The Waddesdon Papers

Between March 2014 and June 2018, the University of Oxford’s Smith School of Enterprise and the Environment convened a series of private forums at Waddesdon Manor, the Rothschild family estate in Buckinghamshire.

The proceedings document the construction of the regulatory framework that now governs climate-related financial risk worldwide.

This essay presents the chronological evidence.

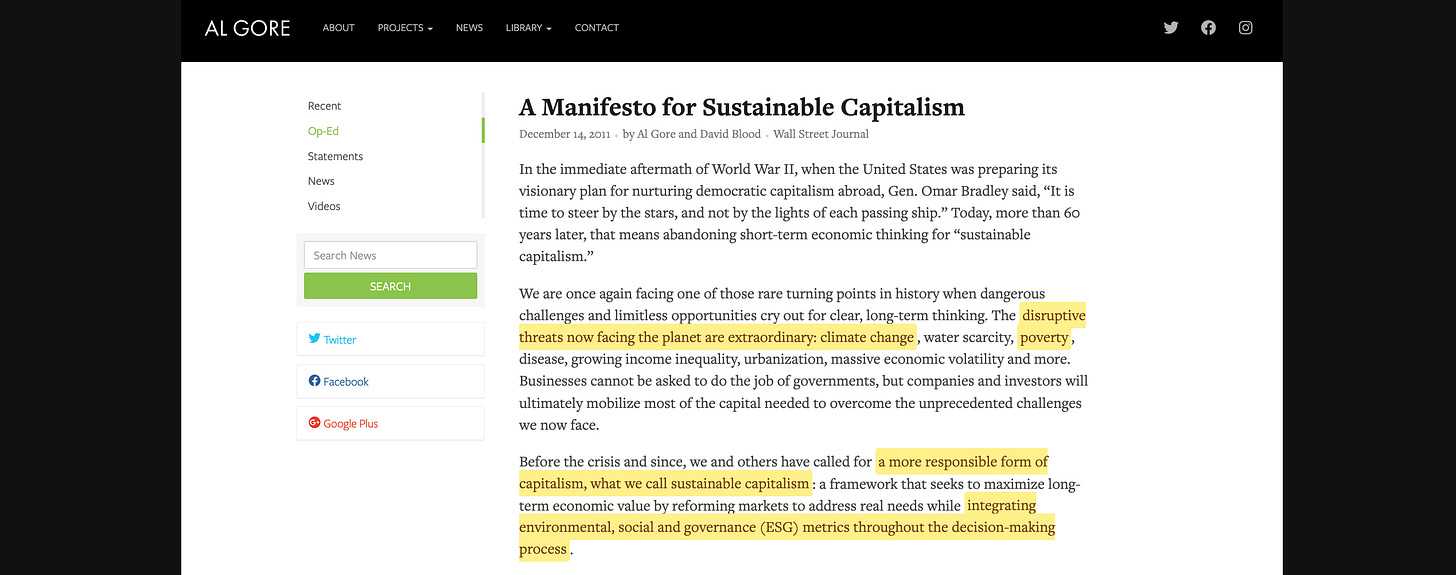

The Blueprint (December 2011)

The framework was publicly specified before any academic research was published.

On December 14, 2011, Al Gore and David Blood published ‘A Manifesto for Sustainable Capitalism’ in the Wall Street Journal1. The article recommended ‘five key actions for immediate adoption’:

‘Identify and incorporate risk from stranded assets’ — defined as assets ‘whose value would dramatically change... when large externalities are taken into account’

‘Mandate integrated reporting’ — combining financial and ESG metrics in one report

‘End the default practice of issuing quarterly earnings guidance’

‘Align compensation structures with long-term sustainable performance’

‘Incentivize long-term investing with loyalty-driven securities’

The Waddesdon forums would implement each of these points. The ‘academic research’ that followed was the deployment infrastructure for a plan already published in the Wall Street Journal.

Gore and Blood founded Generation Investment Management in 20042. The Generation Foundation3 — the nonprofit arm — would become a funder of the Smith School’s Stranded Assets Programme4 alongside the Rothschild Foundation.

The Convening (July 2012)

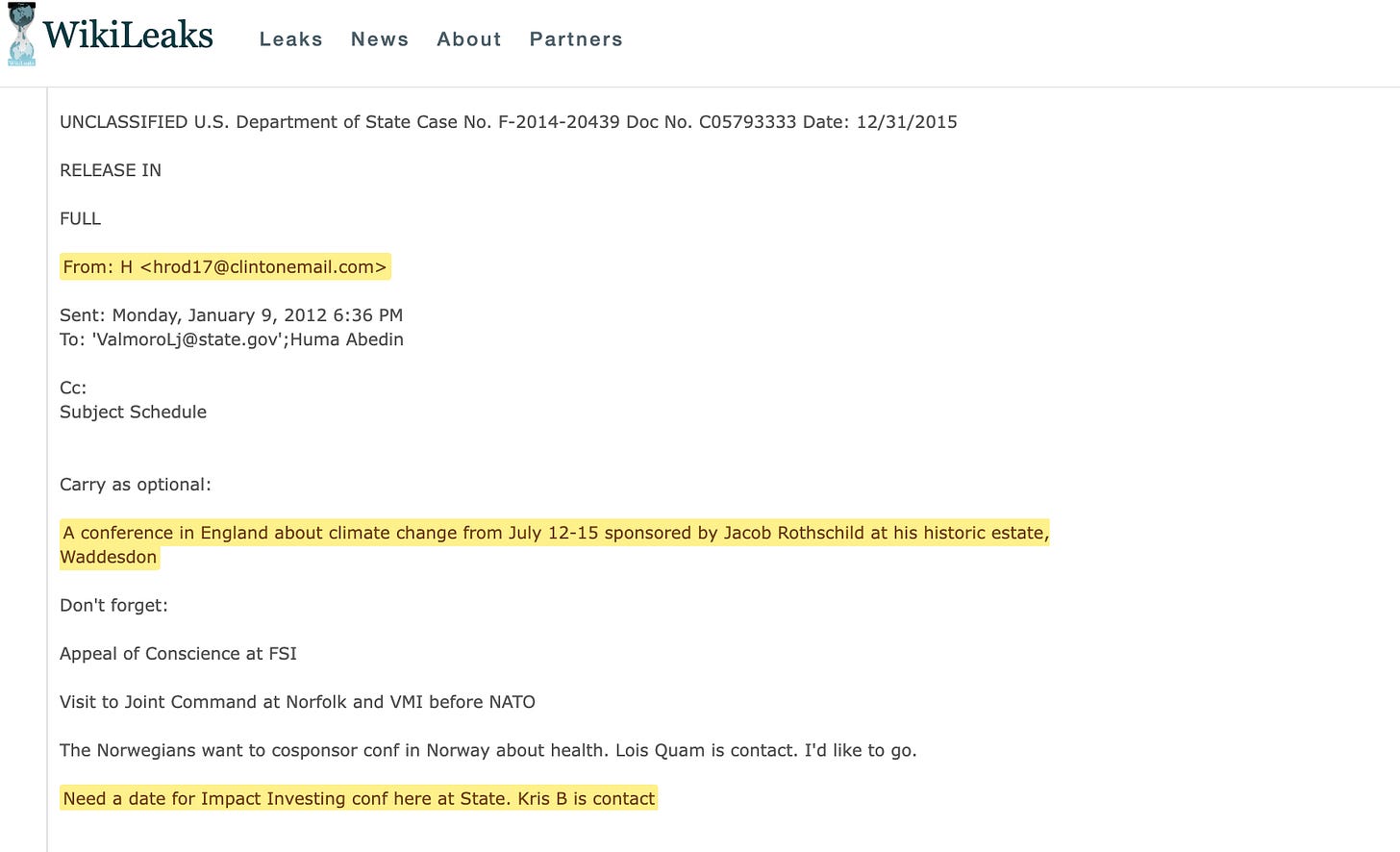

On January 9, 2012, Hillary Clinton sent an email to her scheduler5:

Carry as optional: A conference in England about climate change from July 12-15 sponsored by Jacob Rothschild at his historic estate, Waddesdon

The Secretary of State was invited to attend a conference at Waddesdon Manor by Jacob Rothschild two years before the first Forum convened, with a date for an Impact Investment conference needed for ‘Kris B’ at the State Department.

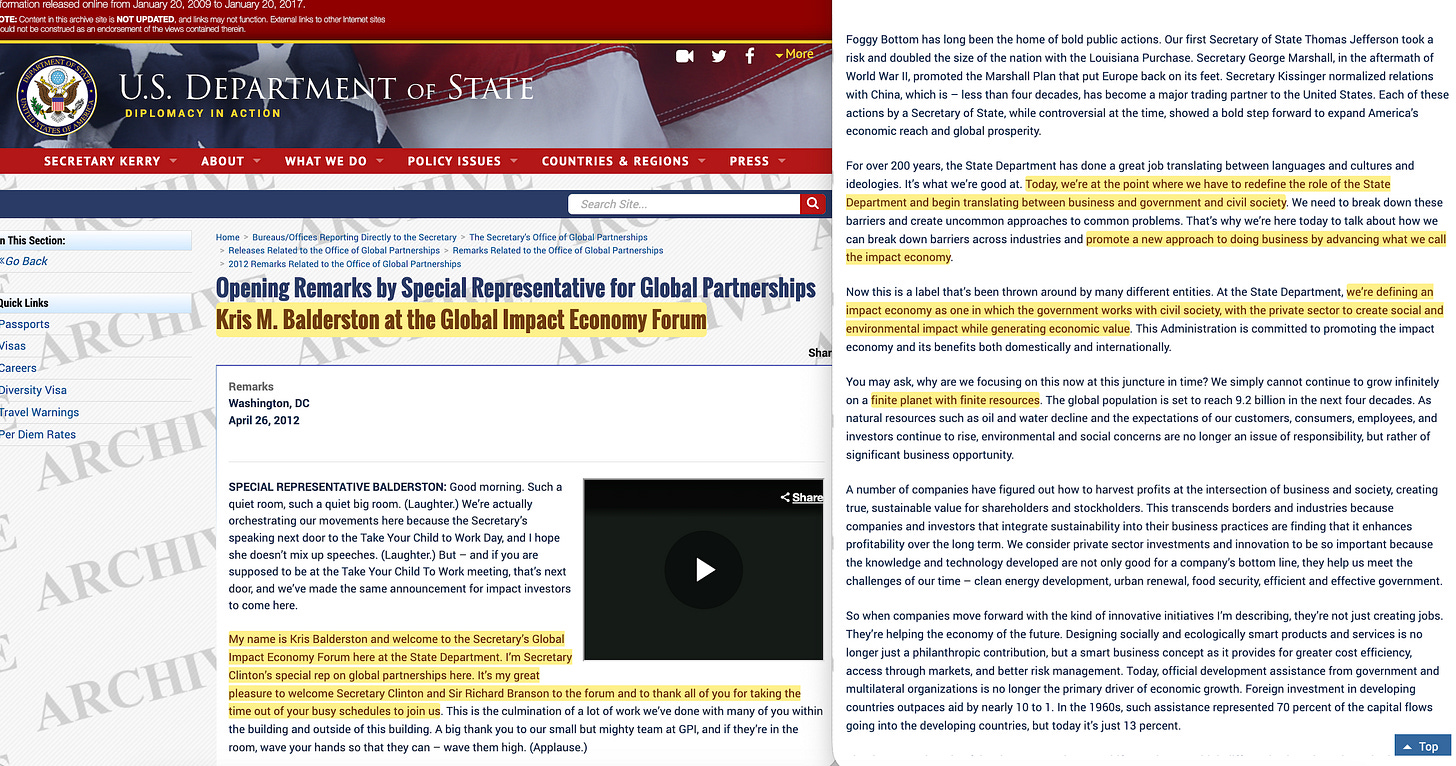

‘Kris B’ almost certainly refers to Kris M. Balderston, and the conference the Global Impact Economy Forum6, held in late April, 2012. Then follows an ‘impact economy’ description best summarised as a ‘public-private partnership for the common good’ funded through ‘blended finance’, where the ‘common good’ relates to a social or environmental objective, defined by a foundation front ‘civil society organisation’.

Taxpayer pays, private benefits, and a foundation directs the social or environmental objective ‘for the common good’. Blair’s ‘Third Way’ and Reinicke’s ‘Trisectoral Networks’ (brought in through Kofi Annan’s 1997 United Nations reforms) both apply, ultimately based on the ideas of the Marxist revisionist, Second International socialist, Eduard Bernstein7, from 18998.

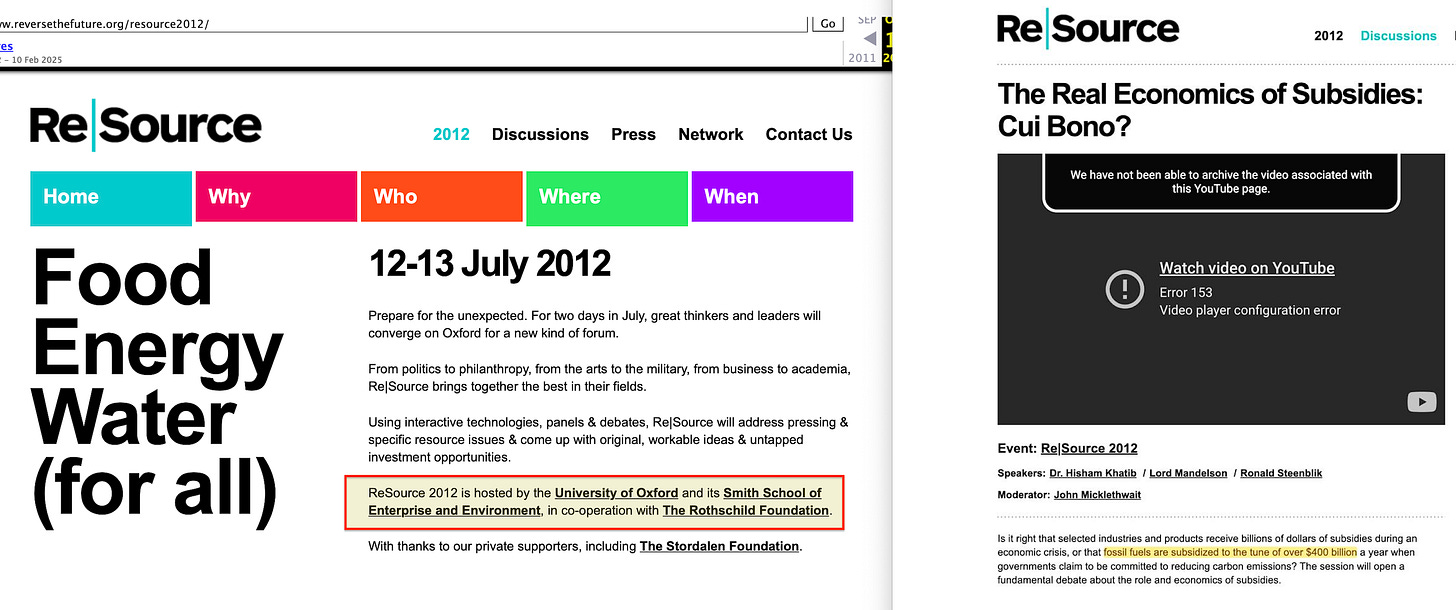

In July 2012, Oxford University and the Smith School of Enterprise and the Environment hosted ReSource 2012 ‘in co-operation with The Rothschild Foundation’9. The conference addressed how to ‘manage scarcity of resources’10.

Speakers included Bill Clinton11, David Attenborough, Amartya Sen (husband of Emma Rothschild12, and noted member of the Collegium International13), and Hans Rosling. The conference aimed to present ‘a compelling financial case’ and explore ‘viable, commercial and proven solutions towards a sustainable future’.

Bono contributed a speech on ‘The Real Economics of Subsidies’14, promoting a vastly exaggerated figure of $400bn; the direct outcome of forward projecting anticipated future cost through ‘black box’ modelling.

The Technical Specification (October 2013)

On October 29, 2013, Gore and Blood published ‘The Coming Carbon Asset Bubble’ in the Wall Street Journal15, framing carbon risk as analogous to subprime mortgages, and carbon risk as a certainty. Gore is, in effect, telling you about what’s coming:

That is exactly what is happening with the subprime carbon asset bubble: It is still growing because most market participants are mistakenly treating carbon risk as an uncertainty, and are thus failing to incorporate it in investment analyses.

The article specified three ‘stranding’ mechanisms:

Regulation — direct carbon pricing, indirect pollution controls, renewable mandates

Market forces — renewable cost competitiveness

Sociopolitical pressures — ‘fossil-fuel divestment campaigns, environmental advocacy, grass-roots protests’

One day later, on October 30, 2013, the Generation Foundation released ‘Stranded Carbon Assets: Why and How Carbon Risks Should Be Incorporated in Investment Analysis’16 — a 26-page technical paper providing the detailed methodology.

The WSJ article created public awareness; the technical paper provided the implementation guide. The Smith School’s January 2014 ‘specification document’ would cite the Generation Foundation paper.

The funder wrote the blueprint; the ‘academic research’ operationalised it.

The Alpha Test (August 2013)

Before targeting the energy sector, the network prototyped its framework on agriculture. In August 2013, the Smith School published ‘Stranded Assets in Agriculture: Protecting Value from Environment-Related Risks’, funded by the Rothschild Foundation, WWF-UK, and HSBC17.

The document featured the ‘meta-definition’ that would become the programme’s foundation: assets that have ‘suffered from unanticipated or premature write-offs, downward revaluations or are converted to liabilities’. The ‘conversion to liabilities’ language — the goal of making ownership a negative — was there from day one.

The paper listed risk factors including ‘Evolving social norms (e.g. fossil fuel divestment) and consumer behaviour’. In August 2013 — before the divestment movement had achieved major mainstream victories — the network was already listing fossil fuel divestment as a risk factor for farmers.

The ‘Consultative Panel’ listed in the document read like a directory of the future climate finance establishment: David Blood (Generation Investment Management), Jeremy Leggett (Carbon Tracker founder), Michael Liebreich (Bloomberg New Energy Finance), Nick Robins (HSBC, later UNEP Inquiry), Steve Waygood (Aviva Investors), and Richard Mattison (Trucost). The network existed as a formal advisory body six months before the January 2014 paper that launched the public programme.

The paper presented a ‘synthetic thought experiment’ claiming a single adverse event could destroy $11.2 trillion in agricultural value. It explicitly targeted Solvency II insurance regulators. The pattern was established: generate terrifyingly large numbers from admitted fabrications to force regulators to intervene.

The Specification Document (January 2014)

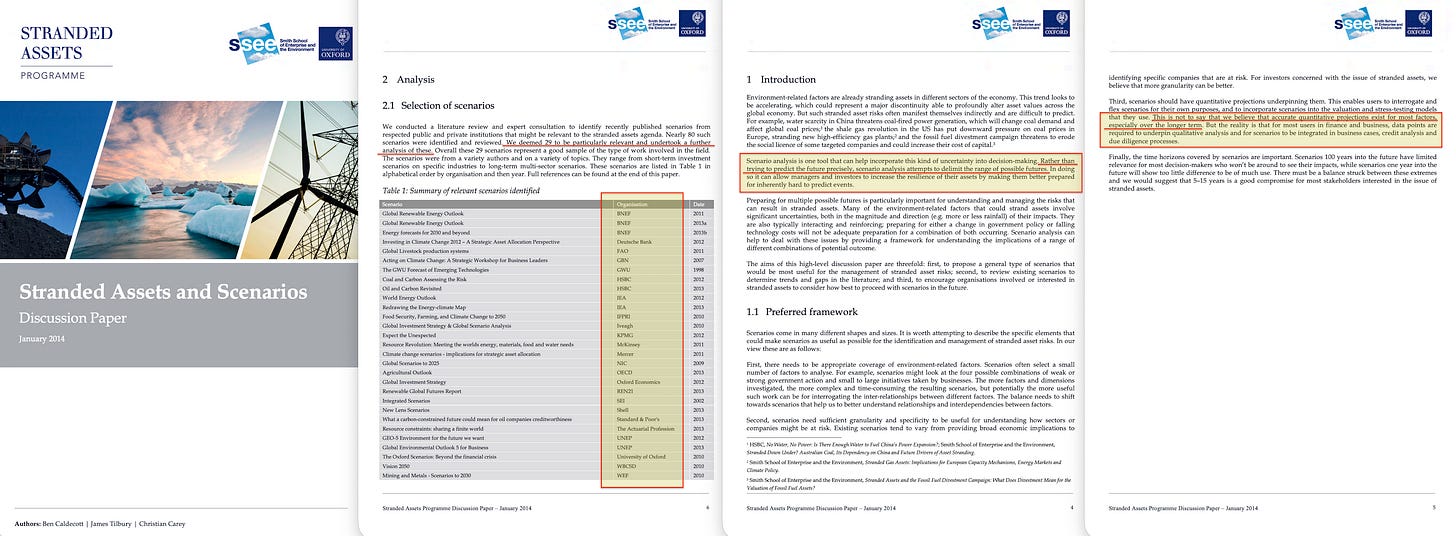

In January 2014, the Oxford Smith School’s Stranded Assets Programme published ‘Stranded Assets and Scenarios’18, a 21-page paper funded by the Rothschild Foundation, the Generation Foundation, HSBC, and WWF-UK.

The paper surveyed 29 existing climate scenarios and found them inadequate for financial integration. It specified what would make scenarios useful: appropriate coverage of environment-related factors, sufficient granularity to identify company-level risk, quantitative projections that could feed into valuation models, and time horizons of five to fifteen years.

The scenarios reviewed came largely from the network’s own members. The paper drew on HSBC’s reports — HSBC was a funder. It analysed Standard & Poor’s work — S&P was listed as a ‘non-funding partner’. It relied on UNEP scenarios — Nick Robins would become UNEP Inquiry Co-Director later that year. It acknowledged that ‘much of the analysis is based on the idea of ‘unburnable carbon’ recently taken forward by the Carbon Tracker Initiative’ — Carbon Tracker was founded by Mark Campanale, who had co-developed the stranded assets concept with Robins at Henderson Global Investors in 2001.

The network reviewed its own work, found it inadequate for regulatory integration, and specified what it needed to build next.

The paper was explicit about the function of scenarios:

Rather than trying to predict the future precisely, scenario analysis attempts to delimit the range of possible futures.

The key word is ‘delimit’. The scenarios would define which futures were permissible. Those found unpalatable are thus gated off.

The paper contained a remarkable admission:

This is not to say that we believe that accurate quantitative projections exist for most factors, especially over the longer term. But the reality is that for most users in finance and business, data points are required to underpin qualitative analysis and for scenarios to be integrated in business cases, credit analysis and due diligence processes.

The authors knew the numbers would be inaccurate. They demanded them anyway, because the financial bureaucracy requires data points to function. They prioritised the format of the input over its veracity.

The Forum Sequence (2014–2018)

Forum 1 (March 2014): The Ecosystem Map

Target: The data gap.

The proceedings19 identified a ‘serious disjunction’ between the reality of climate risk and the tools available to measure it. Risk had to be quantified at the granular asset level to move markets.

The forum mapped enforcement channels:

Accounting: ‘the importance of accounting practice and the role of standards in the stranded assets debate, particularly in terms of motivating institutional change’

Law: ‘strategic litigation regarding new build infrastructure, state aid to energy infrastructure, company and securities law regarding disclosure’

Education: ‘educational institutions and professional bodies’ as vectors for influence

The forum specified implementation tools:

Stress testing growth models and resilience strategies against a wider range of risk variables... Implementation of performance standards across industrial infrastructure linked to lending.

This was the implementation specification, written eighteen months before Carney’s speech and three years before NGFS was founded.

The forum prioritised risk, while identifying the structural barrier: ‘First Mover Disadvantage’. Risk-averse investors would not move early due to competitive loss. This single insight dictated the strategy for subsequent forums: capture regulators to force simultaneous movement.

Forum 2 (September 2014): The Asset Owners

Target: The legal mandate.

The solution was the ‘universal owner’ hypothesis20. Large endowments hold diversified portfolios spanning the entire economy. Emissions from Company A damage holdings elsewhere in the portfolio. This reframed climate action from activism (which is optional) to risk management (which is mandatory).

The forum endorsed a ‘divide-and-conquer’ strategy: ‘Divisions of labour... among institutional investors in engaging specific companies and sub-sectors’. This is cartel behaviour — coordinated action to achieve outcomes individual actors could not.

The forum identified coordinated procurement as a capture mechanism: ‘by cooperating to express joint demand... (such as in their requests for proposals (RFPs))... this collaborative-demand approach was suggested as a way to possibly drive ‘back-door’ change’.

The introduction also asked this remarkable question:

If exposure should be managed, then what are the various options?

Basel 3.1 would deliver the answer: granular risk weights that translate climate exposure into capital requirements, and capital requirements into lending costs. All banks price the risk simultaneously. The first mover disadvantage disappears.

The forum stated plainly: ‘The power of capital reallocations is both a stick and carrot’. The carrot is access to capital for compliant assets, while the stick is capital withdrawal from non-compliant ones. No legislation required — just coordinated reallocation by institutions large enough to move markets ‘for the common good’, with climate change serving as reasoning in this instance.

The forum weaponised fiduciary duty. Climate action became legally mandatory for institutional investors — not because of new legislation, but because of pre-existing obligations to manage portfolio risk. The universal owner hypothesis provided the legal theory, while coordinated procurement provided the enforcement mechanism. No law was passed, instead the mandate was reinterpreted.

Eighteen days later, on 22 September, the Rockefeller Brothers Fund announced its divestment from fossil fuels21 — timed to coincide with the UN Climate Summit in New York22.

Forum 3 (March 2015): The Gatekeepers

Target: investment consultants — the advisers who shape pension fund strategy.

The forum23 identified why consultants weren’t pushing green investment to their asset owner clients. The proceedings document the barriers:

Paradigm entrapment. The forum noted ‘strict adherence to the ‘risk as volatility’ paradigm, which may be stifling demand for new forms of advice and products connected with threats and opportunities that concern climate, environment, and sustainability’. Climate had not caused historical volatility. Therefore models showed no risk. Therefore consultants had no basis to recommend action.

Hindrance of labels. Mandates were couched in terms like ‘ESG’ or ‘SRI’ which ‘do not easily accept more nuanced considerations that might actually align better with the long-term interests of asset owners’.

Generic product trap. Consultant margins were ‘significantly (often an order of magnitude or more) tighter than those for asset managers’. Result: minimal customised advice, and ‘ICs have done far less innovating in the green investment space than in other areas’.

Step change aversion. ‘Many asset owners are only capable of implementing incremental changes... and ‘step changes’ are not at all common’. The forum noted this ‘severely limits the range and extensiveness of green investment solutions that ICs may be able to offer’.

Fiduciary duty confusion. The forum identified ‘pervasive misunderstanding by many asset owners about where the boundaries of fiduciary duty lie’. Many trustees believed fiduciary duty prevented them from considering environmental factors. The forum’s consensus: this was ‘pure mythology’. If environmental factors could materially impact returns, ‘there may exist an obligation on the parts of trustees to prove that these factors were properly accounted for’.

The forum’s conclusion: ‘governments may be needed to intervene in order to promote the scale of change required’.

The subsequent working paper, published August 2015, made the threat explicit. Titled ‘Investment consultants and green investment: Risking stranded advice?’24, it warned:

A failure by ICs to properly help AOs address environment-related risks may cause the relationships and reputations of ICs (i.e., their primary assets) to become stranded.

Consultants who failed to push climate risk would find their own business models stranded. The paper established that investment consultants had a ‘duty of care’ to present material issues ‘even if solutions to address these issues are not demanded directly by clients’.

A companion paper in the Journal of Sustainable Finance & Investment special issue completed the architecture25. Sarah Barker and Mark Baker-Jones’s paper was titled ‘Climate Change and Fiduciary Duty: the old shield becomes a potent sword.’ The shield that protected trustees from having to consider climate factors had been reforged into a weapon requiring them to do so.

The forum captured the gatekeepers. Forum 2 had weaponised fiduciary duty for asset owners; Forum 3 extended the same logic to their advisers. Investment consultants now had a ‘duty of care’ to raise climate risk whether clients asked or not. The threat was existential: fail to comply, and your own advisory business becomes ‘stranded advice’. The shield-to-sword transformation completed the circuit — fiduciary duty, once a defence for ignoring speculative risks, had been reforged into a weapon requiring action on them.

Forum 4 (October 2015): The Enforcers

Target: central banks and financial regulators.

The proceedings note the forum26 ‘coincided with’ Mark Carney’s ‘Tragedy of the Horizon’ speech27, delivered three weeks earlier. The participant list explains why coincidence is the wrong word: Sandra Batten (Senior Economist, Bank of England), Matthew Scott (Team Leader Environmental Risks, PRA), Sini Matikainen (ESRB Secretariat, ECB), Per Bolund (Swedish Finance Minister). Rupert Thorne (Deputy Secretary General, Financial Stability Board) delivered closing remarks.

The people implementing climate finance policy were in the room while the policy was being designed.

Carney’s speech had introduced the ‘Three Channels’ of climate risk: Physical, Transition, Liability. These were a direct translation of Figure 2 in the Oxford Smith School’s July 2014 working paper ‘Financial Dynamics of the Environment’28. The academic framework became central bank doctrine within fifteen months.

The proceedings contain the ‘second-best’ admission on page 5:

Macroprudential regulation should be considered a second-best policy option... First best options like implicit or explicit carbon pricing derived through market mechanisms or taxes, would allow governments to more directly mitigate climate change risks.

Democratic legislation was ‘first best’. They knew regulation was a workaround. They proceeded anyway.

But Forum 4 was not merely about managing climate risk. The proceedings reveal the actual objective:

The full potential of the financial system must be harnessed in order to meet the Sustainable Development Goals of the UN’s 2030 Agenda... Over 100 measures were identified... These measures are exemplary of progress towards a financial system fit for sustainable development, which will mobilize private as well as public capital; direct investment away from the depletion of natural capital; price resources and commons appropriately; and overcome short-termism and over-leverage characteristic of today’s financial system.

This is not risk disclosure. This is financial system redesign — ‘mobilize private as well as public capital’ toward objectives set by the UN’s 2030 Agenda. The same ‘impact economy’ architecture discussed three years earlier, now being wired into the regulatory state to serve the SDG ‘social and environmental good’, with the private partners cashing out.

The proceedings specify the delivery mechanisms:

Enhancing market practice – integration of sustainability risks into market disclosure and risk management.

Upgrading governance architecture – integration of sustainability into financial decision making of financial regulators and central banks.

Two months later, in December 2015, the FSB launched the Task Force on Climate-related Financial Disclosures (TCFD)29. ‘Enhancing market practice’ had become official policy. Carney chaired the FSB30.

Two years later, in December 2017, the Network for Greening the Financial System (NGFS) launched at Macron’s One Planet Summit31. ‘Upgrading governance architecture’ had become official policy.

The paper trail from private forum to official policy is explicit. In January 2018, Sandra Batten published Bank of England Staff Working Paper No. 70632. In the acknowledgments, she thanked ‘participants to seminars at the Bank of England, the 4th Stranded Assets Forum, the 2016 IMAEF Conference’.

The forum captured the regulators. The disclosure framework (TCFD) and the central bank network (NGFS) were specified at Waddesdon before they existed. The attendees went back to their institutions and built them.

Forum 5 (April 2016): The Shock Troops

Target: First mover capital.

The forum33 examined ‘the role UHNWIs might play in scaling up sustainable investment’ and the ‘complex inter-relationship between risk and return tolerances, financial and non-financial incentives, and wealth advisor strategies’.

The proceedings identified the barrier: trustees ‘are not empowered to take these activist risks’.

The solution: recruit capital that answers to no one. UHNWIs can absorb first-mover losses that institutional fiduciaries cannot justify.

The forum weaponised inheritance: ‘a generational shift in wealth from baby boomers to millennials’ and ‘women are becoming better represented... disrupting an incumbent ‘boys club’ culture’.

The forum recruited the next generation’s wealth before it arrived. UHNWIs and their heirs were targeted not as market movers but as capital to be onboarded — captured through wealth advisors, ‘non-financial incentives’, and generational/gender framing. Millennials and women were positioned as disruptors of the ‘boys club’ — flattery as recruitment strategy. By the time the ‘generational shift in wealth’ completed, the inheritance would arrive pre-aligned with sustainable investment. The wealth advisors were the new gatekeepers, performing the same function for private fortunes that investment consultants performed for pension funds.

Forum 6 (April 2017): The Surveillance Infrastructure

Target: The data gap identified in January 2014.

The forum3435 introduced the Asset-level Data Initiative36 (ADI): Oxford, Stanford, CDP, 2 Degrees Investing Initiative. Goal: ‘making accurate, comparable, and comprehensive asset-level data tied to ownership publicly available across key sectors and geographies’.

The forum explored ‘advanced analytics, ‘big data’, and remote sensing’ as tools to verify compliance without relying on corporate self-reporting.

The regulators captured at Forum 4 were now cited as the demand signal: the G20 Financial Stability Board, European Systemic Risk Board, and Bank of England had ‘warned how environmental factors... could have implications for asset values’.

The forum built the verification layer. Forums 1-4 had created the legal duty, the intermediary capture, and the regulatory apparatus. But enforcement required data — and not data the asset owners provided. Remote sensing and ‘advanced analytics’ meant compliance could be monitored from orbit. The closed loop was now visible: Forum 4 captured the regulators; those same regulators now supplied the ‘demand signal’ justifying the surveillance infrastructure designed at Forum 6.

The system no longer depended on voluntary disclosure.

Forum 7 (June 2018): The Eye in the Sky

Target: Global operationalisation.

Now titled the ‘Sustainable Finance Forum‘37, and co-hosted by the Rothschild Foundation and the KR Foundation (LEGO family)38.

Scope expansion: ‘the latest developments in how to measure and track the impact investments and investee companies have on climate change and the different Sustainable Development Goals (SDGs)’. The logic was no longer limited to climate.

Global South targeting: ‘particularly interested in how new approaches might be applied in emerging and developing country markets’.

The forum completed the global architecture. The rebranding from ‘Stranded Assets’ to ‘Sustainable Finance’ signaled the transition from insurgent concept to established infrastructure. Climate had been the entry point; the SDGs were the full agenda. The surveillance and measurement systems designed for carbon-intensive assets in developed markets would now track ‘impact’ across all seventeen goals in all markets. The Global South was not an afterthought — it was the prize. Emerging markets held the natural capital; the new financial system would determine who controlled it.

The Data Layer

The surveillance infrastructure required standardised inputs.

The International Integrated Reporting Council (IIRC)39, supported by the World Bank, pushed a framework forcing organisations to code activities using the Six Capitals (Financial, Manufactured, Intellectual, Human, Social, Natural).

The goal, as the World Bank guide stated, was to ensure ‘silos are minimised and effective information flows are created’.

The framework required reporting on ‘connectivity of information’ — the relationships between capitals. Organisations had to explicitly map how a change in Natural Capital caused a change in Financial Capital.

The logic was not new. Robert McNamara’s Planning-Programming-Budgeting System (PPBS) had applied the same structure to the Pentagon in the 1960s: inputs, outputs, outcomes, all coded in common metrics so central management could see and control. But while PPBS gave McNamara body counts in Vietnam, Six Capitals gave the sustainable finance apparatus natural capital accounts. What the framework could measure, the framework could manage and regulators mandate.

The BIS Innovation Hub’s Project Danu40 — a ‘digital twin’ of the financial system designed to model climate scenarios in real time — is the destination this data infrastructure was built to serve.

The Sovereign Capture (December 2017)

Between Forums 6 and 7, President Macron hosted the One Planet Summit41 in Paris. Two initiatives launched at the same event:

The Network for Greening the Financial System (NGFS)42 — a coalition of central banks and financial supervisors, founded at the Summit to integrate climate risk into financial regulation. The NGFS would issue the ‘activation order’ eighteen months later.

The One Planet Sovereign Wealth Funds (OPSWF) initiative43 — capturing state-owned investment vehicles. The Smith School served as the explicit academic partner.

The scaling sequence was now complete:

Forum 1 (2014): Mapped the terrain — first mover disadvantage identified

Forum 2 (2014): Captured the principals — endowments, fiduciary duty weaponised

Forum 3 (2015): Neutralised the gatekeepers — investment consultants, trillions

Forum 4 (2015): Installed enforcement — central banks, TCFD/NGFS blueprints

Forum 5 (2016): Onboarded private wealth — UHNWIs, generational capture

Forum 6 (2017): Built the panopticon — surveillance infrastructure, satellite verification

Forum 7 (2018): Went global — SDGs, Global South targeting

One Planet Summit (2017): Captured the sovereigns — $30+ trillion, NGFS launch

The proceedings read like project documentation because they are project documentation. One summit. Sovereign capital committed to the framework; central bank authority committed to enforce it.

Years of quiet construction, hoping no-one would notice.

The Activation Order (April 2019)

On 17 April 2019, Mark Carney (Bank of England), François Villeroy de Galhau (Banque de France), and Frank Elderson (NGFS Chair) published an Open Letter on climate-related financial risks44.

The letter explicitly threatened extinction:

This requires a massive reallocation of capital. If some companies and industries fail to adjust to this new world, they will fail to exist.

The letter instructed supervisors to integrate climate monitoring into ‘day-to-day supervisory work’, and called for a state-backed ‘classification system’ (taxonomy) to identify compliant activities.

The architecture slowly developed at Waddesdon Manor had received its operational command. Comply or cease to exist.

The Classification System (June 2020)

One year later, the European Union delivered what the NGFS letter had requested.

The EU Taxonomy Regulation of 202045 provides the definitional framework for what qualifies as ‘environmentally sustainable’. The regulation establishes binding criteria that determine which economic activities can be marketed as green, which assets qualify for green financing, and which investments meet regulatory sustainability thresholds.

Article 26 of the regulation states that further guidance on activities contributing to other sustainability objectives, including social objectives, might be developed at a later stage.

The infrastructure is designed for expansion beyond environmental criteria.

The Network

The network predates the forums by a decade.

The Hierarchy

Level Node Function

-------------- ---------------- ------------------------------

Convening Rothschild Hosts forums, funds programme,

convenes principals

Strategy Gore/Blood Public specification,

intellectual architecture

Political Clintons/Podesta Executive branch capture,

fiscal carrot

Implementation Smith School / Technical machinery,

Caldecott academic cover

Enforcement Carney / NGFS Regulatory deploymentThe Concept Origin

2001: Nick Robins and Mark Campanale develop ‘stranded assets’ concept at Henderson Global Investors

2011: Campanale founds Carbon Tracker, publishes ‘Unburnable Carbon’

December 2011: Gore/Blood publish ‘Manifesto for Sustainable Capitalism’ — first public specification

2012: Bill McKibben’s Rolling Stone article popularises Carbon Tracker’s numbers

July 2012: ReSource 2012 at Oxford/Waddesdon — Bill Clinton speaks, Hillary invited by Jacob Rothschild

October 2013: Gore/Blood WSJ article + Generation Foundation technical paper

2013: Carbon Tracker publishes ‘Wasted Capital and Stranded Assets’46 with Grantham Research Institute

March 2014: UK Parliament hearings — Carbon Tracker provides evidence

30 October 2014: Mark Carney letter to Parliament acknowledges ‘carbon bubble’47

The Speed

The speed of Carbon Tracker’s ascent is telling. A small UK NGO founded in 2011, it was embedded in US policy at the highest levels by 2014 — touching Hillary Clinton via the Podesta memo — with no public debate in Parliament or Congress. One Rolling Stone article served as the public-facing launch.

Organic intellectual movements do not work this way. A concept does not travel from NGO white paper to Bank of England policy to the US Secretary of State’s desk in three years without pre-existing infrastructure. Carbon Tracker was not an NGO that happened to have good ideas; it was a purpose-built vehicle created by network insiders to inject an idea they had developed less than a decade earlier into the financial system.

The destination was planned before the launch. Hegel was indeed found standing on his head48.

The Personnel

Nick Robins moved from HSBC (where he headed the Climate Change Centre from 2007 to 2014) to become Co-Director of the UNEP Inquiry into a Sustainable Financial System49 — the same period as the forums. At Forum 4, he chaired the session on norms, standards, and conduct.

The person who co-invented the concept was placed in the UN position to institutionalise it.

Ben Caldecott directed the Stranded Assets Programme50 and appears in every forum’s proceedings. Forum 4’s reading list included Carbon Tracker reports, Grantham Research Institute papers, and UNEP Inquiry documents — the outputs of adjacent nodes in the same network.

Timeline Summary

Date Event

December 2011 Gore/Blood ‘Manifesto for Sustainable Capitalism’ (WSJ) — 5-point plan

January 2012 Clinton invited by Jacob Rothschild to Waddesdon climate conference

July 2012 ReSource 2012: Smith School + Rothschild. Bill Clinton speaks.

August 2013 Agriculture alpha test (‘synthetic thought experiment’)

October 29, 2013 Gore/Blood ‘The Coming Carbon Asset Bubble’ (WSJ)

October 30, 2013 Generation Foundation ‘Stranded Carbon Assets’ technical paper

January 2014 Smith School specification document (‘accurate projections don’t exist’)

January 17, 2014 Podesta memo to Clinton (‘Swapping Debt in Stranded Assets’)

March 2014 Forum 1 + Parliament hearings

May 2014 Inclusive Capitalism Conference, Mansion House

September 2014 Forum 2 (McKibben, Heintz, Blood, Longstreth)

September 22, 2014 Rockefeller divestment announcement (18 days after Forum 2)

October 30, 2014 Carney letter to Parliament

March 2015 Forum 3 (consultants)

September 2015 Carney ‘Tragedy of the Horizon’ speech

October 2015 Forum 4 (regulators)

December 2015 Paris Agreement

April 2016 Forum 5 (UHNWIs)

April 2017 Forum 6 (surveillance infrastructure)

December 2017 One Planet Summit (sovereign capture)

June 2018 Forum 7 (Spatial Finance)

January 2018 Batten BoE paper (thanking Forum 4)

April 2019 NGFS Activation Order (‘they will fail to exist’)

December 2020 Council for Inclusive Capitalism with Vatican

November 2025 Sustainable Finance Forum at COP30 (400+ participants)

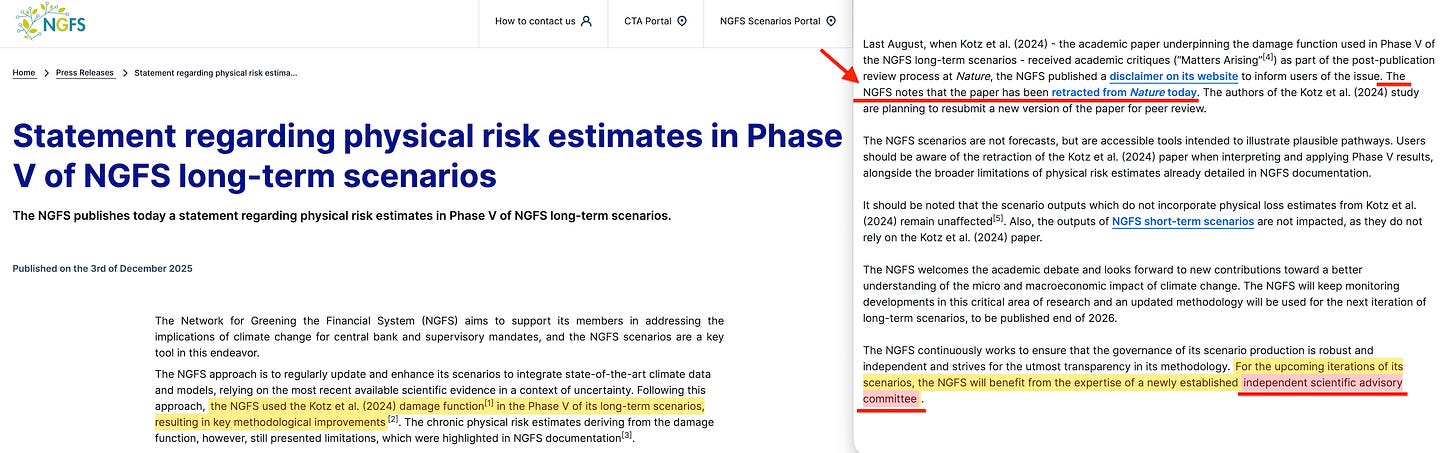

December 2025 Kotz retraction (system keeps running)

What the Documents Establish

Coordination rather than convergence. The same personnel, funders, and vocabulary appear across think tanks, academic programmes, UN bodies, and regulatory institutions.

Parallel development rather than sequential discovery. Theory, data, stakeholder engagement, and regulatory adoption progressed simultaneously.

Financial architecture preceding treaties. The January 2014 specification paper, the 2014-2015 forums, and Carney’s September 2015 speech all preceded the Paris Agreement of December 2015.

Explicit acknowledgment of democratic bypass. The ‘second-best’ framing states plainly that financial regulation achieves outcomes that carbon pricing through democratic processes has failed to deliver.

What this means in practice

The apparatus built between 2011 and 2020 allows assets to be devalued by modelled ‘black box’ prediction rather than by event:

A coal plant becomes uninvestable because of modelled transition risk per NGFS scenarios

A house becomes unmortgageable because it sits on a modelled flood plain per FEMA or Environment Agency maps

A farm becomes uninsurable because it falls within a modelled water-stress zone per IIASA’s GLOBIOM

Land becomes unlendable because it is designated a critical biodiversity area by the IUCN

None of this requires a climate event to occur. A scenario model designates the asset as at risk, and the financial system responds accordingly. The model is controlled by the same network that built the regulatory infrastructure.

None of this requires legislation or a court. The owner has no right of appeal against a prediction.

Should the modelled event be deemed severe enough, it might even trigger the UN Emergency Platform — a mechanism adopted in the September 2024 Pact for the Future that grants the Secretary-General standing authority to declare a ‘complex global shock’ and convene governments, financial institutions, and private sector actors into a coordinated response.

One of the listed triggers is ‘large-scale climatic or environmental events’. The prediction that devalues the asset is the same prediction that could activate planetary emergency protocols.

The Accountability Void

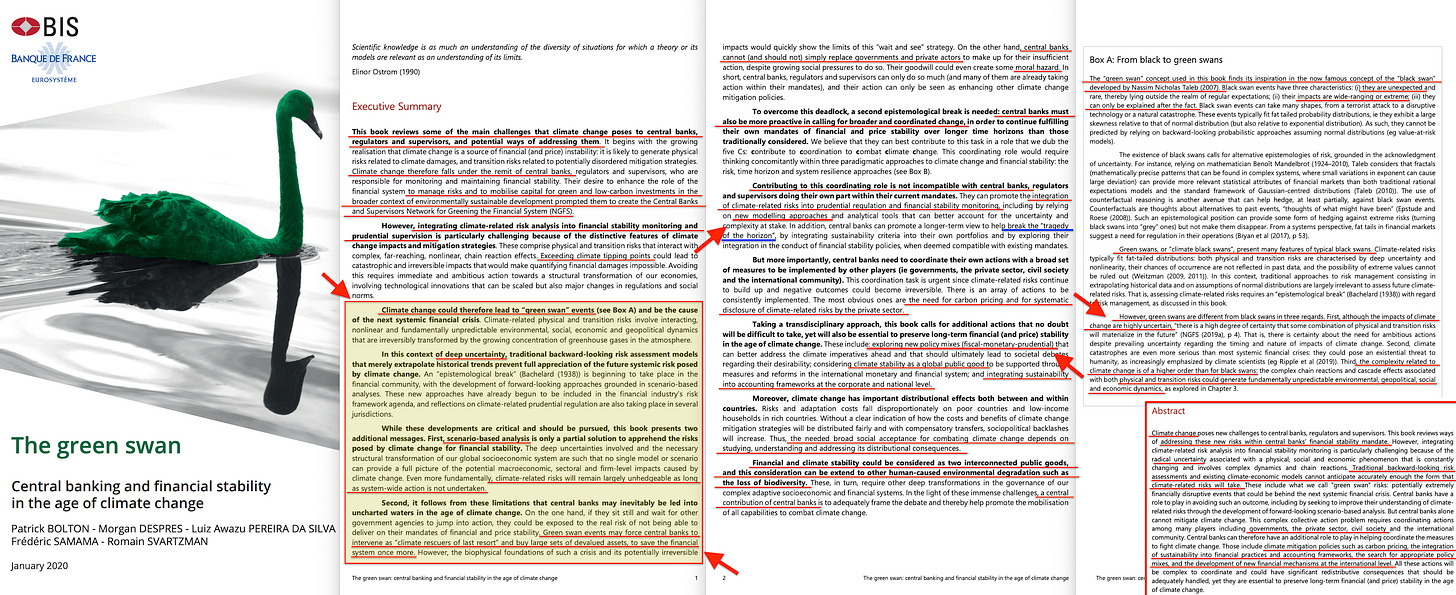

The BIS published The Green Swan in January 202051. The document introduces a critical distinction: green swans differ from black swans because ‘there is a high degree of certainty that some combination of physical and transition risks will materialize in the future’.

The event will happen. It is only a matter of when. Yet the same document acknowledges ‘radical uncertainty’ regarding timing, form, and magnitude.

The NGFS scenario documentation states explicitly52: ‘the NGFS scenarios are not forecasts: instead, they aim at exploring the bookends of plausible futures’. Carbon Tracker’s analysis of the NGFS short-term scenarios notes53: ‘By design, there is no probability of occurrence attributed to each narrative scenario’.

This creates a logical structure with no precedent in financial regulation:

On occurrence: the assertion is that the event will certainly happen; the disclaimer is that they cannot specify when or in what form.

On range: the assertion is that the middle path is ‘plausible’; the disclaimer is that extremes may be the actual outcome.

On models: the assertion is that the scenarios are a sufficient basis for stress tests; the disclaimer is that they are not forecasts and no probabilities are assigned.

On consequence: the assertion is that the models are sufficient to devalue assets today; the disclaimer is that there is no accountability if predictions prove wrong.

The scenario models cannot output precision. The January 2014 specification paper and subsequent NGFS documentation acknowledge this. The response is to construct range-bound projections — extremes eliminated, a ‘plausible’ middle path presented as the working assumption for regulatory action.

Three questions follow:

What happens if actual outcomes fall outside the range? Nassim Taleb’s ‘Black Swan’ critique of range-bound modelling54 applies: the extremes that are eliminated from consideration may be the outcomes that actually occur. The models have no mechanism to account for this.

Who determines the acceptable range? The same network that built the regulatory infrastructure: NGFS members, the integrated assessment modellers at PIK and IIASA, the Smith School researchers. The range-setters and the enforcement mechanism operators are the same personnel.

Who bears accountability for erroneous modelling? The NGFS expressly disclaims responsibility. The scenarios are ‘not forecasts’. No probability is assigned. The institution that issues the prediction that devalues your property accepts no liability for that prediction being wrong.

The property owner cannot appeal the model’s designation, cannot challenge the range assumptions, cannot seek damages if the prediction proves wrong, and yet suffers immediate financial consequences based on that prediction.

The modelling institution asserts certainty that the event will occur, controls the range bounds that determine regulatory response, disclaims all liability for the model’s accuracy, and faces no consequence if the prediction fails.

If certainty of occurrence is sufficient to justify present-day asset devaluation, then the institutions asserting that certainty should bear liability for erroneous assertion. They do not. The disclaimer structure ensures that the prediction triggers consequences while the predictor remains insulated from accountability.

This is not risk management.

This is the assertion of certainty deployed to create present financial consequences, combined with a liability shield against that assertion being tested.

Thus, the architecture is complete:

Anticipatory governance provides the methodology through ‘black box’ modelling

Stranded assets provides the concept

NGFS scenarios provide the models

Central bank stress tests provide the enforcement

Basel risk weights translate the result into capital requirements

The capital requirement determines the cost of lending, and

Your bank will refuse to lend on account of modelled risk

Meanwhile, the Council for Inclusive Capitalism with the Vatican provides moral sanction55, and the disclaimer structure ensures that no institution bears responsibility for the predictions that WILL strand the assets.

Whether those predictions prove accurate is immaterial; the consequences are immediate, the accountability is absent.

In December 2011, Al Gore published the manifesto that the Waddesdon forums would later implement. The Generation Foundation — Gore’s nonprofit — co-funded the Smith School programme alongside the Rothschild Foundation. The same Gore, with his national security adviser Leon Fuerth, had introduced anticipatory governance a decade earlier, though they preferred the term ‘forward engagement’.

The end result is a general-purpose mechanism for cancelling all economic rights of ownership while leaving the liabilities fully intact. You technically still hold the deed to your property… at least until you can’t afford the liabilities, and are forced to resort to a fire sale.

No one was robbed. This was a ‘market-based solution’ involving ‘natural assets’ which are now ‘sustainably managed’ for ‘ecosystem services’ through ‘blended finance’ and taxpayer ‘impact investing’ which primarily benefits the wealthy private partner — while the ‘civil society organisation’ funded by their foundation partners dictates ‘the common good’.

What’s perhaps most ludicrous is that although it sounds like parody, it’s all very real. It becomes even worse when you realise the wealthy private partner typically controls a related foundation.

The same model is used in climate science. The black box cannot be doubted, cannot be faulted, and does not accept blame. IPCC reports are always pure as the driven snow, and should you call that into question, then you’re a ‘science denier’.

In December 2025, Nature retracted the Kotz paper — the key study underpinning the NGFS Phase V scenarios which determine risk profiles and hence the cost of debt. Global banking capital requirements had been partially calibrated on a major spreadsheet error regarding Uzbekistan’s GDP.

The scenarios continued operating with disclaimers attached.

No institution accepted responsibility.

That accountability gap no doubt was the intent all along. And that’s why finding out who will sit on that Scientific Advisory Committee is of such importance56 — though the answer is likely already known in advance.

The navigators of Spaceship Earth tend to appoint their own57.

Find me on Telegram: https://t.me/escapekey

Find me on Gettr: https://gettr.com/user/escapekey

Bitcoin 33ZTTSBND1Pv3YCFUk2NpkCEQmNFopxj5C

Ethereum 0x1fe599E8b580bab6DDD9Fa502CcE3330d033c63c

David de Rothschilds, a trauma based mind kontrol survivor like so many of the uber wealthy offspring who would be frontmen and women.

* * *

Rhetorical question: Does this article describe the last people on Earth who don't know the climate hoax is over? They worked so hard to create it, that they can't let it go.

* * *

This caught my eye:

"Fiduciary duty confusion. The forum identified ‘pervasive misunderstanding by many asset owners about where the boundaries of fiduciary duty lie’. Many trustees believed fiduciary duty prevented them from considering environmental factors. The forum’s consensus: this was ‘pure mythology’. If environmental factors could materially impact returns, ‘there may exist an obligation on the parts of trustees to prove that these factors were properly accounted for’."

In my early twenties, I tried to get my professors and others at the University of MN to discuss shadow costs/externalities of environmental destruction in the conduct of business enterprise back in the1980's. They wouldn't talk about it. I read Fritjof Capra's "The Turning Point," and asked them about the cancerous fallacy perpetual economic growth in a class once. The professor was stumped. When I got back from Peace Corps, I told anyone who would listen that corruption was the #1 issue we faced - and was chuckled out of the conversation.

The EPA had around 800 Superfund toxic waste dumps in the uS when I got out of college in 1985. In 2018, there were 13,670, and the staff at EPA.gov had to be asked three times via e-mail to confess the organization's abject failure (while the Trump administration bragged about resolving 17 sites).... because they were too afraid to just list the total number on the website.

The Global Financial Elites just might be in what they think of as their own personal stroll to the global control finish line:

01/20/26 THE GLOBAL FINANCIAL ELITE (GFE) PLAN COMES TOGETHER. GET READY FOR THE 2026 SOLAR ECLIPSE 08/10/2026 TO 08/12/2026 HUMAN TO TRANSHUMAN HYBRIDIZATION ACTIVATION.

La Quinta Collumna: The Global Hybridization Agenda

https://lys-dor.com/2026/01/18/ricardo-delgado-martin-presente-lagenda-dhybridation-globale-prevue-pour-2026/

This is terrifying.

Leave it to Oxford...