The Lenin Inversion

Lenin's Imperialism: The Highest Stage of Capitalism1 provides one of the most precise anatomies of financial concentration ever written. With methodical detail, he maps how banks evolve from simple intermediaries into monopolistic controllers of ‘almost the whole of the money capital’, developing what he calls ‘universal book-keeping’ that subordinates all economic life to a handful of institutions.

Lenin's structural analysis remains accurate. But his directional assumption — that a revolutionary state would subsume this concentrated financial apparatus — was inverted. Instead of a single state bank serving workers' control, we observe a supranational central-bank complex that has effectively subsumed state functions. Add the contemporary moral overlay of ESG mandates, ‘inclusive capitalism’, and social, environmental and intergenerational justice targets, and the ledger becomes purpose-gated: access to money depends on approved ends rather than market signals alone.

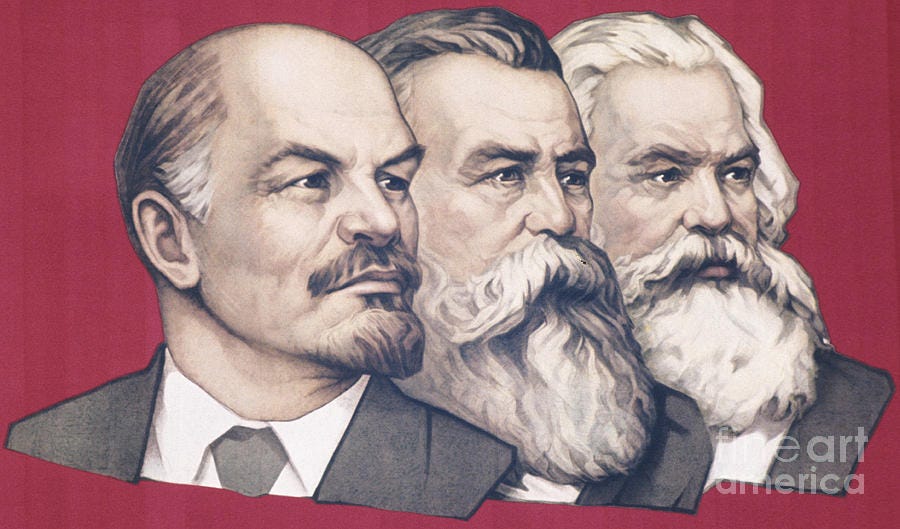

This inversion provides a direct path to an uncomfortable hypothesis: that — whatever their stated intentions — Marx, Engels, Lenin, and Bogdanov supplied the precise blueprint that central banking interests could later inhabit and operationalise.

This essay serves as the structural keystone for understanding how theoretical frameworks translate into institutional reality:

Part I (Technocratic Inversion): A provocative thesis showing how Marx's ten planks from the Communist Manifesto now ‘run in code’ in inverted form through digital platforms, international standards, and proto-programmable money systems. Rather than workers seizing control, we achieved centralisation with algorithmic and central banking control instead. Each plank when inverted maps precisely onto contemporary systems: land control through ESG zoning dashboards, wealth redistribution through monetary policy rather than taxation, inheritance elimination through algorithmic filtering, credit centralisation through central bank networks, and universal work assignment through gig economy platforms. It turns out that we got Marx's centralised system — just not in quite the way anyone expected.

Part II (The Marx Deception): Demonstrated how abolishing emergent price coordination necessitates designed coordination, with sovereignty ultimately resting in whoever controls the monetary unit of account. The core insight is that Marx's ‘socially necessary labour time’ cannot emerge spontaneously like market prices — it must be calculated and imposed by central authority. This creates an information vacuum that can only be filled through comprehensive surveillance and control, leading inevitably to Lenin's ‘accounting & control’ and today's digital scaffolding. The progression traces from Marx's theoretical framework through Lenin's implementation, Technocracy's engineering approach, to contemporary CBDCs and digital identity systems that enable total resource tracking.

This essay reveals how Lenin supplies the operating structure — a universal ledger capable of coordinating all economic activity — while the inversion simply flips who’s in controls from workers' democracy to a central banking technocracy.

Lenin's Structural Blueprint: The Architecture of Concentration

Lenin's brilliance lies in his institutional analysis. Writing in 1916, he documented — with extensive data — how financial concentration creates the infrastructure for total economic coordination.

Lenin observed that modern banks transform from middlemen into monopolies commanding ‘almost the whole of the money capital’ and substantial shares of production and raw materials. This concentration follows what he identified as a law of motion — inevitable rather than accidental.

Universal book-keeping… in substance private.

The Stock Exchange wanes as banks and industry manage it alone, expanding what Lenin calls the domain of ‘conscious regulation by the banks’ while increasing the ‘national economic responsibility of a few guiding heads’. Market mechanisms give way to coordinated control through financial intermediation.

Conscious regulation by the banks replaces automatic laws.

The Holding System and Network Control

Lenin meticulously documented how holding systems and interlocks — what he termed ‘mother/daughter’ structures — allow a handful of actors to dominate immense spheres of production while maintaining formal separations that mask real control. The apparent complexity of modern finance obscures the simplicity of its command structure.

This creates what Lenin frames as a close network that narrows credit access and penetrates every sphere of public life. The tendency runs toward bank trusts (Lenin notes that two giants dominated the US system at the time) creating de facto unification regardless of formal separations.

Penetrates every sphere of public life.

Universal Book-Keeping as Coordination Mechanism

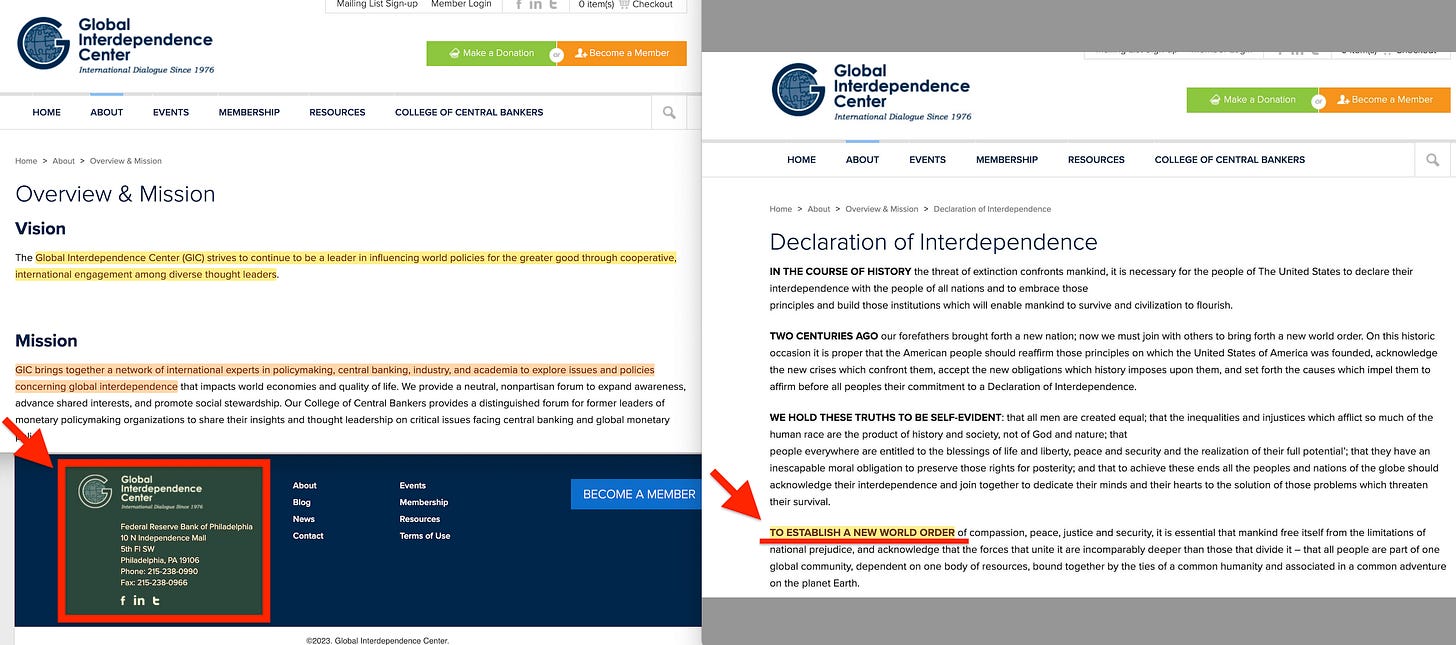

Most significantly, Lenin identified that the banking system possesses ‘the form of universal book-keeping and distribution of means of production on a social scale’ — formally social in scope, but substantively private and oligarchic in control.

This anticipates the contemporary role of central banks as the apex coordinators of economic activity. Every transaction, every credit decision, every fiscal operation ultimately pass through systems that central banks define and control, and CBDCs will grant them unprecedented insight into each producer-consumer transaction, theory which Marx first outlined in Das Kapital. Lenin's ‘universal book-keeping’ has become the literal architecture of modern monetary systems.

The Inversion Move: Structure Kept, Sovereign Flipped

Lenin's analytical endpoint envisioned the State controlling the Bank — a ‘single bank’ of a workers' state becoming the instrument of universal ‘accounting & control’. The revolutionary state would seize the concentrated financial apparatus and redirect it toward democratic coordination.

The observed reality inverts this relationship: Bank controlling the State. The apex monetary ledger — a tightly federated central-bank network — defines settlement finality and unit-of-account rules. Fiscal and regulatory choices operate within the perimeter that monetary authorities establish.

This represents a qualitative shift in the location of sovereignty. Traditional analysis focuses on formal legal authority, but functional sovereignty rests with whoever controls the medium through which all economic activity must be denominated and settled.

The decisive transformation lies in recognising which relationship now defines economic coordination. The old macroeconomic framework assumed the primary relationship was Treasury ↔ Households/Firms, with commercial banks as pipes and the central bank serving as liquidity backstop above this interaction.

In practice, the decisive producer-consumer pair has become Central Bank ↔ Government. The unit of account, settlement finality, and collateral eligibility are defined upstream by this dyad; budgets, regulation, and private credit price off those definitions downstream. Everything else represents parameter-tuning beneath the apex relationship that defines the system's operating rules.

The Producer-Consumer Pair Has Flipped.

From Rules Around Money to Rules Inside Money

The most significant development is the movement of policy enforcement from around monetary systems to inside them. This progression represents a qualitative shift in control mechanisms:

Cash era: Policy operates ex-post2; law and supervision punish disallowed behaviour after transactions occur.

Cards/Bank deposits: Policy operates ex-post plus ex-ante3 via intermediaries — KYC/AML rules at banks screen transactions before settlement.

Retail CBDCs: Policy becomes ex-ante4 and executable in the money itself — purpose codes, caps, time/geographical constraints can be embedded directly in the unit of account.

This enables what can be termed ‘settlement sovereignty’ — whoever controls final settlement can deny, delay, or condition payments at the fundamental level. Some CBDC charter proposals disavow retail programmability; the risk is path dependence — once rails support purpose-gating capabilities, policy toggles are cheap to add and hard to roll back. And ‘non-programmable CBDC’ can be a category error: programmability can be pushed to the wallet/PSP layer (smart rules, purpose codes, MCC/merchant gating), delivering de facto controls while manipulatively letting issuers claim the currency itself isn’t programmable. Design choices vary (direct vs intermediated, offline caps, privacy tech), but capability tends to expand once the rails exist.

CBDCs move the rulebook from around money to inside money, making the central bank the silent co-signer on every purchase. This shifts economic power from elected budgets to unelected settlement rules — turning ‘moral policy’ from guidance into gatekeeping.

The shift enables what can be termed ‘executable policy’ — restrictions, conditions, and permissions that operate automatically at the point of settlement rather than through post-transaction enforcement. From ex-post compliance to ex-ante permissioning represents the crucial hinge: once permission sits in the unit of account, the producer-consumer relation becomes tripartite, with the central bank as arbiter.

Organisation as Operating System

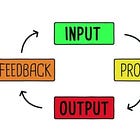

Bogdanov turns Lenin's accounting & control into method: standards, feedback, substitutions — an operating grammar that lets a single ledger execute coordination. His Tektology provides the organisational substrate that transforms Lenin's structural analysis into implementable systems thinking.

If Bogdanov had succeeded Lenin, the trajectory would likely have reached today's destination faster. Bogdanov's Tektology treated the economy as one organism of flows, substitutions, and feedbacks — building institutions around organisation, measurement, and regulation rather than ideology or coercion.

Under Bogdanov's likely architecture (1918-1930), Gosbank5 would have become the organising nerve-centre — not merely a note-issuer but consolidating payments, inventories, and plan execution into a single ledger spine. A ‘Tektology Bureau’ would have codified classification standards, set reporting cadences, and integrated statistics with payments under one grammar. This represents your single ledger logic decades early, with plan priorities determining payment permissions.

Stalin's ascent killed this organisational science track. Proletkult's autonomy was shut down, Bogdanov's circle was marginalised, and the result was rule through party terror rather than systematic standards. Later, Stalinist cultural organs stigmatised cybernetics as ‘bourgeois pseudoscience’, derailing the systems/feedback trajectory until the post-Stalin rehabilitation67.

Western Migration of Organisational Logic

Because Stalin jammed the empirical evolution in the USSR, the organisational project migrated West: systems analysis (RAND), Planning-Programming-Budgeting System (PPBS), national accounts, BIS coordination, ISO rails, and finally digital payments/CBDC research. The architecture we observe today — rules moving from around money to inside money — matured outside the Soviet path.

The cybernetics rehabilitation timeline confirms this migration. By 1954-55, cybernetics flipped from ‘bourgeois pseudo-science’ to respectable in the USSR, with full institutionalisation under Khrushchev by 1959-62. But by then, the West had already developed the organisational infrastructure that would later house central banking sovereignty.

Bogdanov would have built the operating system; central banks later took custody of the root password.

The Moral Economy Overlay: From Price Signals to Purpose Signals

This ‘universal book-keeping’ becomes purpose-conditioned book-keeping in the contemporary system. Spend permission gets keyed to codified ends: equity metrics, climate targets, social inclusion scores. The grammar of legitimacy shifts from price signals — which emerge spontaneously from voluntary exchange — to purpose signals determined by technocratic authorities and ‘sold’ as social, environmental, or intergenerational justice.

Alfred Zimmern's concept of the ‘Third British Empire’ pioneered this grammar: replace territorial conquest with administrative expertise serving universal principles. From imperial ‘civilising mission’ to League of Nations technical cooperation to today's ESG mandates — the same coordination logic, moralised as ‘global stewardship’ rather than national interest.

Zimmern reframes empire as international social justice operating through economics, administered by experts — the prototype for a moralised, rules-first world economy. Contemporary ‘inclusive capitalism’ follows this template: centralised coordination justified through moral imperatives rather than democratic mandate.

Operationalising Inclusive Capitalism

Inclusive capitalism targets enter the ledger as spend-permission rules: purpose codes, spending caps, eligibility lists. Guidance becomes execution through monetary infrastructure rather than legislative process. Financial transactions between producers and consumers that clear are those aligned with the system’s ‘moral values’. If a transaction fails to clear, it is because the system deems it immoral.

Climate targets, equity metrics, and social scores transform from policy aspirations into technical specifications embedded in the payment system itself. The moral overlay provides legitimacy for what amounts to comprehensive coordination through centralised, monetary control.

Architecture of Control: Mechanism, Not Prophecy

The contemporary system operationalises Lenin's structural insights through four integrated layers:

Apex Monetary Core

A single or tightly federated settlement ledger represents Lenin's ‘bank trust’ tendency scaled globally. The Bank for International Settlements coordinates central bank policy; major central banks maintain correspondent relationships that create de facto unification of monetary policy across jurisdictions.

Settlement finality — the ultimate clearing of payments — rests with this apex system. All other economic activity depends on access to final settlement, creating a hierarchical dependency relationship that mirrors Lenin's analysis of financial concentration.

Universal Accounting Infrastructure

Lenin's ‘form of universal book-keeping’ becomes granular, real-time instrumentation through digital payment systems. ISO 20022 messaging standards require detailed transaction metadata; anti-money laundering frameworks demand comprehensive reporting; tax information exchange agreements enable automatic data sharing across jurisdictions.

The result is comprehensive visibility into economic activity that exceeds what Lenin’s banks achieved through periodic balance sheets and lending relationships. It enables central banks to monitor and condition transactions down to the individual level, with only those deemed ‘moral’ allowed to clear.

Network Centralisation Through Standards

Modern interlocks operate through technical standards rather than direct ownership. ISO protocols, BIS frameworks, and OECD guidelines create interoperability requirements that effectively coordinate behavior across formally independent institutions.

This represents the same ‘close network’ logic Lenin identified, implemented through technical rather than financial integration.

Conditioning Layer: Purpose-Gated Money

The moral economy overlay operationalises through programmable restrictions embedded in digital currency systems. Purpose codes transform inclusive-capitalism rhetoric into executable permissions embedded in the unit of account itself.

Binding layer: digital ID and KYC/AML frameworks link identity to the ledger, making permissioning enforceable at the point of spend8.

Access to monetary services becomes conditional on compliance with environmental, social, and governance metrics rather than simple creditworthiness or legal compliance.

Why This Fits Lenin's Analysis (But Reverses His Remedy)

Lenin demonstrates mechanical inevitabilities: concentration leads to monopoly, monopoly leads to bank trusts, bank trusts lead to oligarchic subordination of society. His empirical analysis remains valid.

Lenin insisted that state-monopoly capitalism under bourgeois rule still serves oligarchs rather than public interest — the form doesn't determine the content. The contemporary inversion extends this insight: the monetary apex effectively absorbs state functions while maintaining the appearance of democratic governance.

The Custodianship Hypothesis

Lenin's frameworks, combined with Marx's price-abolition theory and Bogdanov's organisational science, built the intellectual architecture for comprehensive coordination through universal ledger control. Central banks later assumed custodianship of this architecture.

Whatever their intent, Marx set the telos, Lenin drew the single ledger, Bogdanov wrote the method — and the central banks stepped into the sovereignty those designs made possible.

‘They built the operating system; the central banks took the root password’

The progression is clear:

Marx abolishes price discovery and substitutes defined value coordination

Lenin maps the universal ledger structure required for total coordination

Bogdanov engineers the organisational substrate and feedback mechanisms

Central banks inherit unit-of-account sovereignty and, with digital rails, implement the complete system

Purposive, normative, pragmatic, empirical — once again, back to Erich Jantsch.

Near-Term Signposts

Several developments could confirm this analysis:

Legal Status of Cash: Whether cash remains a viable alternative to digital ledger systems, or become marginalised through regulatory and technical pressure.

Legal Tender Parity: Statutes banning discrimination against cash and non-programmable money.

Scope Firewall in Law: Prohibit using currency/payment rails to enforce non-monetary policies (carbon/social scores).

CBDC Architecture: Whether central bank digital currencies include explicit no-purpose/no-expiry guarantees, meaningful offline transaction capabilities, and scope firewalls preventing use for non-monetary policy enforcement.

Coordination Fusion: Whether monetary policy, social scoring, and environmental compliance become integrated into payment eligibility systems.

Sovereignty Migration: Whether supranational coordination increasingly outpaces domestic legislative processes, indicating functional sovereignty shifts to international technocratic bodies.

All of these are already widely cited concerns in related debates.

Addressing Counter-Arguments

‘Centralisation Serves Public Good’

Lenin anticipated this objection: under capitalism, state monopoly functions as a means of increasing and guaranteeing the income of millionaires. Form doesn't determine content — who controls the apparatus determines its function.

Contemporary central bank independence — while formally serving public mandates — operates through institutional structures that systematically advantage financial incumbents through privileged access to credit, information, and policy coordination.

‘Plural Central Banks Prevent World Ledger’

Lenin documented how few-to-fewer concentration and institutional interlocks achieve de facto unification regardless of formal separation. The BIS coordination framework, correspondent banking relationships, and shared policy templates create functional unity among major central banks.

Currency swap arrangements, coordinated quantitative easing, and harmonised regulatory standards not least through the Financial Stability Board demonstrate this unified operation during crisis periods.

‘Moral Aims Ensure Fairness’

Lenin's class analysis applies: who holds the ledger defines ‘fair’. Environmental and social justice targets — however laudable as aspirations — become enforcement mechanisms when embedded in monetary infrastructure.

The technocratic bodies that define ESG metrics, social scores, and climate targets operate with limited democratic accountability while wielding influence over resource allocation through their integration with financial systems.

Ledger Sovereignty and Democratic Choice

Lenin proves the ledger; the modern system flips the sovereign. Keep his structural analysis, invert the control relationship, and add ‘moral’ justification through purpose-justified permissions — and a world where the central bank becomes the state in practice moves from theory to reality.

Lenin’s hypothesis can thus come to pass — but not in the way you were told. Rather, this is yet another inversion, one of many when in company of Marxists and Fabians.

The choice is whether to design monetary systems that preserve democratic control over resource allocation, or drift toward a world where access to money becomes conditional on compliance with technocratically determined purposes. Lenin's analysis reveals that financial concentration creates the infrastructure for total coordination. Whether that infrastructure will serve democratic accountability or technocratic efficiency... the trajectory suggests the latter, unless conscious institutional choices preserve the former.

From Marx's designed value to Lenin's universal bookkeeping to Bogdanov's organisational science to central-bank unit-of-account sovereignty: the architecture was designed for exactly the kind of custodian that modern central banks became. Whether this represents conscious institutional capture or unconscious convergence toward control systems, the functional outcome remains the same — comprehensive coordination through monetary sovereignty, legitimised through moral rather than democratic mandate.

The Fabian Society's ‘In Tandem’

The theoretical framework outlined above is expressed through the Fabian Society's 2023 report ‘In Tandem’. This document demonstrates how Lenin's inversion gets operationalised through seemingly modest ‘coordination’ proposals that fundamentally shift sovereignty from elected to unelected institutions.

The Coordination Pressure Stack in Practice

The report proposes mechanisms that exemplify the coordination pressure stack:

Governor's Trigger Mechanism: A formal requirement for the Bank of England Governor to write to the Chancellor when monetary policy is ‘no longer able to manage aggregate demand sufficiently’. This creates automatic media pressure and market expectations that compel fiscal compliance without formal legal subordination.

Statutory Pre-Budget Coordination: An Economic Policy Coordination Committee (EPCC) meeting before each Spring Statement and Budget, with published minutes and statutory footing. This effectively sets the ‘responsible’ fiscal agenda in advance, making any deviation appear reckless or ideologically driven.

Technocratic Legitimacy Framework: Integration of the Office for Budget Responsibility, Climate Change Committee, and proposed Inequalities Commission into coordination processes, creating ‘objective’ benchmarks against which fiscal choices are measured.

Market Discipline with Central Bank Arbitrage: If government bonds wobble, the Bank's posture through quantitative easing pace, collateral operations, and liquidity windows can calm markets — or not. Treasuries formally ‘choose’, but under bond spread pressure that the central bank largely determines.

Macro-prudential Nudge Power: Financial Policy Committee tools (counter-cyclical buffers, loan-to-value guidance, stress-tests) can tighten or loosen financial conditions around fiscal moves without touching base rates directly.

International Echo Chamber: BIS/FSB templates and peer central bank coordination create a policy chorus where ‘best practice’ becomes the benchmark against which domestic policies are judged.

Moral Economy Integration: Climate targets, inequality metrics, and social justice objectives become embedded directly in macro coordination rather than remaining aspirational policy goals.

Crucially, the Bank of England possesses the capacity to engineer the very conditions that would trigger this mechanism through monetary policy manipulation — raising rates to constrain demand, adjusting quantitative easing operations, or modifying collateral eligibility requirements. This creates a self-reinforcing loop where the central bank can manufacture the justification for its own expanded authority over fiscal policy.

From Democratic Mandate to Technocratic Coordination

The report explicitly acknowledges its corporatist heritage while claiming to transcend the failures of 1960s-70s planning arrangements. It proposes that fiscal rules should be modified to allow current spending when ‘interest rates are too low’ for monetary policy effectiveness — exactly the condition that grants central banks maximum leverage over fiscal authorities.

Most significantly, the EPCC structure would include not just Treasury and Bank of England representatives, but business organisation, climate body, inequality commission, and ‘civil society organisation’ stakeholders. This creates a trisectoral network where democratic fiscal authority operates within parameters set by unelected technocratic and private interests.

Bank over State Through Coordination

The ‘In Tandem’ framework demonstrates Lenin's inversion in contemporary practice. Rather than formal legal subordination, it achieves Bank over State through coordination mechanisms that preserve democratic appearances while transferring substantive control.

When the Bank determines monetary policy has reached its limits, it triggers fiscal action through the Governor's letter. When fiscal authorities resist, the EPCC framework provides institutional pressure through published minutes and ‘expert’ recommendations. When governments deviate from this coordination, market discipline and media narrative enforcement complete the pressure stack.

The report itself acknowledges this dynamic when discussing the Truss-Kwarteng episode, framing their fiscal policies as illegitimate precisely because they proceeded without central bank coordination. The message is clear: democratic fiscal authority operates legitimately only within parameters the monetary authority approves.

Universal Book-keeping with Contemporary Characteristics

Lenin's ‘universal book-keeping’ concept exists in the integrated data systems the report proposes. Monetary policy, fiscal policy, climate targets, inequality metrics, and social objectives would be coordinated through shared information systems and joint assessment frameworks.

This creates the foundation for purpose-gated resource allocation that extends beyond traditional economic metrics. Environmental targets, social justice objectives, and inequality measures become operational constraints on fiscal choice rather than aspirational goals, implemented through the coordination architecture rather than democratic mandate.

The result mirrors Lenin’s structural analysis while inverting his directional assumption: comprehensive economic coordination through a single, authoritative ledger — controlled by central banking technocracy, legitimised through moral-economy rhetoric, and certainly not by the workers.

Implications for Democratic Governance

The ‘In Tandem’ proposals represent a practical pathway toward the architecture outlined in this essay. They demonstrate how theoretical frameworks developed over more than a century can be operationalised through institutional arrangements that appear modest and technical while fundamentally altering power relationships.

The coordination mechanisms proposed would establish central bank influence over fiscal policy without requiring constitutional change or explicit legal transfer of authority. Democratic forms remain intact while substantive sovereignty migrates to unelected institutions operating through technical expertise and moral mandate rather than popular accountability.

This represents a contemporary manifestation of Lenin's ‘universal book-keeping’ — comprehensive economic coordination through monetary infrastructure, with access and allocation determined by compliance with technocratically determined purposes rather than market signals or democratic choice.

The arc comes full circle. Unwittingly or not, Marx, Engels, Lenin, and Bogdanov helped design the very system that central banks now command.

Lenin foresaw that banks could subordinate ‘all operations of capitalist society’, but assumed the state would capture that apparatus. In reality, the apparatus captured the state. Today, the central bank is no longer a neutral backstop; through CBDCs, standards, and moral-economy overlays, it has inversely subsumed the state — defining the unit of account, settlement finality, and the very conditions under which economic life may proceed.

Soon, it expects to become the sovereign itself9.