The Biosphere

The stranded asset framework was always more than a policy for penalising coal. It was a proof-of-concept for a general-purpose confiscation engine. That engine is now being recalibrated for a new variable.

The target is moving from the coal mine to the farm, the factory — and the family home.

I. The Template

Yesterday’s essay, ‘Stranded Assets’, was no easy read. The objective was to give this load-bearing pillar the attention it truly deserves. It had to be sourced impeccably to pre-empt any potential objections, to truly shut these down before even voiced.

So let’s begin by summarising the essay, isolating the mechanism perfected through a focus on atmospheric carbon. It operates in four steps:

Define a Budget: Establish a limit — a carbon budget (UNFCCC) or biodiversity threshold (CBD) — derived from models produced by a handful of research institutes outside of democratic reach (IIASA/Potsdam).

Model the Risk: Run scenarios demonstrating that if the budget is enforced, specific assets become liabilities (NGFS-IIASA). This reframes political choices as matters of financial stability.

Weight the Capital: Use the risk model to justify higher capital requirements for banks holding exposure to these assets (Basel Committee). This raises the cost of credit without any new legislation.

Strand the Asset: As capital withdraws, the asset becomes uninsurable and unbankable. Its value collapses — not because it has become useless, but because the financial system has been configured to reject it.

The ‘Stranded Asset’ mechanism converts political preference into fiduciary duty. It allows central banks to enforce what amounts to a prohibition simply by pricing it as a risk.

The variable is now changing. ‘Carbon Intensity’ is being replaced by ‘Nature Value-at-Risk’. The same process that stranded coal mines through the carbon budget will strand homes through the biodiversity budget.

II. The Founding Vision

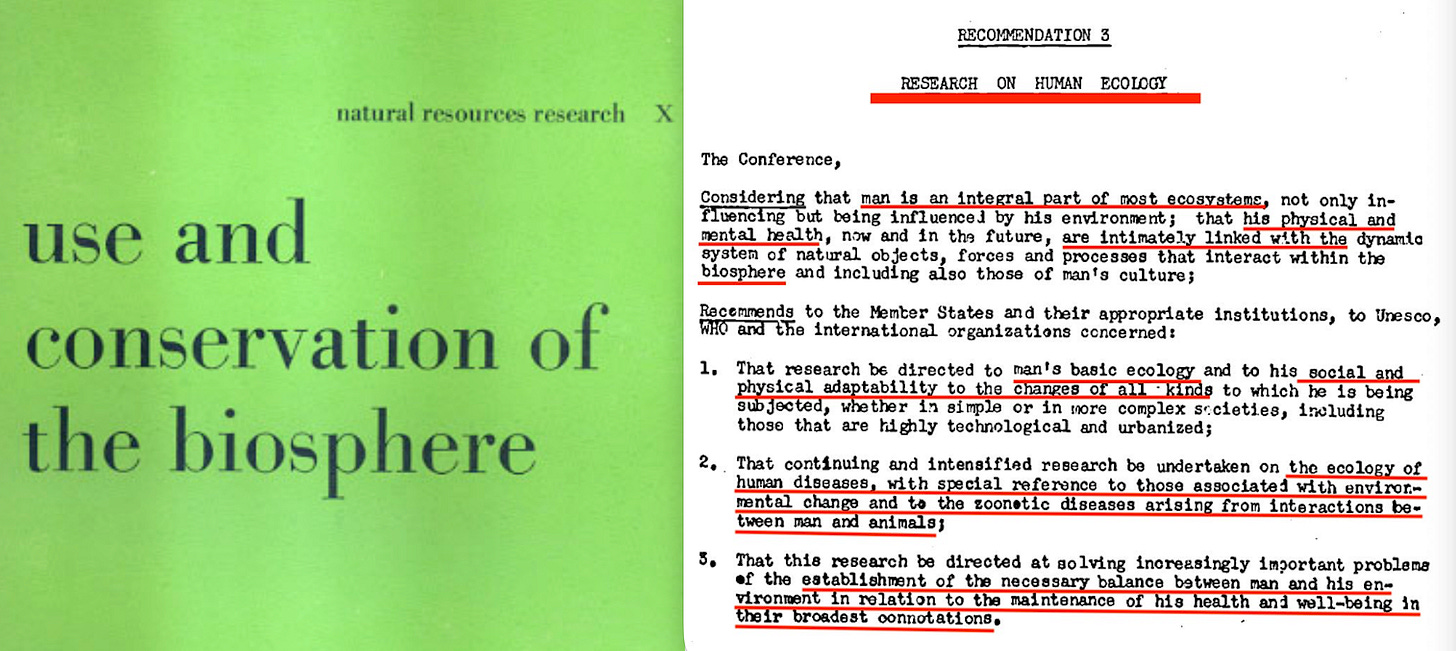

In September 1968, UNESCO convened the first global conference to address humanity’s relationship with the natural world as a matter of international governance1. Recommendation 3.3 stated the objective:

… the establishment of the necessary balance between man and his environment in relation to the maintenance of his health and well-being in their broadest connotations.

That final phrase is significant. ‘Broadest connotations’ signals an intent to expand the definition of well-being beyond its traditional meaning — which is precisely what occurred, not least through ‘determinants’ such as ‘social determinants of health’.

Three years later, UNESCO launched the Man and the Biosphere Programme2. Its principal innovation was the biosphere reserves3: designated areas combining core conservation zones with buffer and transition zones where human activity would be permitted but managed. By 2025, the network had grown to 785 sites across 142 countries.

These reserves were governance laboratories — test beds for integrating human activity with ecosystem management under international coordination.

III. The Financial Mechanism

The financial architecture preceded the treaties.

Debt-for-Nature (1980s): Conservation organisations began purchasing sovereign debt at steep discounts, then negotiating with debtor governments to cancel it in exchange for conservation commitments. The first swap was executed in 1987, when Bolivian debt was exchanged for the establishment of the Beni Biosphere Reserve.

By 2023, debt-for-nature conversions had restructured over $2 billion in sovereign obligations across dozens of countries. Nations that could not service their debts found relief, but the relief came with territorial commitments. Land was locked into managed non-development.

The creditor’s leverage became the conservationist’s leverage.

The GEF (1991): The Global Environment Facility was established as a pilot programme before either the UNFCCC or the Convention on Biological Diversity had been signed. The financing architecture was ready before the legal framework existed.

The GEF pioneered ‘blended finance’: public funds (taxpayer money) hold the junior position and absorb losses first, while private investors hold the senior position and are protected from loss. The structure mirrors the collateralised debt obligations of 2008, applied to ecosystem services.

The public absorbs the risk. Private capital takes the return.

IV. Ecosystem Services as Asset Class

The conceptual transformation came next: reframing nature as something that provides quantifiable services rather than something to be protected for its own sake.

The Millennium Ecosystem Assessment4 (2005) codified the taxonomy: provisioning services (food, water), regulating services (flood protection, pollination), cultural services, and supporting services.

This framing made nature legible to economic accounting. The logic that follows is straightforward:

If ecosystems provide services, those services have value.

If they have value, they can be priced.

If they can be priced, they can be traded.

If they can be traded, they can be collateralised.

If they can be collateralised, they can be leveraged.

The OECD’s 2025 System of National Accounts5 update completed the integration: ecosystem degradation now enters GDP calculations as a cost of production.

V. The Lease Structure

Debt-for-nature swaps established the precedent. The next iteration was the ecosystem service lease.

Under this structure, a government or private entity receives financing in exchange for committing land to conservation management over multi-decade terms. The land generates ‘ecosystem service credits’ — carbon sequestration, biodiversity offsets, watershed protection — that can be sold to entities requiring offsets.

The credits flow to international markets. The land remains locked. The local population loses access to development pathways.

The legal form is a lease. The economic substance is a long-term extraction right over the land’s capacity to generate tradeable environmental compliance instruments.

VI. Natural Asset Companies

In September 2023, the New York Stock Exchange filed with the SEC to create a new listing category: Natural Asset Companies.

The structure would have allowed private entities to hold the rights to ecosystem services on public or private land, quantify those services, and float shares representing claims on the revenue streams. Investors would own fractional interests in the economic output of ecosystems — ownership of the land’s capacity to generate credits rather than the land itself.

The proposal was withdrawn in January 2024 following political opposition. Critics recognised that Natural Asset Companies would grant foreign sovereign wealth funds the ability to purchase ‘ecosystem rights’ over American public lands, effectively allowing external actors to shut down local economies by declining to permit development.

The political optics proved untenable. But the underlying architecture remains intact, and the pricing mechanism that would make such companies viable is now being constructed by central banks.

VII. The Targeting System

The Taskforce on Nature-related Financial Disclosures provides the coordinates.

Over 730 organisations representing $22 trillion in assets have adopted the TNFD’s LEAP methodology: Locate, Evaluate, Assess, Prepare.

The ‘Locate’ phase is the targeting mechanism. Companies and banks must map their operations and exposures to specific GPS coordinates, then cross-reference those coordinates against databases of ecologically sensitive zones maintained by bodies including the International Union for Conservation of Nature.

If an asset sits in what the system designates a ‘Priority Location’ — a biodiversity corridor, a groundwater recharge zone, or a habitat for Red List species — its risk coefficient rises automatically.

The satellite feeds the database. The database feeds the coefficient. The coefficient feeds the capital formula.

There is no court that adjudicates whether the satellite interpretation is correct, and no appeals body that reviews whether the Priority Location designation is fair. The satellite has become the judge.

VIII. Nature Value-at-Risk

In December 2025, the European Central Bank published Occasional Paper 380, titled ‘Nature at risk’.

The paper introduces Nature Value-at-Risk — a methodology for converting ecosystem conditions into credit risk metrics. The formula is Hazard multiplied by Exposure multiplied by Vulnerability, computed across eighteen ecosystem services.

The findings are significant: 72 per cent of euro-area corporations are highly dependent on at least one ecosystem service, and 75 per cent of corporate bank lending flows to these firms.

The paper calls for mapping Nature Value-at-Risk into standard credit-risk parameters: probability of default, loss given default, and exposure at default. The stated next step is ‘the development of a nature-related stress test for euro area banks’.

This is the stranded asset mechanism applied to biodiversity.

IX. What This Means for Property

The application to real estate represents the critical escalation.

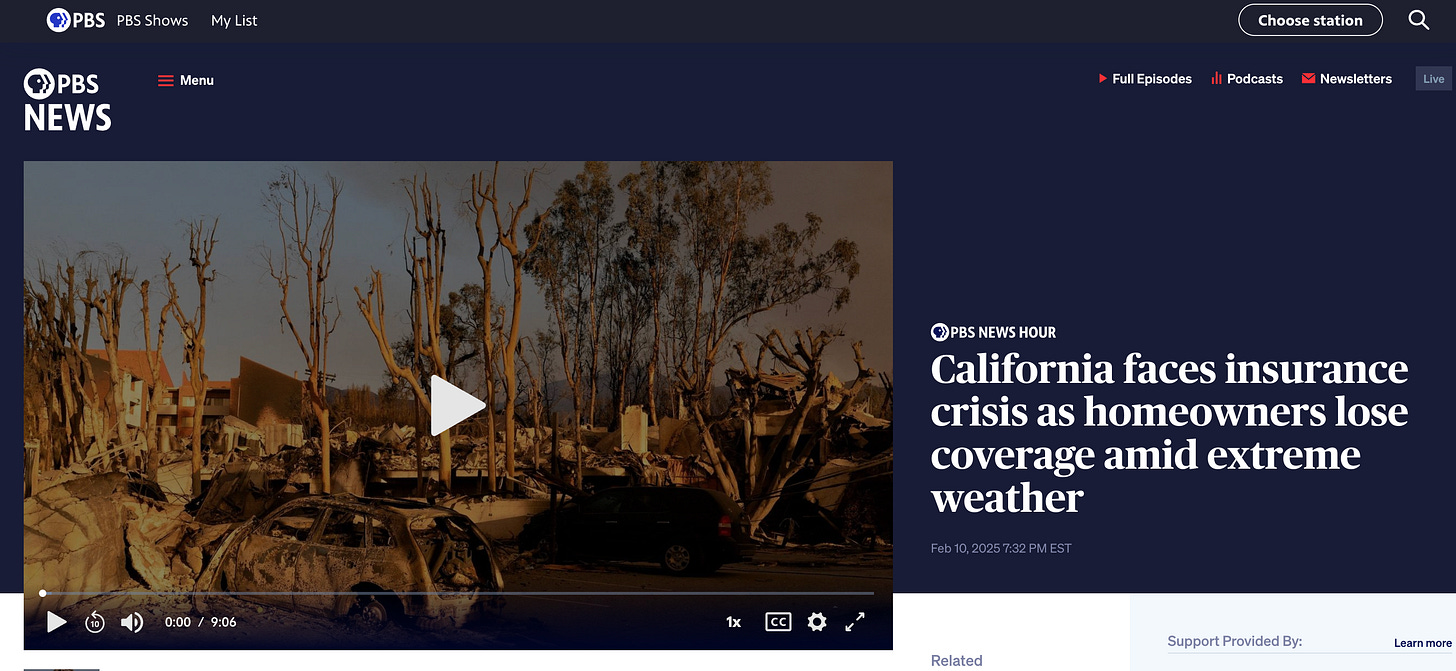

If your home sits in a zone reclassified as a Priority Location — perhaps a wildfire corridor, a flood plain, claimed weather concerns, or a biodiversity buffer — its Nature Value-at-Risk coefficient rises. The stranding proceeds through three gates.

Insurance: Insurers modelling physical risk and nature dependency withdraw coverage or raise premiums to prohibitive levels. This gate is already closing in California and Florida.

Credit: Banks, required to hold capital against Nature Value-at-Risk exposures, refuse to write new mortgages or refinance existing ones. Without insurance, there is no mortgage.

Stranding: The property cannot be sold to anyone requiring financing. Its market value collapses — not because the house has become worthless, but because the financial system no longer recognises it as viable collateral.

You own the deed. But the ledger controls whether that ownership has any practical value.

The same process that stranded coal mines through the carbon budget will strand homes through the biodiversity budget6. The mechanism is identical. Only the input variable has changed.

X. The Enforcement Layer

Pricing alone does not constitute enforcement. That function belongs to the Cape Town Convention.

The Convention on International Interests in Mobile Equipment7 (2001) establishes an international registry for security interests in high-value mobile assets — aircraft, railway rolling stock, space assets, and now, under the MAC Protocol, mining, agricultural, and construction equipment.

A creditor with a registered interest can repossess the asset anywhere in the world. The debtor’s national courts cannot block enforcement.

Consider how this interacts with conservation finance. A nation receives blended finance for conservation. The deal is secured by ecosystem service revenues. The nation’s agricultural equipment is financed separately, with interests registered under the Cape Town Convention. If the nation fails to meet its conservation obligations, creditors can enforce against the nation’s productive equipment through a registry that bypasses domestic courts.

The same nation that accepted conservation obligations to relieve its debt burden now faces equipment seizure if it fails to perform.

XI. The Pincer

The architecture operates on both hemispheres simultaneously.

In the Global South: Debt-for-nature converts financial distress into conservation obligations. Blended finance positions taxpayers as junior creditors who absorb losses first. The Cape Town Convention provides enforcement against productive assets. Land is locked into managed non-development.

In the Global North: Taxpayers fund GEF concessional finance. Nature Value-at-Risk coefficients render ‘nature-negative’ property uninsurable and unbankable. Property rights are hollowed out to system-recognised control. Insurance withdrawal pre-strands assets before any disaster occurs.

Both populations pay. Neither benefits.

XII. The Terminus

In 1968, UNESCO’s Recommendation 3 called for three things: research into human adaptation to environmental change, research into ‘zoonotic diseases arising from interactions between man and animals’, and the establishment of ‘balance between man and his environment’.

Climate, biodiversity, and One Health — all three vectors appeared in one document, fifty-six years before the WHO Pandemic Treaty negotiations began and fifty-seven years before the ECB published its Nature Value-at-Risk paper.

The convergence was not accidental. It was designed from the founding document. But the vision was utopian then. There was no infrastructure to make it operational.

There is now.

The IUCN Red List, once simply a catalogue of endangered species, is becoming a financial trigger. A species listing in Geneva translates to a capital charge in Frankfurt.

What begins as a ‘planetary ethic’ becomes treaty. What becomes treaty becomes scenario. What becomes scenario becomes coefficient. What becomes coefficient becomes capital requirement.

The planetary ethic supplies the criteria. The ‘black box’ modelling institutes supply the scenarios. The satellites supply the targeting. The central banks supply the capital formulas. The insurers supply the first gate. The Cape Town Convention supplies the enforcement. The Bank for International Settlements supplies the settlement layer.

The stranded asset thesis was the prototype. The biosphere is the deployment.

In January 2026, the Basel Committee’s SCO60 standard came into effect, assigning Bitcoin and other decentralised tokens a 1,250 per cent risk weight — effectively requiring banks to hold a dollar of capital for every dollar of cryptocurrency on their books. Faced with these economics, banks have quietly withdrawn from the market. No legislation banned cryptocurrency, but the capital rules rendered it institutionally irrational to hold, achieving through risk pricing what prohibition never could.

The mechanism is indifferent to its inputs. Point it at carbon reserves and they strand. Point it at ecosystems and they become services to be leased. Point it at homes in designated zones and they become uninsurable, unbankable, and unsellable. Point it at cryptocurrency and it becomes unconvertible.

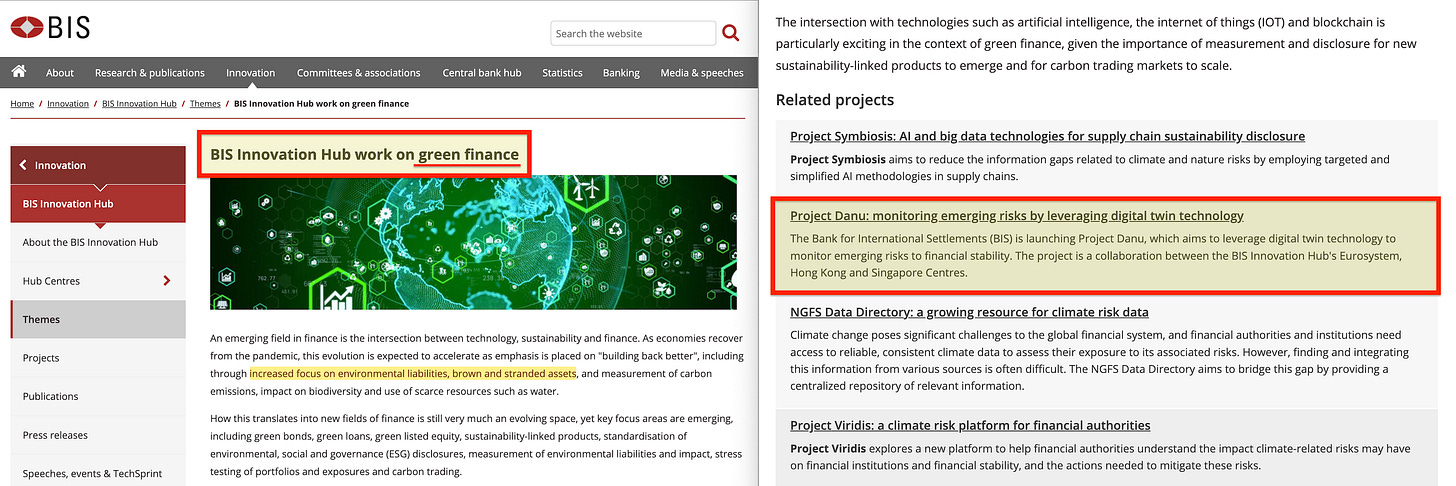

The BIS Innovation Hub Project Danu8 specialises in exactly this type of risk modelling — stranding assets before any crisis occurs9.

The ‘black box’ will confess to anything, yet answer for nothing.

That’s the ‘democracy’ they seek ‘to strengthen’.

Find me on Telegram: https://t.me/escapekey

Find me on Gettr: https://gettr.com/user/escapekey

Bitcoin 33ZTTSBND1Pv3YCFUk2NpkCEQmNFopxj5C

Ethereum 0x1fe599E8b580bab6DDD9Fa502CcE3330d033c63c

I know you are correct. I work in financial services. This list of unacceptable property especially for lifetime mortgages keeps increasing.

Beautifully convincing and detailed work esc, as always. Thank you.

So Nature-VaR as black boxed risk-modeled (IIASA/Potsdam), which includes (allegedly) non continuous ecological cliffs, step functions, tipping points, hard boundaries, regime changes, etc

And tens of Trillion dollar derivatives exposures will reprice based on any Nature-VaR modeled changes (once adopted). But derivatives pricing models are priced in practice on smooth risk surfaces (not thresholds, cliffs, regime changes etc)

This breaks derivative 'Greek delta hedging' (delta hedged not equal to regime change hedging)

Leading to a clear model-based potential mechanism to trigger the systemic derivatives based Great Taking mother of all crisis

[insert 'This is Fine' burning house meme]