd hosts an event, launching a Greenhouse Gas Emissions Trading Forum, hosted by none other but Maurice Strong.

1997. And later in that year, October 1997, Al Gore and Larry Summers hosted a panel on ‘Climate Change Policy and U.S. Economy‘30… on which Richard L Sandor featured as a panelist. The entire event was one long sales pitch for… emissions trading.

Incidentally, at 41 minutes in, Al Gore delivers the following -

‘… when we start priming this particular move into carbon emissions trading I think that it's much more reasonable to assume that we don't have perfect information at all. We have no idea how many opportunities are out there to have very large savings at much lower cost.’

Make sure you thank Al Gore for alleged ‘lower cost’.

His words.

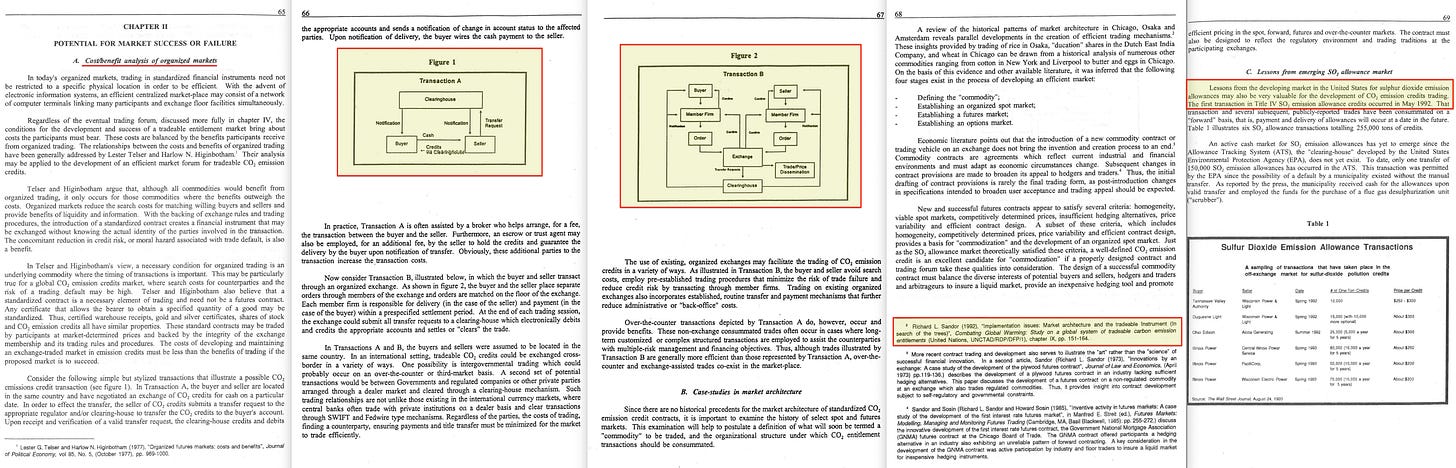

Diving through the remaining material… I see no need for detailed analysis here. How could this possibly be made more obvious. Instead, let me highlight a few… er pretty pictures, which further outline where and how the exchange and clearing house should fit into his system. Oh, and he further sources his own 1992 contribution, before outlining -

‘Lessons from the developing market in the United States for sulphur dioxide emission allowances may also be very valuable for the development of CO, emission credits trading. The first transaction in Title IV SO2 emission allowance credits occurred in May 1992‘

… and that market had only just come into being, just as well. And though this legislation establishing said SO2 cap-and-trade program was voted through under George HW Bush - as part of the Clean Air Act Amendments of 199031 - and officially was negotiated by congress… the acting EPA administrator at the time was William K Reilly32 with whom we’ve crossed paths on several occasions.

Chapter 3 details where to trade, what to trade, how to trade, before finishing off, outlining recent experiences with so2 auctions, courtesy of the EPA. I see no particular need to comment but will point out that this appears impressively detailed, given the alleged immaturity of the proposal.

Chapter 4 sets out to standardise carbon credit trading instruments… before issuing 8 related recommendations for this allegedly immature market.

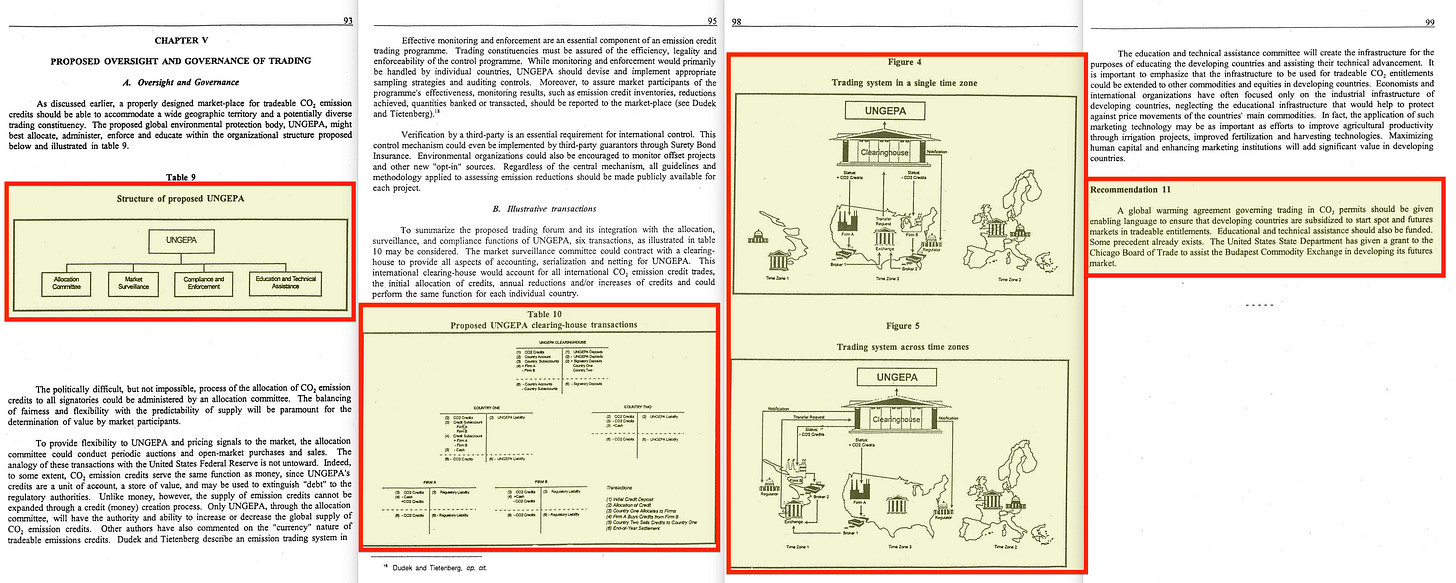

And finally, chapter 5, with a similar impressive foresight outlines the roles of the future potential agency of the UNGEPA, how this should function relative to a clearing house, and even down to its operation across multiple timezones.

And finally, from recommendation 11 we get -

‘A global warming agreement governing trading in CO2 permits should be given enabling language to ensure that developing countries are subsidized to start spot and futures markets in tradeable entitlements. Educational and technical assistance should also be funded. Some precedent already exists. The US State Department has given a grunt to the Chicago Board of Trade to assist the Budapest Commodity Exchange in developing its futures market.‘

They simply cannot wait to… protect more UNESCO Biosphere Reserves.

Recall per above how Sandor’s ‘Centre Financial Products Ltd‘ in 1996 proposed a trading system to the UNCTAD? Well, there’s a document, courtesy of the UNCTAD relating to expressly that33 - ‘A Pilot Greenhouse Gas Trading System‘ -

‘The UNCTAD Secretariat has been encouraging public/private partnerships in this area and has worked with the Earth Council and Centre Financial Products to develop a pilot emissions market through the establishment of the Global Environmental Trading System (GETS).‘

Great. The CFP is explicitly dragged in by name, and we even have a new name; the Global Environmental Trading System, which appears… remarkably close to… something else we’ve discussed... repeatedly. Something… perhaps of use in terms of the monitoring of said greenhouse gases?

Did you get all that? Well, it’s actually fairly well summarised through the final paragraph of the 1992 report, let me repeat it here again -

There are a number of… impressive feats in regards to these two documents. First off, beyond the obviously ‘evolving’ concept of ‘private participation’, the two documents are virtually entirely in sync, which is neigh-on absurd considering the oft-stated immaturity of the field itself.

In reality, had this field really been quite as immature as claimed, you’d probably find a range of errata, and sections in the latter report, working to synthesise prior research. But neither of those exist. I’ve read a lot of documents, especially in terms of early stage research. Two documents as these, where the latter exposes essentially no flaw in the former basically doesn’t happen. Consequently, I find it hard to believe both weren’t penned at the express same time, or at least, the narrative was established for both prior to the release of the first report. And there are a range of factors which lead me to this conclusion -

The two were penned by a range of different contributors.

The topics - where overlapping - largely builds on the former - but with no obvious flaws debated related to the former.

The topics outline a natural progression, where the case is first presented, and then specific structures and policies are outlined.

All of this relates to a market which isn’t yet established, yet they speculate about instruments, logically following far down the road.

Beyond very early experiments relating to so2 trading - this approach being discussed as unique, especially when considered at this scale.

In other words - both were absolutely perfect and complementary, and this in spite of a plethory of different authors, working from different locations, contributing in different fields of specialisation, and - allegedly - the system not only not existing, but being progressively developed and rolled out. What this essentially means is that while penning the first report, they appear to have had perfect visibility in terms of conclusions relating to the latter.

And that then leads to the conclusion that all of this was planned in advance, and certainly not in the 1990-1994 timeframe alleged by the documents.

A while back I reviewed SCOPE 1 & 3, and while the latter was a natural progression of the first, it did somewhat… introduce an inflection point, through a natural progression of thought. This does not. This is completely seamless.

And we could further discuss the actual content itself, especially in the context of progressively rolled out legislation - but is there a point? The timeline in regards to Sandor should make pretty obvious that this was an inside job from minute one, right down to the inclusion of none other but Maurice Strong.

And as for the inclusion of the IUCN, that actually makes a lot of sense. Because directly controlling the organisations relating to certification and monitoring could… appear suspicious after a while, thus drawing attention. And we can’t have that.

Much better to hide in the shadows, subtly influencing regulation. And - beyond the IUCN - that is where the IETA enters the stage; incidentally another organisation with direct, foundational input from… Maurice Strong.

Incidentally, Maurice Strong further -

Was a leading figure in the creation of the Earth Charter (1997-2000), a declaration of fundamental ethical principles for the 21st century.

Served on Ted Turner's UN Foundation from 1997 onward, advancing the stakeholder approach within UN capacity.

Worked on UN reform through Our Global Neighbourhood in 1995, leading to Kofi Annan’s reforms in 1997.

Played a key role in organizing the 1992 Earth Summit in Rio, which led to the establishment of the UNFCCC and CBD.

Called on ICSU to organize the ASCEND 21 conference in 1991 in preparation for the Rio Earth Summit.

Participated in the 1987 4th World Wilderness Congress, which suggested the creation of a World Conservation Bank, eventually becoming the Global Environment Facility.

Contributed to the 1987 Brundtland Commission…

Was involved in the 1982 World Charter for Nature…

Co-founded the World Resources Institute in 1982, a global environmental think tank conducting research and suggesting policy in the context of climate change…

Organized the 1972 UNCED in Stockholm, leading to the creation of UNEP, the central agency driving the environmental agenda…

… and requested the 1971 SCOPE report on Global Environment Monitoring, which laid the groundwork for modern systems of global environmental surveillance and accountability.

And I don’t know about you… but that just appears a few too many ‘extraordinary coincidences’ to accept in one take.

Finally, though I cannot release the PDFs for obvious reasons, I can add34 a35 few36 documents37 which I personally found of interest during this long, long, long process of… Discovery.

John Hopkins no less

'To receive certification the emission reduction must be

1 surplus

2 enforceable

3 permanent

4 quantifiable '

Sounds like surveillance will be critical and price discovery could not possibly be achieved on a peer to peer basis. We must have more communism to save the planet.

What a massive web covered. Its almost like it has been scripted.

It is a good thing all these people are looking out for us or we would be more wealthy, happy and free and God only knows where that would lead us but most likely off of the reservation.