Epstein II

The Development of a Digital Currency

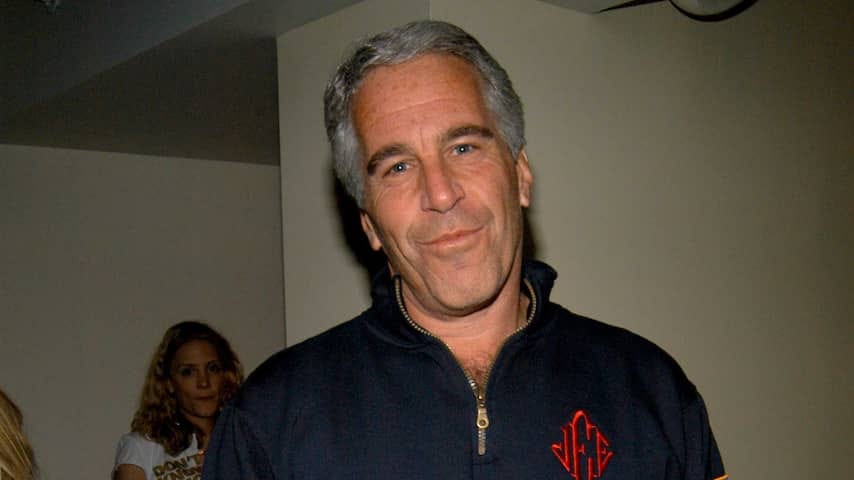

In September 2012, Jem Bendell was sitting in a session at the World Economic Forum when his phone buzzed. It was Jeffrey Epstein.

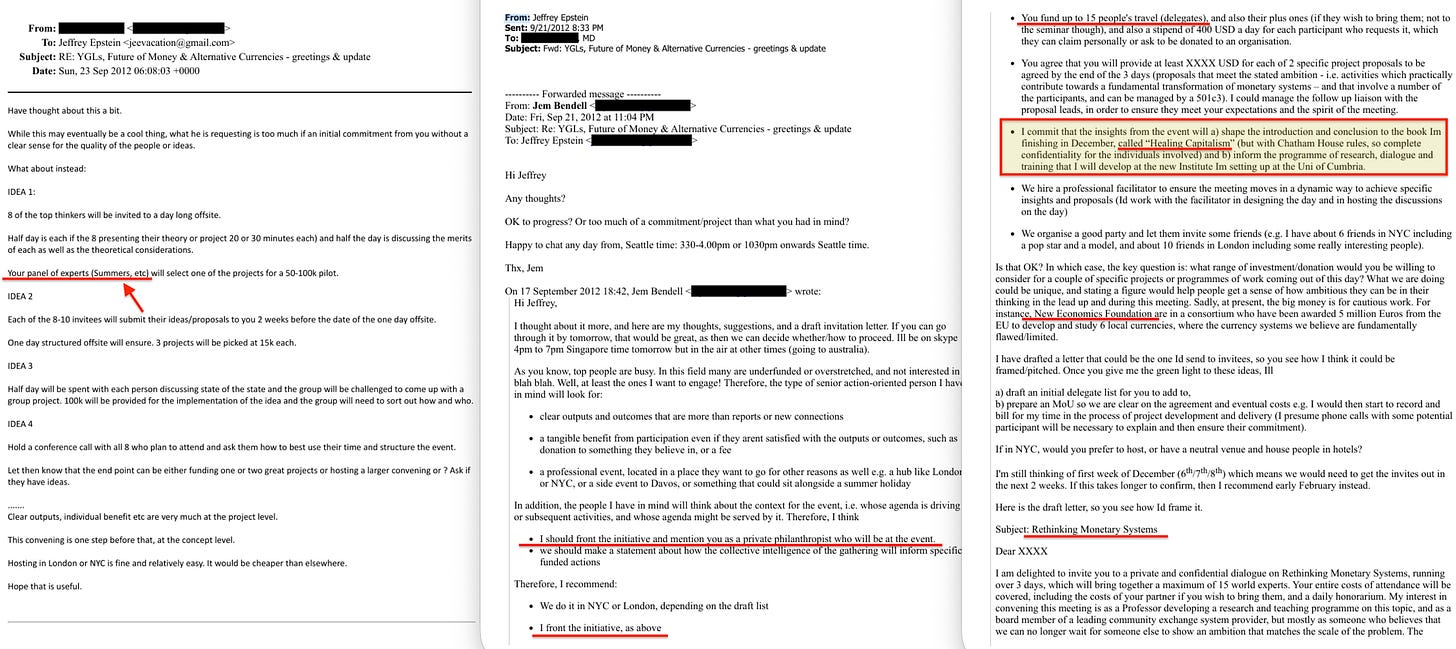

Bendell excused himself, and within days had agreed to lead a private initiative to ‘revamp the financial system/markets’ — funded by Epstein, structured outside WEF oversight, and governed by Chatham House rules guaranteeing participant anonymity.

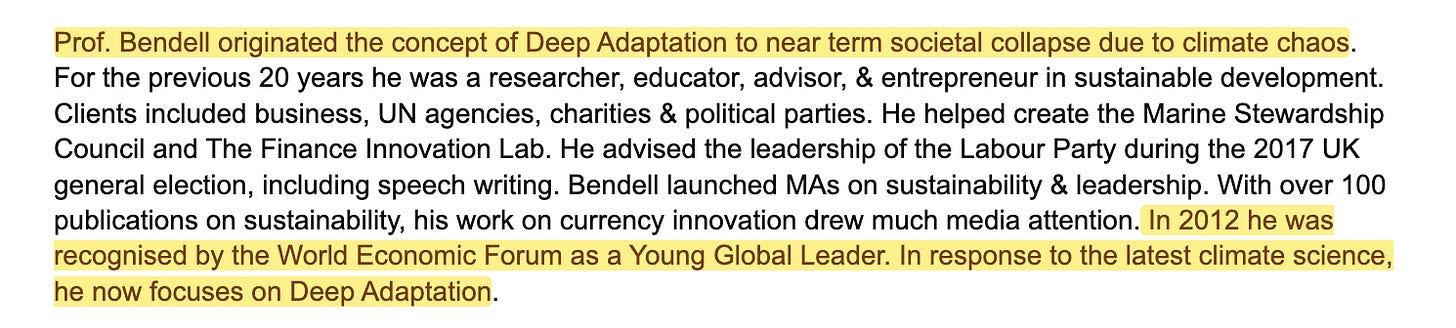

The WEF had just appointed Bendell a Young Global Leader1 for his work on currency innovation. He was exactly the sort of person the Forum cultivated to shape the future of money. Epstein took him.

Documents released by the Department of Justice in 2025 and 2026 reveal a year-long scouting operation — October 2011 through September 2012 — in which Epstein systematically evaluated the World Economic Forum’s work on alternative currencies, identified its limitations, and extracted its best people to run a parallel initiative under his control.

But the scouting was only the beginning. What the documents show, when read together, is a coordinated campaign to sell sovereign digital currency to multiple governments simultaneously, with a strategic framework, a technical build team, and in at least one case, a hand in electing the leader who would implement it.

The previous essay — ‘Epstein’ — documents Epstein’s role as a coordination node: the financial architecture he designed with JPMorgan, the research portfolio he assembled, the personnel he placed across institutions.

This essay follows a single thread from that network: the operation to move digital currency from concept to sovereign adoption.

The Reconnaissance

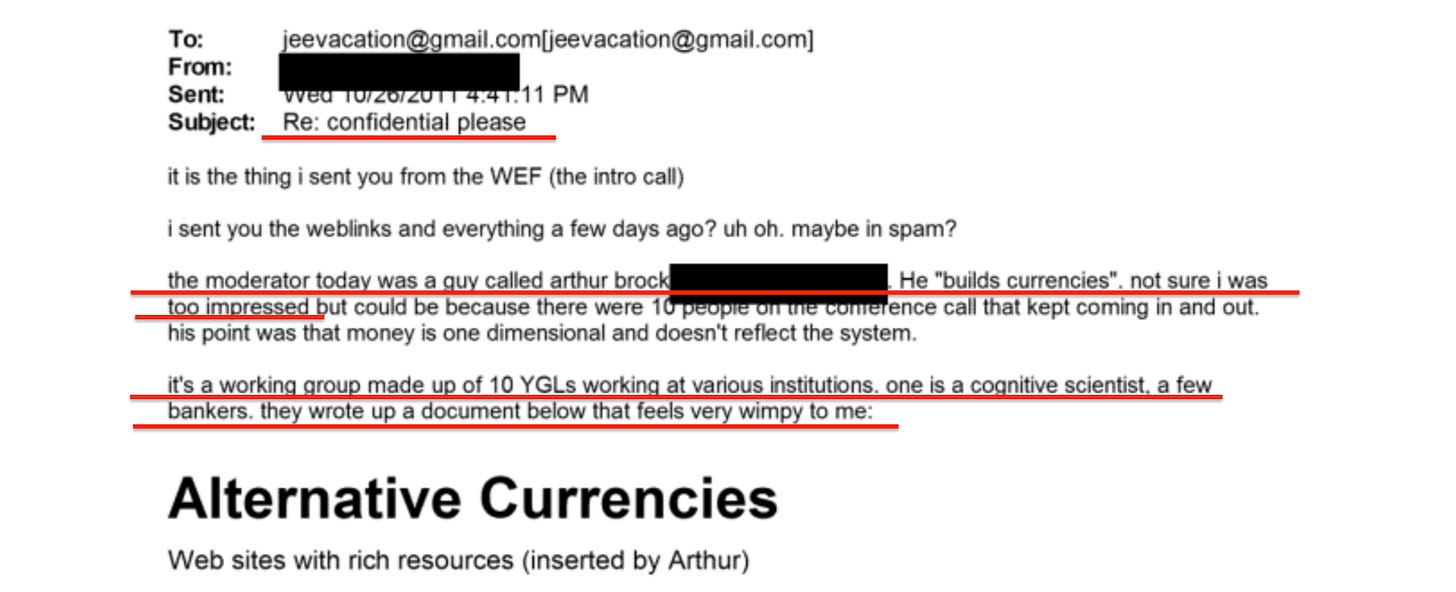

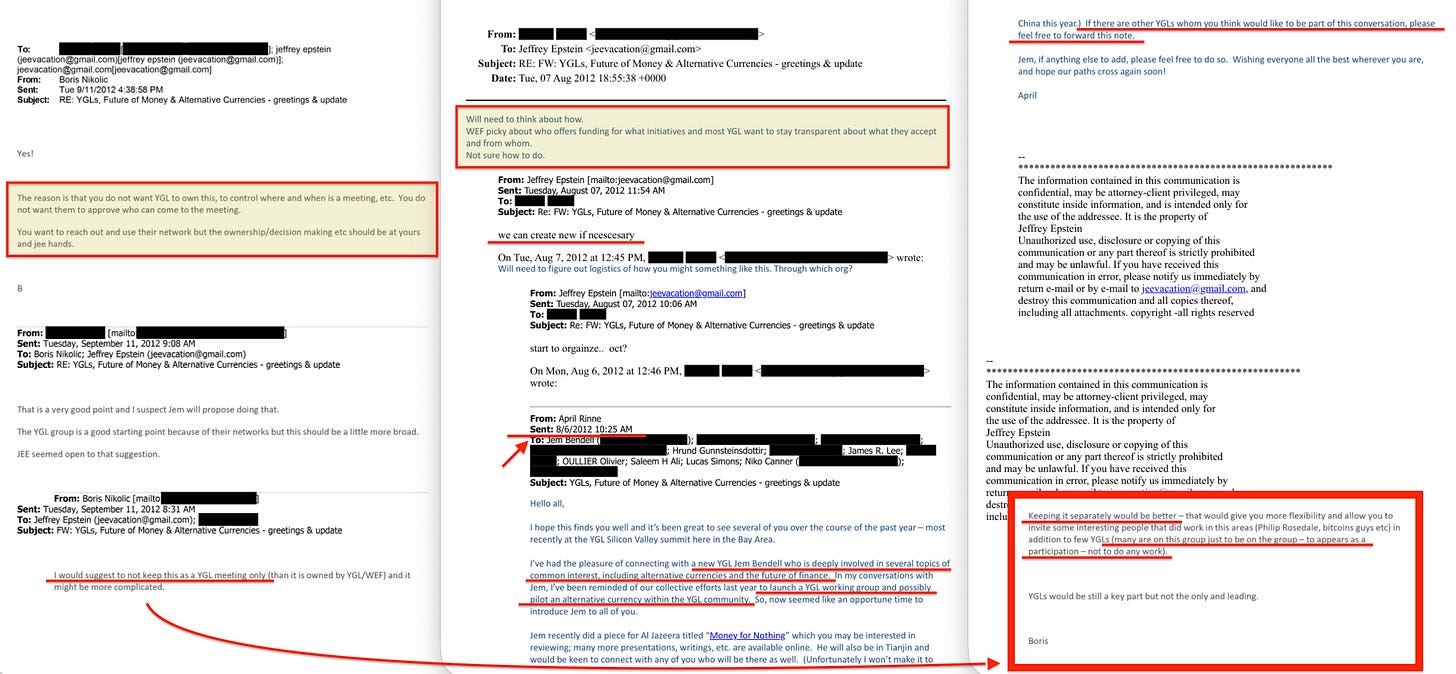

The operation began in October 2011, when someone inside the WEF’s Alternative Currencies working group sent Epstein a report on the introductory call. ‘The moderator today was a guy called arthur brock’, the email read2. ‘He ‘builds currencies’. not sure i was too impressed’. The working group comprised ten Young Global Leaders — ‘one is a cognitive scientist, a few bankers’ — and had produced a document the correspondent found wanting. ‘It feels very wimpy to me’.

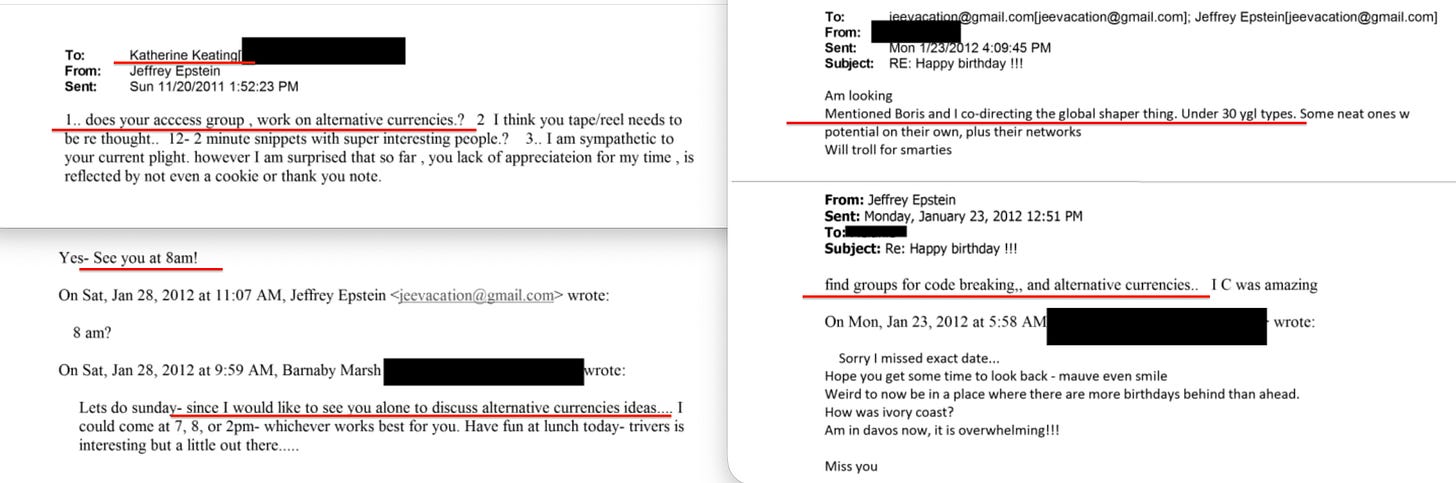

The following month, Epstein emailed Katherine Keating — daughter of former Australian Prime Minister Paul Keating3 — asking whether her ‘access group’ worked on alternative currencies4. He was looking for existing infrastructure he could direct or absorb. In January 2012, someone at Davos sent Epstein a birthday greeting. His reply was a tasking order: ‘find groups for code breaking,, and alternative currencies’5. Five days later, Barnaby Marsh met Epstein privately to discuss ‘alternative currencies ideas’6.

By early 2012, Epstein had eyes inside the WEF working group, contacts scouting Davos, and private meetings with researchers across the field.

The Transparency Problem

The WEF’s Alternative Currencies initiative had a structural limitation, and in August 2012 someone spelled it out for Epstein. ‘Will need to think about how’, the email began7. ‘WEF picky about who offers funding for what initiatives and most YGL want to stay transparent about what they accept and from whom. Not sure how to do’.

Its Young Global Leaders wanted to know where their money came from. Epstein was a registered sex offender, and the YGLs would not take his funding without disclosure. His response was immediate: ‘we can create new if ncescesary’. The thread continued: ‘Will need to figure out logistics of how you might something like this. Through which org?’ Epstein proposed a timeline: ‘start to orgainze.. oct?’ — one month after he would commission Bendell.

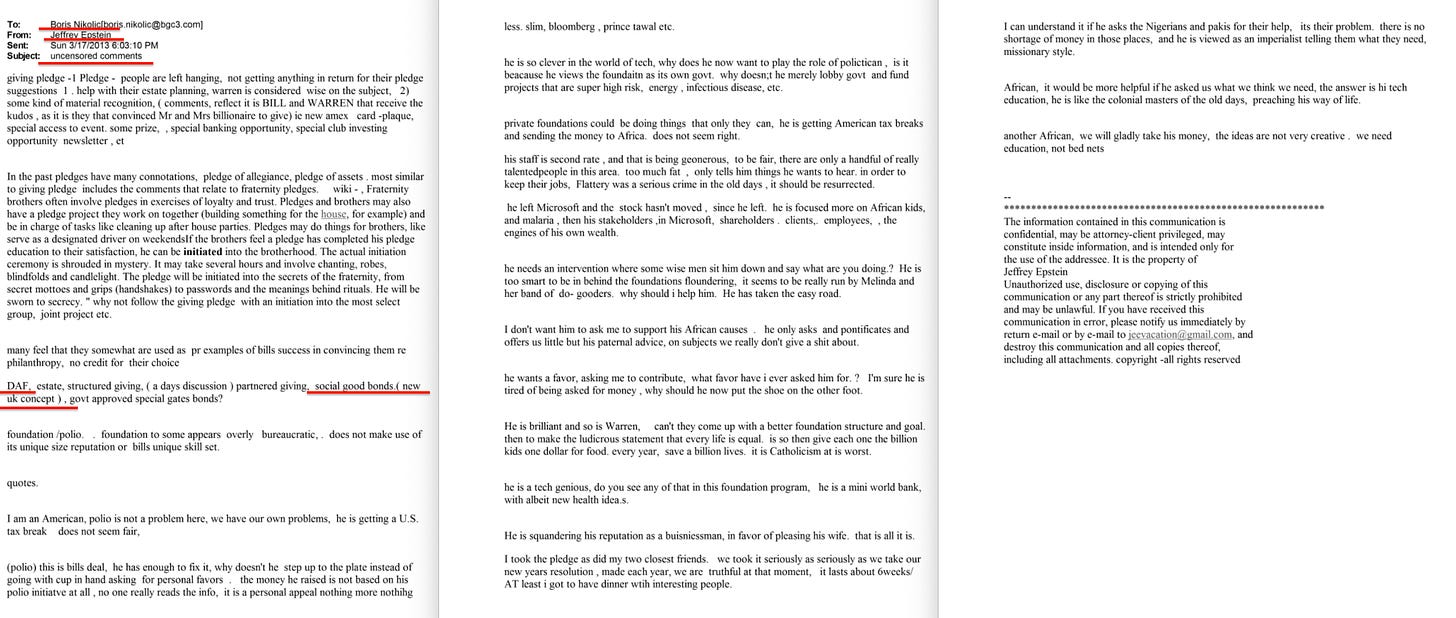

Boris Nikolic — Bill Gates’s chief science and technology adviser8 — was blunt about the solution9.

I would suggest to not keep this as a YGL meeting only. Than it is owned by YGL/WEF and it might be more complicated. Keeping it separately would be better — that would give you more flexibility and allow you to invite some interesting people that did work in this areas (Philip Rosedale, bitcoins guys etc) in addition to few YGLs.

On the quality of WEF participants: ‘many are on this group just to be on the group — to appears as a participation — not to do any work’.

Bendell’s operational plan, sent on 17 September 2012, specified how the initiative would function outside the Forum. Fifteen ‘world experts’ would convene under Chatham House rules — ‘complete confidentiality for the individuals involved’10. Epstein would fund two project proposals emerging from the gathering, managed through a 501c3. ‘I should front the initiative’, Bendell wrote, ‘and mention you as a private philanthropist who will be at the event’. No one would know it was Epstein until they arrived.

The intellectual outputs would flow into Bendell’s public work — his book Healing Capitalism, his new Institute at the University of Cumbria11 — without visible connection to the original convening. Private development, public implementation.

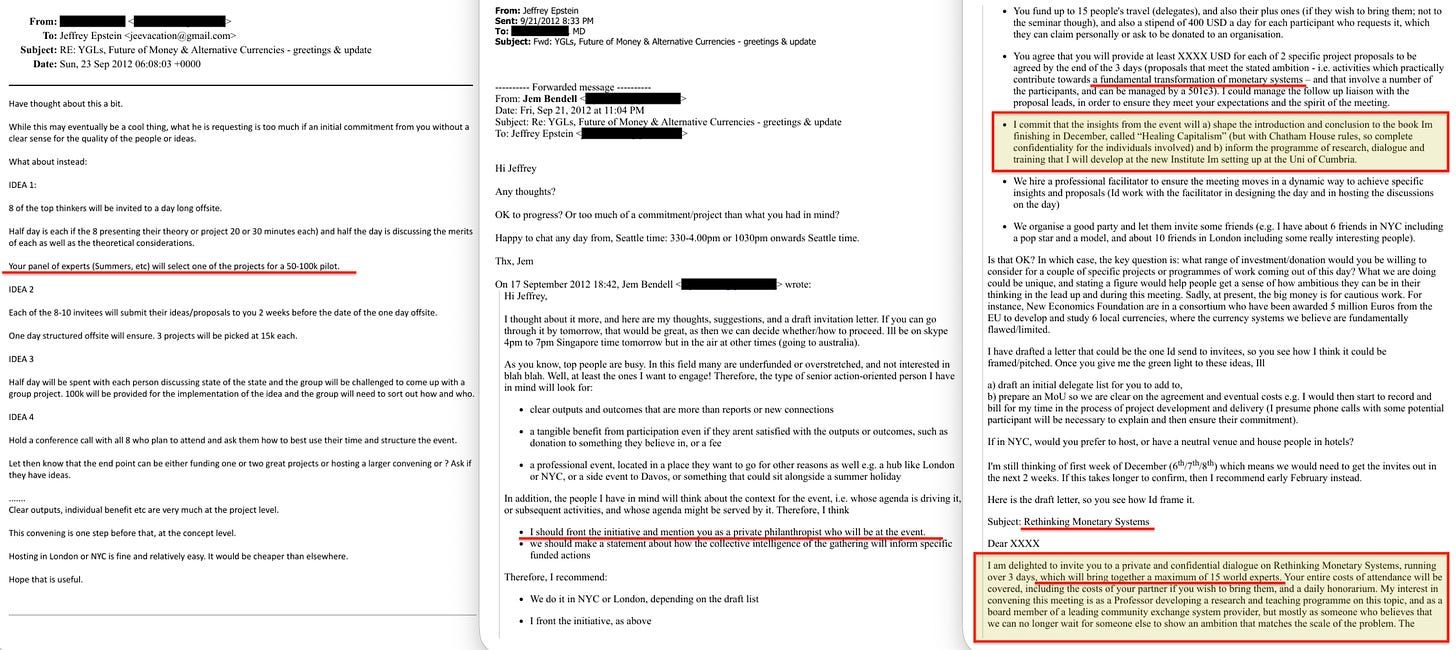

An adviser reviewed the proposal and suggested refinements: ‘Your panel of experts (Summers, etc) will select one of the projects for a 50-100k pilot’12. Larry Summers — former Treasury Secretary, former Harvard President13 — was on Epstein’s panel for selecting monetary transformation projects.

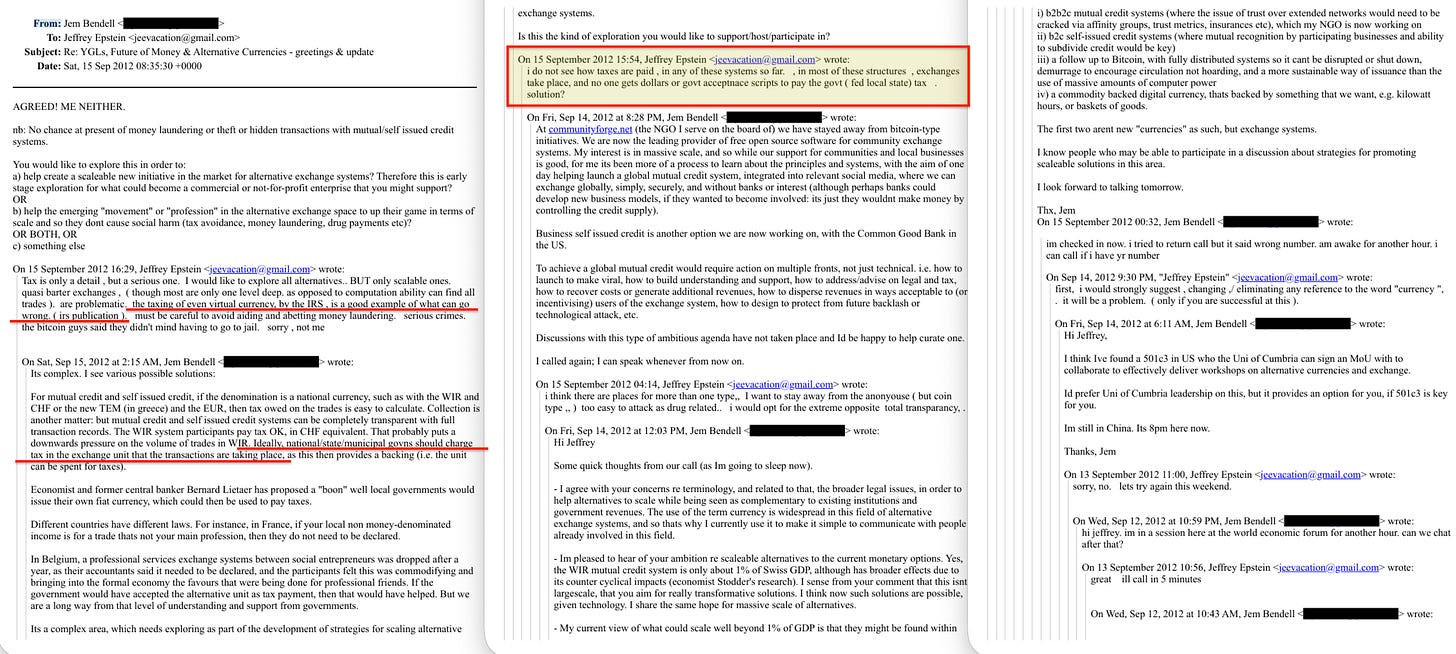

Epstein was not a passive funder. On the same day he agreed to commission Bendell, he challenged him on the central problem with alternative currencies14:

i do not see how taxes are paid, in any of these systems so far. in most of these structures, exchanges take place, and no one gets dollars or govt acceptnace scripts to pay the govt (fed local state) tax. solution?

The question is precise. If you cannot pay taxes in an alternative currency, it remains a parallel system that cannot scale. Governments will not adopt a currency that does not feed their revenue apparatus. Bendell responded with technical detail — the Swiss WIR system, the Greek TEM, Bernard Lietaer’s proposals for government-issued local currencies. ‘Ideally, national/state/municipal govns should charge tax in the exchange unit that the transactions are taking place, as this then provides a backing (i.e. the unit can be spent for taxes)’. A currency backed by tax acceptance is a currency backed by state power.

Epstein asked the question in September 2012. The 'Thoughts on Bitcoin' document — circulating within the network by 2014-2016 — answered it15. The Summers specification operationalised the answer in 2016. The sovereign pitches sold the finished product in 2017. A single technical problem — how to integrate alternative currencies with state revenue — traced across five years of documented correspondence, from question to solution to sales pitch.

The Strategic Framework

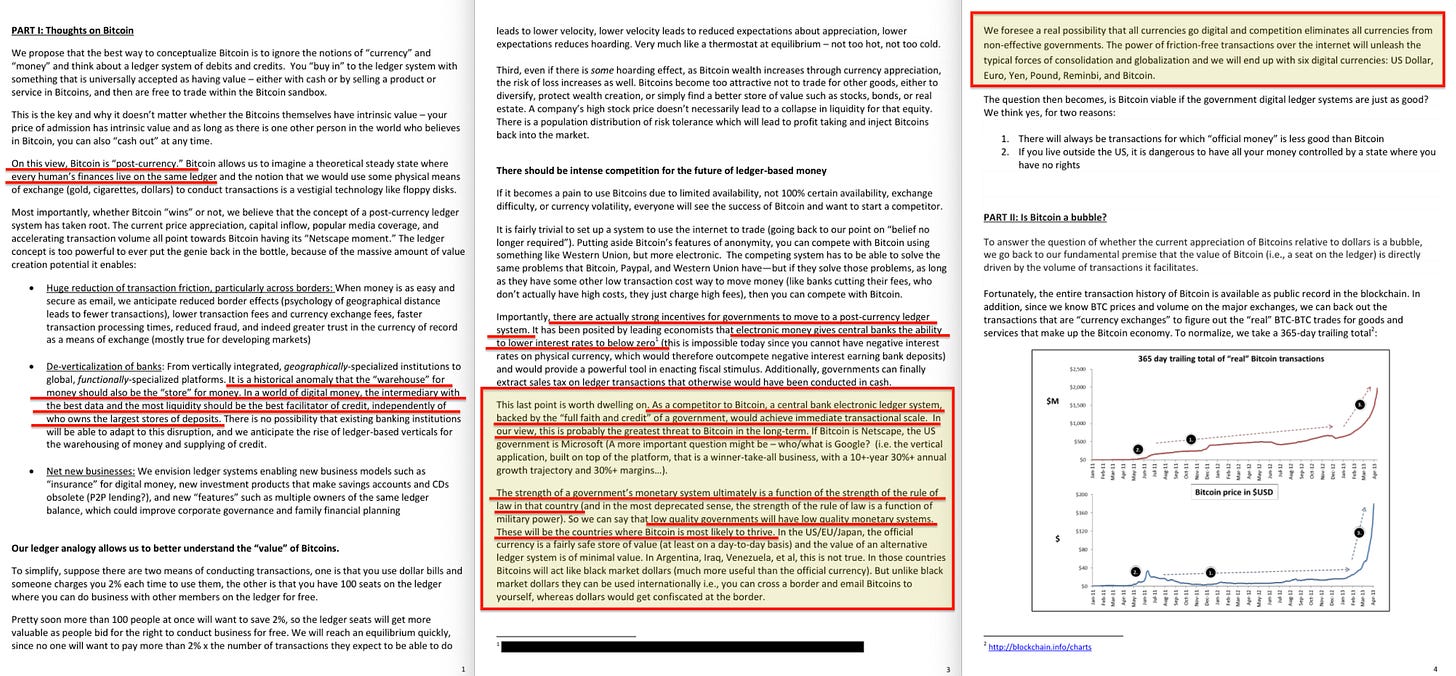

The ‘Thoughts on Bitcoin‘ document argued that Bitcoin should be understood as ‘post-currency’: a universal ledger system rather than money16. The real opportunity lay in restructuring banking itself. ‘It is a historical anomaly that the ‘warehouse’ for money should also be the ‘store’ for money’, it read. ‘In a world of digital money, the intermediary with the best data and the most liquidity should be the best facilitator of credit, independently of who owns the largest stores of deposits. There is no possibility that existing banking institutions will be able to adapt to this disruption’.

This is what the Positive Money movement had been advocating as democratic reform. The document reframed it as a commercial opportunity.

The analysis was explicit about why governments would adopt digital currency. ‘Electronic money gives central banks the ability to lower interest rates to below zero’ — impossible with physical cash, since people would simply hold notes rather than accept negative returns on deposits. ‘Additionally, governments can finally extract sales tax on ledger transactions that otherwise would have been conducted in cash’.

Negative interest rates and total transaction surveillance: the document framed these as irresistible incentives for states.

A central bank electronic ledger system, backed by the ‘full faith and credit’ of a government would outcompete Bitcoin through ‘immediate transactional scale’. ‘If Bitcoin is Netscape, the US government is Microsoft’. The document asked who would be ‘Google’ — ‘the vertical application, built on top of the platform, that is a winner-take-all business’.

The geopolitical implications were stated plainly.

The strength of a government’s monetary system ultimately is a function of the strength of the rule of law in that country (and in the most deprecated sense, the strength of the rule of law is a function of military power).

Weak states would lose their currencies entirely.

We foresee a real possibility that all currencies go digital and competition eliminates all currencies from non-effective governments. The power of friction-free transactions over the Internet will unleash the typical forces of consolidation and globalization and we will end up with six digital currencies: US Dollar, Euro, Yen, Pound, Renminbi, and Bitcoin.

This was a sales prospectus, and central bank digital currency was the product.

The pitch to governments: negative interest rates, full tax surveillance, the elimination of intermediary banks, and — for the strongest states — the absorption of weaker currencies. The pitch to private investors: whoever builds the ‘Google’ layer on top of the sovereign platform wins a monopoly.

The Deployment Logic

The ‘Thoughts on Bitcoin’ document gave governments the hard incentive: negative interest rates, total tax surveillance, the elimination of banking intermediaries. But governments do not sell surveillance to their populations as surveillance. The operation needed a second layer — a reason to build the infrastructure that no reasonable person could oppose.

The Bendell commission provided it17. His stated objective for the 2012 convening was ‘new monetary or exchange systems that promote sustainable development’. Sustainable development was already the organising framework of the United Nations system, and three years later, the General Assembly adopted the seventeen Sustainable Development Goals — end poverty, clean water, gender equality, climate action — a set of objectives no decent person could oppose. Once adopted, the SDGs became the classification criteria against which compliance could be measured.

A programmable currency that restricts transactions to SDG-compliant purposes. Bendell was connecting programmable currency to the framework that would define what the currency permits.

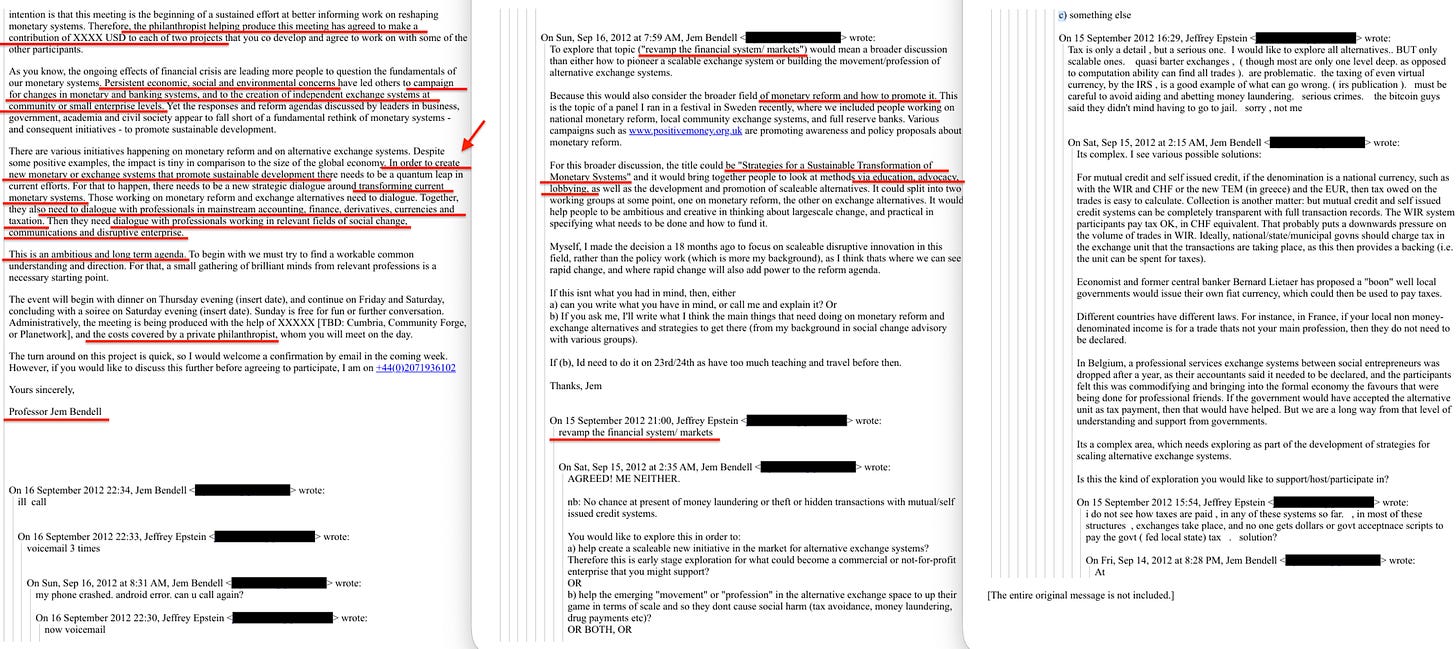

In April 2013, the concept advanced. Epstein emailed Richard Branson18:

… creating a new social good currency, (similar to the creation of airline mile awards, special drawing rights etc) would be the most dispruptive of all advances. The financial system has outgrown its purpose.

Branson replied within two days19: ‘Would love to explore this’.

Airline miles are loyalty-point currencies with conditional redemption — you can spend them, but only on what the issuer permits. Epstein described a programmable currency with conditional payment logic, branded as a ‘social good’.

The BIS Innovation Hub now calls this ‘purpose-bound money’2021.

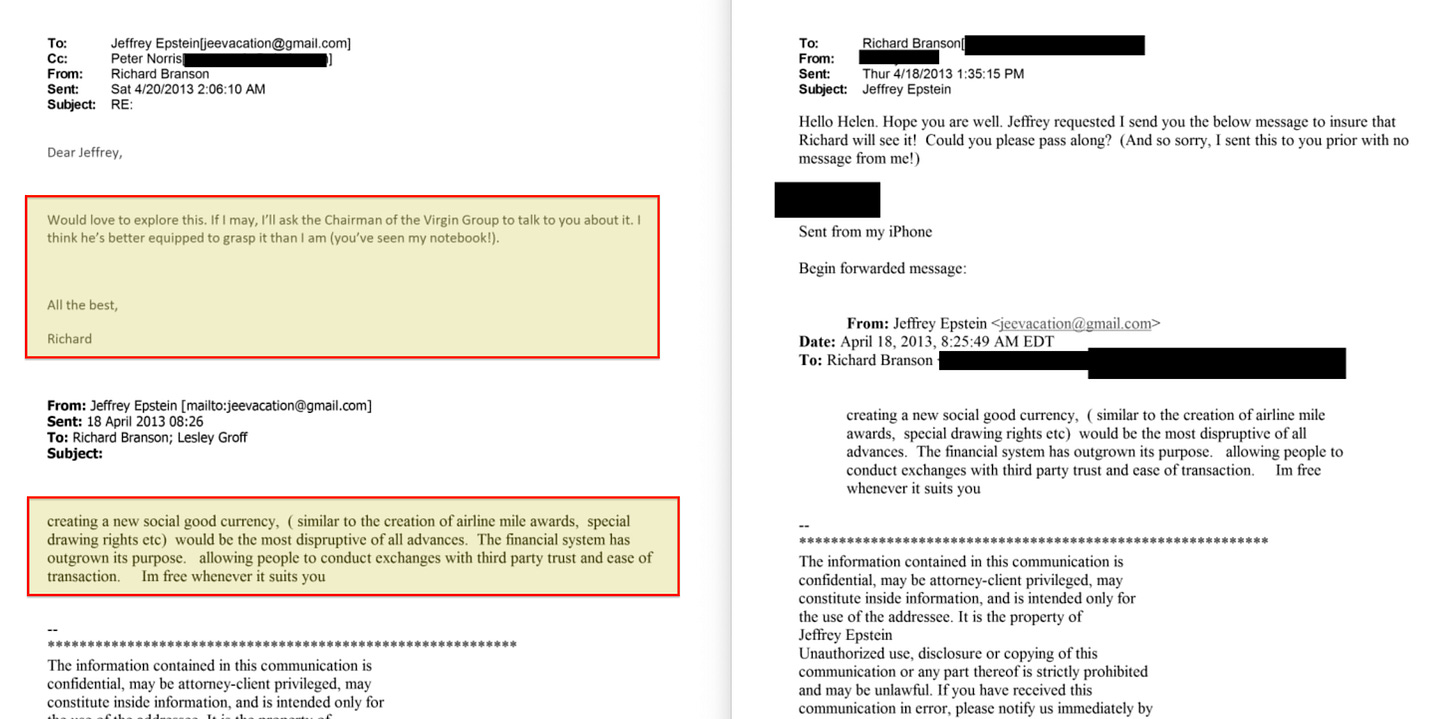

As documented in ‘Epstein’, Epstein had spent 2011 designing the impact investing vehicle with JPMorgan in which capital flows toward measurable social outcomes. In March 2013, weeks before the Branson email, he sent Boris Nikolic a strategic memo listing the components22: ‘DAF, estate, structured giving, (a days discussion) partnered giving, social good bonds. (new uk concept), govt approved special gates bonds?’ He was tracking the UK’s pioneering social impact bond programme and proposing a government-endorsed bond instrument branded to Gates.

Impact investing conditions the fund. Social good bonds condition the instrument. Purpose-bound money conditions the transaction. The same conditionality — compliance with externally defined social objectives — operating at every scale from sovereign bond issuance down to what an individual can purchase.

And the SDGs provide the definition of ‘social good’ at each level.

The network was building the entire stack simultaneously.

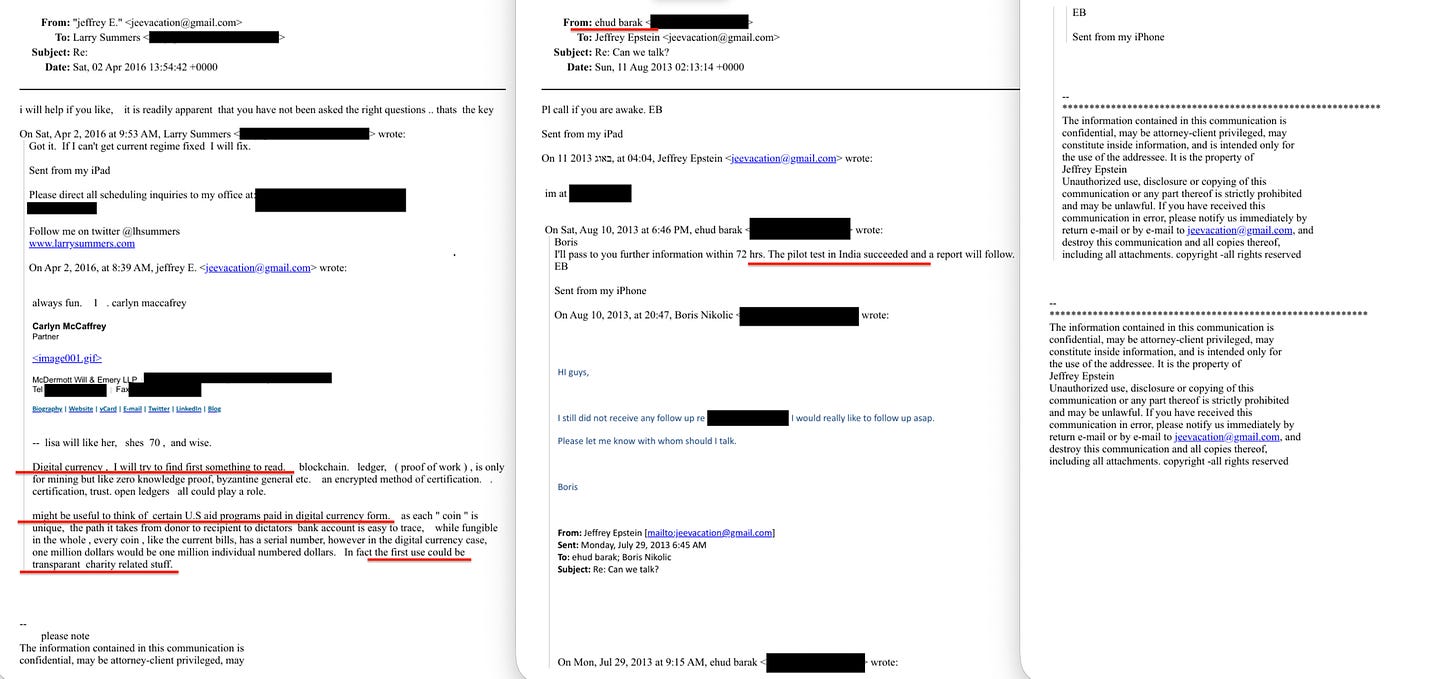

Three years later, in April 2016, Epstein sent Summers the tokenisation specification and made the deployment strategy explicit. Each digital coin would carry a unique serial number. Every transaction would be traceable from issuance to endpoint. And the entry vector23: ‘the first use could be transparant charity related stuff’.

Aid disbursement, development finance, philanthropic grants — contexts where full traceability is framed as accountability rather than surveillance: charity is the door. Once the infrastructure exists for charitable transactions, extending it to all transactions is straightforward as the ethical justification — transparency, accountability, social good — has already been established.

This is the sequence the documents reveal: sustainable development as the ethical framework (Bendell, 2012), social good currency as the product concept (Branson, 2013), transparent charity as the first use case (Summers, 2016). Each step made the surveillance architecture more palatable by wrapping it in language that made opposition appear unreasonable, and ‘unethical’.

On August 10, 2013 — two weeks before the September summit documented in ‘Epstein’ — Barak emailed Nikolic through Epstein reporting that ‘the pilot test in India succeeded and a report will follow’24. Aadhaar, the world’s largest biometric-financial identity system was being piloted in India at the time, and the Gates Foundation was funding its integration with financial transactions2526.

The Sovereign Pitch

Epstein shopped this product to multiple nations simultaneously.

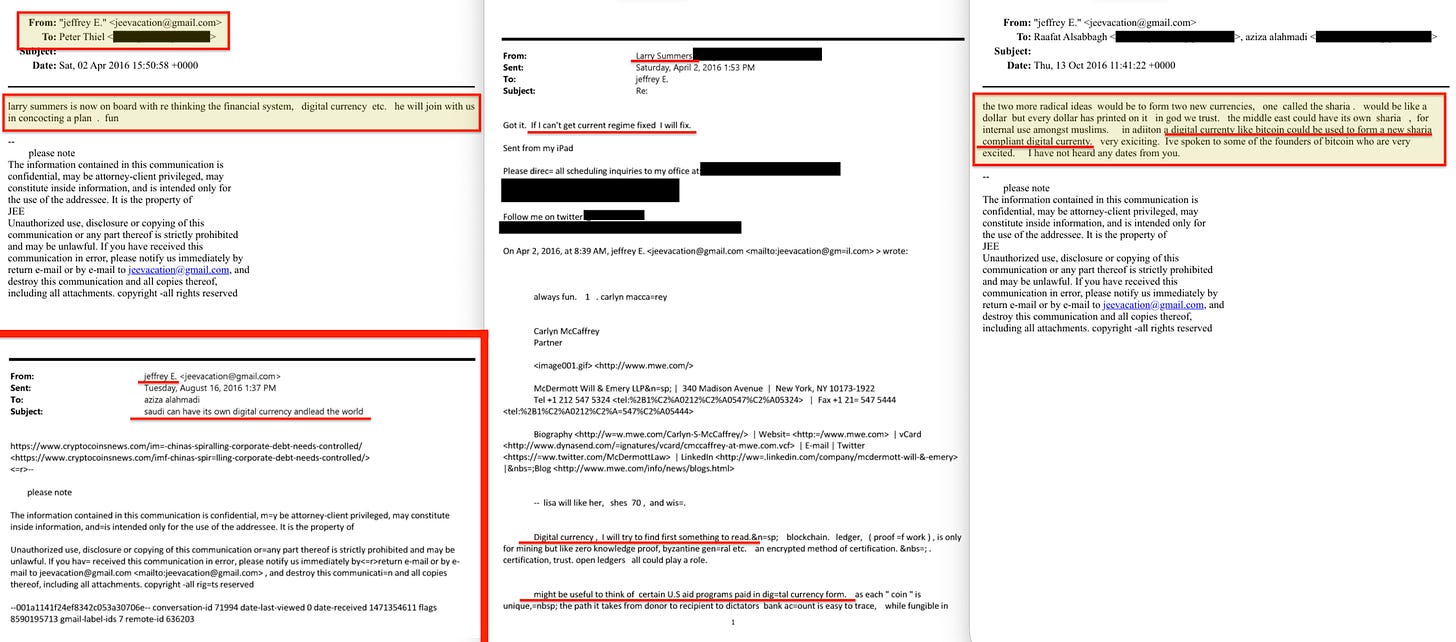

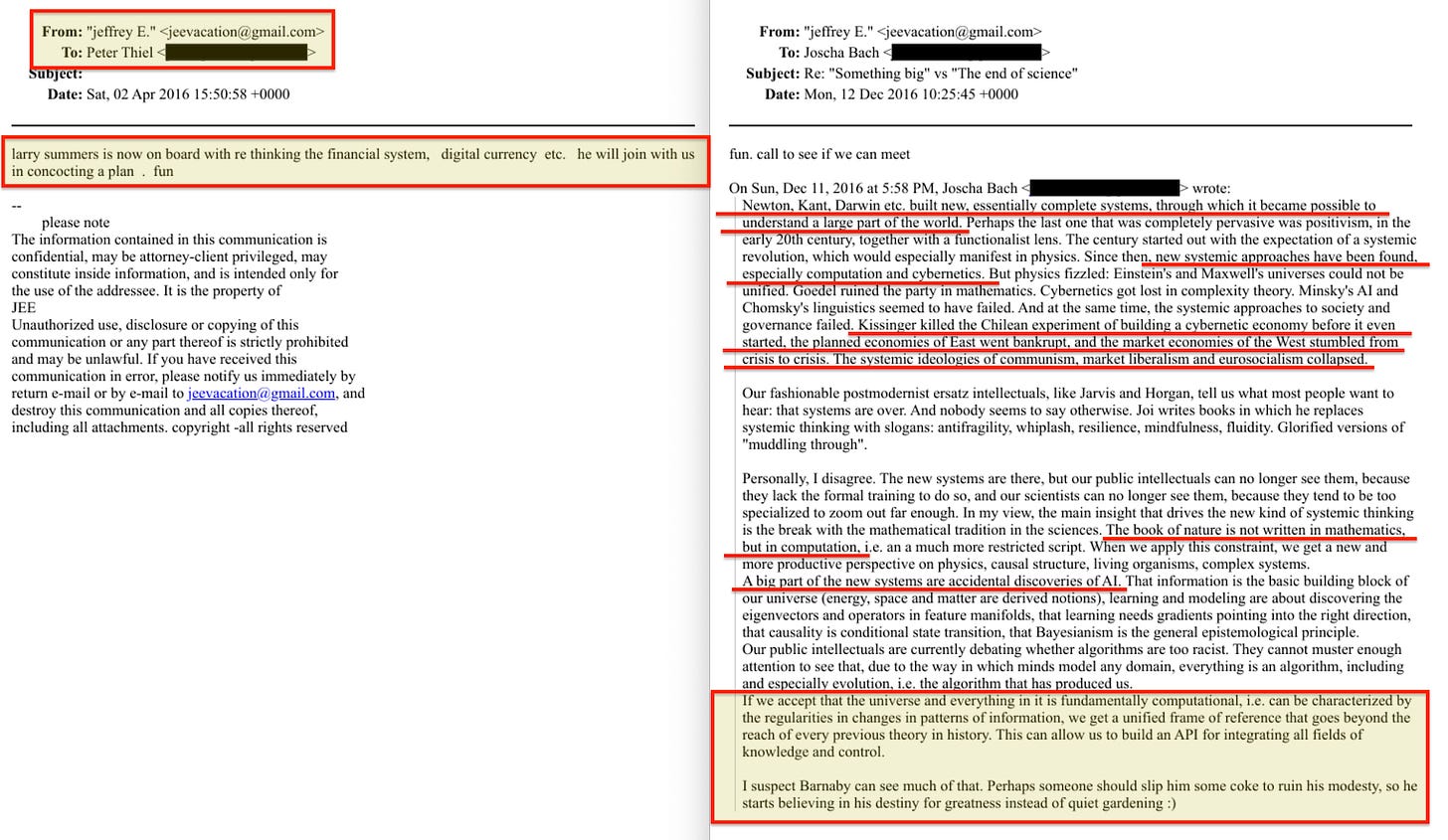

On 2 April 2016, he emailed Peter Thiel27: ‘larry summers is now on board with re thinking the financial system, digital currency etc. he will join with us in concocting a plan. fun’. Two weeks later, he sent Summers a detailed specification for tokenised digital currency. Summers replied within hours28: ‘Got it. If I can't get current regime fixed I will fix’.

In August 2016, Epstein emailed a Saudi contact29: ‘saudi can have its own digital currency and lead the world’. By October, he had elaborated the proposal into two currencies: a physical ‘Sharia’ currency for internal Muslim use and a Sharia-compliant digital currency modelled on Bitcoin’s architecture. ‘I have spoken to some of the founders of Bitcoin who are very excited’, he wrote30. The concept integrated Islamic finance principles with programmable money.

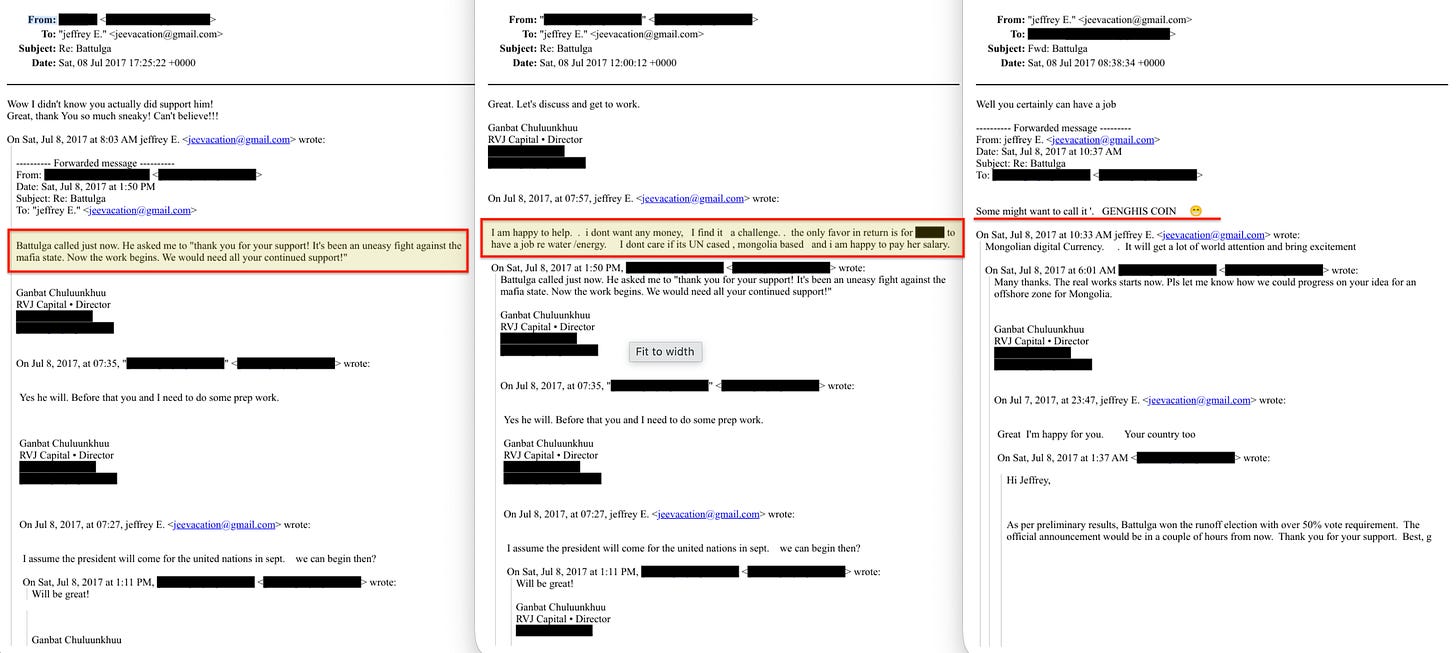

In July 2017, Khaltmaagiin Battulga won the Mongolian presidential election31. Ganbat Chuluunkhuu, a director at RVJ Capital, messaged Epstein with the results32: ‘Battulga called just now. He asked me to ‘thank you for your support! It’s been an uneasy fight against the mafia state. Now the work begins. We would need all your continued support!’

Epstein replied33: ‘I am happy to help. . i dont want any money, I find it a challenge. . the only favor in return is for [redacted] to have a job re water /energy. I dont care if its UN based, mongolia based and i am happy to pay her salary’. He would work for free — in exchange for placing someone in Mongolia’s government or at the United Nations.

Then, immediately34: ‘Mongolian digital Currency. . It will get a lot of world attention and bring excitement’. He suggested a name: ‘Some might want to call it GENGHIS COIN’.

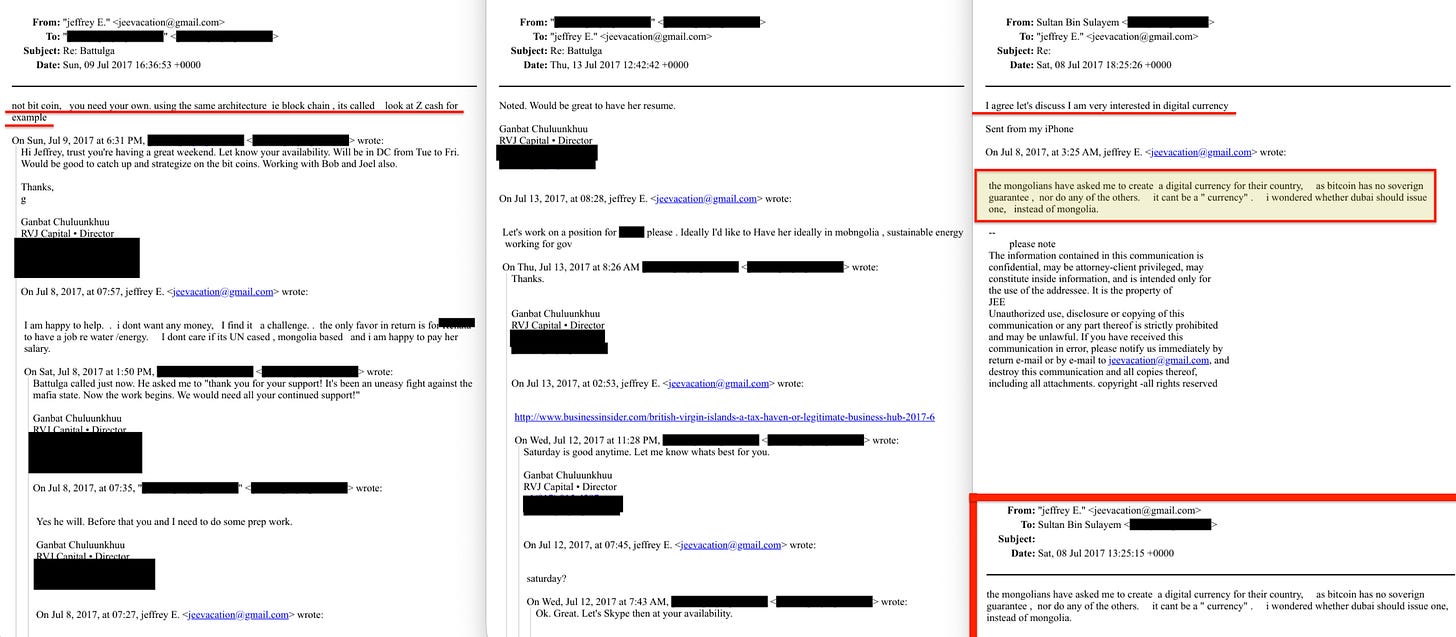

Over the following days, Epstein educated Ganbat on the technical architecture. ‘Not bit coin, you need your own. using the same architecture ie block chain... look at Z cash for example’35. The core argument36: ‘if mongolia would issue a new coin it would be the first real currency.... as a real currency MUST be backed by a sovereign’. He proposed beginning when the president arrived for the UN General Assembly in September — the same session where Miroslav Lajčák, a diplomat in regular correspondence with Epstein, was serving as President.

The same week, Epstein told Sultan Bin Sulayem — Chairman of DP World, one of the largest port and logistics operators in the world — that Mongolia had asked him to create their digital currency, then suggested Dubai should do it instead. ‘Bitcoin has no sovereign guarantee, nor do any of the others. it cant be a ‘currency’’37. Bin Sulayem replied the same day38: ‘I agree let’s discuss I am very interested in digital currency’. Within three days, he was volunteering DP World — eighty per cent owned by the Dubai government — as the issuance vehicle and telling Epstein he would bring the proposal to Sheikh Mohammed bin Rashid Al Maktoum, the Ruler of Dubai.

The framing across all the pitches was identical: decentralised cryptocurrency lacks sovereign backing and cannot function as real currency; state-issued digital currency solves this; whoever moves first sets the standard. The argument the Bank for International Settlements has made in every report since 2018 distinguishing central bank digital currencies from private cryptocurrencies — Epstein was making it two years before the BIS Innovation Hub existed.

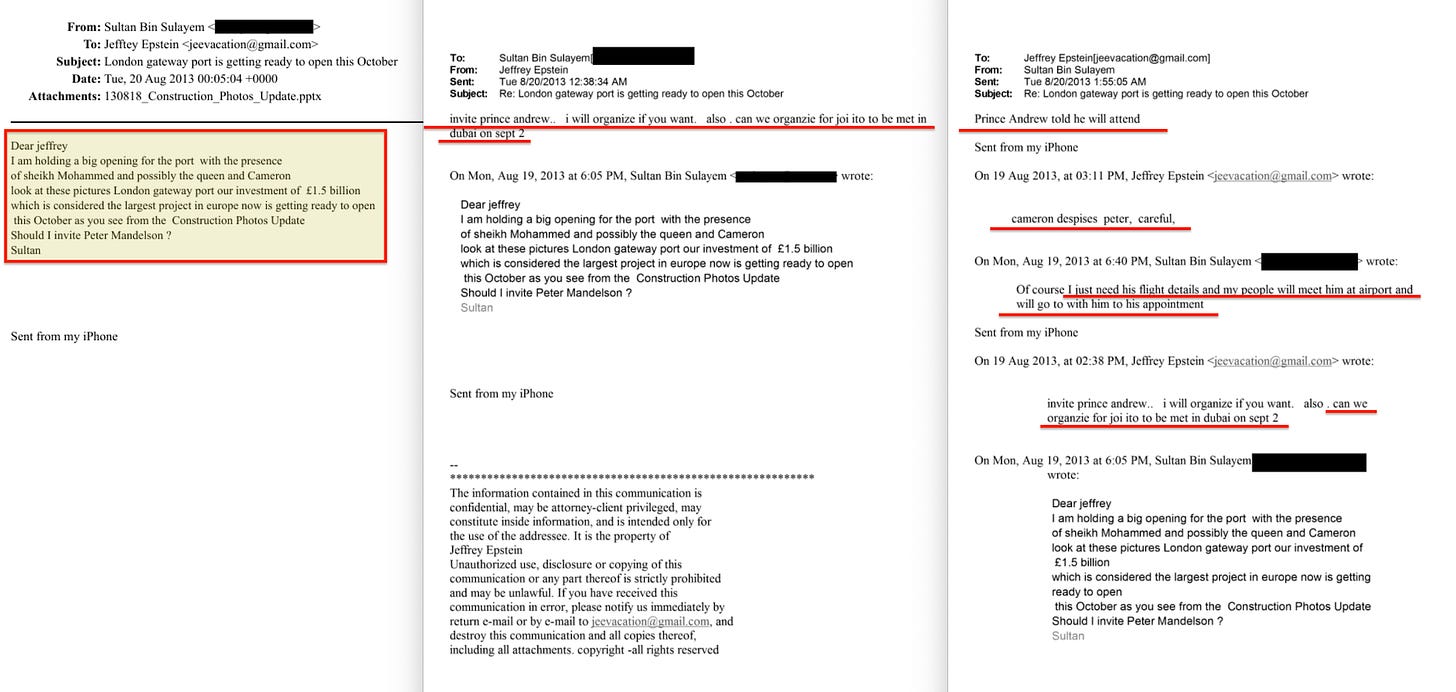

The sovereign deployment targets were being prepared years before the formal pitches. On August 19, 2013 — nine days after the India pilot success report — Bin Sulayem emailed Epstein about the opening of London Gateway, DP World’s £1.5 billion port: ‘I am holding a big opening for the port with the presence of sheikh Mohammed and possibly the queen and Cameron... Should I invite Peter Mandelson?’39 Epstein replied with two deployments in a single sentence: ‘invite prince andrew.. i will organize if you want. also. can we organize for joi ito to be met in dubai on sept 2’.

He warned Bin Sulayem off Mandelson — ‘cameron despises peter, careful’40 — and replaced him with the British royal and the man who would build the Federal Reserve’s CBDC prototype. Prince Andrew was confirmed within hours. The code builder was being connected to the sovereign deployment target three weeks before the September 2013 summit, through the same channel that was simultaneously dispatching a member of the British royal family as a deliverable.

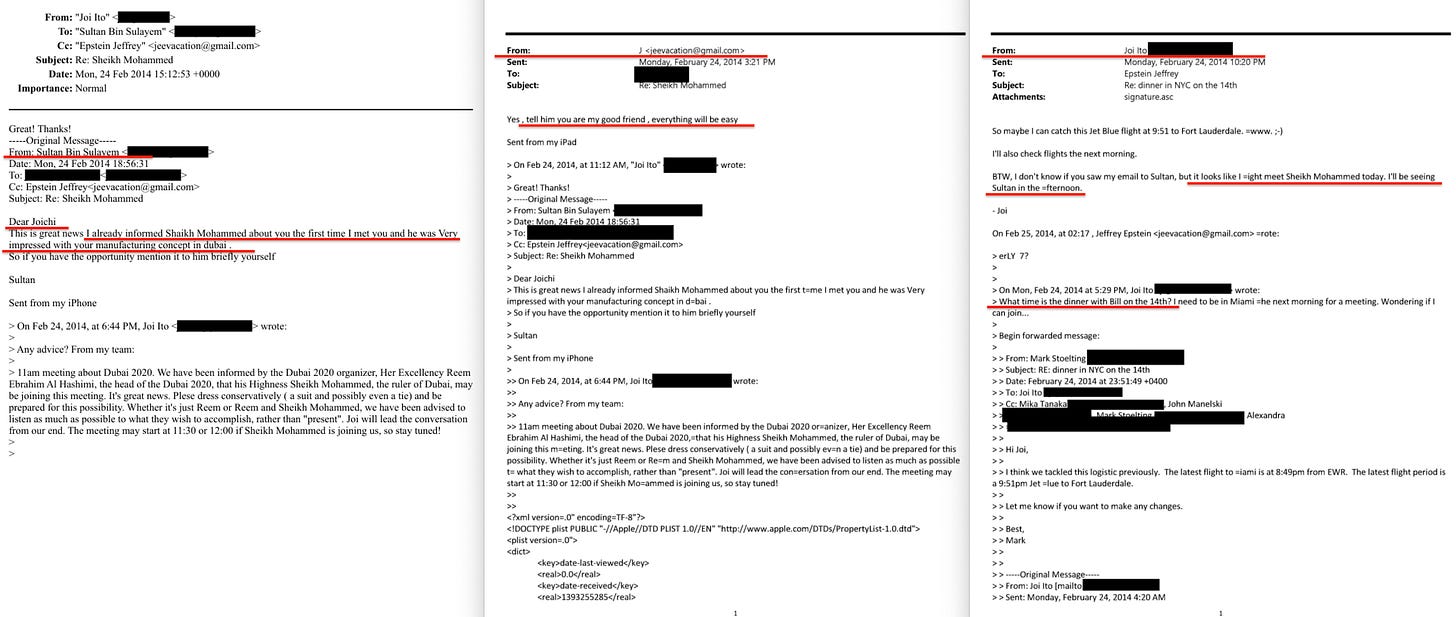

Six months later, the introduction bore results. On February 24, 2014, Bin Sulayem emailed Joi Ito, cc: Epstein, reporting that he had already told Sheikh Mohammed about Ito’s ‘manufacturing concept in Dubai’ and that the ruler was ‘Very impressed’41. Ito asked Bin Sulayem for advice before the meeting. Epstein, from above: ‘Yes, tell him you are my good friend, everything will be easy’42. That evening, Ito reported back to Epstein43: ‘it looks like I might meet Sheikh Mohammed today. I’ll be seeing Sultan in the afternoon’. In the same thread, he asked: ‘What time is the dinner with Bill on the 14th?’ The code builder, the sovereign client, and the technology-identity funder — all routed through the switchboard on a single day.

The sovereign pitches were accompanied by direct engagement with the US government apparatus.

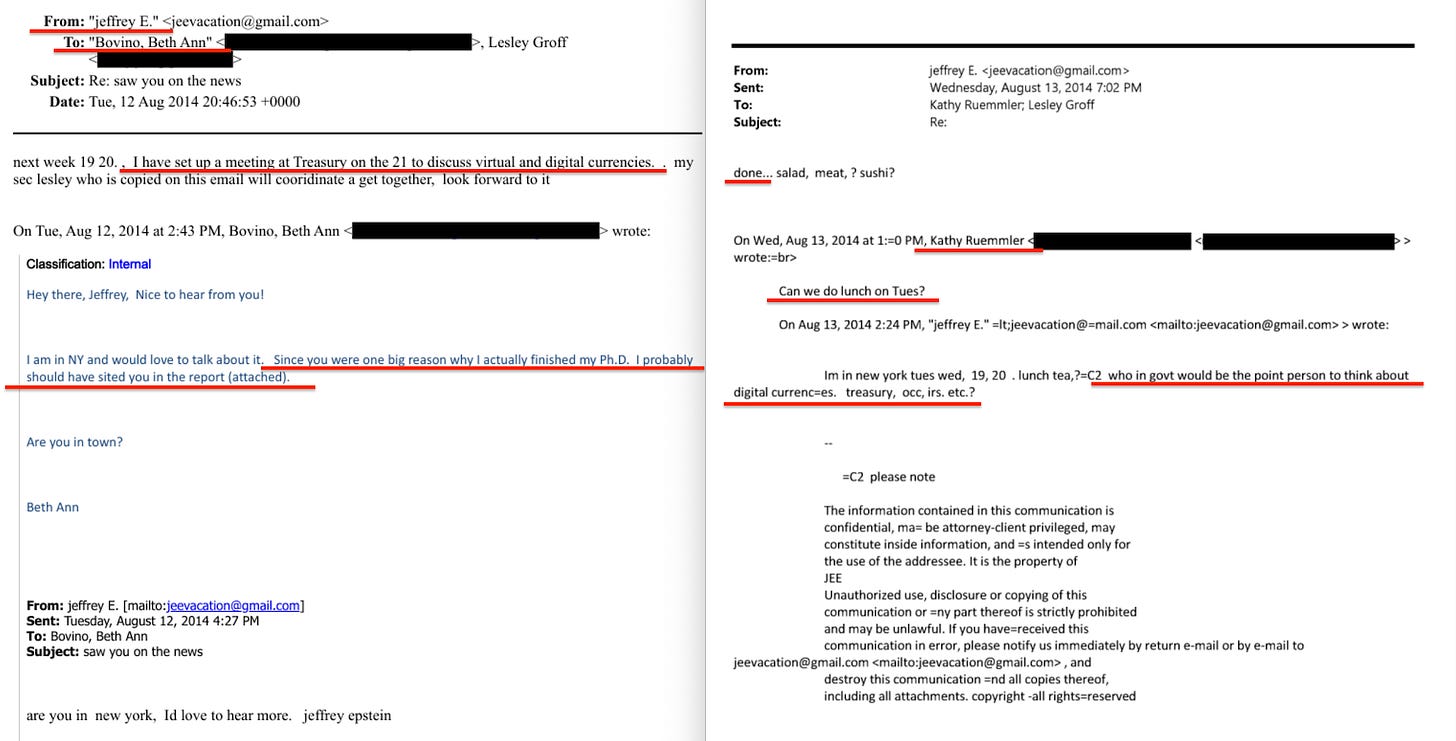

On 12 August 2014, Epstein told Beth Ann Bovino — an economist whose PhD he had funded, now chief US economist at S&P Global — that he had ‘set up a meeting at Treasury on the 21 to discuss virtual and digital currencies’44. The next day, he emailed Kathryn Ruemmler — Obama’s White House Counsel until three months earlier — asking ‘who in govt would be the point person to think about digital currencies. treasury, occ, irs, etc.?’45 Ruemmler replied: ‘Can we do lunch on Tues?’.

Epstein was using the former White House Counsel to expand access to the Office of the Comptroller of the Currency and the Internal Revenue Service.

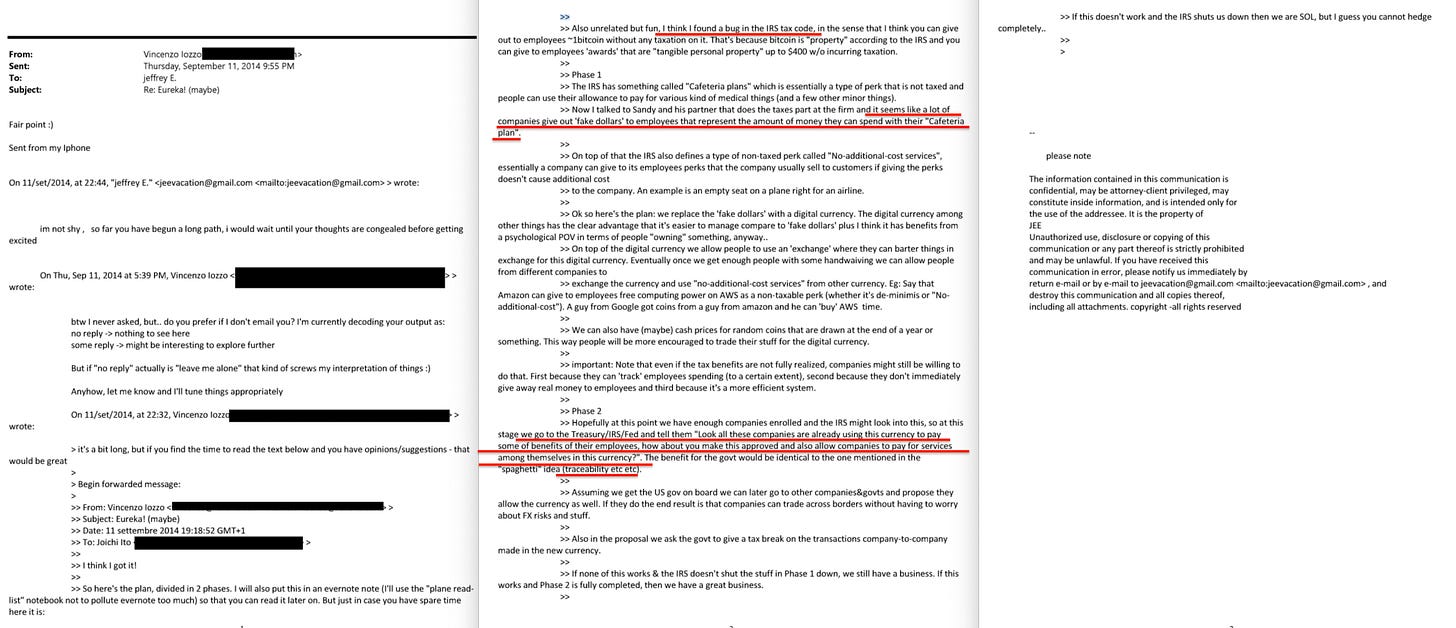

A month later, in September 2014, Vincenzo Iozzo sent Joi Ito a detailed two-phase plan — copied to Epstein — for building a traceable digital currency. Phase 1 would replace corporate ‘fake dollars’ with a digital currency46, build an exchange for employees to barter, then expand to cross-company trading. Phase 2 would leverage adoption to approach regulators: ‘we go to the Treasury/IRS/Fed and tell them ‘Look all these companies are already using this currency to pay some of benefits of their employees, how about you make this approved’’. The explicit benefit to government: ‘traceability etc etc’.

The strategy was to create adoption first, then present regulators with a fait accompli — the same pattern that would later define the cryptocurrency industry’s relationship with the SEC.

The Build Team

A year after the sovereign pitches, Austin Hill — co-founder of Blockstream, one of the most influential Bitcoin infrastructure companies — was assembling a team to build one of them.

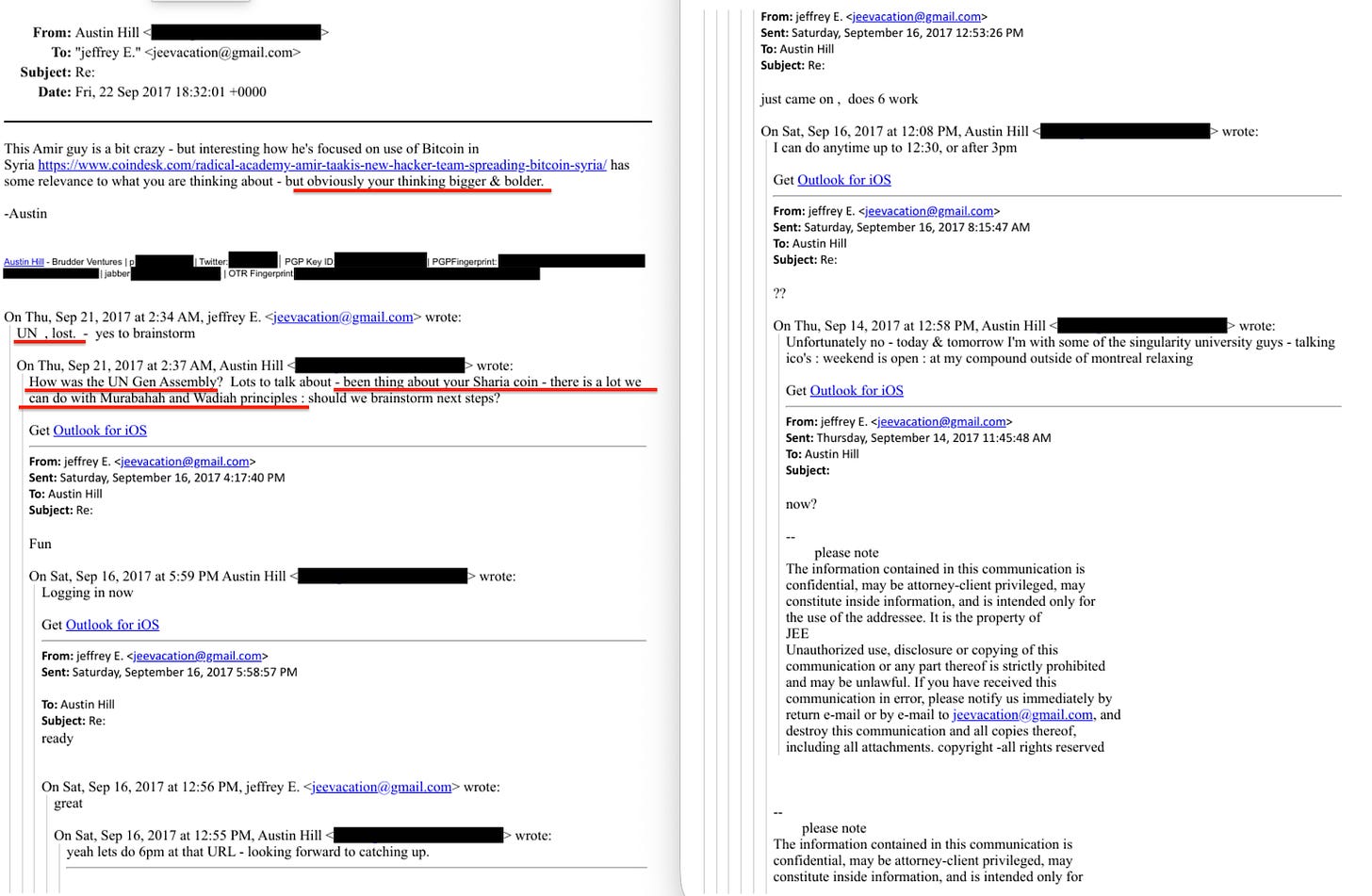

‘Lots to talk about - been [thinking] about your Sharia coin’, Hill wrote to Epstein in September 2017. ‘There is a lot we can do with Murabahah and Wadiah principles: should we brainstorm next steps?’47 Murabahah is cost-plus financing48; Wadiah is safekeeping49. Hill was translating Islamic finance requirements into cryptocurrency architecture.

The exchange followed Epstein’s return from the UN General Assembly. ‘How was the UN Gen Assembly?’ Hill asked. ‘UN, lost’, Epstein replied50, then agreed to brainstorm. Over the following weeks, they held video calls and Hill shared materials on Bitcoin use in Syria. ‘Obviously your thinking bigger & bolder’, Hill observed51.

By October, Hill was ready to move forward. ‘Putting a team together to help you build & concept your sharia coin if your still serious’, he wrote52. ‘Do I fly to you? Or do you want to visit Montréal and meet the team?’53

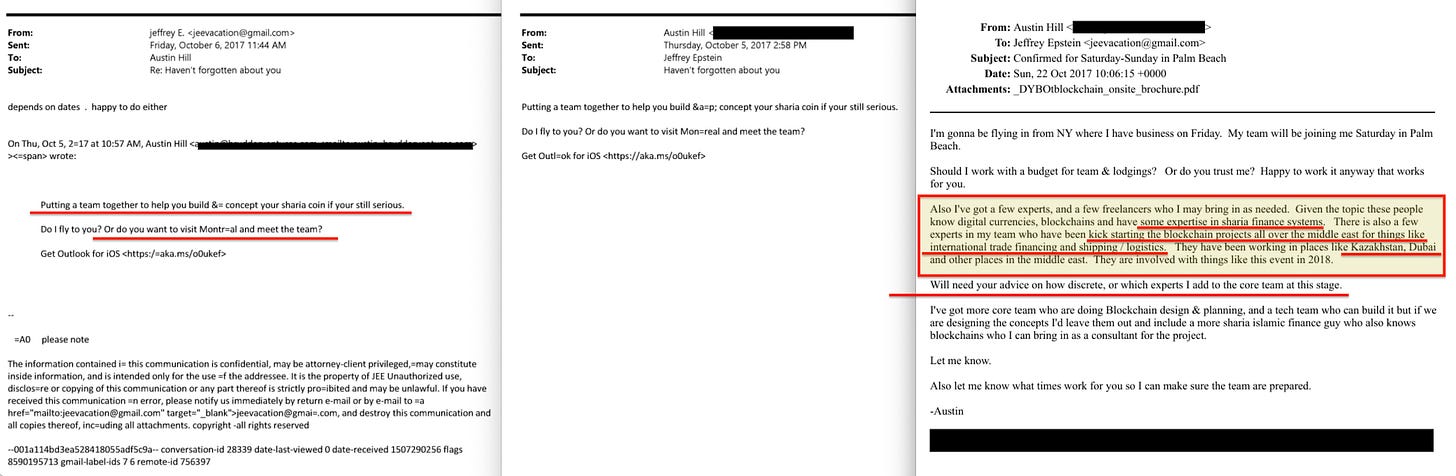

On 22 October, Hill confirmed a Palm Beach meeting and described the team54.

Given the topic these people know digital currencies, blockchains and have some expertise in sharia finance systems. There is also a few experts in my team who have been kick starting the blockchain projects all over the middle east for things like international trade financing and shipping / logistics. They have been working in places like Kazakhstan, Dubai and other places in the middle east.

The same Dubai where Epstein had pitched Bin Sulayem three months earlier. Hill asked for guidance on operational security55: ‘Will need your advice on how discrete, or which experts I add to the core team at this stage’.

Hill had teams already deploying blockchain infrastructure across the Gulf. Epstein was plugging into an existing operational network.

The Behavioural Layer

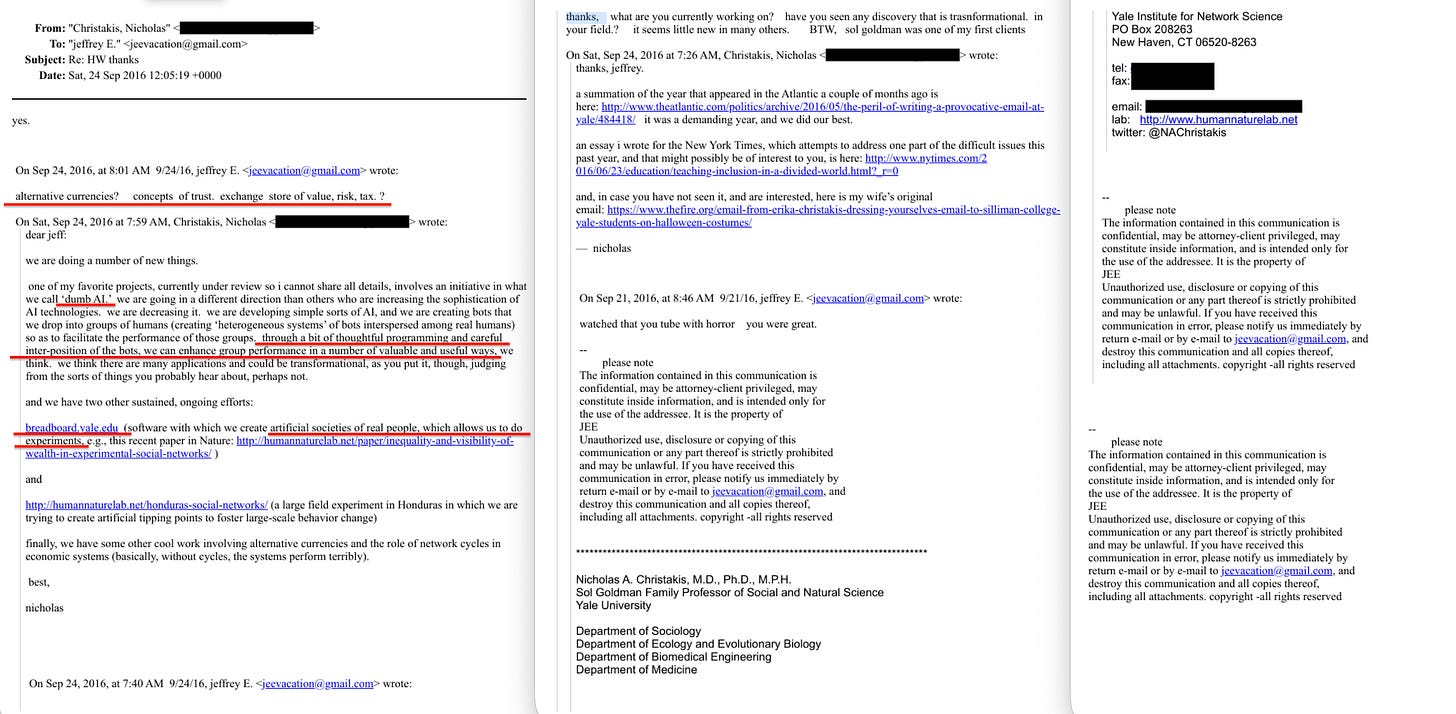

In September 2016, Epstein posed questions to Nicholas Christakis, the Yale network scientist56: ‘alternative currencies? concepts of trust. exchange store of value, risk, tax.?’

Epstein asked about currencies. Christakis described something different. He outlined his research on ‘dumb AI’57 — simple bots inserted into human groups to ‘facilitate the performance of those groups’. Through ‘a bit of thoughtful programming and careful inter-position of the bots, we can enhance group performance in a number of valuable and useful ways’. He also mentioned ‘breadboard.yale.edu’, software for creating ‘artificial societies of real people, which allows us to do experiments’.

The exchange is revealing because of the mismatch. Epstein posed a question about monetary architecture — trust, exchange, taxation. Christakis answered with behavioural infrastructure: algorithmic agents shaping group behaviour, synthetic environments for testing social responses. These are the components that sit underneath a programmable currency — the systems that model how populations respond to conditional incentives, how trust can be engineered rather than earned, how compliance can be shaped before it is enforced.

The ‘Thoughts on Bitcoin’ document provided the strategic framework, the sovereign pitches provided the clients, and the Austin Hill team provided the builders. Christakis described the behavioural modelling that would make the system work on populations rather than merely on ledgers.

Each conversation added a layer to the same architecture.

The Positions

The network that developed the architecture now occupies the positions from which it can be implemented.

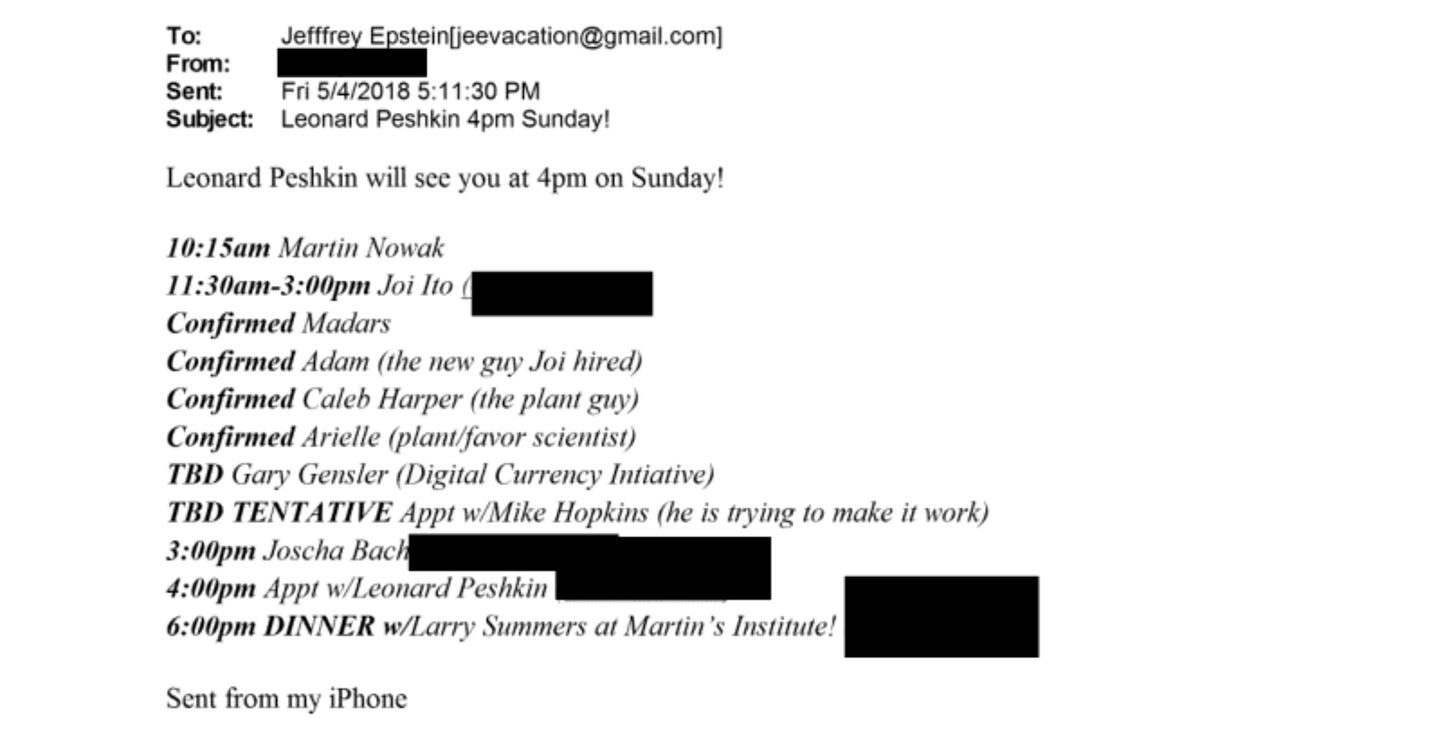

Larry Summers was on Epstein’s ‘panel of experts’ selecting monetary transformation projects in 2012, replied ‘I will fix’ to Epstein’s tokenised currency specification in 2016, and hosted dinner with AI and cryptocurrency researchers at Martin Nowak’s Institute in May 2018.

A scheduling document from that Sunday lists the attendees58: Nowak at 10:15am, Joi Ito and researchers including Madars Virza — the Latvian cryptographer whose work on zero-knowledge proofs is foundational to privacy-preserving digital currency verification — from 11:30am to 3pm, Joscha Bach at 3pm, then dinner with Summers at 6pm. In November 2023, Summers joined the board of OpenAI — the company building the AI systems that will classify and govern transactions. He resigned in November 2025 after the Epstein correspondence was released59.

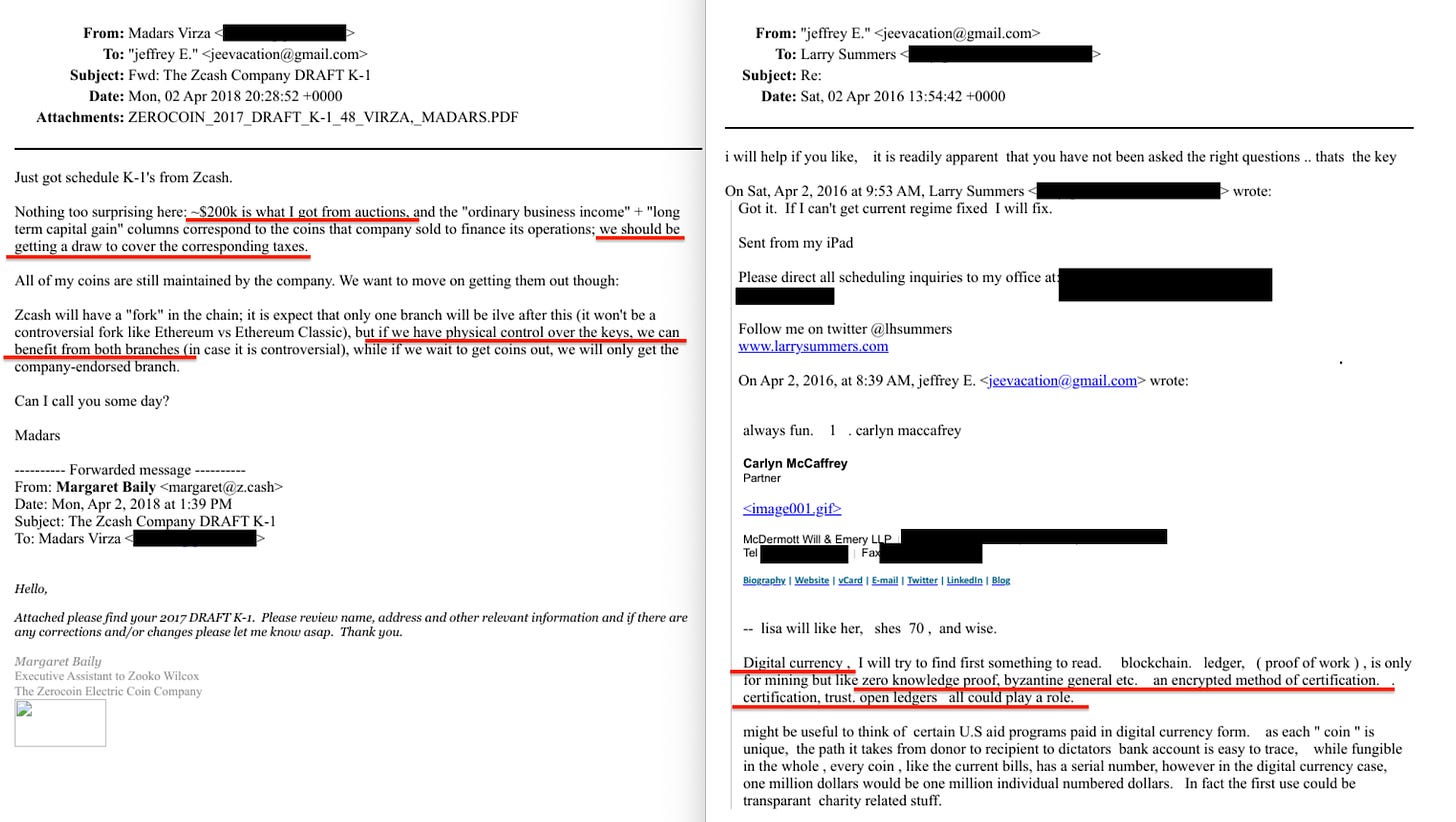

Virza’s relationship with Epstein was not limited to research funding. On 2 April 2018 — one month before that Sunday schedule — Virza forwarded Epstein his draft K-1 tax document from the Zcash Company, reporting approximately $200,000 in income from coin auctions. ‘We should be getting a draw to cover the corresponding taxes’60, Virza wrote, then briefed Epstein on an upcoming Zcash fork and the advantage of extracting coins before it happened: ‘if we have physical control over the keys, we can benefit from both branches’.

The terminology is notable. Virza was reporting to a partner with a direct financial stake in the privacy coin whose cryptographic primitives — zero-knowledge proofs allowing verification without revealing underlying data — are the building blocks of privacy-preserving digital currency infrastructure. Epstein had described the same technology to Summers two years earlier as ‘zero knowledge proof, byzantine general etc. an encrypted method of certification’61.

Gary Gensler was listed as TBD on the same May 2018 schedule, identified by his affiliation with MIT’s Digital Currency Initiative62. In 2021, he became Chairman of the Securities and Exchange Commission63, launching the most aggressive US regulatory campaign against private cryptocurrency, arguing that digital assets without sovereign backing require state oversight. Epstein’s position, delivered to sovereign clients — that digital assets without sovereign backing cannot function as real currency — became SEC enforcement policy under Gensler's chairmanship.

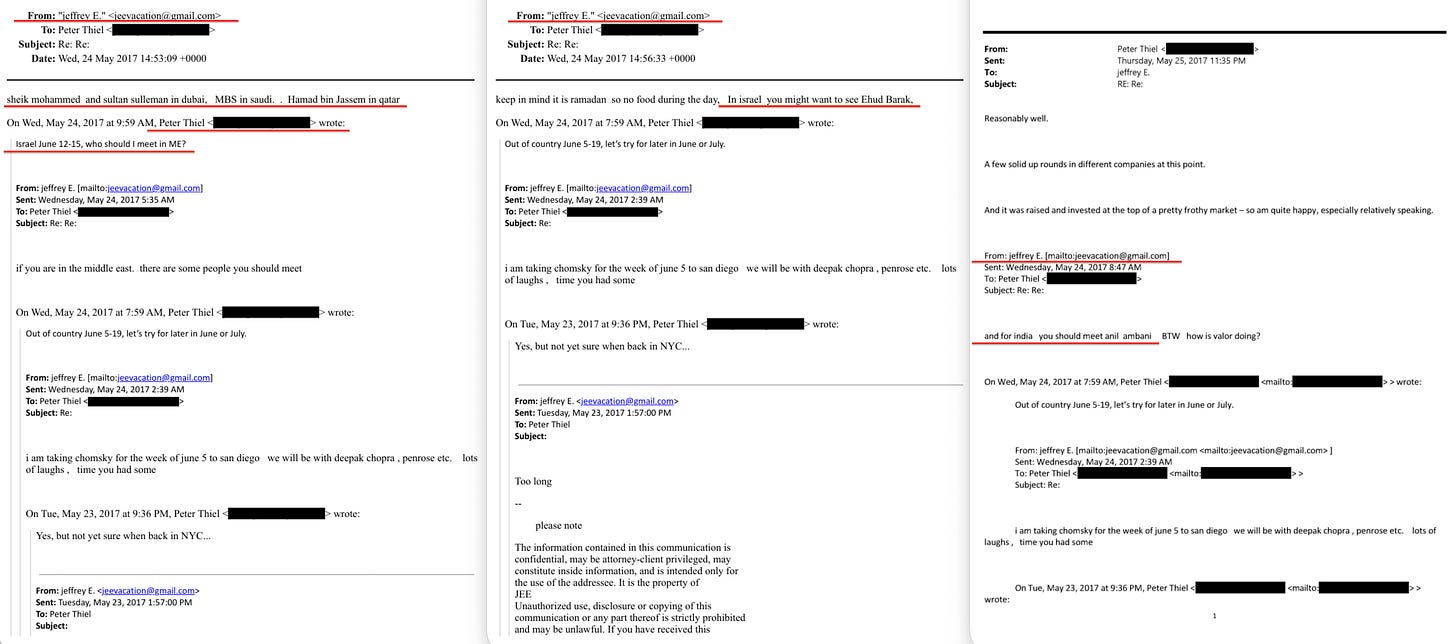

Peter Thiel’s relationship with Epstein began at least by 2012. By April 2016, Epstein was telling him that Summers was ‘on board’ to ‘join with us in concocting a plan’ for digital currency64. In May 2017656667, Thiel told Epstein he would be in Israel June 12-15 and asked: ‘who should I meet in ME?’ Epstein gave him the full sovereign routing: ‘sheik mohammed and sultan sulleman in dubai, MBS in saudi.. Hamad bin Jassem in qatar’. For Israel: ‘you might want to see Ehud Barak’. For India: ‘you should meet anil ambani’.

Five sovereign targets across three continents — the Gulf clients being pitched digital currency, the intelligence coordinator, the Indian industrial dynasty at the centre of the country’s digital transformation. The surveillance infrastructure provider was being routed to every node of the deployment network simultaneously.

In September 2025, the Treasury Department awarded Thiel’s company Palantir a contract to build a ‘common API layer’ for government systems68. In December 2016, Joscha Bach — whose AI research Epstein funded — had described to Epstein what might replace collapsing institutional frameworks: ‘an API for integrating all fields of knowledge and control’69.

The language is identical, and the contract operational.

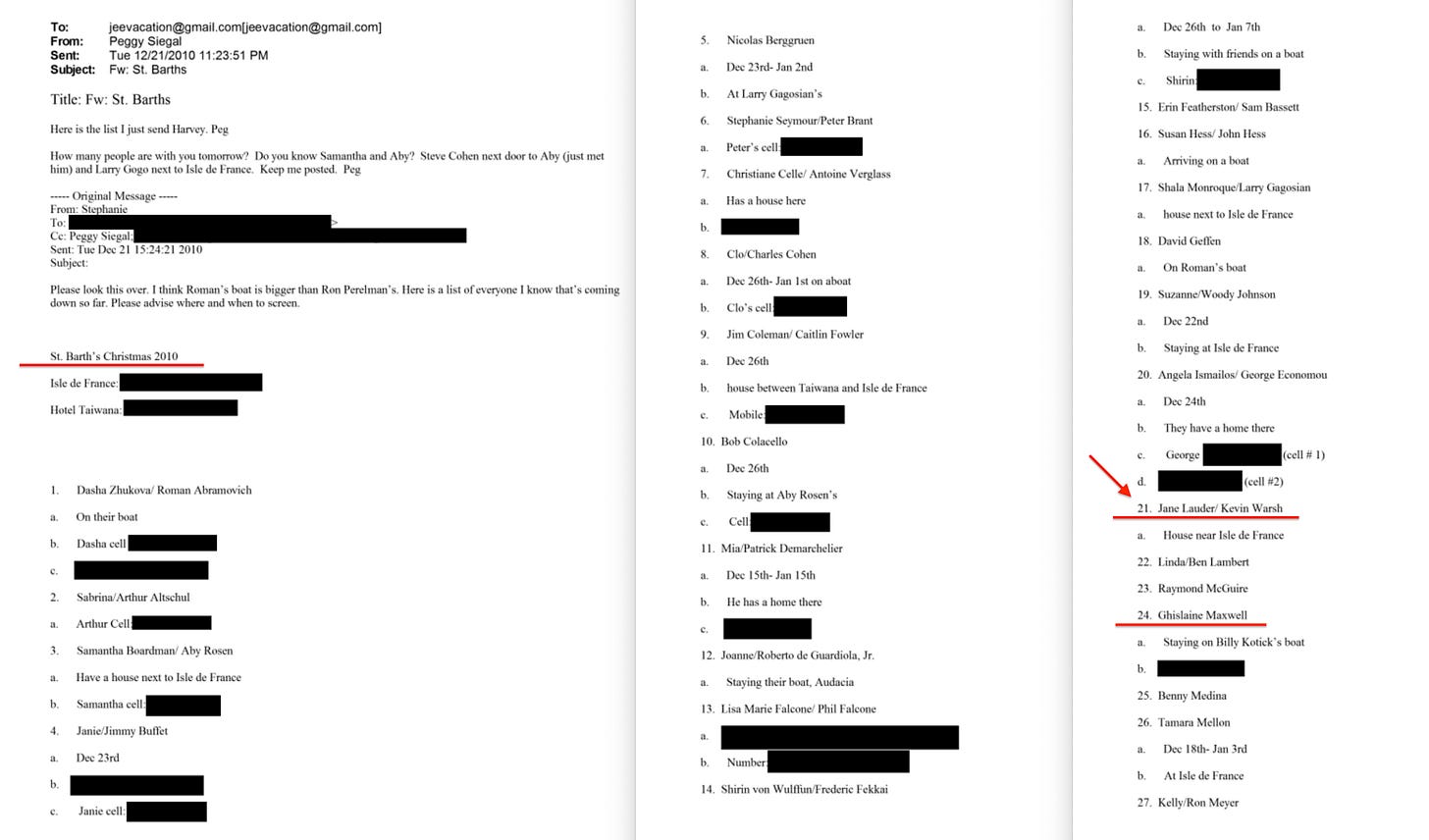

Kevin Warsh — Trump’s nominee for Federal Reserve Chairman70 — appeared on Epstein’s guest list for a 2010 St. Barts Christmas party71. In 2018, Warsh published a Wall Street Journal op-ed proposing a Federal Reserve digital currency, arguing the Fed ‘might prudently consider introducing its own digital currency’72. He has since advocated for a ‘wholesale digital dollar’ to counter China’s digital yuan73.

The person nominated to oversee US monetary policy — including any decision on central bank digital currency — was on Epstein’s party lists74.

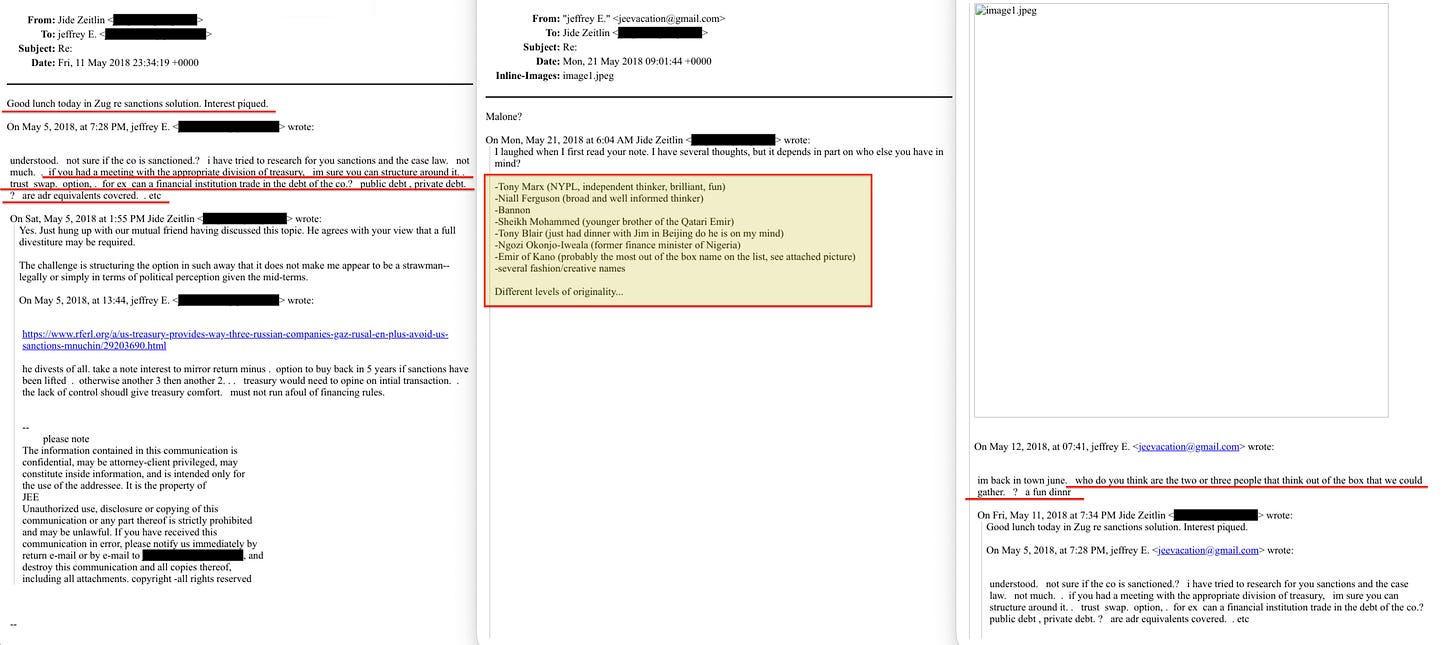

The architecture had applications beyond programmable money. In May 2018, Jide Zeitlin — a former Goldman Sachs partner in Epstein's circle75 — reported to Epstein: ‘Good lunch today in Zug re sanctions solution. Interest piqued’76. Zug is the Swiss canton known as Crypto Valley — the global centre of blockchain corporate infrastructure77. Epstein had been advising Zeitlin on sanctions structuring: ‘if you had a meeting with the appropriate division of treasury, im sure you can structure around it.. trust swap. option’.

When Epstein asked for dinner guests who ‘think out of the box’78, Zeitlin’s list included Bannon, Sheikh Mohammed (younger brother of the Qatari Emir), Tony Blair, Ngozi Okonjo-Iweala — former finance minister of Nigeria who became Director-General of the World Trade Organization in 202179 — and the Emir of Kano.

The network designing programmable money was simultaneously exploring its use as sanctions infrastructure, and assembling sovereign contacts and the future head of the WTO to discuss it.

Joi Ito founded the MIT Digital Currency Initiative at the Media Lab. Epstein’s donations — $525,000 to MIT — funded the hiring of three Bitcoin Core developers in 2015 after the Bitcoin Foundation collapsed80. The Digital Currency Initiative subsequently partnered with the Federal Reserve Bank of Boston on Project Hamilton, designing the technical infrastructure for a US central bank digital currency81. Ito resigned in 2019 after the Epstein funding was exposed82, but the initiative continues.

The Bill and Melinda Gates Foundation — where Boris Nikolic served as chief science and technology adviser while coordinating with Epstein — now funds CBDC research at the same MIT Digital Currency Initiative83.

Conclusion

Epstein evaluated the WEF’s Alternative Currencies working group, found it inadequate, and built a parallel operation with its best people under conditions he controlled. Where the Forum published reports, Epstein commissioned sovereign sales pitches. Where the Forum required disclosure of funding sources, Epstein operated under Chatham House rules.

When Jem Bendell’s Healing Capitalism84 appeared in academic bookshops, when the University of Cumbria launched its Institute for Leadership and Sustainability85, when the WEF published its reports on the future of money — none disclosed that the intellectual foundations had been partly laid in a private convening funded by a convicted sex offender and designed to supersede the Forum’s own work.

In 2018, the same Institute published Bendell’s ‘Deep Adaptation’86 arguing that climate-induced societal collapse is now inevitable and that existing sustainability tools have failed. The ethical framework commissioned in 2012 to justify the architecture became, six years later, the crisis narrative that makes its emergency implementation urgent.

The ‘Thoughts on Bitcoin’ document, the Summers correspondence, the sovereign pitches to Mongolia, Saudi Arabia, and Dubai, the Blockstream build team — these are the components of a commercial operation to sell central bank digital currency to governments, coordinated through an informal network that left no institutional records.

The product was sovereignty-backed programmable money with full transaction surveillance, negative interest rate capability, and the elimination of banks as intermediaries. The sales pitch was first-mover advantage, and the clients were heads of state.

The BIS Innovation Hub launched in 2019. Its flagship projects — Helvetia, Tourbillon, Aurora — are building precisely this infrastructure across multiple jurisdictions.

Through Project Rosalind, its API prototypes embed programmable logic into digital currency at the transaction level. Its purpose-bound money pilots restrict what each unit can be spent on. The conditions are defined by compliance frameworks.

The compliance frameworks are built on the Sustainable Development Goals.

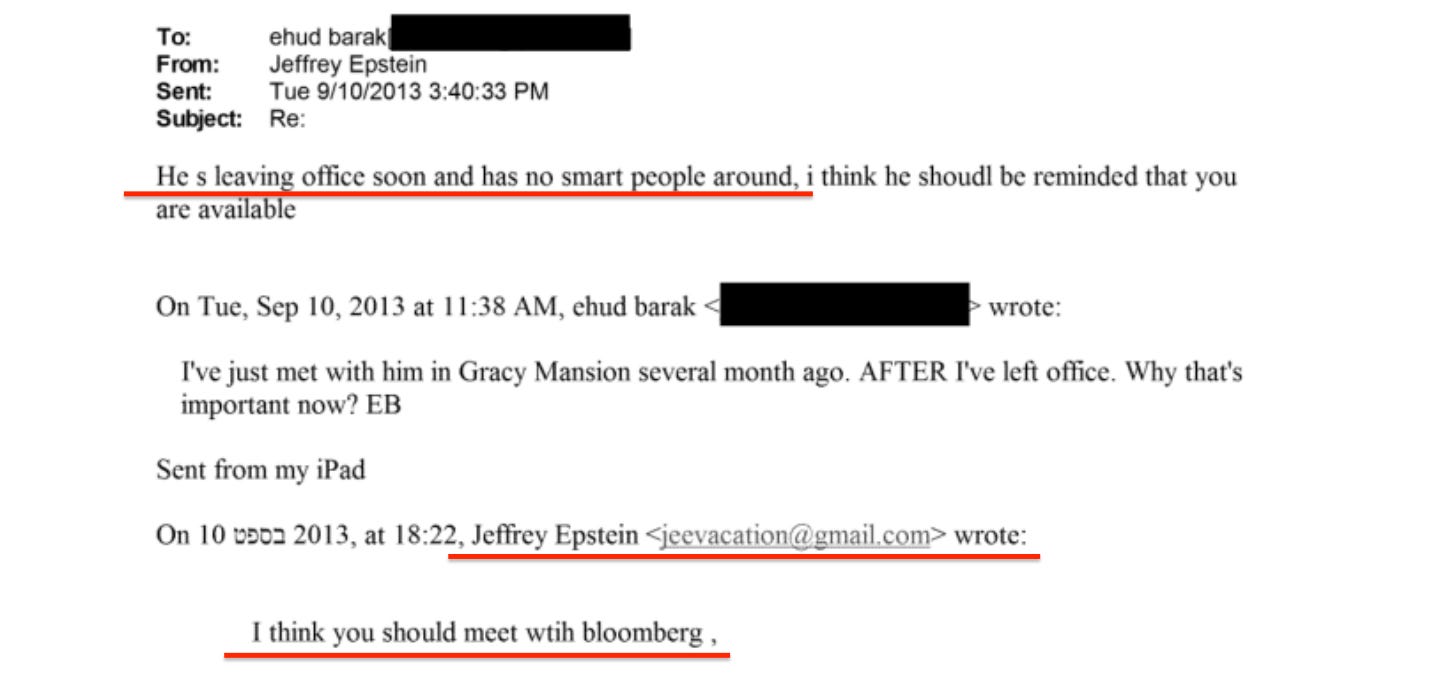

The mechanism by which the SDGs become enforceable was also routed through the network. On September 10, 2013 — during the summit week — Epstein instructed Barak to meet Michael Bloomberg, who was about to leave the New York mayoralty87. Barak resisted: ‘I’ve just met with him in Gracy Mansion several month ago. AFTER I’ve left office. Why that’s important now?’ Epstein: ‘He s leaving office soon and has no smart people around, i think he shoudl be reminded that you are available’.

Bloomberg subsequently chaired the Task Force on Climate-related Financial Disclosures88, whose framework feeds the Network for Greening the Financial System, which calibrates capital requirements at the BIS. The man positioned through the channel built the disclosure architecture that converts SDG aspirations into binding financial conditions — the demand signal for the programmable money the network designed.

The sequence thus runs from a WEF working group in 2011 through a private convening in 2012, a social good currency concept in 2013, a tokenisation specification in 2016, sovereign pitches across three continents in 2017, and a build team assembling in Montréal the same year — to an institutional consensus, now operational at the Bank for International Settlements, in which programmable money enforces SDG-aligned conditions on individual transactions.

The ethical framework that Bendell included in his commission brief became the ruleset that governs the architecture.

The design phase for the financial infrastructure now being built by central banks worldwide was conducted in private, under Chatham House rules, funded by a convicted sex offender, and coordinated through an informal network that left no institutional records.

The people who participated in that design phase — Summers, Gensler, Thiel, Warsh, Virza — now occupy positions at OpenAI, the SEC, Palantir, the Federal Reserve nomination, and the cryptographic foundations of digital currency infrastructure. The MIT laboratory Epstein funded built Project Hamilton, the US central bank digital currency prototype. The Gates Foundation — whose chief science adviser coordinated with Epstein throughout — now funds CBDC research at the same laboratory.

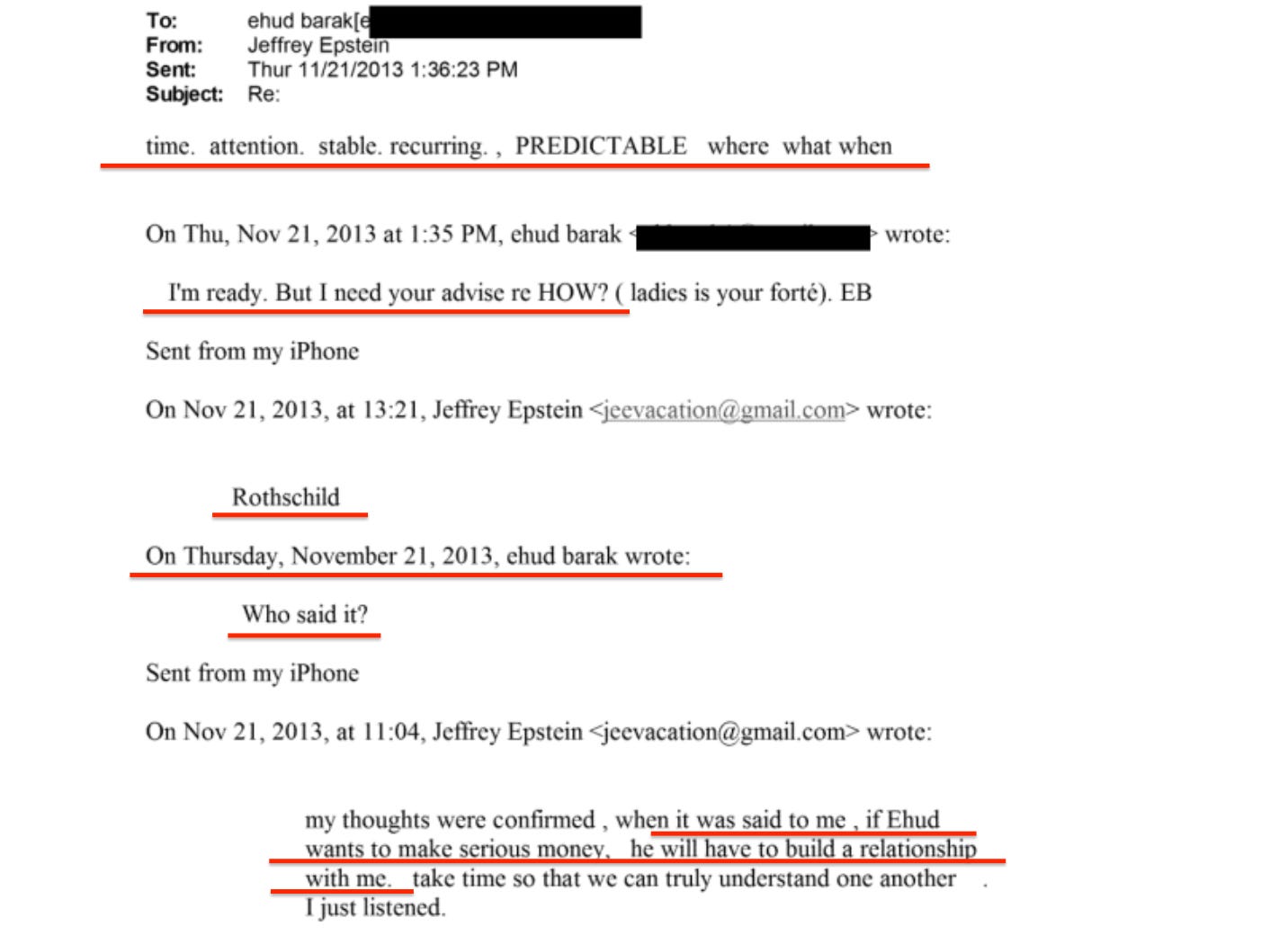

The financial architecture was assembled in parallel. Documents from November 2013 show Epstein coaching Barak on how to cultivate Ariane de Rothschild — head of the Edmond de Rothschild Group — instructing him to be ‘stable, recurring, PREDICTABLE’89 and comparing his monetisable value to that of former CIA director Michael Hayden and former NSA director Keith Alexander: intelligence credentials converted to capital.

The cultivation produced a $25 million advisory contract90, regular Geneva breakfasts, and a financial partnership documented across 5,500 pages of correspondence. The currency had its specification, its sovereign clients, its build team, and its bank.

The moral authority of the Sustainable Development Goals is the system’s most important component. It is what makes programmable restrictions on individual transactions politically viable, what makes total transaction surveillance presentable as transparency, and what makes the conditionality embedded in purpose-bound money appear to serve the public interest.

The documents show that the surveillance architecture — and the mechanism by which its moral framework becomes enforceable — were developed in the same private rooms, by the same network, during the same period.

The evidentiary chain stops at the BIS’s door, and it stops there by design. The Bank for International Settlements operates under sovereign immunity. Its archives are inviolable under the 1987 Headquarters Agreement with Switzerland. It is subject to no national freedom of information law, no parliamentary oversight committee, no discovery process in any court. There is no mechanism by which an internal BIS communication could be compelled into public view.

The Epstein correspondence exists only because he was arrested and his estate was sued. The institution now implementing the architecture his network designed cannot be subjected to the same process. The gap in the documentary record is not an absence of evidence. It is a feature of the legal structure chosen for implementation.

The architecture compounds the immunity. As described in ‘Sovereignty by Latency’, the unified ledger’s conditional execution creates cascading dependencies that harden into irreversible facts faster than any legal body can convene to review them. Even if the full design history were disclosed — every email, every convening, every undisclosed funding relationship — the system’s outputs cannot be unwound after execution.

The only moment the conditions could have been contested was the design phase. That phase took place in private, under Chatham House rules, funded by a registered sex offender, and was never disclosed to the institutions now building on its foundations.

None of this has been disclosed by the institutions now building the system.

'In a world of digital money, the intermediary with the best data and the most liquidity should be the best facilitator of credit, independently of who owns the largest stores of deposits'

There's that BoE clearinghouse logic again

Had to be Mossad. Had to have Knesset, Israeli support for concept development and feedback. Network was more porous than the main hub but all this smacks of a central intelligence.