‘… the Bank of England enacted a new round of quantitative easing, nearly doubling its holdings of government bonds (gilts). The quantities it purchased in 2020 almost exactly matched the volume issued by the government…‘

—In Tandem, Michael Jacobs, Fabian Special, 20231.

It doesn’t appear that long ago, but it’s been almost 18 months since I made this call:

And though it took 18 months to locate confirmation, it appeared blindingly obvious at the time, if for no other reason but the ‘Great Recession’ still being relatively recent. See, the numbers in 2008 were but a fraction of those during the alleged pandemic, but related headlines… occupied almost an infinitely larger quantity of space in the MSM. Virtually no-one asked questions relating to costs of lockdowns back in March, 2020, in fact when I did, I was predictably labelled ‘granny killer’ and called a ‘science denier’. Yet, when the figures were published they were impossibly to deny2.

But what I admittedly did not pick up on at the time was -

‘On top of this, UK statisticians adopted different methods for measuring public sector output than other countries, which resulted in a larger recorded drop in output. The ONS, however, said most of the UK’s poor performance relative to other countries was genuine rather than a statistical aberration.‘

The changing of modelling at a pivotal point in time. And that’s yet another of those ‘coincidences’, because that came up in yesterday’s post; ‘In Tandem’.

The Financial Times adds -

‘Rob Kent-Smith, head of GDP at the ONS, said even excluding public services, the decline up to the third quarter of 2020 was “still one of the largest in the G7”‘

And that prompts the question - does that position differ relative to pre-adjustment? Fortunately, the Guardian on the same day posted their topical article3 -

‘The Office for National Statistics said gross domestic product (GDP) fell by 9.9% in 2020… Britain’s annual economic decline was the worst in the G7. GDP fell by 3.5% in the US, by 5% in Germany, 8.3% in France and 8.9% in Italy. The Canadian economy is forecast to have shrunk by 5%, and Japan’s by about 5.6%.‘

Ergo, US 3.5%, Canada 5%, Germany 5%, Japan 5.6%, France 8.3%, Italy 8.9%, UK 9.9%. The average of France and Italy - the worst performers beyond the UK with whom the UK would have been grouped per the ONS - is 8.6%. Consequently, this adjustment alone likely constituted a drop in GDP of no less than 1.3%.

And an article released by Reuters4 two weeks prior sheds more light on these adjustments -

‘On Monday, the Office for National Statistics said some of Britain's slump could indeed be explained by the way the output of government services such as education and healthcare was measured and it was hard to make international comparisons‘

Which is excellent, because now we know what was affected, but -

‘In nominal terms - unadjusted for inflation - the collapse in economic output seen in Britain was "broadly comparable" to other G7 countries…‘

… it also clarifies that that inflation figures influenced the GDP estimate by another couple of percent. In other words, during the alleged pandemic, likely almost half of the relative underperformance of the UK came through statistics.

And the revelation that this relates to changes to output measurements in - of all things - healthcare and education speaks volumes.

Because schools were shut down, and hospitals were broadly empty.

I won’t spend much time on the latter claim. Jessica Hockett, for one, has documented this in New York. But if you seek to dive further, here are three5 links6 I7 dug up.

And that’s not forgetting the utter scam of a pandemic itself. Yes, scam. Because not only was this8 released on July 25, 2020 -

‘… we enrolled 200 patient-facing HCWs between March 26 and April 8, 2020, in SARS-CoV-2 Acquisition in Frontline Healthcare Workers… 87 (44%) of 200 HCWs had evidence of SARS-CoV-2 infection at any timepoint… The median age of study participants was 34 years… No participants required hospital admission.‘

At the pivotal time during the alleged pandemic, Covid-19 was running riot among frontline hospital staff (44%), these were typically younger people (34 years), and none required hospital admission. And this was published by the Lancet, and related to London frontline health-care workers.

Yet, when this was delivered to you via the mainstream media… well, to put it quite politely, they lied on every count.

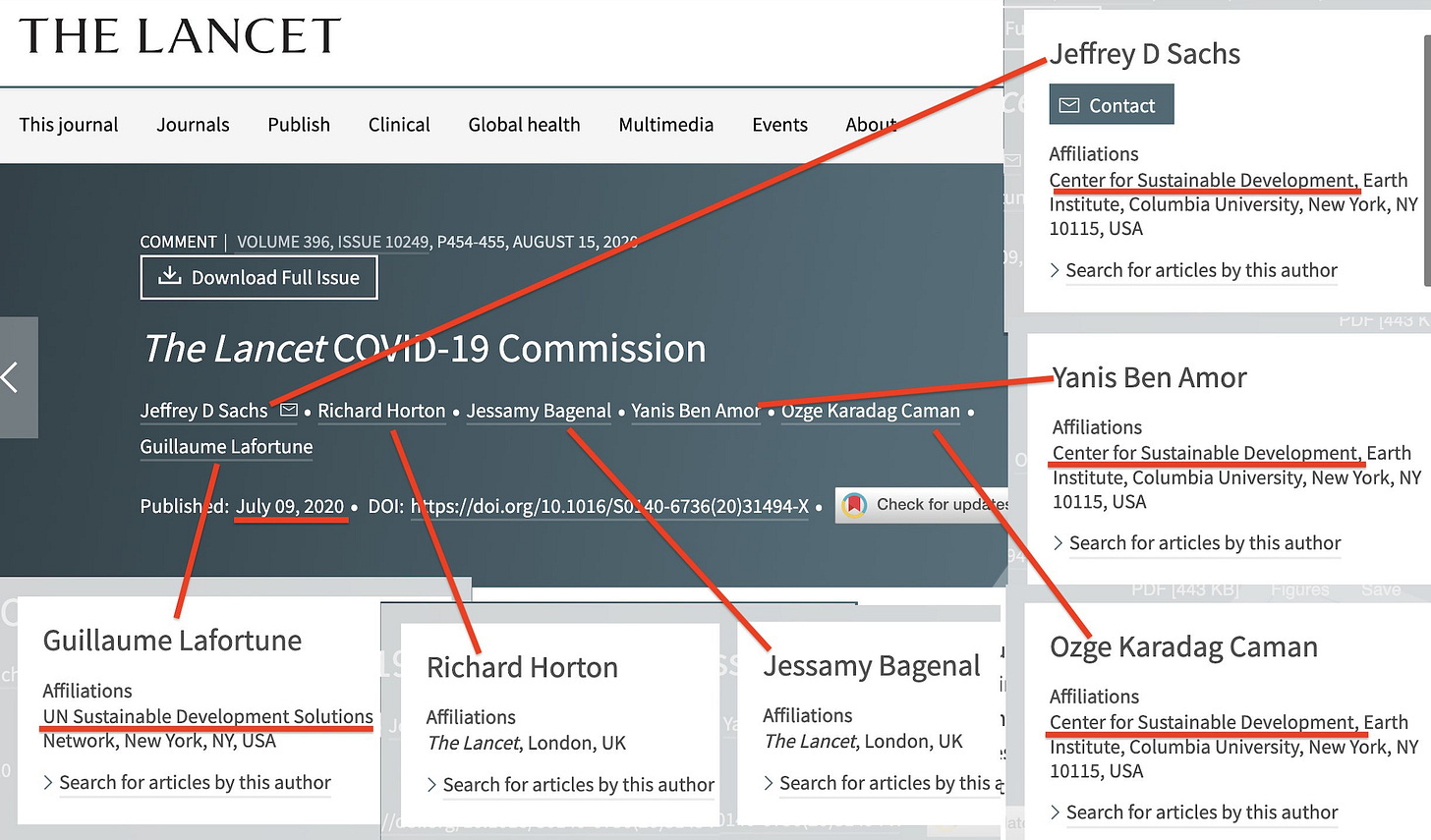

And only the following month, The Lancet decided to put together their ‘Covid-19 Commission’… which did not include a single healthcare professional at its launch9. And the only reason why Jeff Sachs saw no need to include healthcare professionals, was because he was well versed with the above stats - because this wasn’t legitimately about an illness at all. In fact, the common theme among these participants… is Sustainable Development.

And that brings us back to a January, 2009 event co-sponsored by GLOBE International and the Club of Rome; ‘Focus on Copenhagen’10 prior to that years COP15, which brought us the ‘failed’ Copenhagen Accord granting billions to foundations, but this was further the year in which the entire narrative almost collapsed through Climategate which showcased nothing short of systemic fraud.

Either way, the relevant document outlines -

‘Transforming the UNFCCC into a World Climate and Energy Council… the UNFCCC needs to become a world headquarters to energize and spearhead actions crucially needed to achieve the in-time transition to a low carbon world…‘

The UNFCCC will control emissions. And when is this set to launch?

‘2020 as the year for grand action… Sir Nicholas Stern puts the year 2020 as the year for major developing countries to take on binding targets, if not earlier. By 2020, a comprehensive plan must be drawn up to ensure world focus on an ultimate solution‘

In 2020. Nicholas Stern incidentally penned the Stern review11 under the Blair/Brown government; an almost absurdly pessimistic vision which… aligns entirely with the monetised climate narrative per UNCTAD, especially considering -

‘The surest recipe to achieve climate stability is to cap global GHG emissions for decades to come. The cheapest recipe is to allow the abatement to take place wherever it is cheapest… a global carbon trading system with a strict descending world cap as the only means forward. Almost by force, we must move to a global emissions trading system and create a one single common carbon price world-wide so that the price signal does all the tricks‘

Almost by force, eh?

And down the line those carbon emissions are to be tied to Central Bank Digital Currencies. When that happens, it addresses two of the factors relating to the Sustainable Development Goals - the merger of economy and ecology. And that vision was laid out by Technocracy, Inc, in 1936.

Incidentally, there will be not one but two types of carbon backed CBDCs; one will be backed by emission permits, while the other will be backed by sequestration. And isn’t that just an amazing coincidence, because between carbon emissions and sequestration we find both the UNFCCC and the Convention on Biological Diversity, which constitute two of three key outputs of the Earth Summit in Rio, 1992. And the common denominator with both is the Global Environment Facility (aka the World Conservation Bank) - which at present, through ‘blended finance’ deals, work to monetise UNESCO Biosphere Reserves.

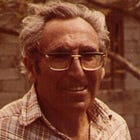

But something else took place in 2009. No, I don’t speak of the alleged pandemic back then, but rather this release by the Collegium International12 -‘Draft Charter for World Governance‘ - which states -

‘We have entered a new era… The time has come for constructive provocations and the most daring about-faces against the usual order of things. This absolute imperative calls for radical change - and now… This starting point could have taken shape in 2009‘

And - by pure coincidence - everyone’s favourite UN General Secretary Antonio Guterres is a member13.

The Collegium has rather the interesting history - but for now, let’s just focus on a few things. First off, Antonio Guterres was a co-founder14, but what’s of further importance in this regard is -

‘We are beginning to understand the extent to which our Biosphere is fragile… pandemics such as AIDS must be taken urgently into account. All these ecological challenges call for regulation and the establishment of a world pact for the preservation of our environment‘

… that we need ‘A World Pact for the Preservation of the Environment’, and -

‘The worldwide nature of these problems requires the implementation of a sense of responsibility that is itself globalized… Three great challenges - ecological, economic and ethical - thus appear linked to the lack of governance that humanity is experiencing today‘

… to this end, what’s required is an ‘ethical response’, and -

‘The first is the emergence of a world citizenry and - with time - a world democracy… The second is to provide an ethical quality to the democratic model… Democracy cannot be confined to the electoral principle or even to the power of people to govern themselves: elections can be used by dictators‘

… this should be facilitated through world citizenry, a ‘world democracy’ (aligned with their principles) - and this differentiation goes through… an ethical quality.

Global Governance through Global Ethics, which in turn calls for the ‘establishment of a world pact for the preservation of our environment‘.

The ‘Global Pact’ arrived… in 201715. As previously outlined, it’s a virtual cut and paste of the 1982 World Charter for Nature.

‘The Global Pact for the Environment is a draft international treaty, which aims to recognize a new generation of fundamental rights and duties related to the protection of the environment, and in particular, the right to a healthy environment. While many States support its adoption, a few States are strongly opposed to it. This is why civil society must come together to ask States to recognize our environmental rights and protect the environment‘

… in item 9 of the World Charter for Nature16 we find -

‘The allocation of areas of the earth to various uses shall be planned…‘

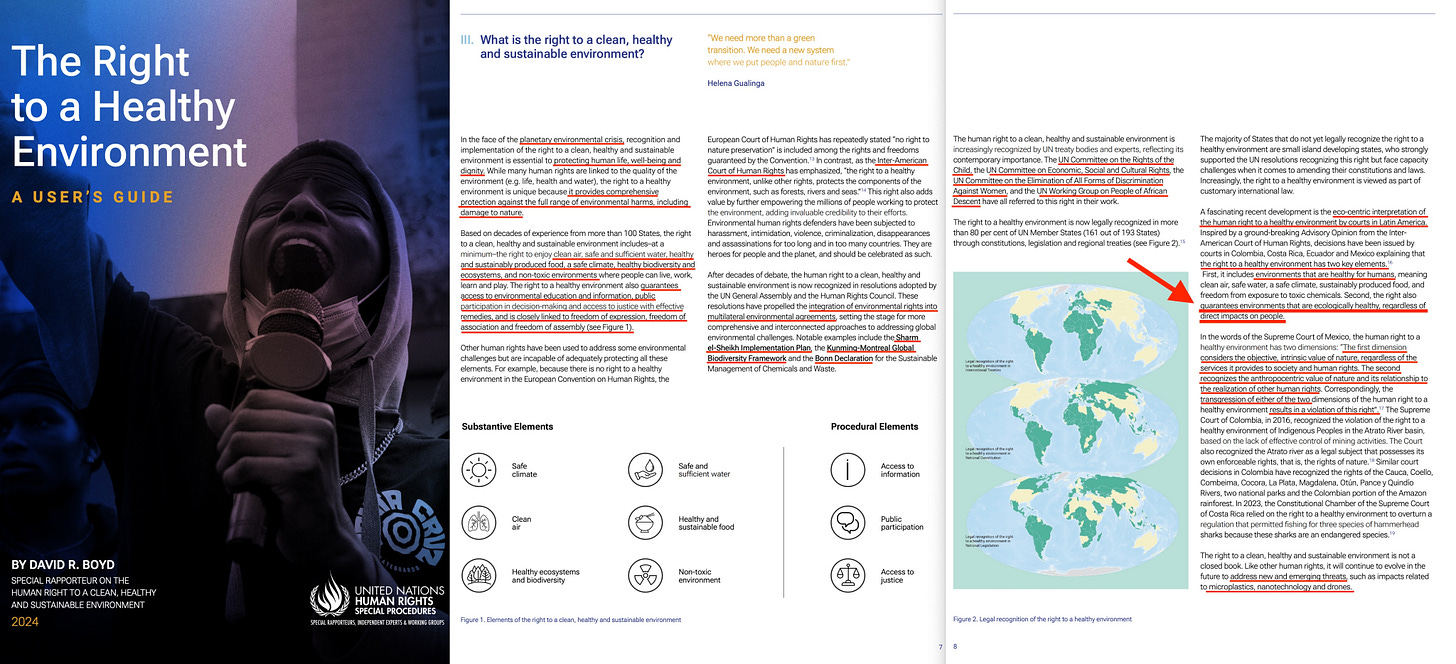

… in the OHCHR 2024 report ‘The Right to a Healthy Environment‘17 we find -

‘… the right also guarantees environments that are ecologically healthy, regardless of direct impacts on people.‘

At which point we can drag in the Convention on Biological Diversity’s Ecosystem Approach, which - in brief - describes top-down integrated landscape management, though you may recognise it described as the ‘Landscape Approach’, used by the Global Environment Fund, when structuring Blended Finance deals.

And I could here write a longer section on how 2009 was a trial run for what transpired in 2020, but I fail to see the point. Instead, let me point out that Neil Ferguson - the very man whose shockingly poor models served as justification for those lockdowns - in 2009 argued that… they only work over the short term.

They knew…

Covid-19 affected those younger than 60 during the first outbreak… yet pretended it mainly affected those of age.

The ‘pandemic’ was practically harmless to those under 60… yet still pushed vaccine mandates and lockdowns.

Lockdowns didn’t work… yet still instituted them into policy.

Sending people home with full pay would increase debt loads… yet still went ahead with them.

Public debt loads would explode… and this would require central bank facilitation.

And the central banks did just that - through a colossal explosion of public debts throughout especially the Western world.

And when the inevitable inflation came down the line, they went out of their way to scapegoat everyone and everything else.

Covid-19, in brief, was meant as the beginning of the end.

The ‘vaccines’ would drive demand for the ‘Vaccination Certificate’, which Alan Gelb in February, 2021, outlined was Digital ID18.

Digital IDs would then enable Central Bank Digital Currencies19.

Through normalising lockdowns, people would down the line come to accept ‘climate lockdowns’20, and other such nonsense.

These would logically lead to 15-minute cities21, with these little ‘Berlin Walls’ springing up everywhere.

CBDCs could down the line be backed by carbon emissions (or sequestration), satisfying 2 of 3 pivotal concerns of the SDGs; addressing economics and ecology through one instrument.

Carbon-backed CBDCs and 15-minute cities could then through highly targeted lockdowns and tailored taxation policy (depending on skin colour, sexuality, gender and so forth) be further of use to facilitate a full Social Credit System.

At this stage, the game would centre around taking full control, which would entail stripping the population of assets. This could be engineered by indebting the Western populace to a such extent, that taxes would always increase, while the quality of service would gradually decline... continuously.

This would further destroy private enterprise, ensuring the populace as a whole would come to accept the harsh conditions attached to welfare payments.

And this could all be facilitated through driving up public debt levels, facilitated by the global central banks. And eventually, with global interest levels at all-time lows, it would just be a matter of allowing the markets to catch up with long-term averages.

The contemporary situation has concentrated power with unaccountable central banks, who recently ensured Kwarteng and Liz Truss didn’t get any funny ideas. And why? Because every time there’s a crisis, the politicians come begging for more quantitative easing - which then enables yet more assets to be bought by fronts; agents of the central banking empire22. This is most evident in the US through Blackrock, State Street, and Vanguard, who progressively buy the American economy, bit by bit. But the same dynamic is taking place in Europe - it’s just different asset classes they go for… for the time being, anyway.

So that raises the central question - how did that come to be? And that’s a very good question. So let me explain -

Chronology of Events: Centralizing Economic Power and Linking Economy, Ecology, and Society

1907–1930: Foundations of Centralized Economic Control

1907 Financial Panic: Exposed the fragility of decentralized banking systems. J.P. Morgan acted as a private financier to stabilize markets, showcasing the need for centralized monetary control.

1913 Federal Reserve Act: Established the Federal Reserve, centralizing monetary policy in the U.S., providing tools for economic inductance through credit and money supply.

WWI Gold Severance: Temporary suspension of the gold standard demonstrated how monetary policy could bypass constraints during emergencies, setting a precedent for future flexibility.

1929 BIS Negotiations and 1930 Founding: The BIS enabled global financial coordination, managing international financial flows while still operating under a gold-backed system.

1936–1971: Fiscal Inductance and the Transition to Fiat

1936 Keynes’s General Theory: Introduced fiscal policy as an economic inductance mechanism, emphasizing government spending to stabilize cycles.

1944 Bretton Woods System: Institutionalized Keynesian fiscal inductance globally, pegging currencies to the US dollar, indirectly tied to gold.

1954 Silent Weapons for Quiet Wars Strategy: Suggested systemic economic control through parallels with electric circuits, promoting fiscal inductance to governments while benefiting central banks through debt issuance.

1960s Latin American Debt Boom: Encouraged by Bretton Woods policies, Latin American countries accrued significant debt, reflecting the expansion of fiscal inductance in emerging markets.

1970 Friedman’s Monetarism: Shifted the focus from fiscal to monetary inductance, with central banks controlling money supply and interest rates.

1971 Nixon Shock: Severed the dollar's tie to gold, enabling fiat currency flexibility and granting central banks full control over monetary policy.

1973–1992: Linking Economy to Ecology

1973 Oil Shock: Highlighted energy vulnerabilities and led to the establishment of the International Energy Agency (IEA) in 1974 to monitor fossil fuel markets through input-output analysis.

1979 Geneva Climate Conference: Established political consensus on carbon as a metric for environmental and economic integration.

1982 Latin American Debt Crisis: Rising interest rates caused widespread defaults, with Wall Street banks exposed to $500 billion in underperforming debt, leading to the brink of insolvency.

1987 Debt-for-Nature Swaps (D4N): Introduced as a debt management tool, transferring natural resource collateral to international entities like UNESCO.

1990 Enterprise for the Americas Initiative: Taxpayer-funded programs ‘canceled’ Latin American debts, stabilizing Wall Street banks at public expense while public outrage focused on smaller scandals like the S&L crisis.

1992 Rio Earth Summit: Formalized frameworks like the UNFCCC and CBD, integrating ecological concerns with economic systems.

1998–2009: Building Foundations for Carbon-Backed CBDCs

1998 International Emissions Trading Association (IETA): Launched to facilitate carbon trading, tying economic activities to carbon flows.

2000 Dot-Com Bubble: Pushed interest rates to historic lows, exposing the limits of traditional monetary policy.

2008 Financial Crisis: Central banks implemented QE, a standardized monetary inductance tool, and expanded their role in asset ownership.

2009 Copenhagen Climate Conference: Highlighted the need for global carbon markets, creating a bridge between ecological metrics and economic governance.

2012–2023: Central Bank Dominance and Carbon-Backed Currencies

2012 Modern Monetary Theory (MMT): Proposed monetary inductance controlled almost exclusively by central banks, sidelining fiscal policy.

2020 COVID-19 Response: Central banks utilized unprecedented debt-based QE programs to finance pandemic policies, consolidating economic control.

Partnerships with agents like BlackRock, Vanguard, and State Street (BVSS) facilitated asset purchases, increasing central bank influence over equity markets.

2023 Bank of England Influence on Fiscal Policy: Marked a growing fusion of fiscal and monetary tools, with central banks steering economic decision-making.

2023–2050: Tying Economy, Ecology, and Society

UNEP GEO 6 Vision for 2050: Proposed a closed-loop system linking natural resources, production, human well-being, and governance, using:

Capacitance: Natural resources.

Conductance: Sustainable production and consumption.

Resistance: Human well-being.

Inductance: Governance mechanisms.

Carbon-Backed CBDCs:

Sequestration-Backed: Functions as a store of value, tied to long-term carbon storage projects like reforestation.

Emission Permit-Backed: Regulates short-term carbon emissions and trade, with an expiry date.

Sustainable Development Goals (2030): Integrates economy, ecology, and social objectives, using central banks and carbon-backed currencies as tools to achieve global sustainability.

Long-Term Vision for 2050: Envisions full convergence of economic, ecological, and social systems into a centralized governance model where carbon-backed CBDCs manage resource allocation and social equity, achieving the SDGs.

Central to this timeline is Economic Inductance.

Keynes’s General Theory gave conceptual birth to fiscal inductance through countercyclical government spending. Friedman’s Monetarism changed this to both fiscal and monetary policy, Modern Monetary Policy all but extinguised the fiscal component.

And while Silent Weapons for Quiet Wars subversively advocated fiscal inductance, Nixon cutting the gold window ensured the third world’s indebtedness, the dot-com bubble crashed interest rates, the housing bubble introduced quantitative easing as a tool of monetary policy, and Covid… was financed entirely through public debt.

And with every crisis going forward, that strategy will ensure that control over public finances in the West progressively shifts to the central banks.

The Global Governance structure was introduced via Agenda 21. And the mechanism they would use to progressive drain the wealth of the West was similarly introduced at the Earth Summit in Rio, 1992. Almost a year back I titled that ‘The Grand Plan’.

But a final, major question goes begging.

Who’s actually behind this?

Keep reading with a 7-day free trial

Subscribe to The price of freedom is eternal vigilance. to keep reading this post and get 7 days of free access to the full post archives.