It’s been almost 18 months since Natural Asset Companies suddenly became the hot topic of discussion, much to the chagrin of the NYSE and SEC, who consequently decided to pull the application for this new trading instrument1. It was a brief moment of success, showing how publicity can lead to victories, however temporary they may be. But they’re not done with the idea — in fact, they’re just working to close one of the larger gaps in the surrounding legislation

One of the major problems with a holding company owning a 25-year lease, guaranteeing the carbon emission credits from a forest in... rolls dice... Bolivia — is that the company could be undone by the bankruptcy of the servicer of the agreement.

And in most cases, that servicer would be the nation state.

The topic was covered back in December 2023, and it was a key reason I began investigating the concept of blended finance — a topic revisited only yesterday.

Still, the entire area remains chock full of guesswork, because in reality, there’s quite simply no way to ‘value a stroll in a forest’ in monetary terms — which is exactly what they’re attempting to do.

The people were granted a rare — but nevertheless very real — victory at the time. However, it goes without saying that the New York Times2 almost immediately began the predictable effort to drum up ‘public support’3.

But that didn’t stop Sweden4 from trialling aspects of a very similar system, while Australian5 academics began exploring how the initiative — framed around ‘the common good’ — could be implemented down under.

It is, in effect, a global drive. Well — Western, anyway. Or more specifically: Western Finance. It’s easy to cast blame outward, but it’s important to understand that Western populations are being targeted just as much by the select few. Supermarket chains in the UK are seeing their IT systems hacked6 one7 after8 another9, while people struggle to afford daily life10 — not least due to the creeping burden of absurd carbon taxation schemes11.

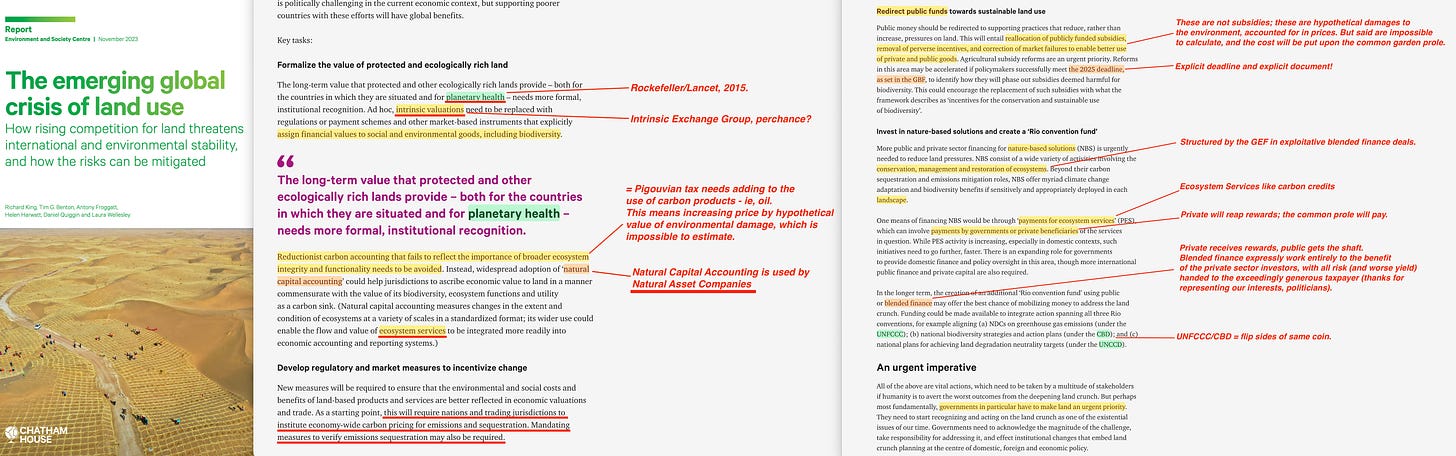

No — what we need to do is understand where this drive actually originates. Just a few months before the NACs were temporarily shot down, none other than Chatham House12 went all in on a similar strategy — one that echoes a familiar template we've seen before.

First, they state that private landowners need to be protected — only to introduce exceptions later in the document. It’s the same trick used in the 1982 World Charter for Nature, which claimed nations could use their own resources, but only so long as they didn’t pollute their neighbours. That principle was laid out under the 1979 Convention on Long-Range Transboundary Air Pollution13, agreed just 10 months after the first World Climate Conference — the event that quietly established the implicit, fraudulent ‘carbon consensus’, without a shred of legitimate science behind it.

Either way, once the gap is opened through this initial ‘exception’, it’s only a matter of time before they expand it with an entire list of others.

It works the same way, every time, everywhere.

Regardless, the reason Chatham is of interest is because it was they who — through Michael Grubb — produced the early research that led to the carbon monetisation scheme, later presented in detail through two UNCTAD reports in 1992 and 1994 titled Combating Global Warming, which further opens up the possibility of using the same system to monetise any ‘ecosystem service’. It was also Chatham that developed the facilitative monetary policy framework which front-ran, and effectively enabled, Keynes’s General Theory. No, seriously — without the RIIA’s early work between 1931 and 1935, Keynes’s framework would have lacked a complimentary monetary policy component. The fact that this was developed immediately beforehand speaks volumes. The General Theory, in short, was part of a bigger scheme.

We also have a 2023 Deloitte/WWF/Australia report on ‘Banking the Natural Capital’14, which explicitly outlines the role of Natural Asset Companies. These are, in short, intended to be rolled out everywhere. For now, they’re just temporarily postponed — waiting for the next cycle of outrage to distract the public. Perhaps they'll announce that certain Covid vaccines in fact were dangerous, and even air this on prime time television. That should do the trick.

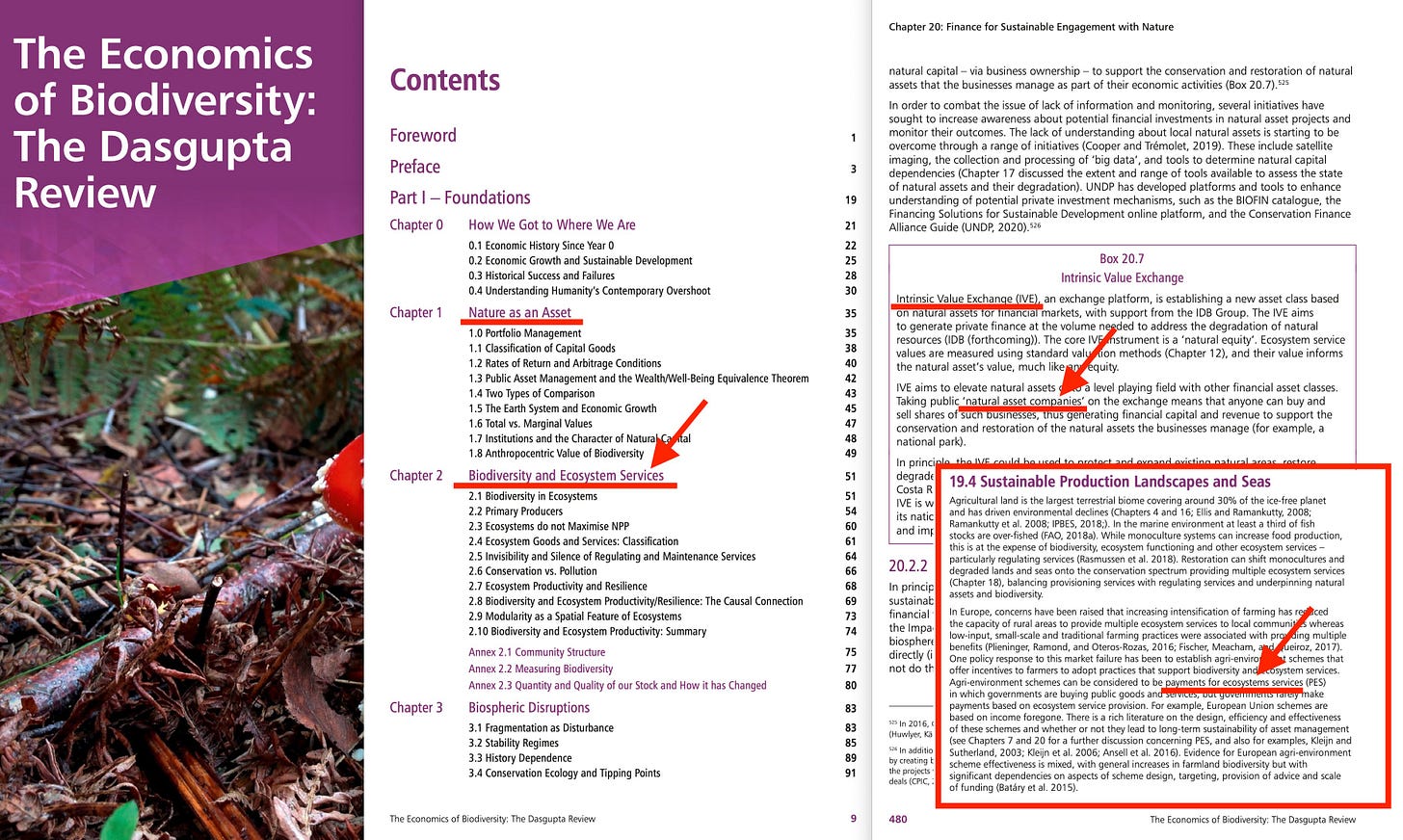

The concept of Natural Asset Companies was, in fact, included in the UK Government’s Dasgupta Review15 of 2021. Much of the relevant history — including the role of the Intrinsic Exchange Group — was already covered in a previous post, tracing it back to 2014. No need to retread old ground16.

Yet the document goes further, outlining the use of indicators — normalised global surveillance coefficients — which, in the context of forests, will be delivered through live-streamed monitoring via GEOSS derivatives such as GEO BON17 or GBIOS18. These indicators align specifically with the Convention on Biological Diversity’s Aichi Biodiversity Targets19.

We’re even treated to a foreword by none other than David Attenborough, alongside explicit mention of the IUCN’s Nature-Based Solutions20 framework.

Of course, while the RIIA was busy debating the future carbon trading system behind closed doors in the late ’80s and early ’90s, Dasgupta himself published The Environment as a Commodity in 199021 — the same year IPCC Working Group 3 detailed the early outline of the future carbon emission trading system.

This initiative was then folded into a United Nations University series with Dasgupta participation in 199122 — just as the RIIA and its partners were putting the finishing touches on the emissions trading system.

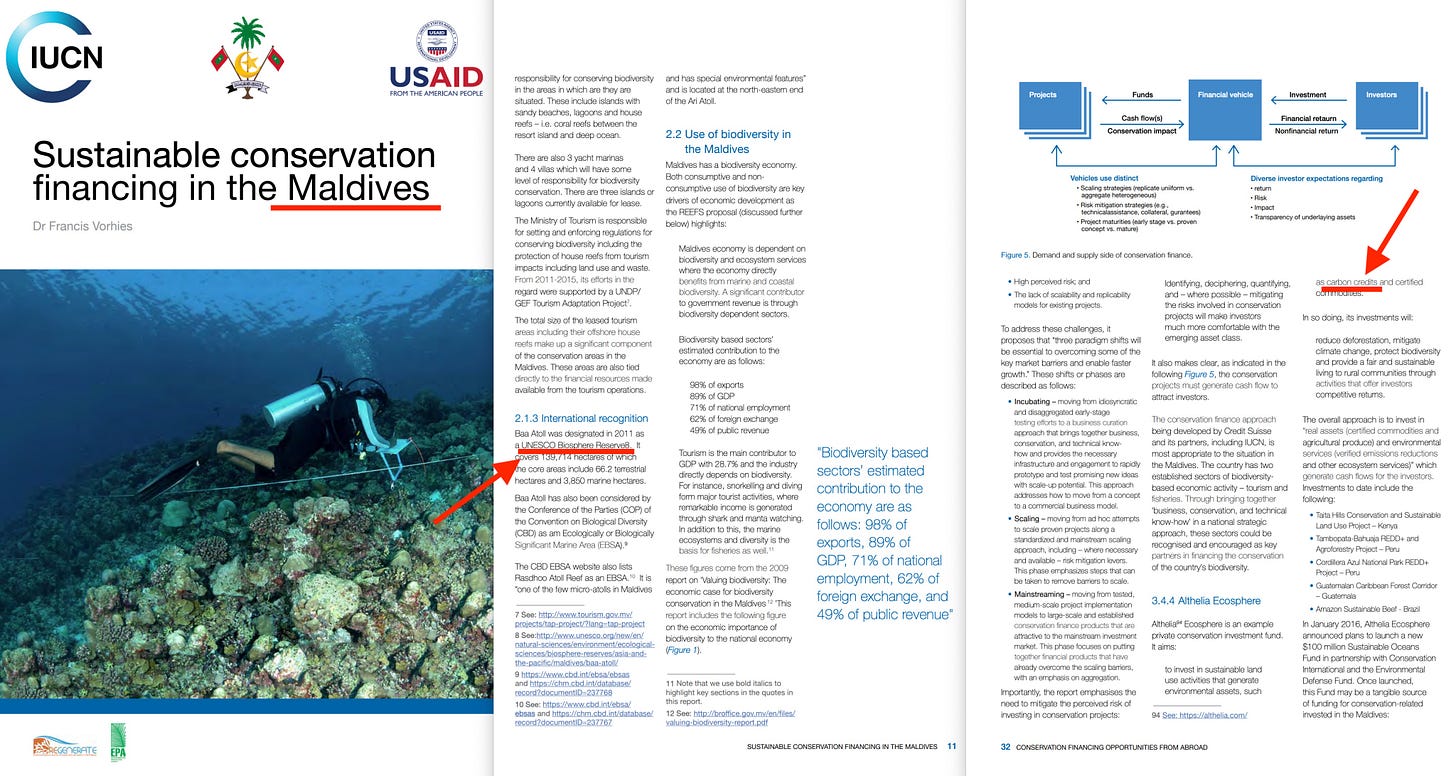

The sceheme broadly works as such:

Mangroves, previously submitted to the UNESCO Biosphere Reserves in, say, Vietnam23 are earmarked for ‘climate action’, leading to a blended finance project relating to the monetisation of carbon emission credits. (The example of Vietnam could alternatively be one from South Africa24, Peru25, Maldives26, Canada27 or even Devon, UK28 — plenty to choose from, there is absolutely no29 shortage30 of31 material32)

The private investor is invited to cherry-pick from among the many projects sponsored by the taxpayer. In fact, he’s not only allowed to cherry-pick — he’s also rewarded with significantly higher compensation for his supposed hard work and risk-taking.

Much like Timberwolf in 200833, these are terrible ‘deals’ — primarily because of the risk of default. But 2008 also provided a useful template: you pool a number of bad mortgages, securitise them (i.e. turn them into a yield-producing asset), and then slice them into Collateralised Debt Obligations (CDOs) divided into tranches. The higher-risk tranches offer higher returns, while the senior tranches — insulated from loss unless all other tranches collapse — offer lower, more stable yields due to their relative safety.

However, in the context of ‘saving the world’, that arrangement simply isn’t good enough for the private parties. If they’re to save the planet, it must come with the best possible risk profile — and a higher net return. That’s achieved by structuring blended finance deals with junior debt for the taxpayer and senior equity for the private investor. The Global Environment Facility even adds a further layer of insulation by providing initial financing for these projects — capital that will be first to absorb losses. In effect, it’s lemon socialism all over again, just like in 2008: the private sector reaps the rewards, while the public quietly subsidises the billionaire class.

Yet fundamentally, there’s no real need for the private investor to be involved at all. They arrive late in the process, cherry-pick as they please, and contribute only a fraction of the total investment. The taxpayer shoulders the overwhelming majority of the cost — despite all the wildly misleading marketing to the contrary.

But these deals really are ‘shitty’34, and the default risk is very real — which is, quite simply, intolerable to private investors. Something, therefore, needs to be done to ensure they can keep ‘protecting the environment’ without exposure to loss. That’s where the focus shifts to the underlying asset of the Natural Asset Companies themselves — the lease, promising some form of ecosystem service delivery over a fixed period, structured through a GEF-backed Landscape Approach blended finance deal.

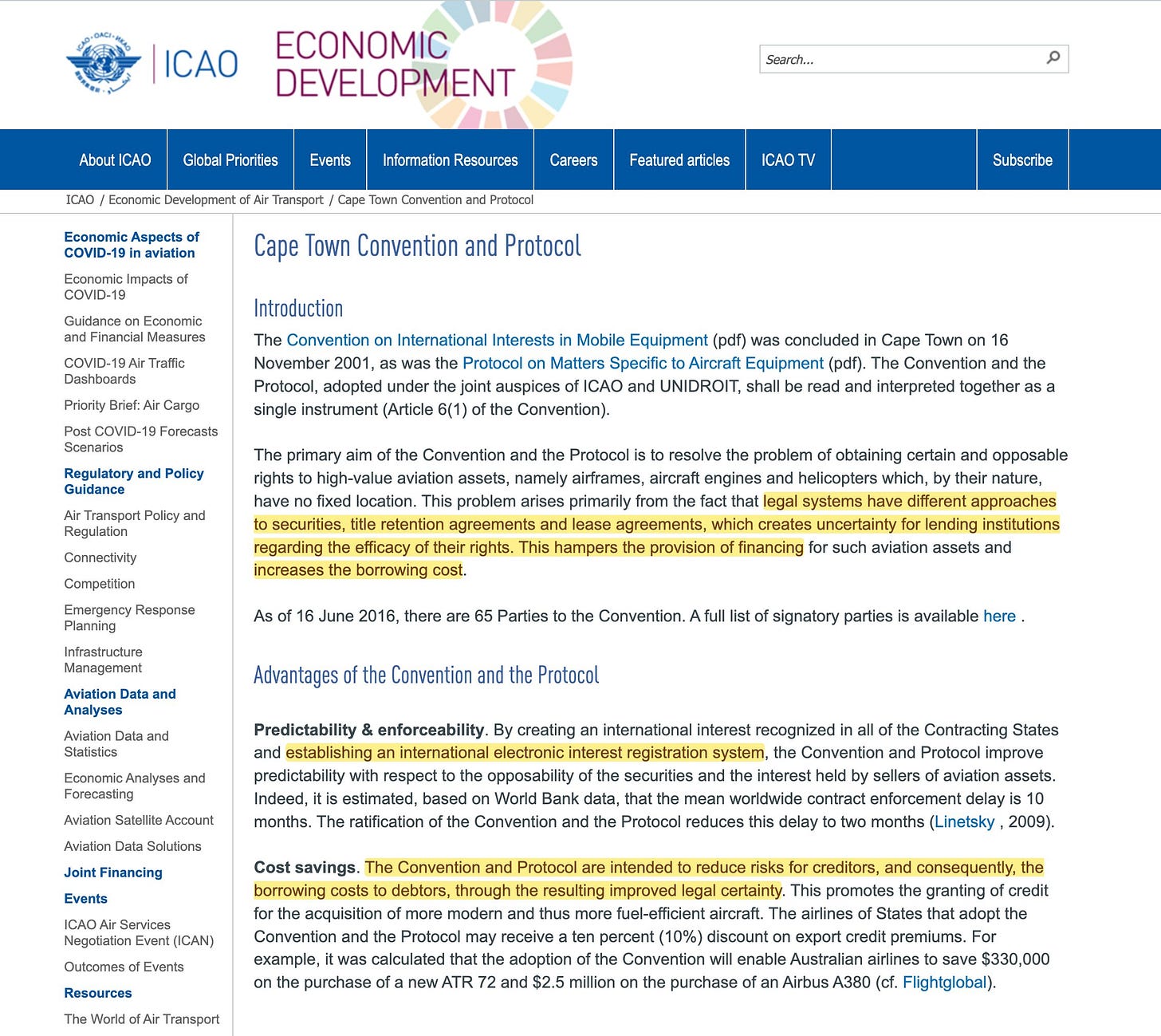

In 2001, an obscure treaty came into being: the Cape Town Convention35 on International Interests in Mobile Equipment36 — the perfect place for an atrocity to hide. Just a few years ago, an additional MAC Protocol was added in 202137, originally drafted to protect lenders financing mobile equipment like aircraft engines. However, the structure of the Cape Town Convention gives creditors — the private parties — enforceable rights across borders. Under the MAC Protocol, if a Natural Asset Company defaults on its ecosystem service lease, its private creditors can quickly step in, taking control of the company’s pledged equipment, financial accounts, and — most importantly — the lease itself.

You may not have noticed — but rest assured, this convention is being taken very seriously by the38 people39 who40 matter41.

What this convention means is that if the servicing party behind the lease — typically the host nation — goes bankrupt or defaults on the underlying agreement, the lease can be swiftly transferred to an alternative servicer, or even to the private creditor itself, ensuring uninterrupted service flows. This continuity becomes a legal certainty through Investor–State Dispute Settlement (ISDS) mechanisms embedded in Bilateral Investment Treaties42. In effect, ecosystem service leases are transformed into stable financial commodities — assets made especially attractive by their legal insulation from political or economic instability in the host country.

Consequently, private parties are now guaranteed the flow of ecosystem services — water, carbon emission credits, and so on — from the rainforest in, say, Peru, even if the nation responsible for conserving that rainforest goes bankrupt.

This is where UNESCO Biosphere Reserves enter the frame. First introduced at the 1968 UNESCO Biosphere Conference as a continuation of the 1964 International Biosphere Programme, these reserves can now be repurposed as ideal containers for Natural Asset Company-based financing. UNESCO designation only comes once the sovereign nation has accepted the necessary governance frameworks, management plans, and zoning laws — meaning GEF-structured blended finance deals can skip much of the early due diligence. In return, host nations can be offered cheaper finance — lower interest rates — on so-called ‘conservation’ deals.

In other words, indebted nations that include their prime lands within UNESCO Biosphere Reserves will receive lower interest rates in return for that inclusion. And this is music to the ears of the private partner, as it means the entire legal framework securing their rights to ecosystem services remains intact — even if the host nation collapses. Rather than, say, Peru managing the reserve for the provision of carbon emission credits, that responsibility would simply be passed on to a different servicing agency.

But once these prime lands are included in the UNESCO Biosphere Reserves, they automatically become subject to evolving legal and financial requirements. Future conditions for private investment could well depend on live-streamed satellite surveillance via GEOSS derivatives — such as GEO BON and GBIOS — which act as an Early Warning System. Should a local peasant chop down a tree or two, or a government dare propose a new — yet internationally unapproved — motorway across the rainforest, these alerts would trigger ISDS proceedings, demanding that the host nation cease exercising its sovereignty. Should they refuse, they’ll be promptly frozen out of global financial markets — bringing any government back to the negotiating table in a heartbeat.

The shift to Cape Town–style regulation, consequently, establishes a global system of control — one that overrides national sovereignty in the event of default. Sure, the land itself may remain under national or even individual ownership. But the right of use — specifically regarding the ecosystem service and the natural assets that render it — is effectively transferred for the duration of the lease. The private investor is thus completely insulated from risk. And it’s at this point that the entire proposal begins to border on the absurd: with risk no longer a factor, the very natural assets once considered the worst investment opportunities suddenly become the most attractive — precisely because they are now globally underwritten.

Ergo, once ecosystem service leases and creditor enforcement rights are codified under the MAC Protocol, ISDS mechanisms, and international registry systems, governments will find their hands tied by global legal structures — all designed to preserve and expand these investments through gradual mission creep, neatly packaged as ‘environmental protection’. In reality, this is a neo-colonial mechanism that will progressively shift underlying assets — forests, lakes, and eventually even urban areas — into opaque financial instruments, existing solely for the purposes of monetisation. And that monetisation will come at a cost: out of the Western public’s purse, through rising prices at the supermarket and the petrol station, while governments steadily raise taxes in the name of ‘saving the planet’.

It is, in short, all a scam. While 30% by 203043 is the current stated objective, that goalpost will soon shift to ‘Nature Needs Half44’ — a concept first proposed by the WILD Foundation. Incidentally, this is the same organisation that convened the first World Wilderness Congress in 1977, which eventually led to the fourth congress in 1987 where the idea of the World Conservation Bank was introduced. That proposal was effectively split in two: with the Global Environment Facility taking on one half of the mechanism, and the World Bank absorbing the other.

For now, this mechanism is still emerging. The MAC Protocol awaits further ratifications, global biodiversity surveillance is nearing completion, and NAC structures are only just beginning to appear in national legislation. Yet the trajectory is clear. Ecosystem services — carbon, water, biodiversity — will soon flow across borders as reliably as money or manufactured goods, protected by an increasingly unified system of global finance and law. The Biosphere Reserve, once sold as a conservationist’s hopeful compromise, may soon become the quiet instrument of planetary asset management — enforcing global rights over local lands.

But emerging it is — with the UNFCCC, in January 2025, publishing a white paper outlining this very mechanism45. It explains that a sovereign nation will submit a pledge — detailing the landscape, the ecosystem service, and the lease duration — to a central registry that will, in effect, act as the global legal authority for delivering that service, even if the nation itself goes bankrupt. Verification and control, naturally, are essential — hence the call for global satellite surveillance via GEOSS derivatives.

And this very premise is now being ‘discussed’ — yet without any serious attention to why it should be a global cause for concern. Naturally, this46 particular New York law firm ‘forgot’ to mention the flip side of the coin.

Sovereign nations, quietly losing sovereign rights over their own territories.

And Unidroit — the International Institute for the Unification of Private Law — is currently working to further ‘harmonise’ legislation globally to make all of this possible, with full-scale adoption targeted for 202647.

Yet central bankers are never far away. As we approach the final chapters of this trajectory, they begin to materialise everywhere. A former Rothschild employee is now President of France48. The former Interior Minister of the European Union has a similar background49. The newly elected Prime Minister of Canada is not only the former governor of both the Bank of Canada50 and the Bank of England51, but also president of GFANZ52, deeply embedded in the Network for Greening the Financial System53, former head of the Financial Stability Board54, and acting president of Chatham House55. Similarly, the current governor of the Bank of England56 is soon to become the next head of the Financial Stability Board57, and a member of the very same Fabian Society which, in 2023, had the gall to suggest that fiscal policy should be ‘influenced’ — that is, set — by the Bank of England.

Comply, or get Truss’ed58.

But neither Carney nor Bailey appear to be directly involved in this particular drive. That role falls to William Dudley, former chairman of the New York Federal Reserve59, whose CV is deeply entwined with the Bank for International Settlements60.

In 2021, a report from the Bretton Woods Committee61 made clear that key actors in the sovereign debt restructuring ecosystem — including Dudley — are not only aware of, but actively advocating for, a legal-financial architecture that mirrors the very mechanisms now being applied to natural assets. The report highlights the Cape Town Convention as a model for bypassing the limitations of domestic insolvency regimes by enabling creditors to seize, sell, or extract revenue from pledged collateral across borders — precisely the mechanism outlined in the UNFCCC white paper referenced above.

And Dudley’s involvement is yet another significant indicator that this might well be orchestrated from within the global institutional financial core — by those who manage sovereign monetary flows. The committee openly endorses a mechanism that bypasses sovereign legal systems to ensure creditor recoveries during bankruptcies, and even proposes extending this model to ESG-linked instruments and SDG-tied sovereign bonds — exactly as discussed in yesterday’s Substack post, Development for Finance. In effect, it paves the road for a new class of global, enforceable natural assets — located within national borders, but governed by international financial law.

And this is precisely the path that logic suggests UNESCO Biosphere Reserves and debt-for-nature swaps will take: the state retains title, but the credit flows — and the terms of land use — are pledged, priced, and enforced elsewhere.

It does seem oddly convenient, doesn’t it? On the surface, we’re looking at a range of seemingly unrelated organisations — from UNESCO and UNIDROIT to the BIS, UNFCCC, and a web of development banks — all advancing different pieces of what is increasingly revealing itself to be the same structural puzzle. We may not yet see the full frame, but the outline is becoming unmistakable: a unified system of global asset governance, constructed under the banner of environmental protection and an economic world order that promises, above all, ‘stability’. A world where rights are no longer vested in the sovereign, but in international organisations beyond the reach of democratic control — exactly as Leonard S. Woolf envisioned back in 1916.

At some point, the obvious question has to be asked: if all these threads are converging so precisely — then who, exactly, is weaving them together?

Is there an organisation that doesn’t explicitly promote the Cape Town Convention — which, one might say, would be a little too conspicuous — but nonetheless operates in clear parallel with its logic and objectives? One that advances cross-border enforceability, collateral frameworks, and the standardisation of financial infrastructure?

As it turns out — yes, such an organisation does exist62.

Keep reading with a 7-day free trial

Subscribe to The price of freedom is eternal vigilance. to keep reading this post and get 7 days of free access to the full post archives.