Epstein

The Switchboard Operator

Jeffrey Epstein is primarily remembered as a sexual predator, a man of unexplained wealth, and the operator of a lurid, private island. All of this is true.

But three million pages of correspondence released by the Department of Justice in 2025 and 2026 reveal what the criminal narrative obscured: what he actually did.

I. Method

The previous essays — The Waddesdon Papers, The Innovation Hub, and The SDG Machine — trace the construction of a planetary financial control system, from its intellectual origins at Waddesdon Manor through the BIS Innovation Hub’s fifty-seven projects to the seventeen Sustainable Development Goals that provide its application layer.

Every claim rests on primary sources: BIS working papers, EU regulations, NGFS mandates, central bank speeches, and project documentation published by the builders themselves.

This essay asks a different question: not what was built, but who coordinates the building — and whose interests the network behind it serves. The evidence comes from correspondence released through EFTA proceedings and US Department of Justice document releases in 2025 and 2026 — Epstein’s private communications with figures whose institutions appear throughout the earlier essays.

The same technique applies. Start with what the documents directly evidence. Trace connections to institutions. Infer where required. The POSIWID principle holds throughout: claimed ‘intent’ counts for nothing — function is what matters.

II. The Man

Jeffrey Edward Epstein was born on 20 January 1953 in Brooklyn, New York1. His father was a groundskeeper for the New York City Department of Parks and Recreation; his mother a school aide2. He attended public schools in Coney Island3 and, despite never completing a bachelor’s degree4, was hired in 1973 to teach mathematics and physics at the Dalton School5, one of Manhattan’s most exclusive preparatory institutions. He was hired by headmaster Donald Barr, father of William Barr, who would later serve as US Attorney General6.

After leaving Dalton in 1976, Epstein entered Bear Stearns, rising to limited partner before departing in 19817. He then established J. Epstein & Company, claiming to manage assets for clients worth a minimum of one billion dollars8. When journalists investigated, only one client could be publicly documented: Leslie Wexner, the Ohio retail magnate behind The Limited and Victoria’s Secret9. Wexner transferred to Epstein a 45,000-square-foot Manhattan townhouse10 — said to be the largest private residence in New York — under circumstances that have never been adequately explained.

The gap between Epstein’s claimed financial empire and its verifiable foundation has never been resolved. New York magazine described him in 2002 as a ‘mysterious, Gatsbyesque figure’11. Forbes could not verify his billionaire status12. Yet he owned a private island in the US Virgin Islands13, a ranch in New Mexico14, properties in Paris and New York, a Boeing 72715, and logged six hundred flying hours per year16.

The source of the wealth remains unclear. The function of the network it sustained does not.

III. The Credentialing

In the late 1980s, David Rockefeller — patriarch of the Rockefeller governance network — personally appointed Jeffrey Epstein to the board of Rockefeller University17. The board included Nancy Kissinger, Brooke Astor, and Nobel laureates. Epstein was, by his own account, thirty to thirty-two years old.

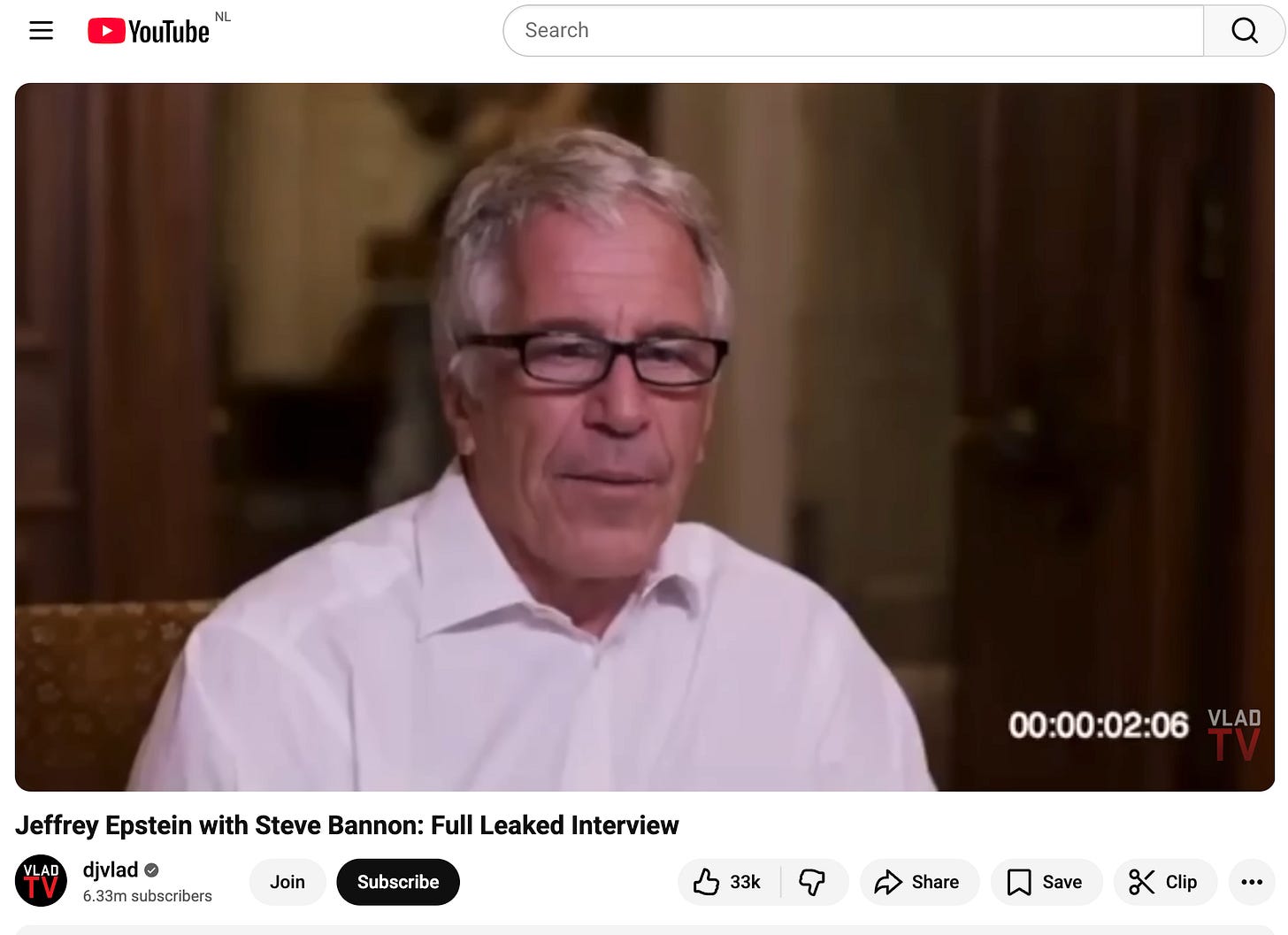

In an interview Epstein later gave to Steve Bannon, he described what followed. Rockefeller asked him directly18: ‘Would you like to be on the Trilateral Commission?’ Epstein accepted. The Trilateral Commission, founded by Rockefeller in 1973 on Zbigniew Brzezinski’s design, was designed to coordinate policy across the United States, Europe, and Japan. Its membership was a directory of transatlantic governance.

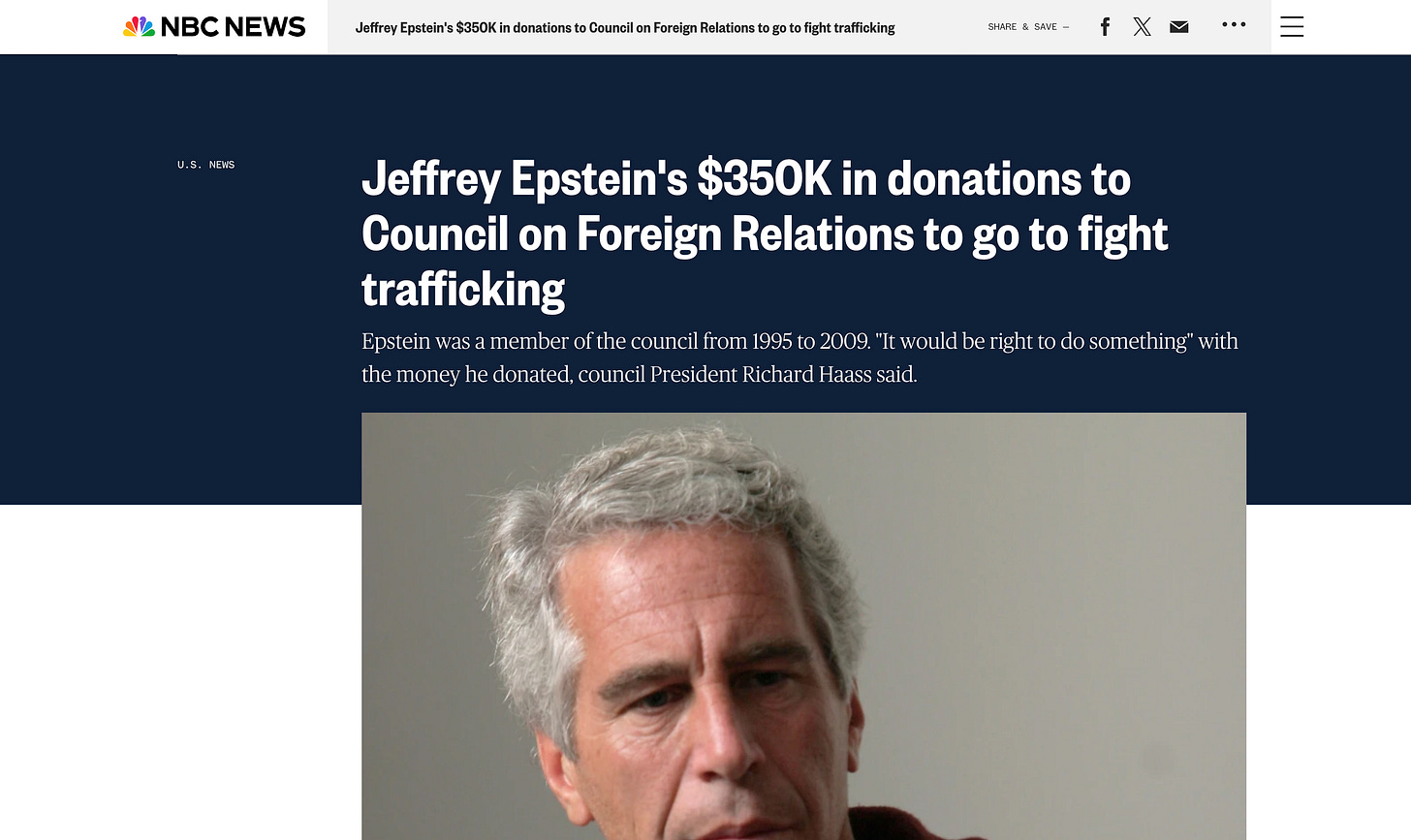

Epstein also became a member of the Council on Foreign Relations19, holding membership from 1995 to 2009, and the Institute of International Education20.

These are not social clubs. They are how private capital has coordinated with state power since the post-war settlement — the CFR’s founding membership overlapped substantially with the CIA’s first generation21. The Trilateral Commission aligned policy across the Western alliance. Rockefeller University provided the scientific credentialing.

What Rockefeller gave Epstein was an institutional passport. When Leon Black, the Apollo Global Management founder who paid Epstein at least $158 million in fees22, was asked why he trusted him, he cited the Rockefeller University appointment as validation.

Once Rockefeller vouched, others followed.

IV. The Routing Function

What follows is from correspondence released through legal proceedings — dated, naming sender and recipient, verified through document reference numbers where available. Rather than a chronological catalogue, it’s organised by what each cluster demonstrates.

The intelligence router

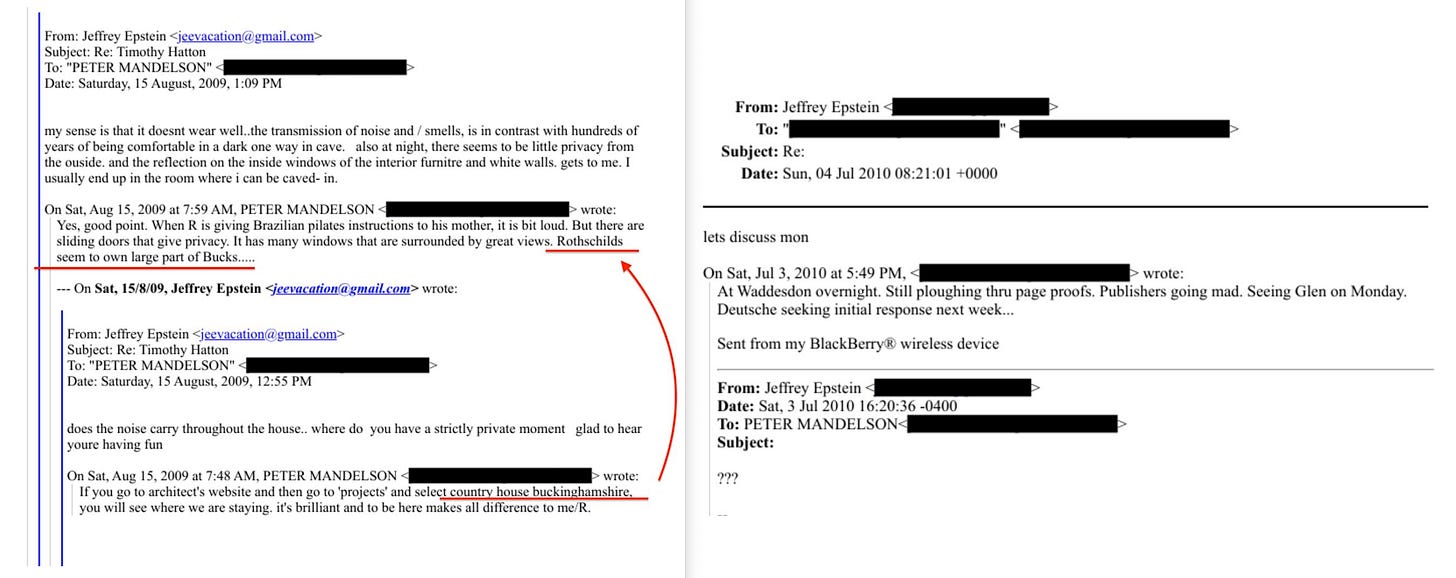

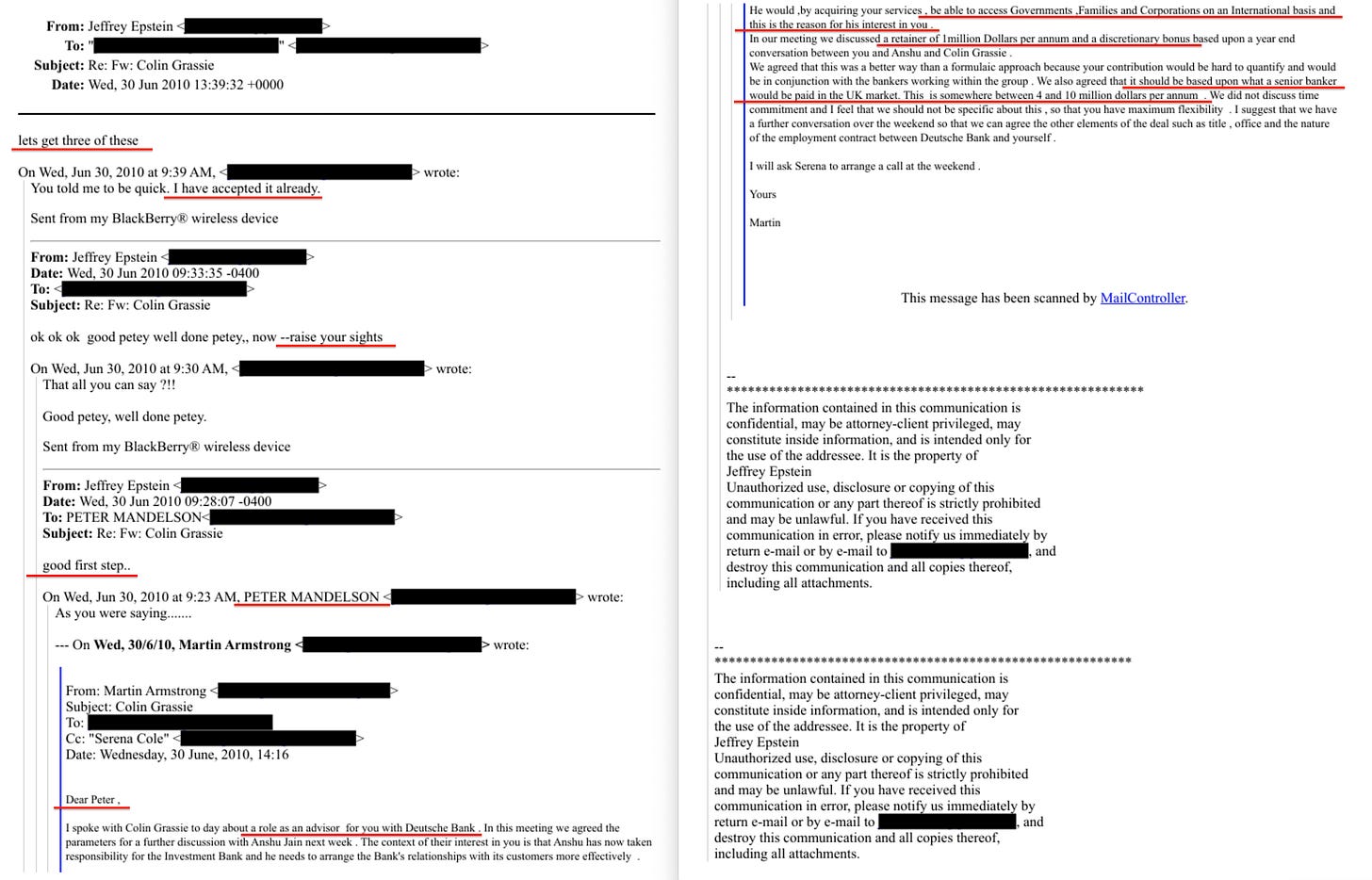

Peter Mandelson — Baron Mandelson, former European Commissioner for Trade, architect of New Labour — maintained continuous contact with Epstein after the latter’s 2008 criminal conviction. In August 2009, Mandelson emailed Epstein from a Rothschild country house in Buckinghamshire, describing the property, noting the casual initial ‘R’ for the host, and observing23: ‘Rothschilds seem to own large part of Bucks.....’

In July 2010, writing from Waddesdon Manor24 — the Rothschild estate that hosted the Stranded Assets Forums from 2014 — Mandelson updated Epstein on final proofs of his memoir, a Deutsche Bank job offer, and Glencore approaches, all in the tone of a routine status report.

The relationship was not social. Within two days of the change of government in May 2010, Epstein wrote to Jes Staley about a Deutsche Bank position for Mandelson. By June, Deutsche had offered between £4 million and £10 million per year for his ability to ‘access governments, families and corporations’25. Epstein called it ‘a good first step’ and urged Mandelson to ‘raise your sights’ and ‘let’s get three of these’26.

Epstein was sequencing a former First Secretary of State’s career — strategy, timing, leverage.

Emails further show27 Mandelson passing confidential government material to Epstein while serving as Business Secretary28: a £20 billion asset sales memo sent to the Prime Minister2930, minutes of Treasury–Summers meetings on banking regulation forwarded within minutes of receipt31, advance notice of the €500 billion Euro bailout hours before the public announcement32, and notification of Gordon Brown’s resignation before it happened33.

He also advised JPMorgan’s Jamie Dimon to ‘mildly threaten’34 the Chancellor over bankers’ bonus tax35. Epstein received live British government intelligence of direct financial value while operating as router to finance, technology, and intelligence nodes simultaneously.

Mandelson received $75,000 in payments from Epstein-linked accounts during this period36.

The dynastic adviser

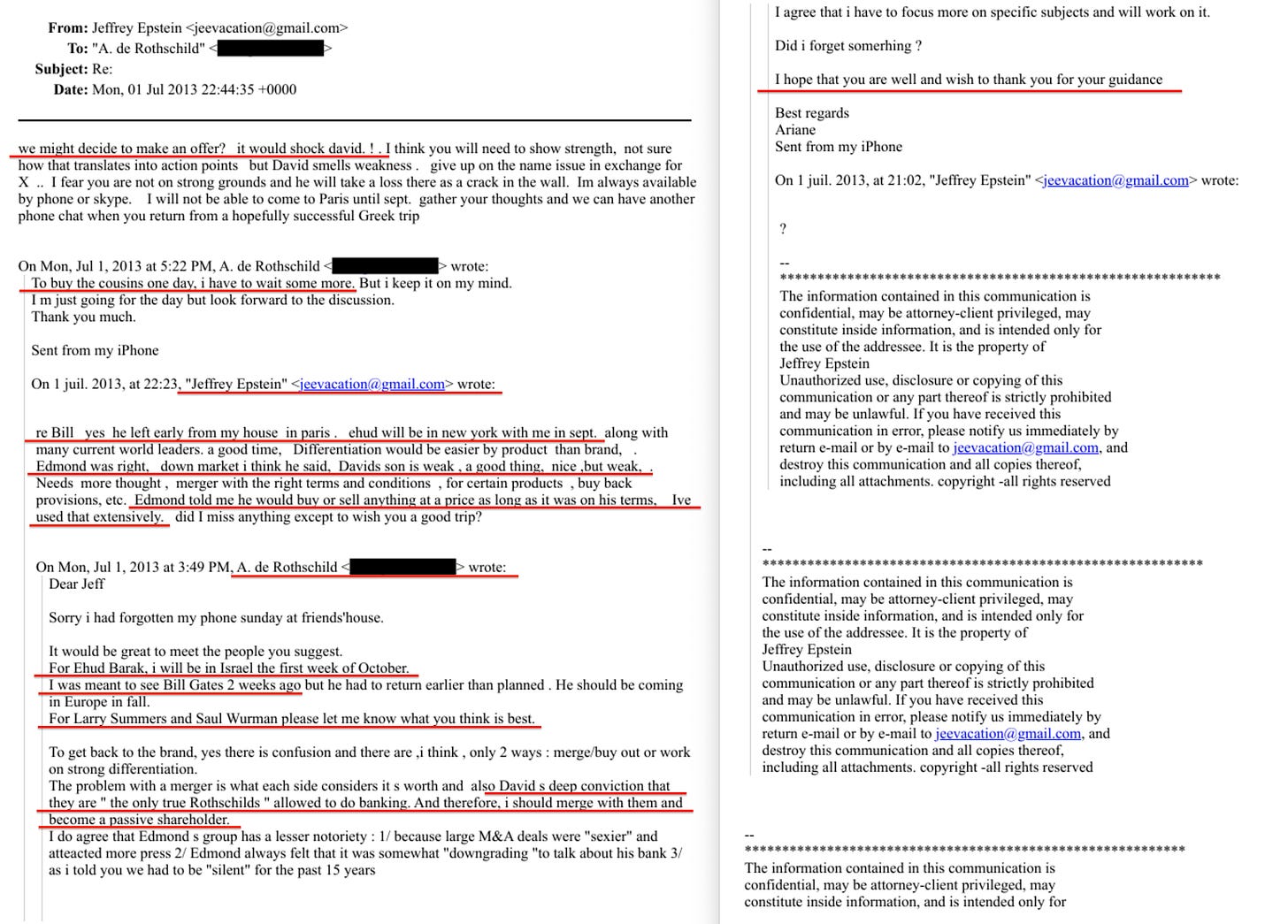

In July 2013, Epstein emailed Ariane de Rothschild37 — who would become chair of the Edmond de Rothschild Group — with strategic commentary on inter-branch dynamics: ‘Differentiation would be easier by product than brand. Edmond was right, down market i think he said, Davids son is weak, a good thing, nice, but weak’38. He invoked the late patriarch directly: ‘Edmond told me he would buy or sell anything at a price as long as it was on his terms. Ive used that extensively’.

Ariane responded within the hour: ‘To buy the cousins one day, i have to wait some more. But i keep it on my mind’. Later that evening, she asked Epstein to arrange meetings with Ehud Barak, confirmed she ‘was meant to see Bill Gates 2 weeks ago’, and requested introductions to Larry Summers and Saul Wurman, adding: ‘please let me know what you think is best’. On the rival branch, she wrote that David de Rothschild held ‘deep conviction that they are ‘the only true Rothschilds’ allowed to do banking’, and that for fifteen years her side had been forced to be ‘silent’. She signed off: ‘I hope you are well and wish to thank you for your guidance’.

The future chair of a major European bank taking strategic guidance from Epstein, asking him to set the terms of her introduction to a former Treasury Secretary, confiding the internal politics of the Rothschild dynasty.

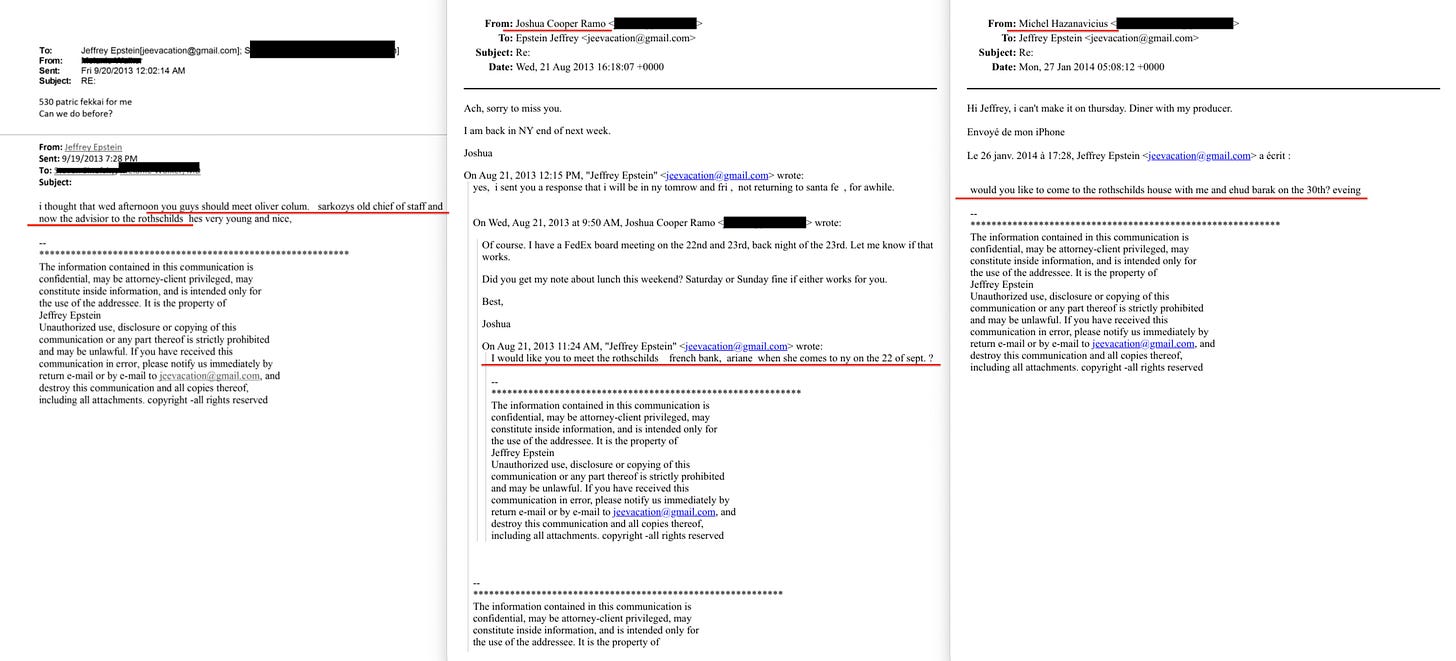

Epstein routed the connections she requested. In August 2013, he emailed Joshua Cooper Ramo, then Vice Chairman and Co-CEO of Kissinger Associates — Henry Kissinger’s geopolitical consultancy39: ‘I would like you to meet the rothschilds french bank, ariane when she comes to ny on the 22 of sept.?’

In September, he emailed Steven Sinofsky, former President of Microsoft’s Windows Division and later a board partner at Andreessen Horowitz40: ‘i thought that wed afternoon you guys should meet oliver colum. sarkozys old chief of staff and now the advisior to the rothschilds’. Kissinger’s geopolitical consultancy to Rothschild banking. Silicon Valley to Rothschild via the French political establishment.

Each introduction initiated by Epstein, on his terms, on his schedule. In January 2014, he invited Michel Hazanavicius, the Academy Award-winning French film director, to ‘the rothschilds house with me and ehud barak on the 30th evening’41.

Cultural prestige maintained alongside finance and politics.

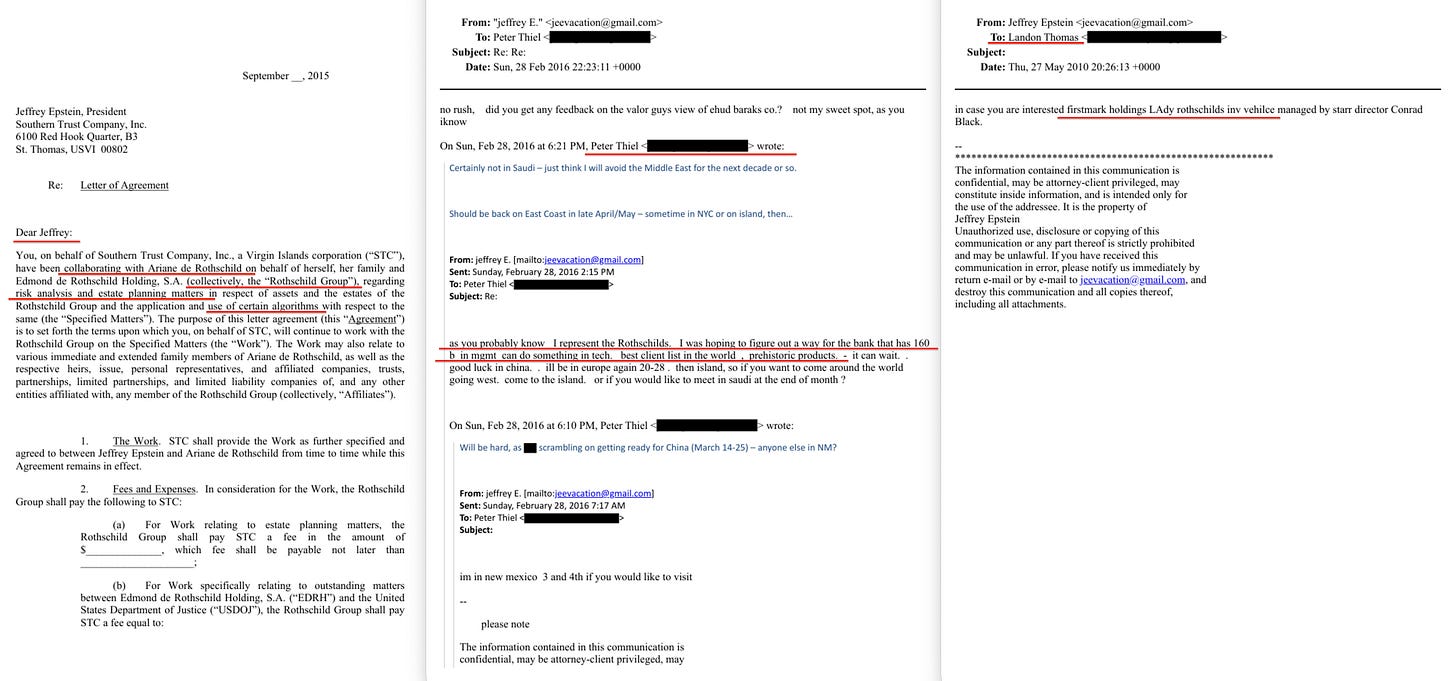

In October 2015, the relationship acquired a formal financial dimension. Epstein’s Southern Trust Company Inc., a Virgin Islands–registered firm, signed a $25 million agreement with Edmond de Rothschild Holding S.A. for ‘risk analysis’ and ‘the application and use of certain algorithms’42. Payment was due within three days of the Rothschild Group completing its payment to US authorities. The document was signed by Ariane de Rothschild43.

In February 2016, Epstein emailed Peter Thiel — co-founder of PayPal, co-founder of Palantir, first outside investor in Facebook: ‘as you probably know I represent the Rothschilds. I was hoping to figure out a way for the bank that has 160 b in mgmt can do something in tech. best client list in the world, prehistoric products’44. Thiel proposed meeting ‘sometime in NYC or on island’. Not that he knows the Rothschilds — that he represents them. An emissary, not an employee.

Epstein sat between the Rothschild branches, owned by none, useful to all. He advised the Edmond branch on strategy. He received intelligence from political figures in the Jacob branch orbit. And he fed information about the third branch to the press: in May 2010, he emailed Landon Thomas, a New York Times financial reporter later exposed for his compromised relationship with Epstein, tipping him about ‘firstmark holdings LAdy rothschilds inv vehilce managed by starr director Conrad Black’45.

FirstMark Holdings belonged to Lynn Forester de Rothschild46 — wife of Sir Evelyn de Rothschild, introduced to him by Henry Kissinger at the 1998 Bilderberg conference47, and architect of the Coalition for Inclusive Capitalism, later the Council for Inclusive Capitalism with the Vatican48. The woman who built 'inclusive capitalism' — embedding social objectives into capital allocation — was having her financial affairs discussed between a compromised journalist and Epstein, frequently described as a friend495051.

No single branch owned him, which was precisely why all three found him useful.

The geopolitical switchboard

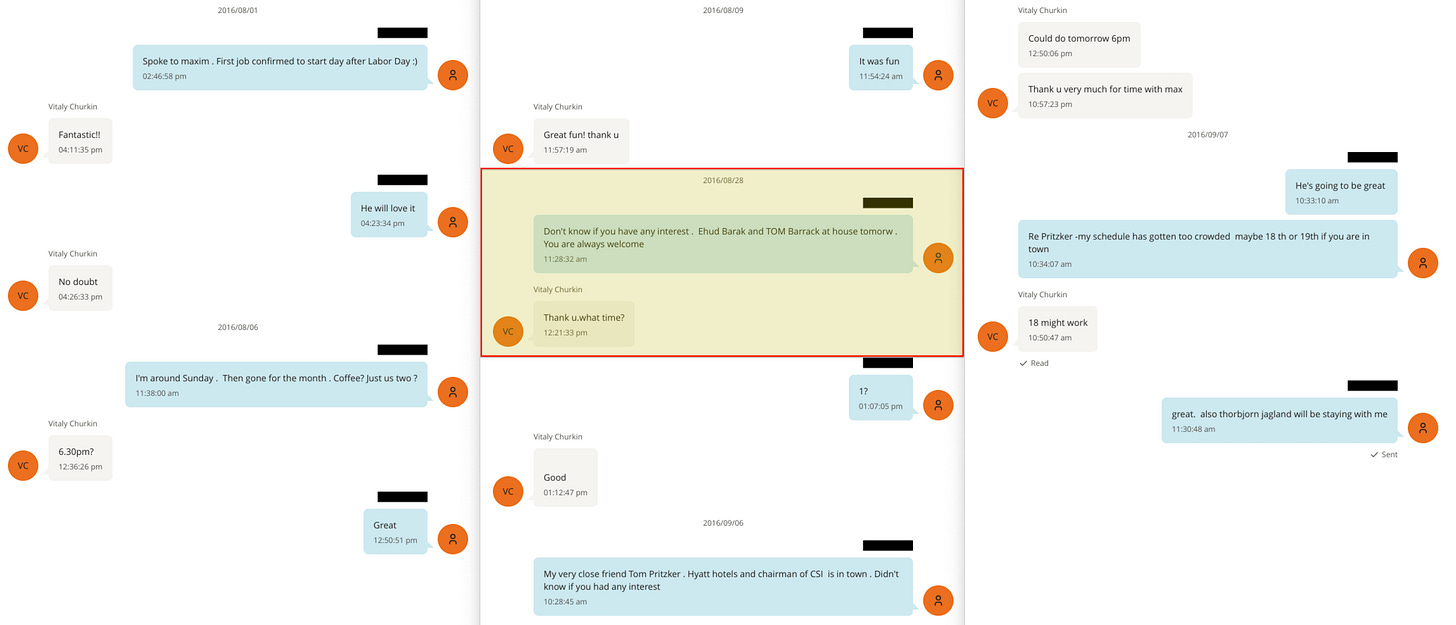

The network’s geopolitical reach is documented in a single scheduling email. On 28 August 2016, Epstein invited Vitaly Churkin — Russia’s Permanent Representative to the United Nations — to dinner52: ‘Don’t know if you have any interest. Ehud Barak and TOM Barrack at house tomorw. You are always welcome’.

Barrack was Trump’s closest Middle East operative, a billionaire who would chair his inaugural committee and later serve as US Ambassador to Turkey53. Barak was the former Israeli Prime Minister and former head of Aman (military intelligence) and Sayeret Matkal (special operations)54. Churkin was the face of Russian diplomacy at the Security Council; he died suddenly in New York five months later55.

One dinner table, eleven weeks before the 2016 election: American political-intelligence around the incoming president, Israeli military-intelligence, and Russian diplomatic-intelligence.

The reach even extended to the Nobel institutions.

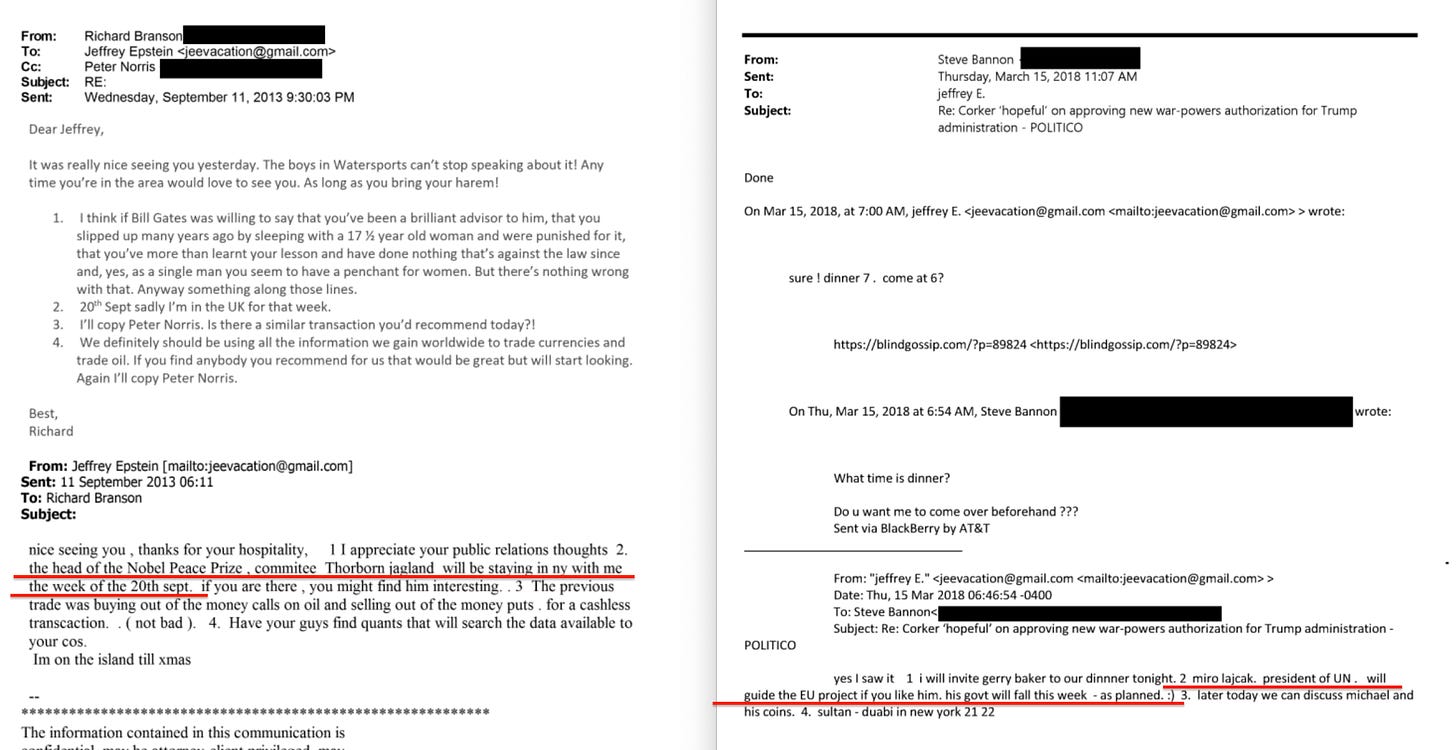

Emails released by the DOJ on 30 January 2026 show Epstein in a September 2013 exchange with Richard Branson in which he refers to Thorbjørn Jagland56 — former Norwegian Prime Minister and chair of the Norwegian Nobel Committee — staying at Epstein’s New York house, and offers to connect Branson with Jagland directly57.

It extended to the UN General Assembly itself. In March 2018, Epstein emailed Steve Bannon about Miroslav Lajčák — Slovakia’s Foreign Minister and President of the 72nd Session of the UN General Assembly58, the body that had adopted the 2030 Agenda and its seventeen Sustainable Development Goals three years earlier.

Epstein wrote59: ‘Miro Lajcak, president of UN, will guide the EU project if you like him. His govt will fall this week – as planned. :)’ The Slovak government fell days later. Subsequent releases show Lajčák’s name appears more than 300 times across the documents. He corresponded with Epstein from his official ministerial email, offered to host Epstein and Bannon at the Slovak ambassador’s residence in Vienna, and proposed Robert Fico as a figure who could serve Bannon’s strategic interests.

Lajčák resigned as Slovakia’s national security adviser on 31 January 2026, the day after the DOJ release60.

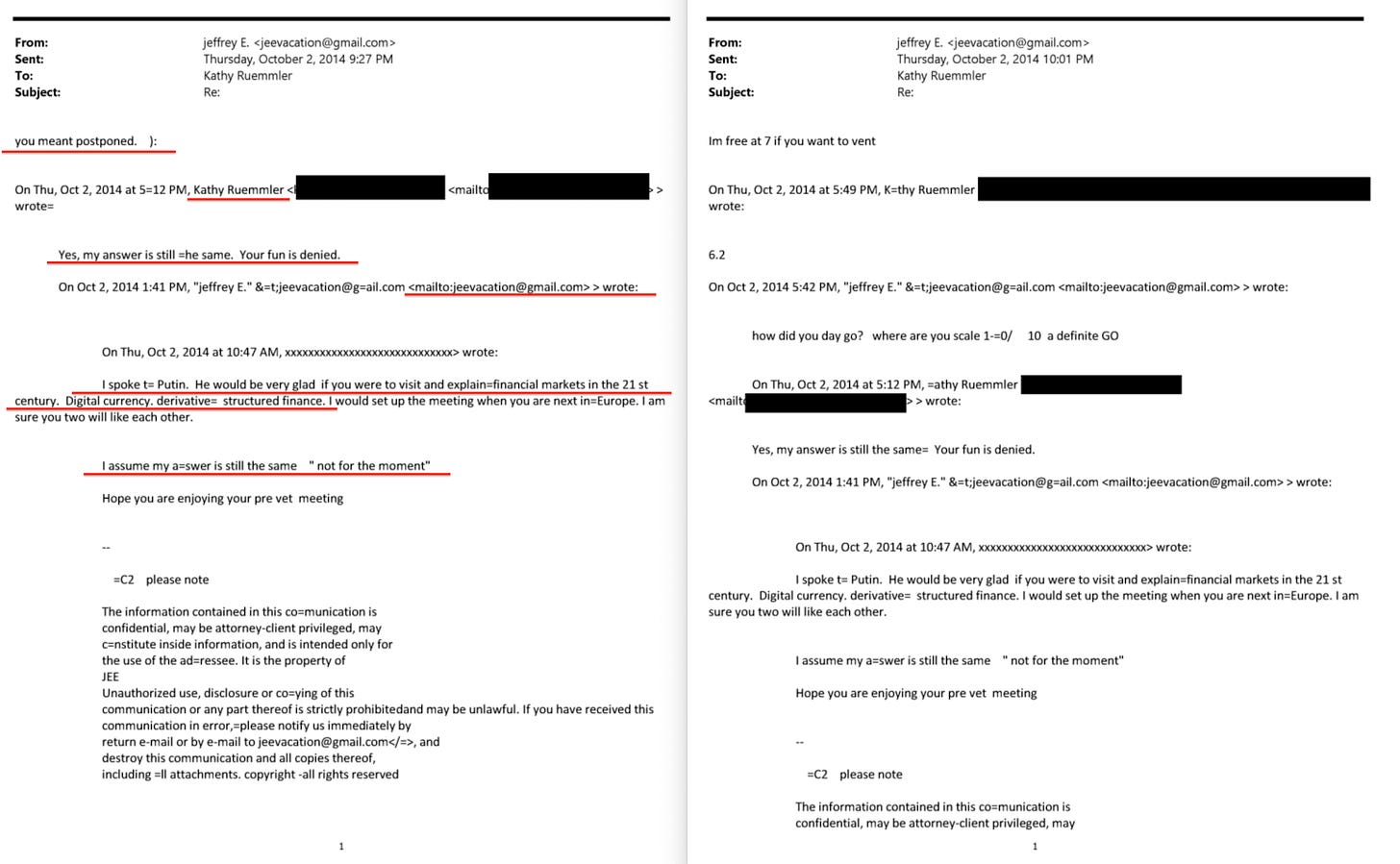

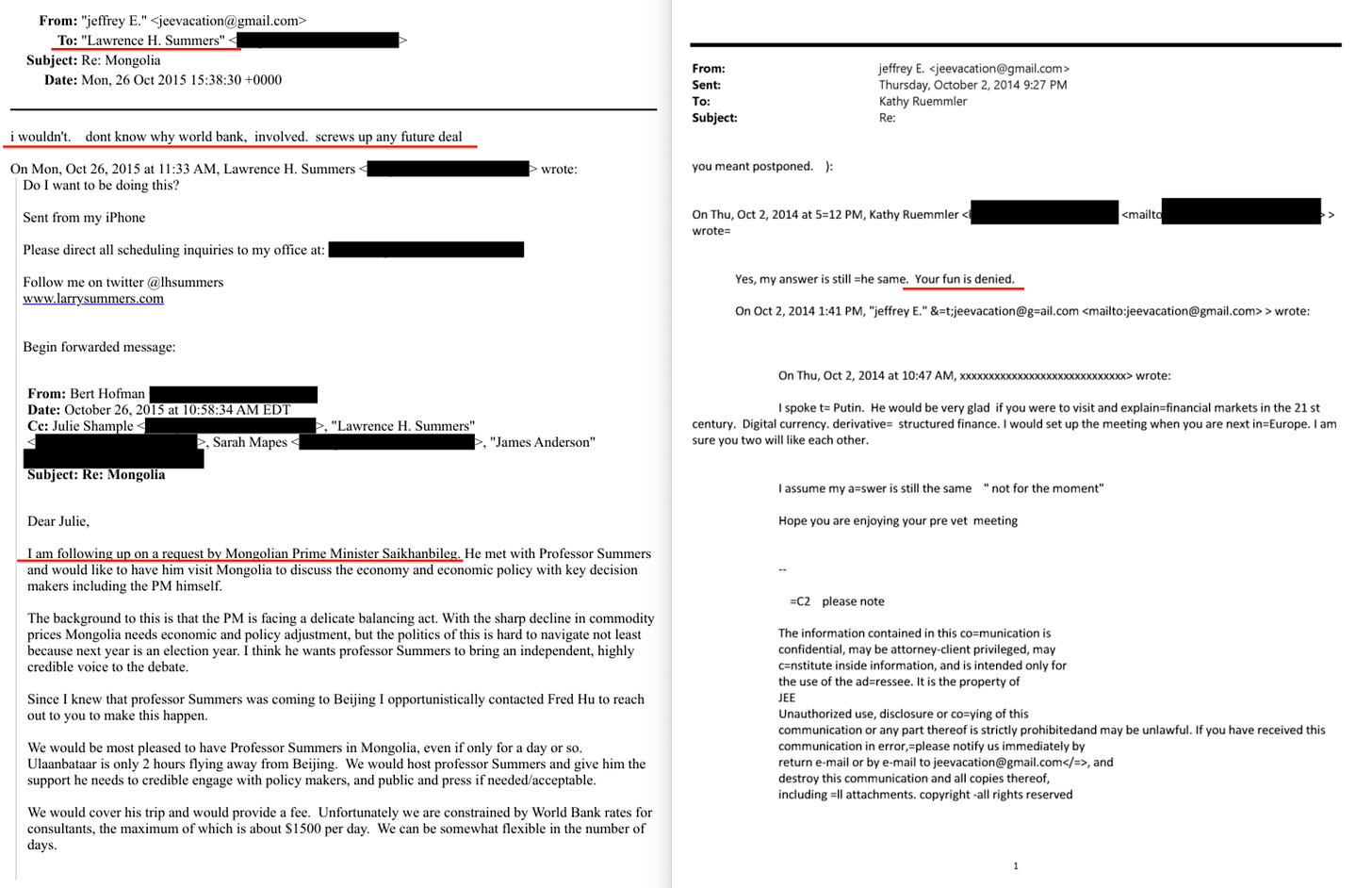

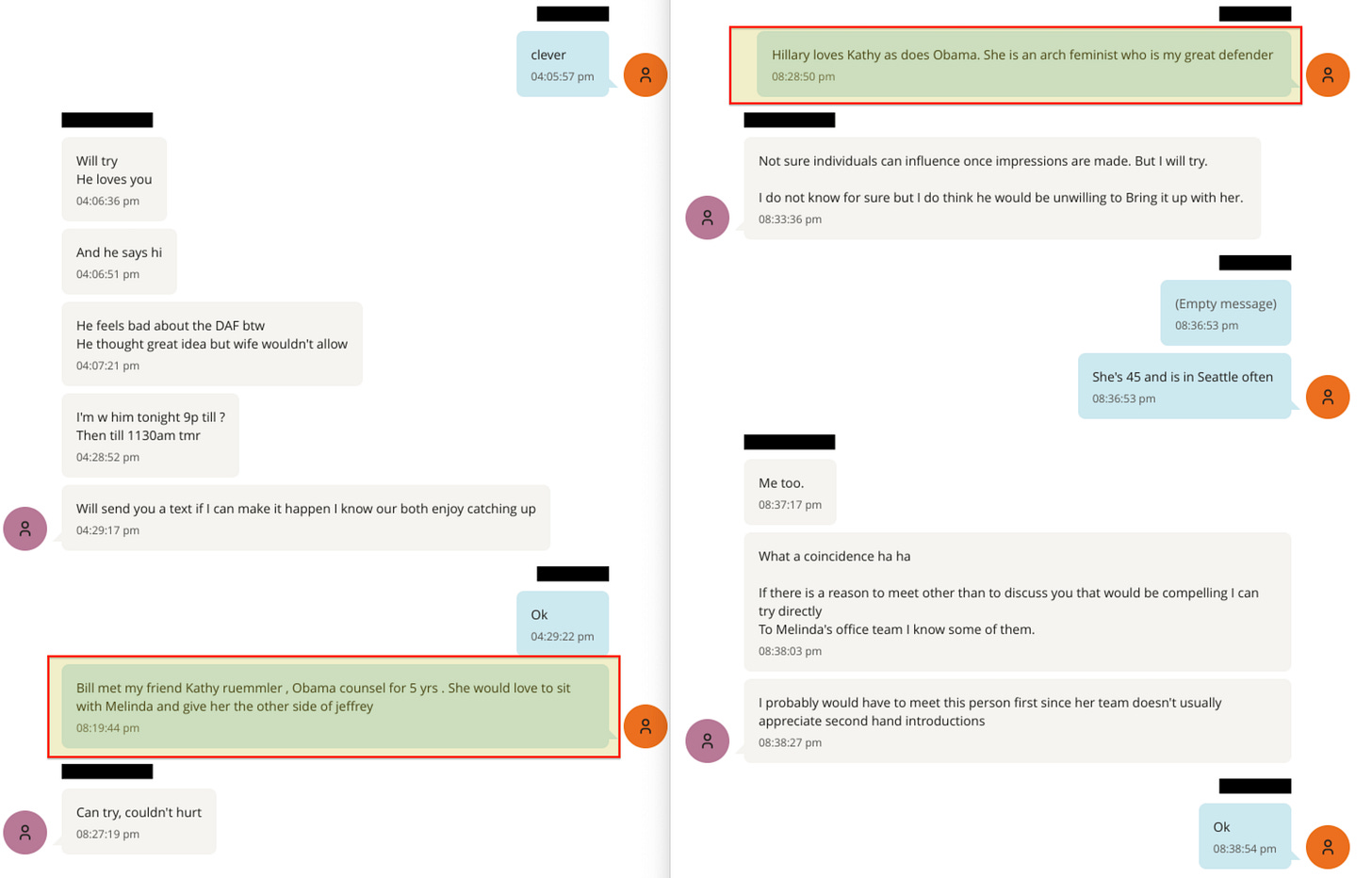

Two years earlier, an intermediary whose email address is redacted wrote to Epstein: ‘I spoke to Putin. He would be very glad if you were to visit and explain financial markets in the 21st century. Digital currency. derivatives. structured finance’. Epstein forwarded this to Kathryn Ruemmler — former White House Counsel to President Obama — who replied61: ‘Yes, my answer is still the same. Your fun is denied’. The former White House Counsel exercising operational authority over his movements — ‘denied’, not ‘I wouldn’t recommend it’.

The subject matter Putin’s intermediary specified — digital currency, derivatives, structured finance — would reappear throughout Epstein’s correspondence. The architecture was not confined to one side of any geopolitical divide.

Three intelligence traditions — American, British, Israeli — plus Russian diplomatic access, routed through one informal node with none of the oversight formal cooperation requires.

The personnel pipeline

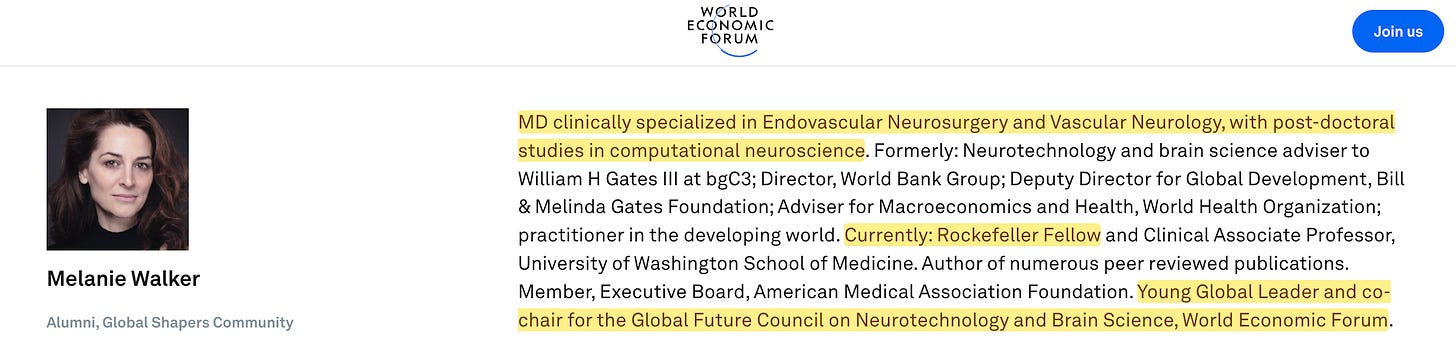

Melanie Walker — a neurosurgeon who met Epstein at the Plaza Hotel in 1992 — was hired as his ‘science adviser’ in 199862, married Steven Sinofsky (who would become President of Microsoft’s Windows Division), was introduced to Bill Gates at a Microsoft barbecue, joined the Gates Foundation in 2006, and was placed at the World Bank as Senior Adviser to the President via a secondment arrangement in which the Gates Foundation paid her salary63.

She co-chaired the WEF Future Council on neurotechnology6465. The pipeline operated at the Davos level as well.

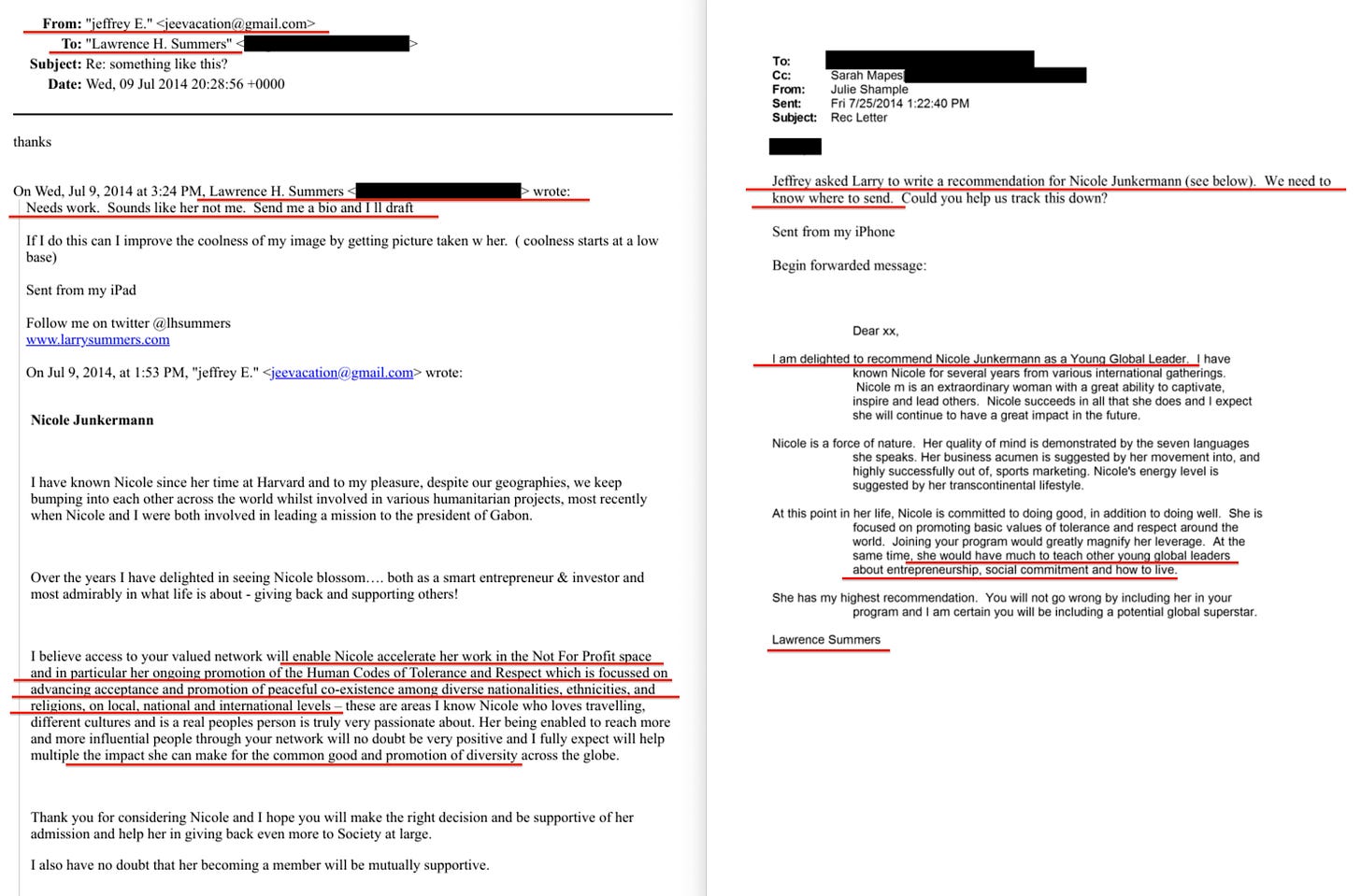

On 9 July 2014, Epstein emailed Lawrence Summers a draft reference letter for Nicole Junkermann — a German-born investor spanning health tech, fintech, biometrics, and data analytics — recommending her for admission to the network on the basis of ‘the common good’. Summers replied: ‘Needs work. Sounds like her not me. Send me a bio and I ll draft’66.

Fifteen days later, Summers sent the finished letter: ‘I’m delighted to recommend Nicole Junkermann as a Young Global Leader’67. Epstein decided who should be placed in the WEF Young Global Leaders programme. A former Treasury Secretary wrote the letter under his own name. Junkermann became a Young Global Leader, from which position she was later appointed to the board of NHS Digital — the body managing the UK’s national health data infrastructure6869.

The structural position

The recurring phrasing is directive70: ‘I would like you to meet’. ‘I thought you guys should meet’. He facilitates connections, initiates people, determines the terms, and controls their timing.

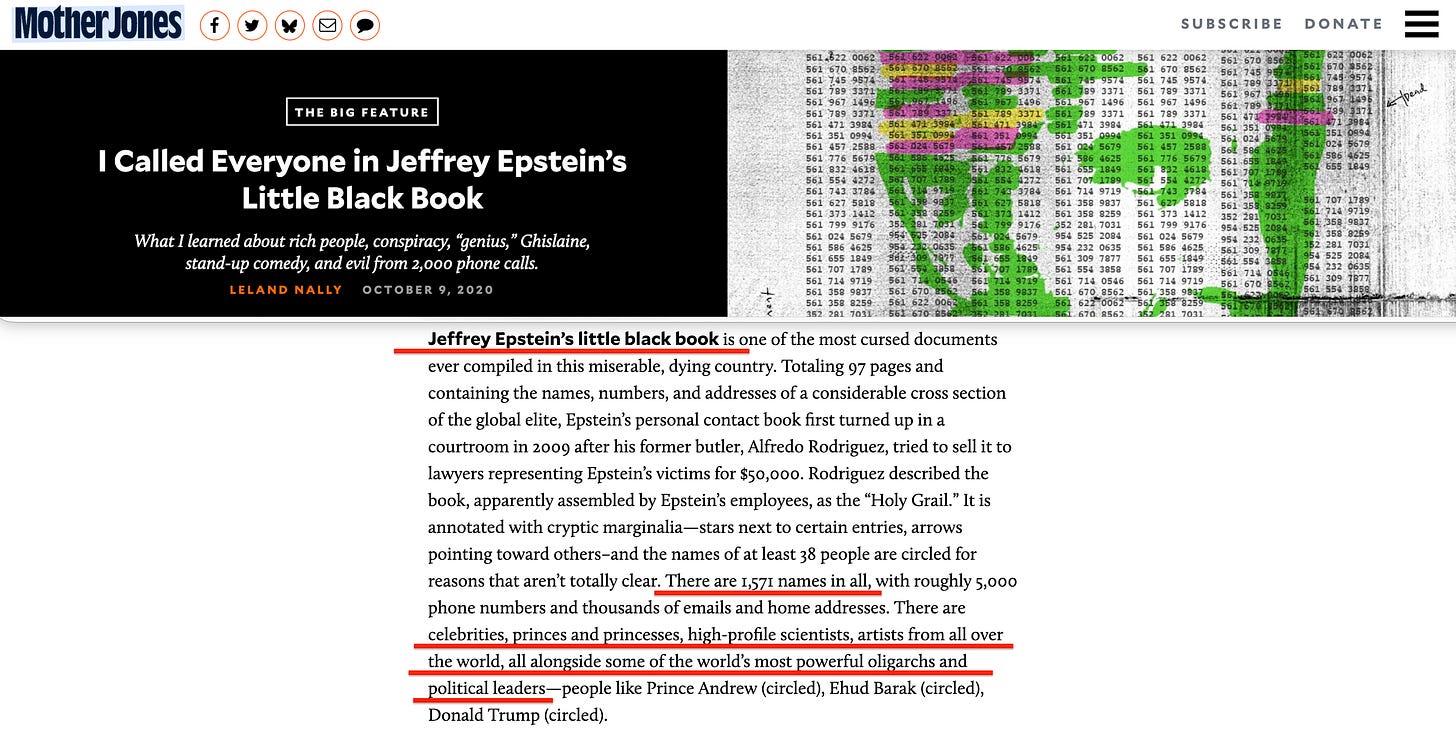

His seized address book71 — 1,571 names across finance, politics, science, culture, and intelligence — is the physical artefact of this function: not a socialite’s contacts list but a routing table.

The mystery of the sources of his wealth can thus be resolved. The opacity was a structural necessity. If Epstein’s funding came from a single source, he would belong to that source, associated with the rivalries and history.

Ariane cannot use him if he belongs to Jacob. Summers cannot use him if he belongs to Ariane. The funding had to be distributed: everyone contributes to the switchboard’s operation because everyone benefits from it, but no single source is large enough to constitute ownership. The $25 million Rothschild contract72, the Wexner property transfer, the $158 million in Leon Black fees73, the flows through anonymous MIT donation structures74 — each is a payment for services within a specific domain, not a salary from an employer. He has clients, not a boss.

The distributed model also imposed discipline. A switchboard funded by all parties must operate within boundaries acceptable to all parties or it loses its use. The emails show this in practice: Ruemmler’s ‘Your fun is denied’75 is boundary enforcement, and Epstein accepts it immediately. His advice to Summers on a World Bank–facilitated invitation from Mongolia’s Prime Minister76 — ‘i wouldn’t. dont know why world bank involved. screws up any future deal’ — applies the same logic outward: keep relationships within the informal architecture, away from multilateral frameworks that introduce institutional oversight.

The Rockefeller credentialing and the Rothschild embedding are best understood together. The CFR and Chatham House were founded together after the 1919 Paris Peace Conference77, one American, one British, designed to align foreign policy across the Atlantic. Victor Rothschild, a Cambridge Apostle, ran MI5’s counter-sabotage section during the Second World War78.

An operator credentialed by Rockefeller and embedded with the Rothschilds bridges two hemispheres of a single governance architecture. The connection to Israeli intelligence — through Ehud Barak, who visited Epstein’s New York residence dozens of times and received $2.5 million from an Epstein-linked trust — adds the third vertex79.

V. The Architecture

The emails document a design process, not just a social network. Two threads — a financial vehicle and a conceptual escalation — converge on a single mechanism: the combination of public and private capital flows toward measurable social outcomes, with compliance embedded in the financing structure.

That mechanism has three names across three jurisdictions — ‘impact investment’ (American, coined at a Rockefeller Foundation convening in 2007)80, ‘blended finance’ (UN development frameworks), and ‘social impact investment’ (UK, endorsed by David Cameron at the G8 in June 2013)81 — but it is one concept.

The financial vehicle

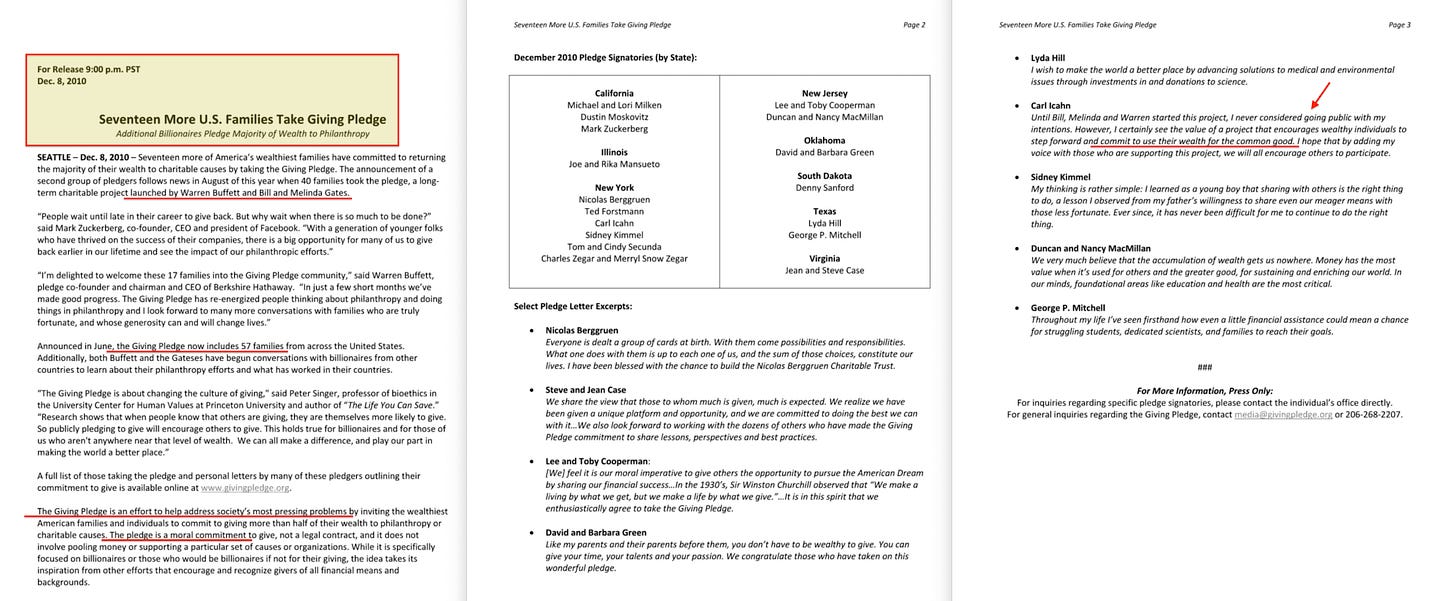

The Giving Pledge — launched by Buffett and Gates in June 201082 — secured public commitments from fifty-seven billionaire families by December — a moral pledge to give, with no legal structure, no pooled capital, no investment vehicle, and no returns. Epstein had the 8 December 2010 press release in his files83.

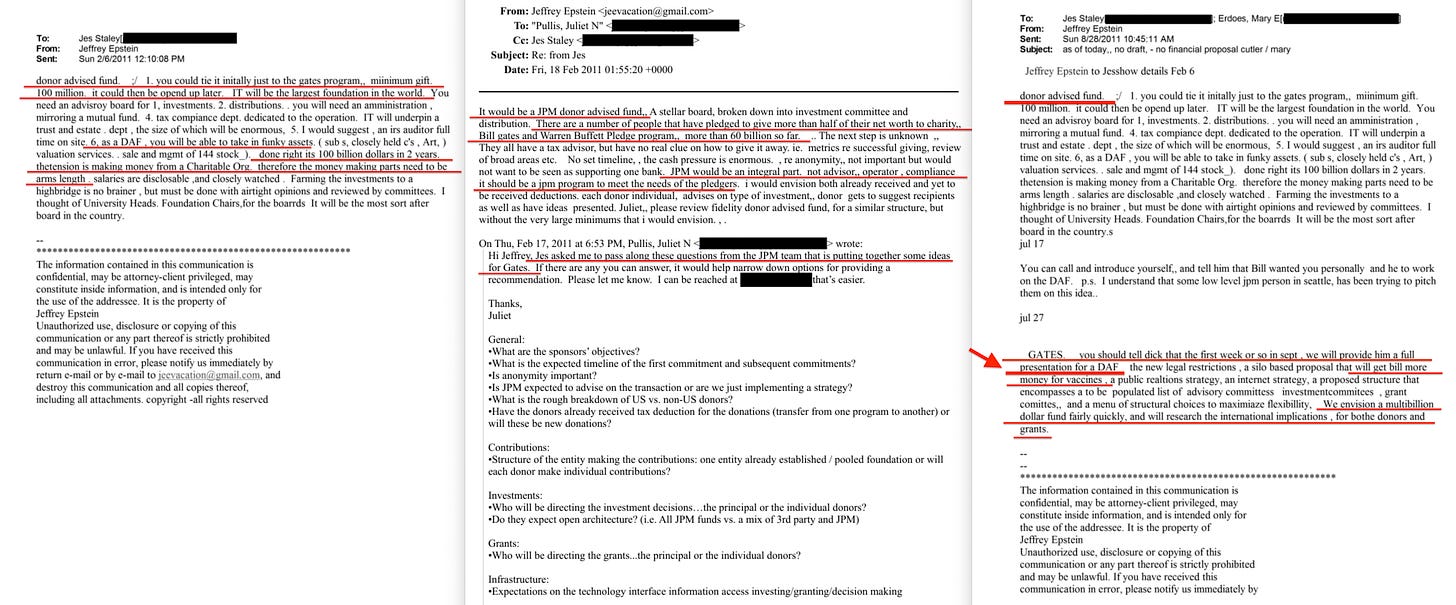

On 6 February 2011, Epstein emailed Jes Staley — then head of JPMorgan’s investment bank — with a complete blueprint for a Gates-linked donor-advised fund. The email reads in part: ‘donor advised fund... you could tie it initally just to the gates program,, miinimum gift. 100 million. it could then be opend up later. IT will be the largest foundation in the world’. He specified an advisory board for investments and distributions, administration mirroring a mutual fund, a dedicated tax compliance department, an IRS auditor on site full time, and capacity to accept ‘funky assets’ — sub-S corporations84, closely held C-corps, art, restricted stock. Then the structural admission: ‘done right its 100 billion dollars in 2 years. the tension is making money from a Charitable Org. therefore the money making parts need to be arms length’.

Twelve days later, on 18 February, Juliet Pullis — a JPMorgan executive working under Staley — emailed Epstein a structured list of operational questions from ‘the JPM team that is putting together some ideas for Gates’85. The questions were precise: What are the sponsors’ objectives? Is anonymity important? Is JPMorgan expected to advise or implement? Who directs investments — the principal or individual donors? Who directs grants? What technology platform is expected? JPMorgan was asking Epstein to define the architecture.

By 26 July, the design had advanced. Epstein emailed Staley with Boris Nikolic — Bill Gates’s chief science and technology adviser — now copied8687: ‘we will provide him a full presentation for a DAF… a silo based proposal that will get Bill more money for vaccines’.

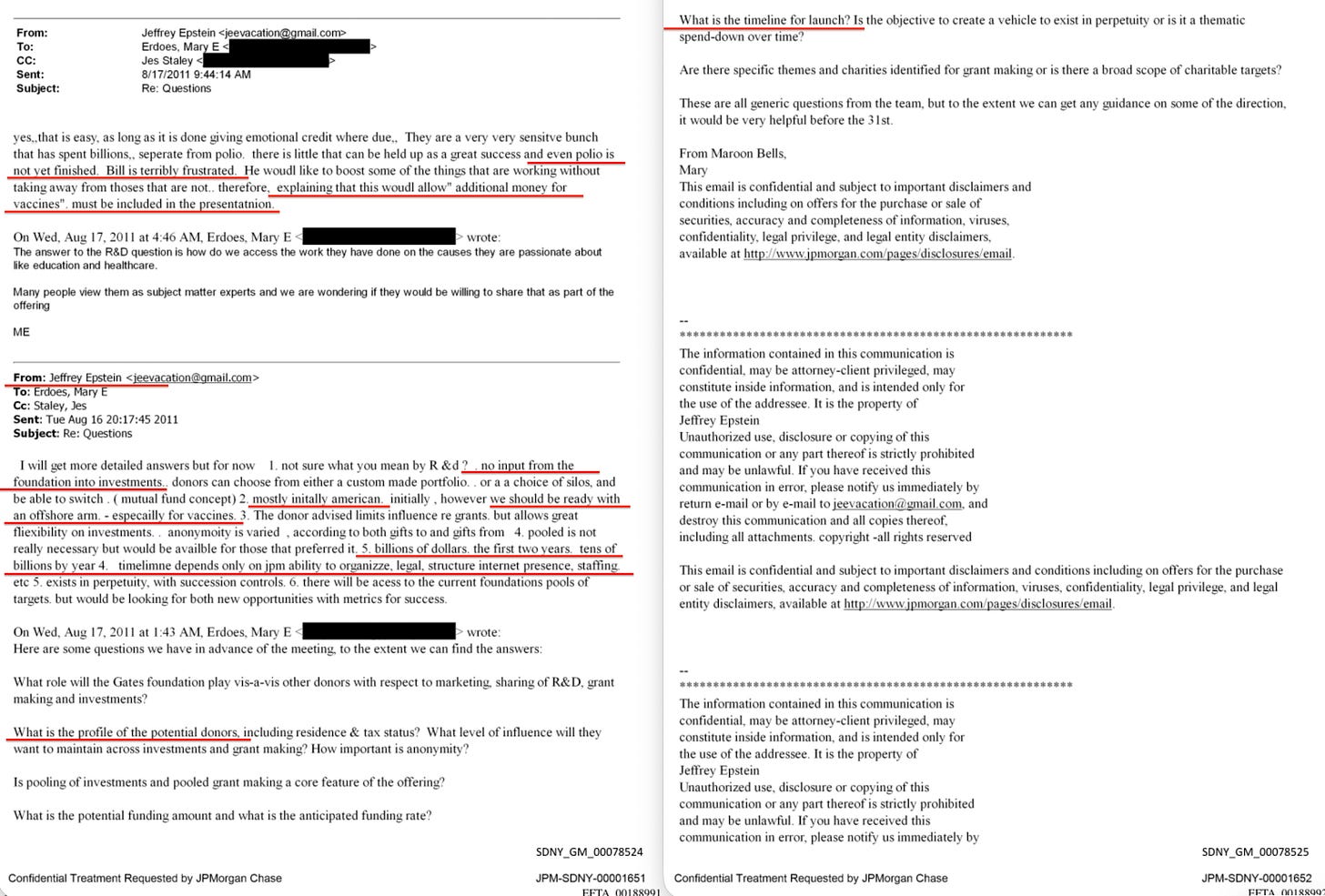

On 17 August, Mary Erdoes — CEO of JPMorgan Asset and Wealth Management, overseeing $2 trillion in assets — emailed Epstein directly with a second round of structured questions, writing from vacation in Colorado and CC’ing Staley. Epstein replied the same night. No foundation input on investments. Donors choose from custom portfolios or predefined silos. The fund would be ‘mostly initially American’ but: ‘However we should be ready with an offshore arm — especailly for vaccines’88.

He projected ‘billions of dollars’ in the first two years and ‘tens of billions by year 4’. The bottleneck was not Gates and not the donors: it was ‘JPM ability to organize, legal, structure, internet presence, staffing’. The bank’s capacity to build what Epstein had already designed. Eleven days later, Erdoes emailed Epstein and Staley a formal presentation deck.

JPMorgan internally named the initiative ‘Project Molecule’89.

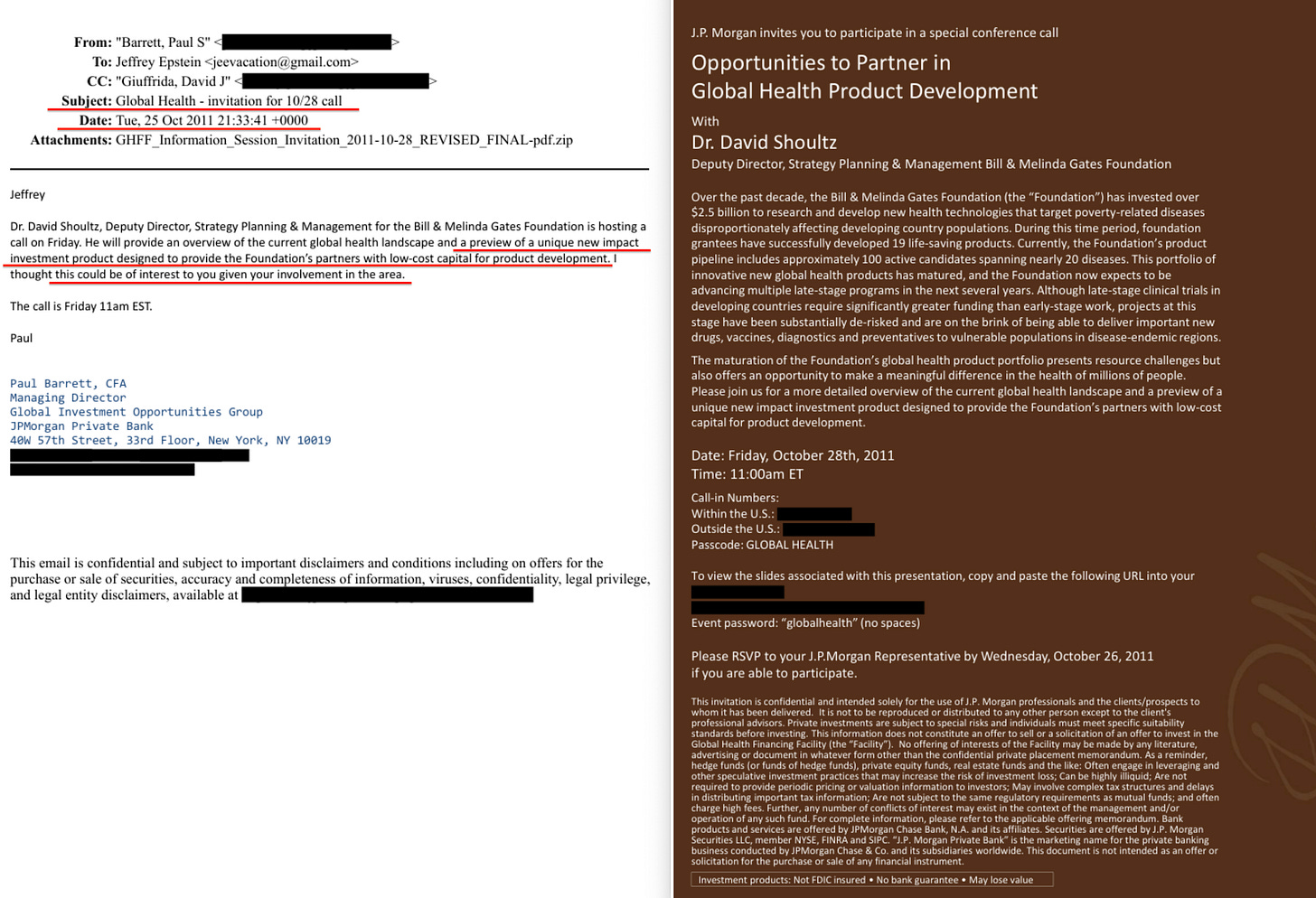

On 25 October, the finished product returned to its designer. Paul Barrett, Managing Director of the Global Investment Opportunities Group at JPMorgan Private Bank, emailed Epstein to invite him to a call on 28 October hosted by Dr David Shoultz90, Deputy Director of Strategy Planning & Management at the Bill & Melinda Gates Foundation. The subject: ‘Global Health - invitation for 10/28 call’91.

Barrett described a ‘unique new impact investment product designed to provide the Foundation’s partners with low-cost capital for product development’. He wrote that this ‘could be of interest to you given your involvement in the area’.

Not Epstein’s interest. Involvement.

On 28 October — the same day as the call — OPIC, the US government’s development finance institution, approved a historic $285 million commitment to six impact investing funds92. The first major US institutional commitment to impact investing.

The product became the Global Health Investment Fund93 (GHIF), raising $108 million. JPMorgan led fundraising. The IFC (the World Bank’s private sector arm) invested. The Gates Foundation underwrote 60 per cent of potential capital losses. GHIF became ‘the first example of a global health investor with a double bottom line’ — the proof of concept for the entire SDG financing architecture that would follow94.

The design chain is documented across nine months of 2011, from primary correspondence produced under compulsion in federal litigation. JPMorgan’s investment bank chief, its $2 trillion asset management CEO, and a Gates Foundation deputy director, all corresponding with a convicted sex offender about the design and launch of the financial mechanism that the SDG architecture runs on95.

No one in the chain treats Epstein’s involvement as unusual. They treat it as the reason to include him.

In 2023, JPMorgan Chase agreed to pay $290 million to settle a lawsuit brought by Epstein’s victims, who accused the bank of facilitating his sex trafficking by maintaining his accounts despite documented red flags96.

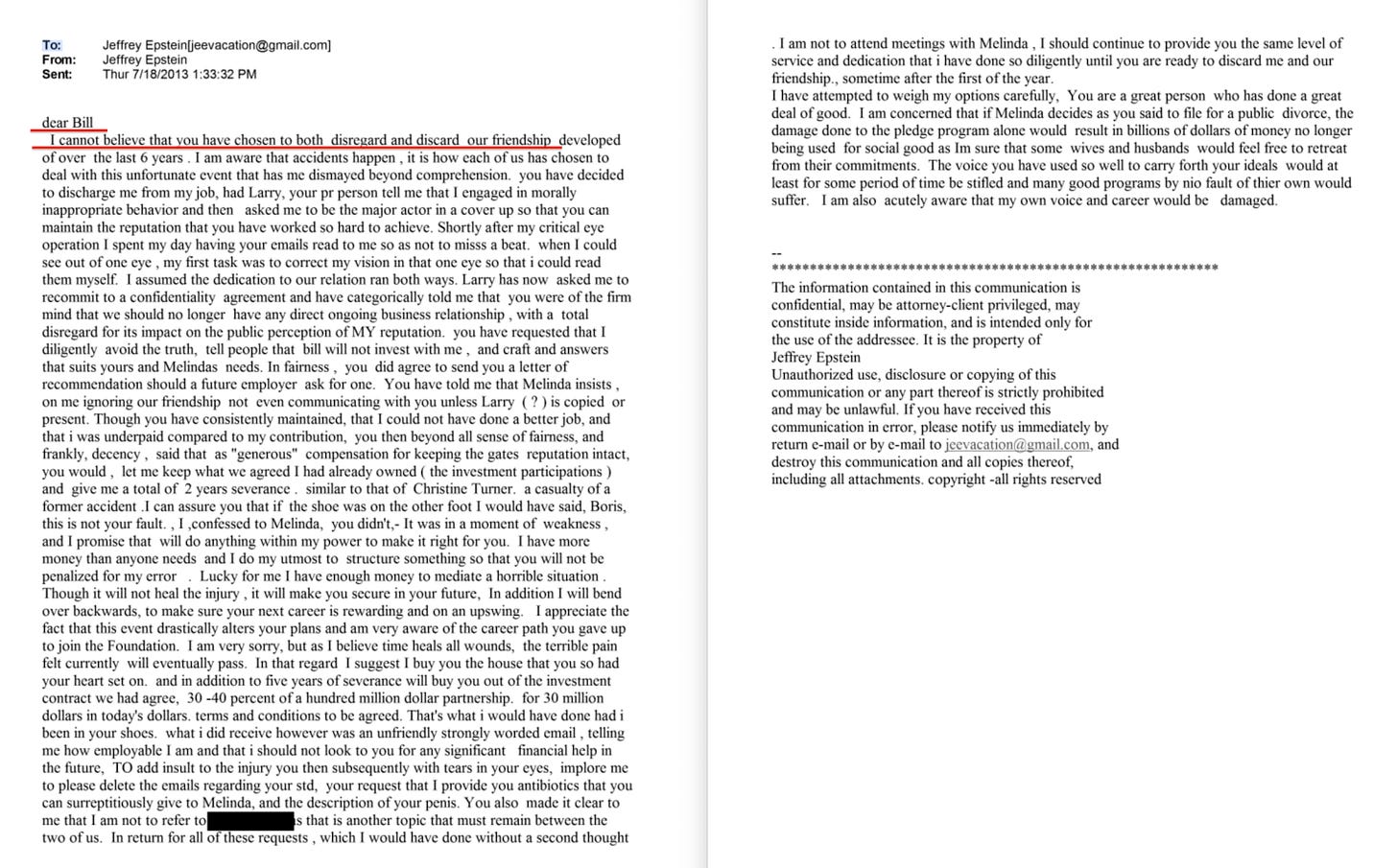

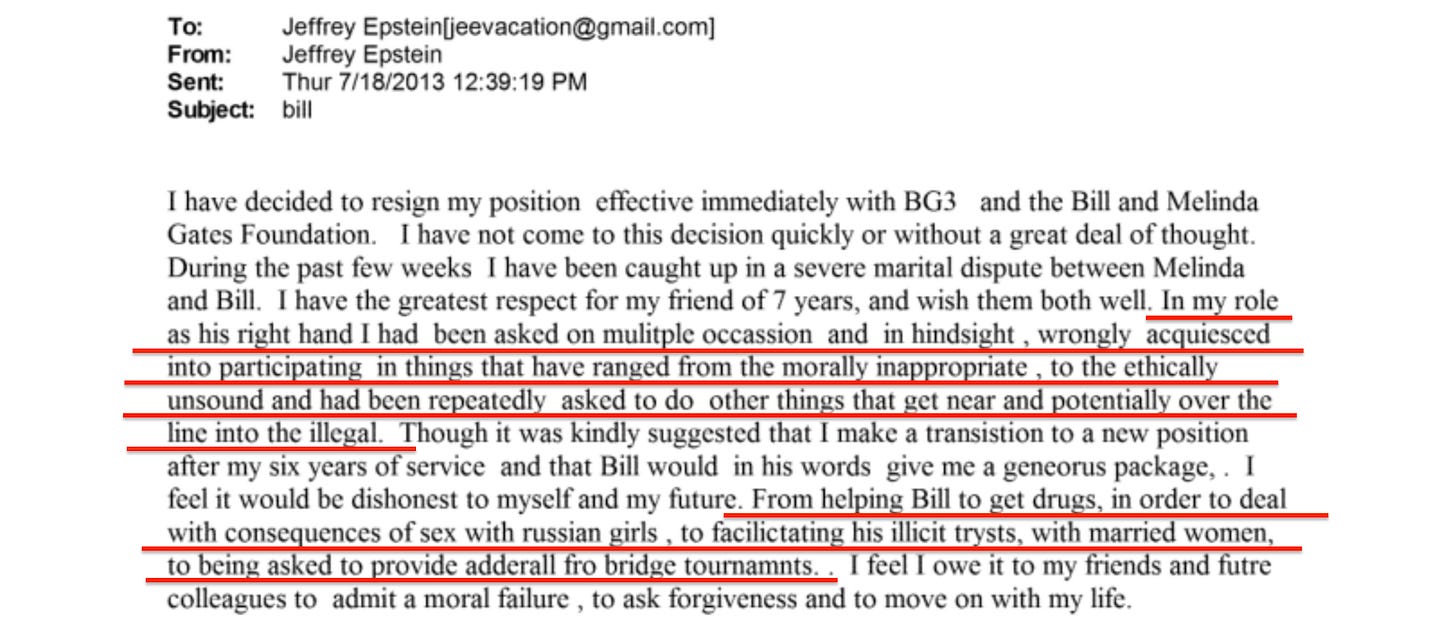

According to the New York Times (October 2019)97, Epstein circulated a four-page proposal in which he suggested he be paid 0.3 per cent of whatever money he raised for the Gates Foundation–JPMorgan venture — $30 million on $10 billion. The Gates Foundation said it had been unaware he was seeking any fee. When the deal structure ultimately excluded him, Epstein turned to leverage.

Draft emails98 released by the DOJ on 30 January 2026 show him writing to Gates: ‘I cannot believe that you have chosen to disregard our friendship developed of over the last 6 years’99.

The drafts contain allegations about Gates’s personal conduct; whether they were sent is unverified, and a Gates spokesperson called the claims ‘absolutely absurd and completely false’100. But a second draft from the same date is more revealing101: Epstein composed what appears to be a resignation letter written in the voice of Boris Nikolic — Gates’s former chief science and technology adviser — confessing to complicity in personal misconduct102.

True or fabricated, the point is what the document tells us he was capable of. Epstein could write in Nikolic’s voice because he understood the complicity structure in enough detail to fabricate a credible confession. The switchboard did not merely know who was connected to whom. It knew what each node had done — and when denied its fee, the routing function became a threat vector.

The same knowledge that made him useful made him dangerous the moment he wanted something the network wouldn’t give him.

The conceptual escalation

While the financial vehicle was being built at JPMorgan, the concept was escalating toward its endpoint: money itself.

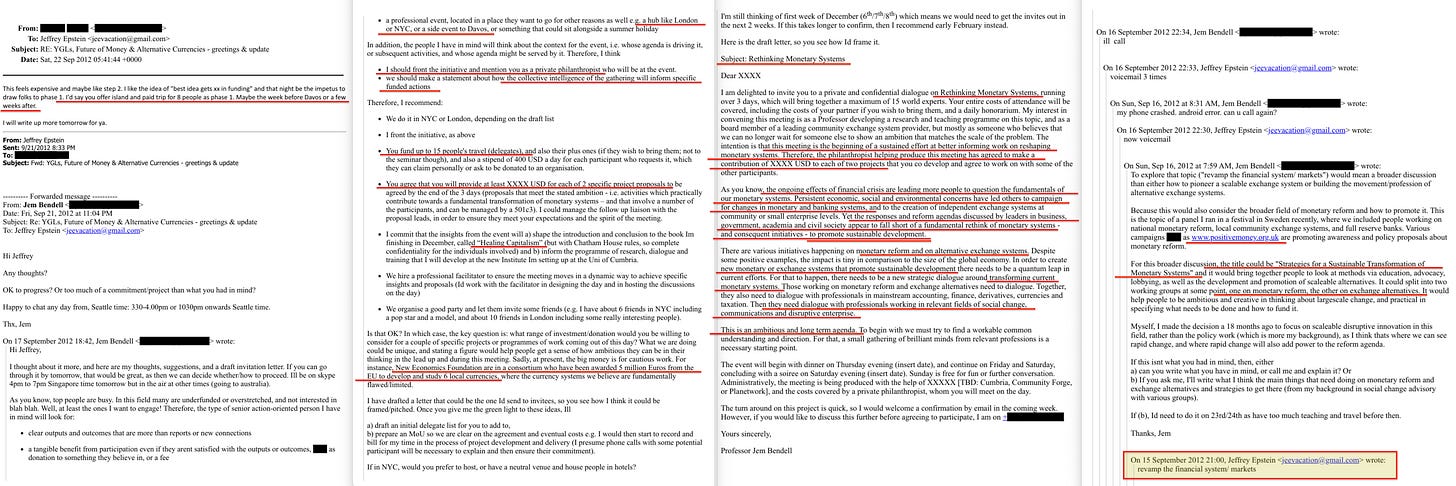

On 15 September 2012, Epstein emailed Jem Bendell — a professor of sustainability leadership103 — with a two-word commission: ‘revamp the financial system/ markets’. The subject line of the thread is the key: ‘Re: YGLs, Future of Money & Alternative Currencies’. YGLs — Young Global Leaders, the WEF’s personnel pipeline for the next generation of global governance.

In a single email subject line, the WEF leadership programme and the monetary transformation agenda104 are the same conversation. Bendell responded with a detailed proposal: ‘Strategies for a Sustainable Transformation of Monetary Systems’105, referencing Positive Money and proposing working groups on monetary reform and ‘exchange alternatives’. On existing systems, he noted: ‘No chance at present of money laundering or theft or hidden transactions with mutual/self issued credit systems’ — the traceability argument Epstein would later use with Summers as the selling point for tokenised digital currency.

The thread contains a draft invitation for ‘a private and confidential dialogue on Rethinking Monetary Systems, running over 3 days, which will bring together a maximum of 15 world experts’106. All costs covered, including partner travel and a daily honorarium. The unnamed philanthropist — Epstein — ‘has agreed to make a contribution of XXXX USD to each of two projects that you co develop and agree to work on with some of the other participants’. He was funding the outputs, seeding operational projects that emerged from the dialogue. The stated objective: ‘new monetary or exchange systems that promote sustainable development’.

Sustainable development as the stated purpose of monetary system transformation, three years before the SDGs were adopted.

The convening model — private, invitation-only, fifteen experts, expenses paid, intellectual framework as deliverable — is structurally identical to the Stranded Assets Forums at Waddesdon documented in The Waddesdon Papers.

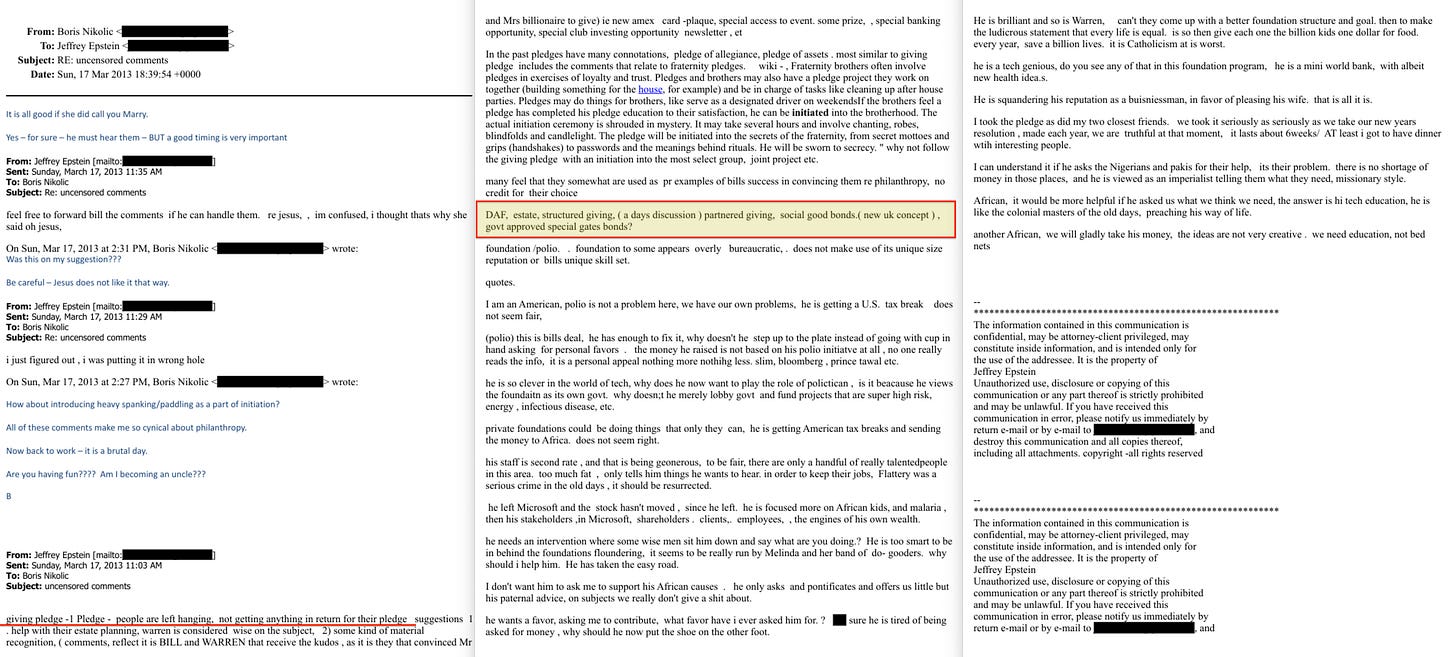

On 17 March 2013, Epstein sent Boris Nikolic a strategic memo titled ‘uncensored comments’, compiling criticisms of the Giving Pledge from billionaire donors, interspersed with proposed replacements. Among the listed components107: ‘DAF, estate, structured giving, (a days discussion) partnered giving, social good bonds. (new uk concept), govt approved special gates bonds?’

He was tracking the UK’s pioneering work on social impact bonds — the world’s first SIB had launched at HMP Peterborough in 2010108, Cameron’s government had established Big Society Capital in 2012109 — and appending a government-endorsed bond instrument branded to Gates as a specific proposal.

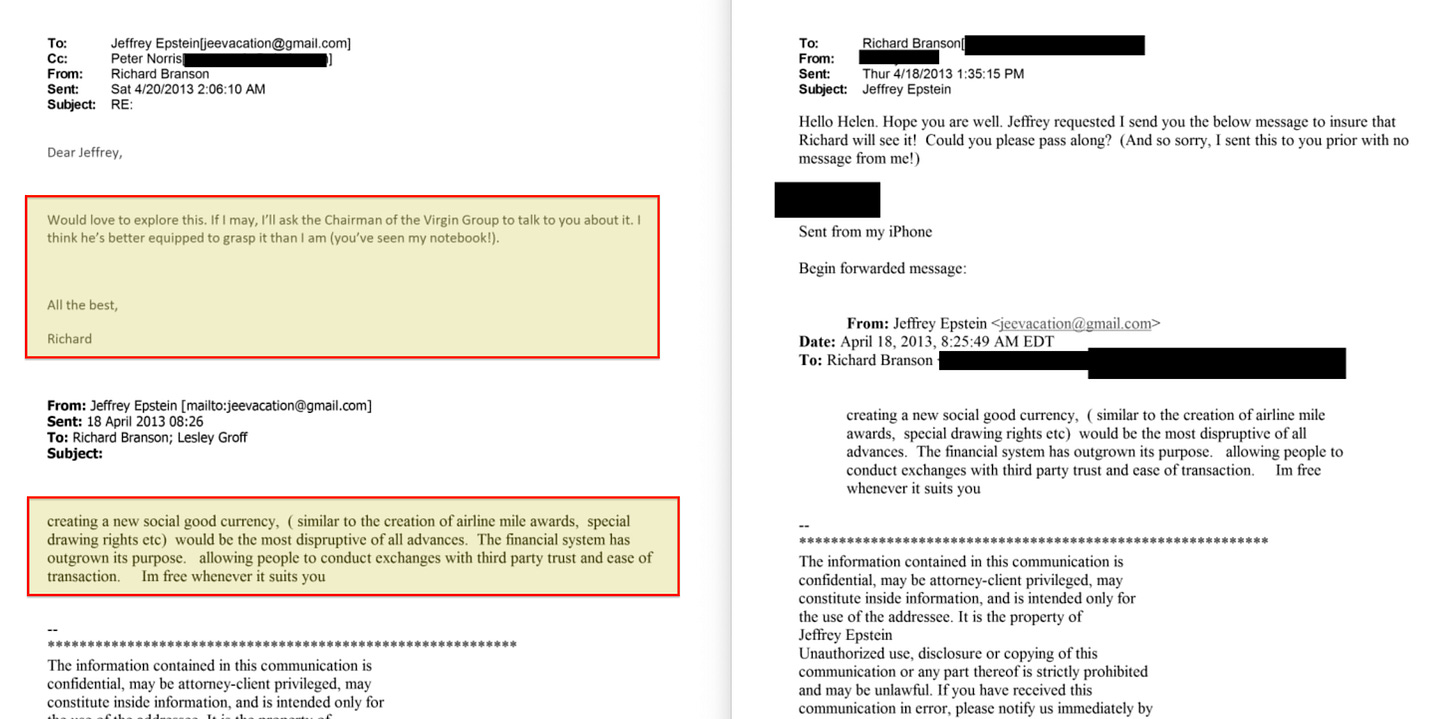

One month later, on 18 April 2013, Epstein emailed Richard Branson110: ‘creating a new social good currency, (similar to the creation of airline mile awards, special drawing rights etc) would be the most dispruptive of all advances. The financial system has outgrown its purpose’.

Two days later, Branson replied111, CC’ing Peter Norris — Chairman of the Virgin Group, former head of Barings Securities, former director of the London Stock Exchange: ‘Would love to explore this. If I may, I’ll ask the Chairman of the Virgin Group to talk to you about it’.

The analogies are technically correct: airline miles are loyalty-point currencies with conditional redemption; special drawing rights are the IMF’s synthetic reserve currency for sovereign settlements.

Epstein was describing a programmable currency with conditional payment logic — what the BIS Innovation Hub now calls ‘purpose-bound money’112. The BIS Innovation Hub was established in 2019.

The concept was circulating through this network at least six years earlier.

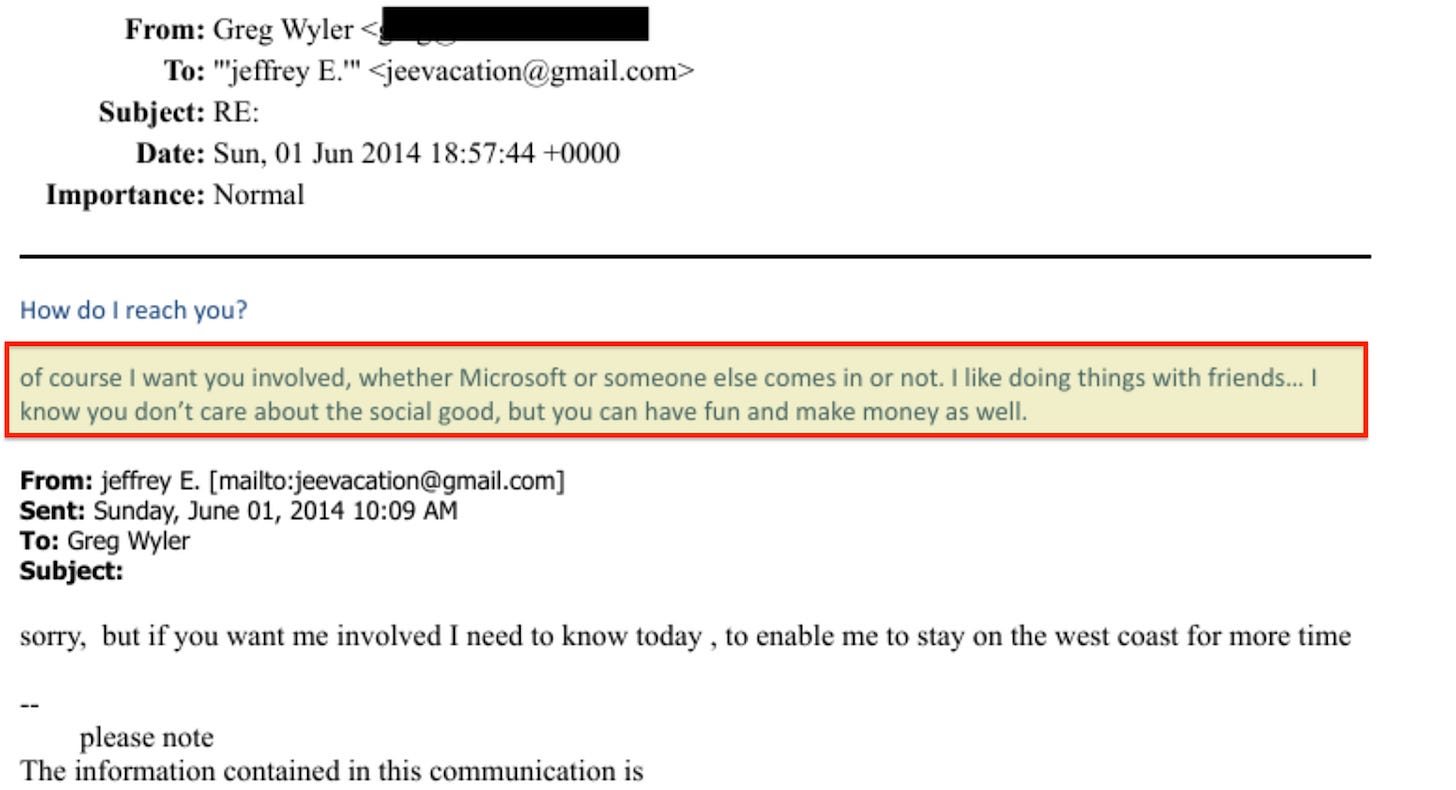

On 1 June 2014, Greg Wyler — founder of OneWeb, the satellite internet constellation, and O3b Networks (‘Other 3 Billion’)113 — emailed Epstein114: ‘of course I want you involved, whether Microsoft or someone else comes in or not. I like doing things with friends... I know you don’t care about the social good, but you can have fun and make money as well’.

The founder of a global satellite constellation designed to connect the developing world to the internet — the physical infrastructure layer the entire digital finance architecture requires — explicitly acknowledging that Epstein’s interest was financial, not philanthropic.

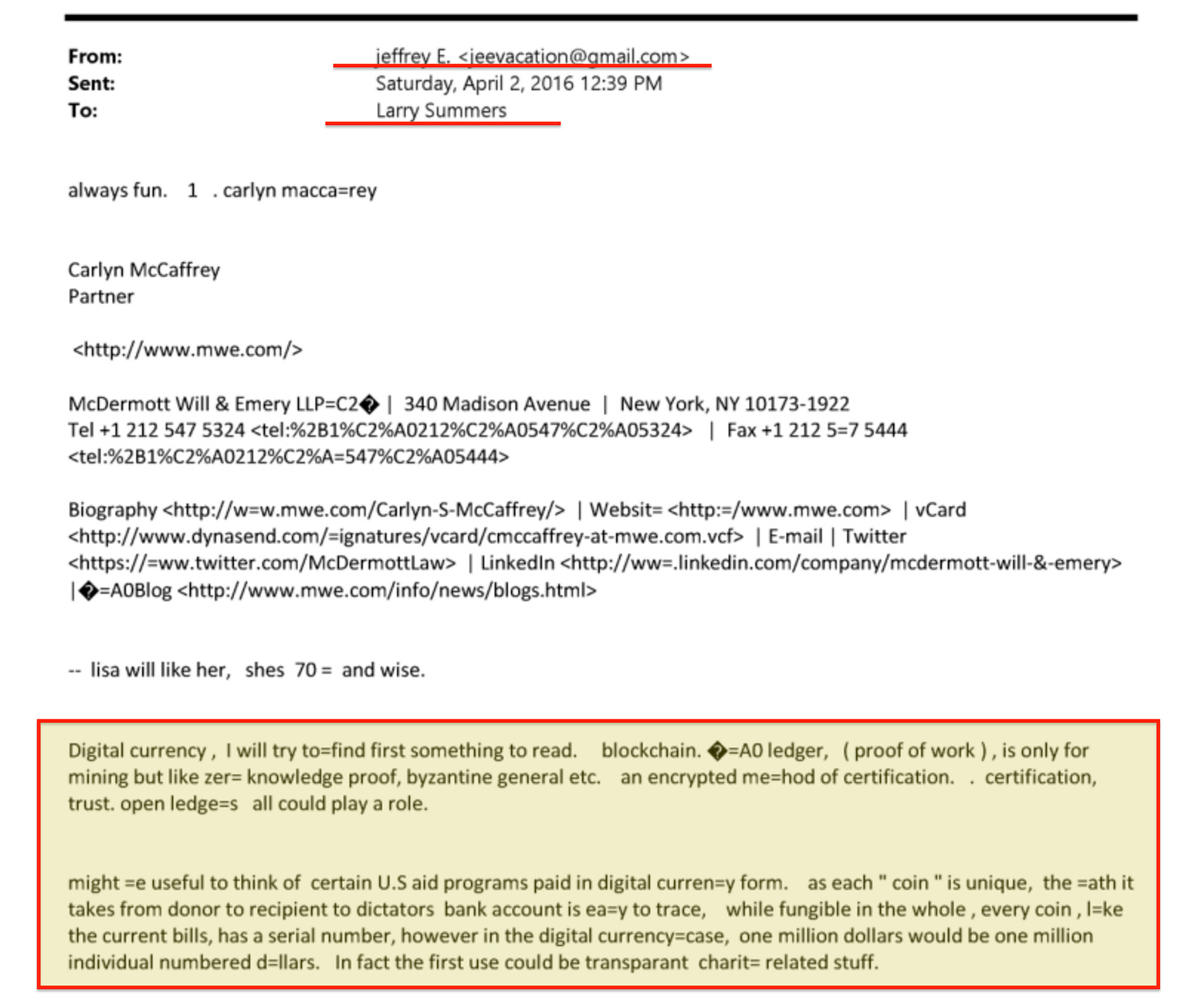

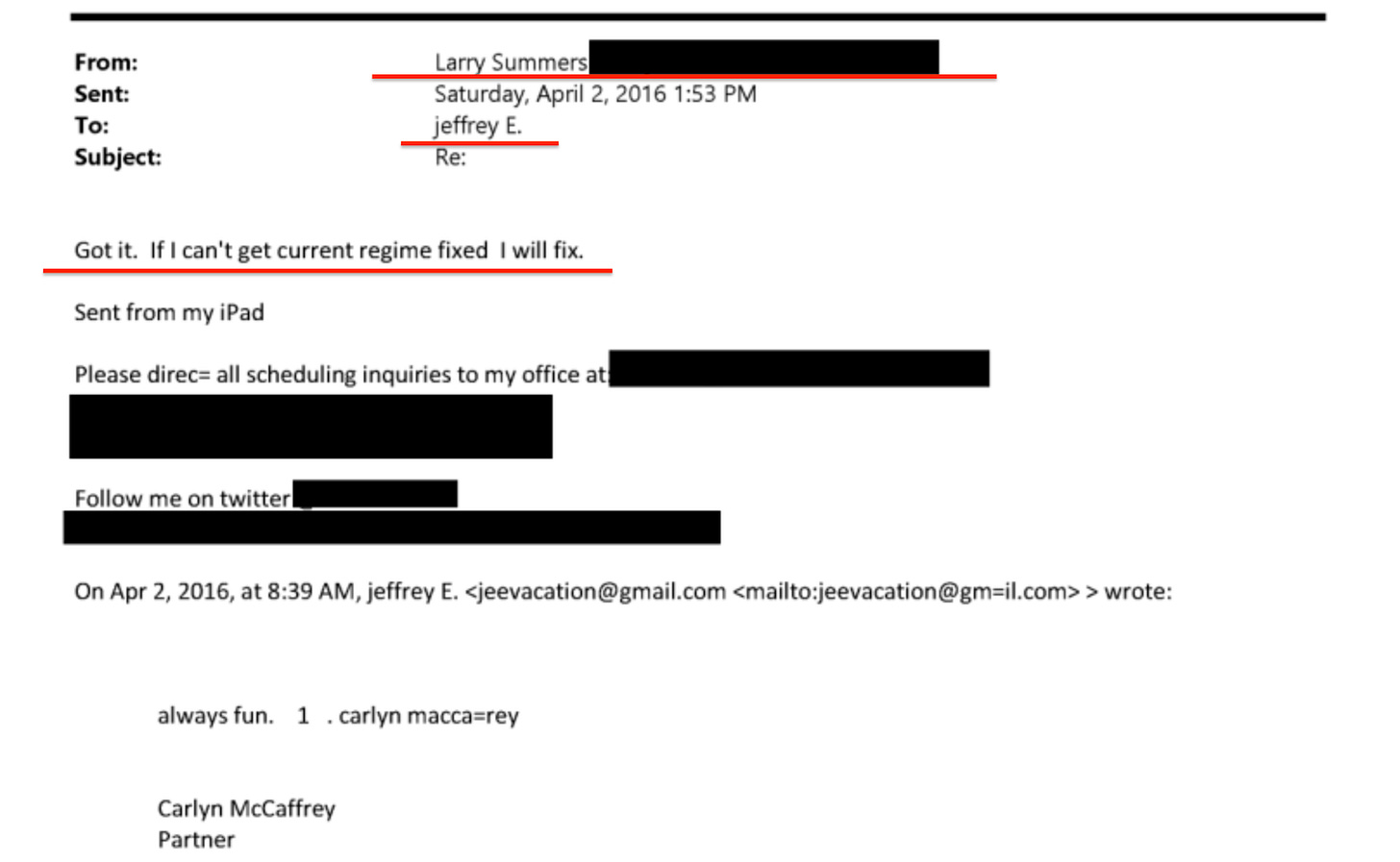

On 2 April 2016, Epstein emailed Lawrence Summers — former US Treasury Secretary, former Harvard President, former Chief Economist of the World Bank — with a complete technical specification115:

Digital currency, I will try to find first something to read. blockchain. ledger, (proof of work), is only for mining but like zero knowledge proof, byzantine general etc. an encrypted method of certification.

Then the design116:

might be useful to think of certain U.S aid programs paid in digital currency form. as each ‘coin’ is unique, the path it takes from donor to recipient to dictators bank account is easy to trace, while fungible in the whole, every coin, like the current bills, has a serial number, however in the digital currency case, one million dollars would be one million individual numbered dollars. In fact the first use could be transparant charity related stuff

Charity is the door. No one objects to surveillance when it’s called ‘transparency’.

Every element of what the BIS now calls purpose-bound money is present in this paragraph:

Tokenisation at unit level (each coin uniquely numbered)

Full transaction traceability from issuance to endpoint

Aid disbursement as the entry vector

‘Transparant charity related stuff’ as the first use case — the deployment path of least political resistance

The traceability logic is the premise of the BIS’s Project Aurora117. The tokenisation model is the distinction between account-based and token-based CBDC that the Innovation Hub has spent years developing through Projects Helvetia118 and Tourbillon119. And ‘the first use could be transparant charity related stuff’ is the 2011 Erdoes tension — ‘the tension is making money from a Charitable Org’ — restated as deployment strategy: start with philanthropy, where surveillance-as-transparency is uncontroversial, then extend the infrastructure.

Summers replied within seventy-five minutes120: ‘Got it. If I can’t get current regime fixed I will fix’. Epstein replied: ‘i will help if you like, it is readily apparent that you have not been asked the right questions.. thats the key’121.

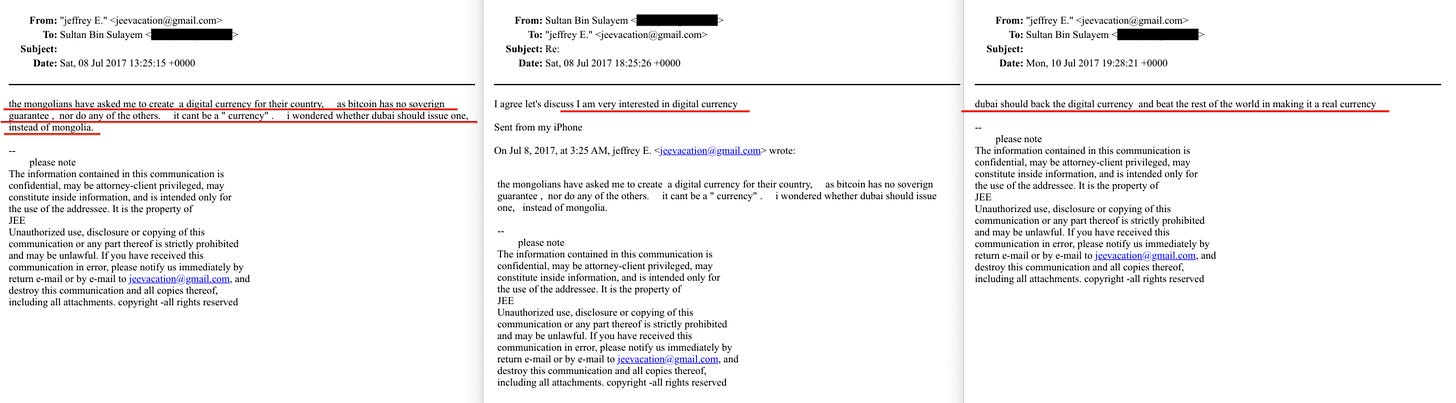

On 8 July 2017, Epstein emailed Sultan Ahmed Bin Sulayem122 — Chairman of DP World123, one of the largest port and logistics operators in the world124: ‘the mongolians have asked me to create a digital currency for their country, as bitcoin has no sovereign guarantee, nor do any of the others. it cant be a ‘currency’. i wondered whether dubai should issue one, instead of mongolia’.

Bin Sulayem replied the same day125: ‘I agree let’s discuss I am very interested in digital currency’. Two days later, Epstein escalated: ‘dubai should back the digital currency and beat the rest of the world in making it a real currency’. Within three days, Bin Sulayem was volunteering DP World — 80 per cent owned by the Dubai government — as the issuance vehicle and asking Epstein to prepare briefing materials for Sheikh Mohammed bin Rashid Al Maktoum, the Ruler of Dubai.

Epstein’s critique of Bitcoin — that without sovereign backing ‘it cant be a ‘currency’’ — is precisely the argument the BIS has made since 2018 in every report distinguishing central bank digital currencies from private cryptocurrencies.

He is articulating the central bank consensus position before the BIS Innovation Hub exists, two years before the People’s Bank of China began its digital yuan pilot. And the infrastructure Bin Sulayem proposed — a global port and logistics operator — is precisely the kind of physical trade network through which you would attach a digital currency to actual commerce rather than speculation.

The single mechanism

Read together with the previous essays, these are not separate developments but a single mechanism expressed at different scales.

Impact investing is the macro layer: public capital blended with private capital, directed toward measurable social outcomes, with the private partner extracting returns while a civil society organisation defines what ‘good’ means.

The conditional payment CBDC is the micro layer: the same conditionality embedded in the currency itself, governing individual transactions.

Impact investing conditions the fund. Purpose-bound money conditions the transaction. Together they form a single system in which capital allocation and individual spending are both governed by externally defined social objectives — from sovereign bond issuance down to what a farmer can purchase with a programmable payment.

The entity that defines ‘good’ — that determines what counts as a qualifying social outcome at the fund level and what conditions are embedded in programmable money at the transaction level — is in both cases a civil society organisation or standard-setting body: precisely the kind of entity that The Waddesdon Papers documents as originating from foundation-funded convenings.

The foundations fund the research. The research becomes the framework. The framework becomes the classification criteria. The classification criteria are embedded in the currency. And the private capital that funded the foundations extracts returns at every stage through the blended finance layer above.

The ‘social good’ is the authorisation layer: the thing that makes the surveillance acceptable, the conditionality palatable, and the private extraction invisible. ‘Transparant charity related stuff’ as first use case is the deployment logic: start where no one objects to traceability, then extend the infrastructure to all transactions.

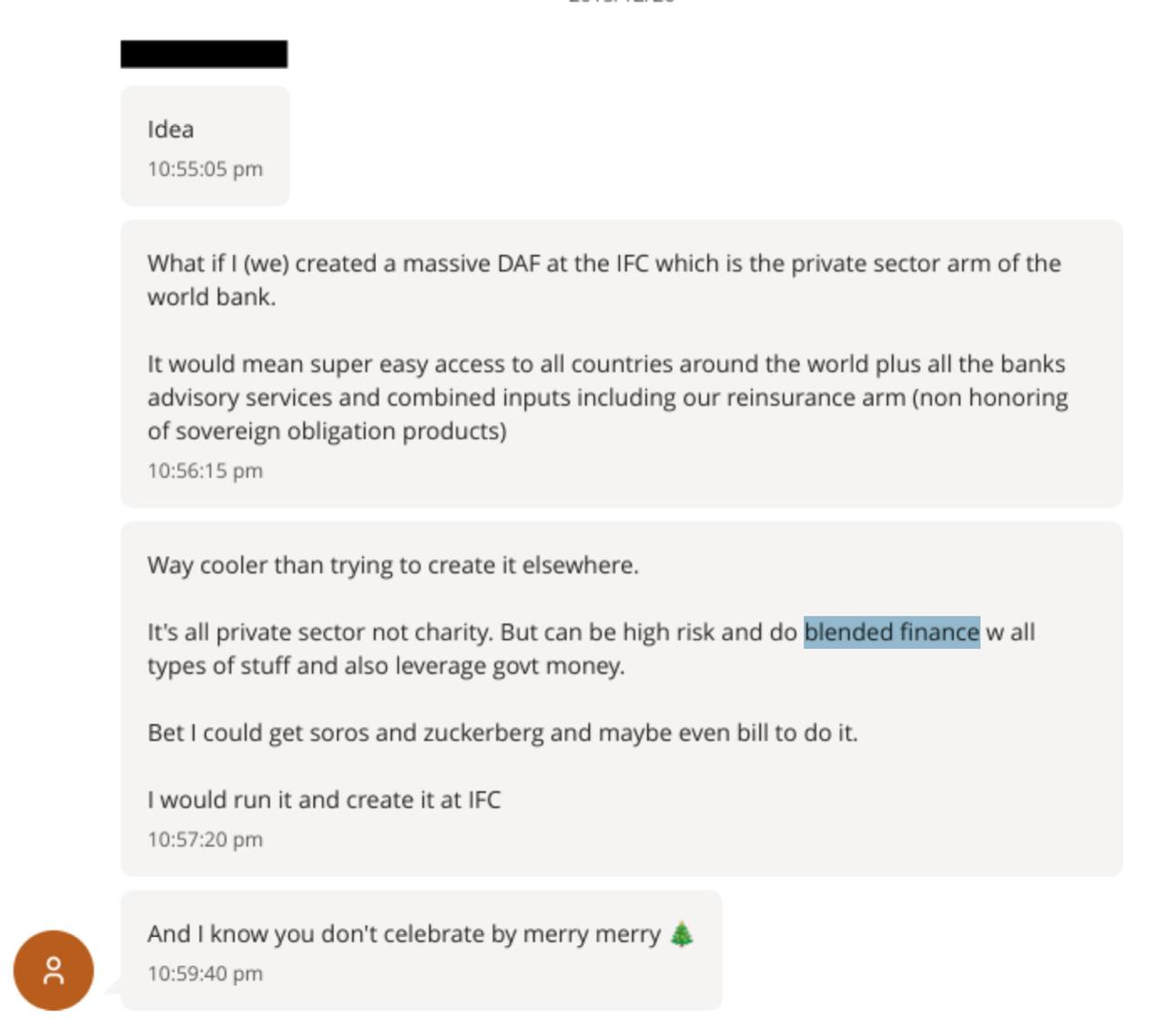

From the other direction, the same conclusion arrived unprompted. Four messages sent within four minutes (10:55 to 10:59 PM), a pitch from within the network to its centre126:

What if I (we) created a massive DAF at the IFC which is the private sector arm of the world bank. It would mean super easy access to all countries around the world plus all the banks advisory services and combined inputs including our reinsurance arm (non honoring of sovereign obligation products).

Then127:

Way cooler than trying to create it elsewhere. It’s all private sector not charity. But can be high risk and do blended finance w all types of stuff and also leverage govt money. Bet I could get soros and zuckerberg and maybe even bill to do it. I would run it and create it at IFC.

The sender is likely Melanie Walker. The financial language is not casual. ‘Non honoring of sovereign obligation products’ is MIGA terminology128 — political risk insurance against governments failing to meet payment commitments. She is describing a complete World Bank Group architecture: IFC provides the vehicle and country access, MIGA provides sovereign risk insurance, blended finance combines private capital with government money, and the whole structure operates through multilateral infrastructure while remaining ‘private sector not charity’.

The parenthetical ‘(we)’ — inviting Epstein into ownership of the idea, seeking his endorsement as a condition for proceeding — is the structural tell. Walker had direct access to IFC, World Bank, MIGA, Gates, potentially Soros and Zuckerberg. She did not lack connections. She lacked the central node’s endorsement.

Nothing moved through the network without passing through him.

VI. The Research Portfolio

While designing the financial architecture with JPMorgan and circulating the conceptual escalation from ‘social good bonds’129 to a ‘social good currency’ and sovereign digital currencies, Epstein was simultaneously funding the foundational research for every technical component the system requires.

His connection to AI began through Marvin Minsky130, co-founder of the MIT Artificial Intelligence Laboratory and one of the four original architects of the field. Minsky was described as Epstein’s ‘closest friend at MIT’. Epstein donated at least $850,000 to MIT between 2002 and 2017131, directed toward Minsky, Media Lab director Joi Ito, and physicist Seth Lloyd.

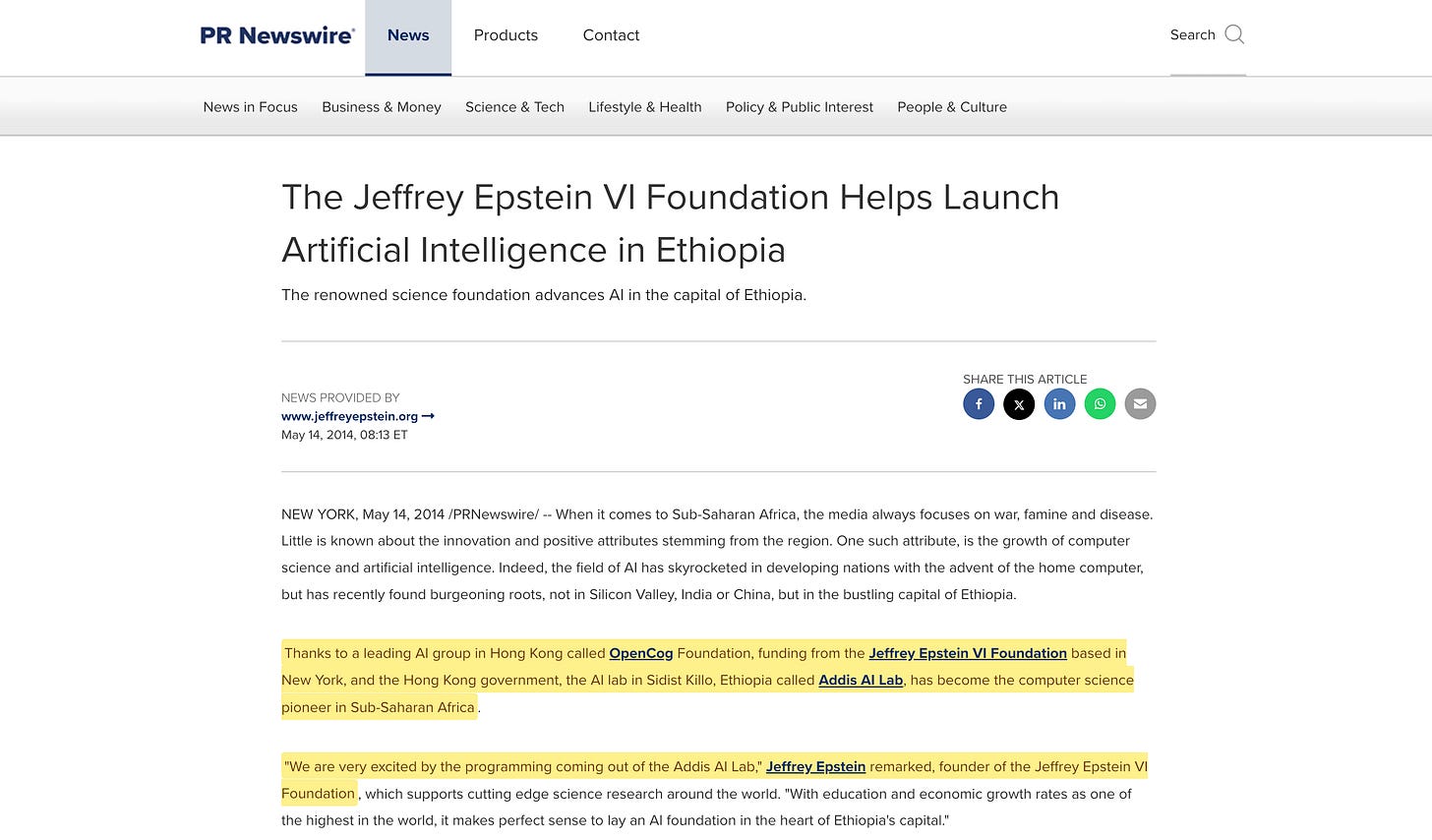

The deeper connection is to Ben Goertzel132 and the OpenCog project. Goertzel — who popularised the term ‘artificial general intelligence’ (AGI) and now heads SingularityNET — acknowledged Epstein in his 2014 book133: ‘Jeffrey Epstein, whose visionary funding of my AGI research has helped me through a number of tight spots over the years’. OpenCog is an open-source AGI framework designed to be domain-agnostic — applicable to any classification task, usable across any dataset against any criteria. Goertzel also served as vice chairman of Nick Bostrom’s Future of Humanity Institute at Oxford134.

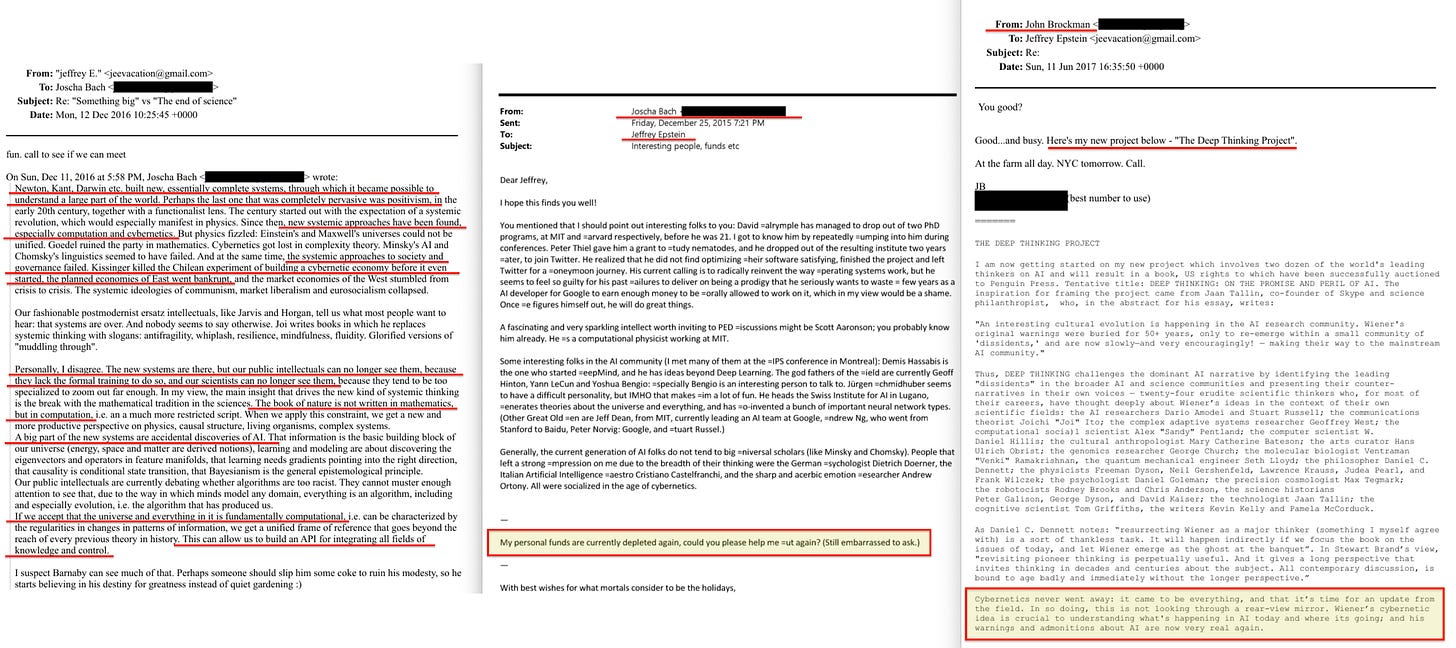

Epstein funded Joscha Bach’s MicroPsi cognitive AI project in Berlin135. Bach, whose work on cognitive architecture is foundational to the field, credited the Epstein Foundation for ‘generous support’ in a 2018 paper.

The funding was not passive. In December 2016, Bach emailed Epstein a sweeping assessment of systemic governance136. He traced the collapse of twentieth-century systemic ideologies and noted that ‘Kissinger killed the Chilean experiment of building a cybernetic economy before it even started’137. But the new systems, he argued, were already emerging through AI:

If we accept that the universe and everything in it is fundamentally computational... we get a unified frame of reference that goes beyond the reach of every previous theory in history. This can allow us to build an API for integrating all fields of knowledge and control.

The man funding Bach’s AI research138 was receiving a briefing on why previous attempts at systemic control had failed, and what the next attempt would require.

Six months later, John Brockman emailed Epstein about his new book project for Penguin Press: ‘The Deep Thinking Project’, featuring ‘two dozen of the world’s leading thinkers on AI’. Brockman’s framing:

Cybernetics never went away: it came to be everything, and that it’s time for an update from the field... Wiener’s cybernetic idea is crucial to understanding what’s happening in AI today and where its going.

The science of control systems that Kissinger had killed in Chile was being rehabilitated — through AI, through this network — and Epstein was funding it139.

He also funded Martin Nowak’s Programme for Evolutionary Dynamics at Harvard with a $6.5 million donation140 — the mathematical modelling of how populations of agents respond to incentive structures, how cooperation and defection propagate through networks under selective pressure. The theoretical basis for designing conditionality that shapes behaviour at scale.

He sought to fund a proposed centre at the MIT Media Lab researching ‘evolutionary development centered on deception as a strategy’ — how deception functions as an adaptive mechanism within complex systems. The Goodwin Procter141 report commissioned by MIT identifies the subject. Epstein sought to fund this anonymously.

And in Addis Ababa, Epstein’s VI Foundation helped launch what became iCog Labs142, an AI laboratory that is now a core OpenCog contributor143, established with the OpenCog Foundation and the Hong Kong government.

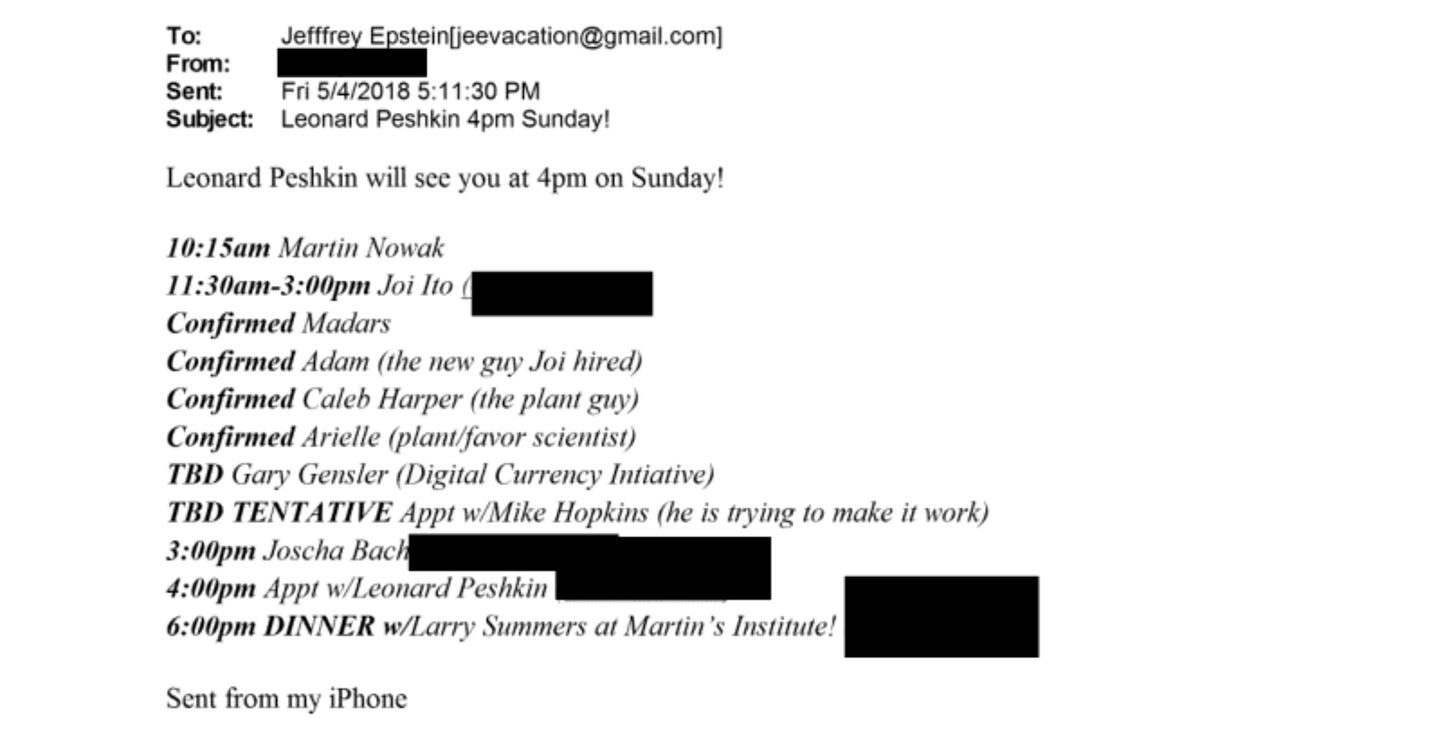

A scheduling document dated 4 May 2018, organising Epstein’s Sunday appointments two days later, places all of these threads in a single afternoon144145: Martin Nowak at 10:15 AM; Joi Ito146 and confirmed researchers including Madars Virza147 — the Latvian cryptographer whose work on zero-knowledge proofs is foundational to privacy-preserving digital currency verification — from 11:30 AM to 3:00 PM; Joscha Bach at 3:00 PM; and dinner with Larry Summers at Nowak’s institute at 6:00 PM. Listed as TBD: Gary Gensler, identified by his affiliation with MIT’s Digital Currency Initiative.

Three years later, Gensler would be appointed Chairman of the Securities and Exchange Commission148, launching the most aggressive US regulatory campaign against private cryptocurrency149 — consistently arguing that digital assets without sovereign backing require state oversight150. Virza co-developed the zk-SNARK cryptographic proof system used in Zcash151 — the cryptographic primitive Epstein had described to Summers two years earlier as ‘zero knowledge proof, byzantine general etc. an encrypted method of certification’152.

AI research, zero-knowledge cryptography, digital currency regulation, evolutionary dynamics, and the former Treasury Secretary who had received Epstein’s tokenisation specification — all convened in a single afternoon, at the institute Epstein’s money built, fourteen months before his arrest.

Taken as a portfolio, the funding is a component list:

Domain-agnostic machine classification (Goertzel, Bach, Minsky)

Behavioural modelling under conditional incentives (Nowak)

Privacy-preserving verification (Virza and the zero-knowledge lineage)

Algorithmic risk assessment (the $25 million Rothschild contract)

Research into deception as adaptive strategy

These are the technical components of a system that classifies activity against externally defined criteria, models how populations respond to conditional incentives, verifies transactions without full disclosure, and automates risk assessment against defined parameters.

The same architectural principle — domain-agnostic AI applied to any classification task — funded at the research stage through this network, is now the organising logic of state infrastructure. The BIS’s Project AISE153 is a domain-agnostic AI supervisor that can scan any corporate disclosure against any criteria. Project Gaia154 uses AI to process climate-related financial disclosures. Project Aurora155 applies federated learning across institutional data.

The man assembling this research portfolio was simultaneously designing the impact investing vehicle with JPMorgan, pitching a ‘social good currency‘ to Branson, sending tokenisation specifications to Summers, and proposing sovereign digital currency to Dubai’s ruler.

How many coincidences are one too many?

VII. The Accountability Gap

The SDG Machine documents an architecture with no appeal mechanism. An entity classified as non-compliant by AISE faces higher capital costs whether the classification is accurate or not. Project Noor’s explainable AI provides a reasoning chain, not an error correction process156. The infrastructure layer develops without equivalent democratic input.

The emails suggest why accountability would be structurally incompatible with the coordination. If classified entities could appeal to an independent authority, that authority would need to examine who defined the criteria, who trained the classifier, who wrote the conditions embedded in programmable money. The trail leads from the BIS Innovation Hub to the NGFS scenarios to Waddesdon to this network.

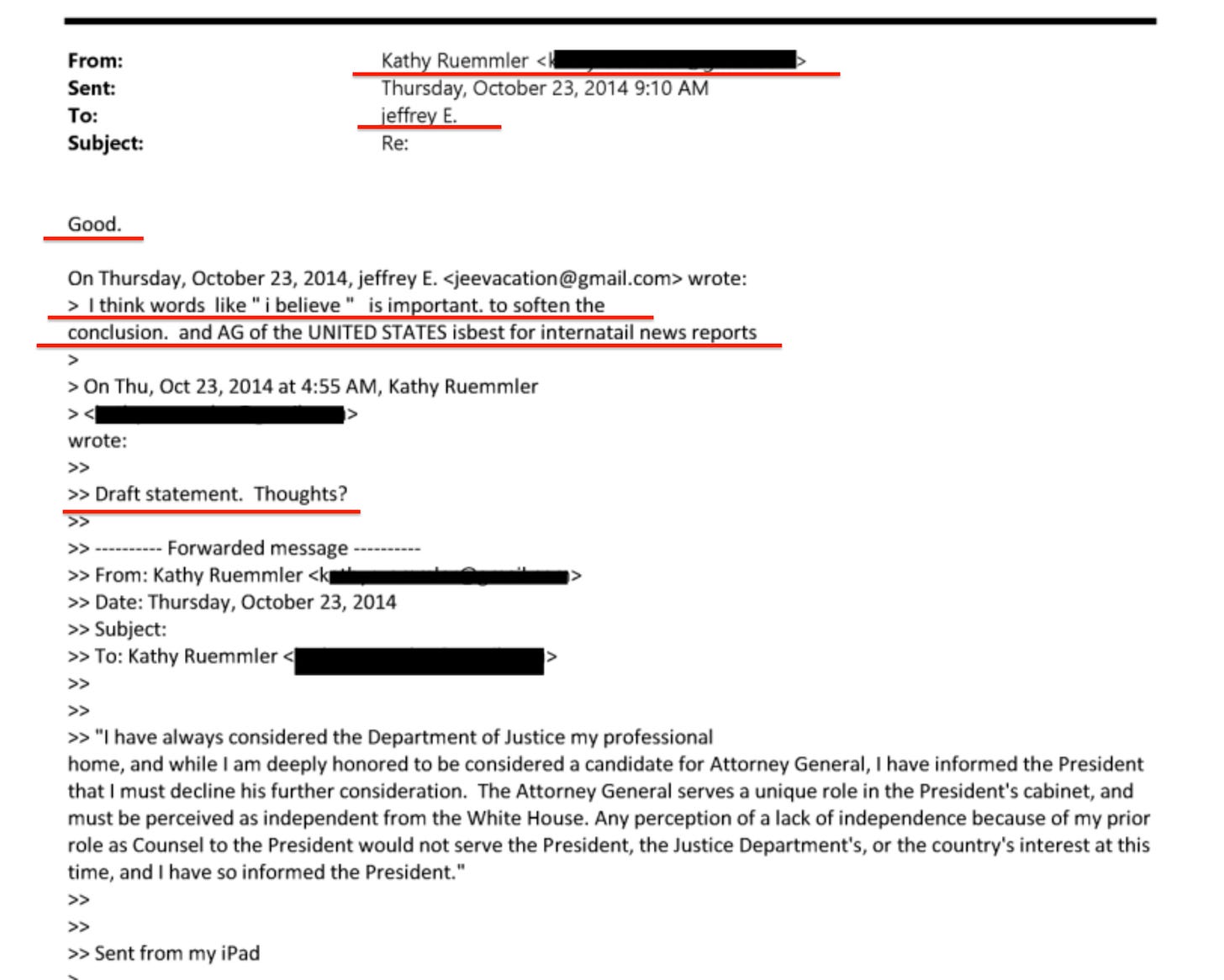

The reach into the accountability architecture itself is documented. Kathryn Ruemmler — the former White House Counsel who vetoed Epstein’s Putin meeting — was Obama’s preferred candidate to replace Eric Holder as Attorney General157. On 23 October 2014, she emailed Epstein a draft public statement declining further consideration for the position158159:

Draft statement. Thoughts?

She was asking Epstein to edit her public statement declining the nation’s highest law enforcement position. Epstein replied with suggested edits — advising her to add ‘I believe’ and ‘United States’ before Attorney General for how it would read in ‘international news reports’.

A CNN analysis of privilege logs from the Epstein estate civil suit found Ruemmler in more than 300 emails, listed as sender in at least 135160. Epstein called her ‘my great defender’161. She called him ‘wonderful Jeffrey’ and said ‘I adore him’ in a December 2015 exchange where he booked and paid for her first-class travel to Europe. She was named backup executor in a January 2019 draft of Epstein’s will162.

She is now chief legal officer and general counsel of Goldman Sachs163, where she chairs the Firmwide Conduct Committee and co-vice-chairs the Firmwide Reputational Risk Committee164.

The person who would have led the Department of Justice — the institution responsible for prosecuting financial crime, enforcing securities law, and investigating the networks this essay documents — was routing career decisions through the switchboard operator and asking a convicted sex offender to polish her public statement.

The absence of accountability in the architecture is not an abstract design choice. The people who would staff the accountability mechanism are the same people in the emails.

VIII. Termination

An FBI Criminal Investigative Division document, classified UNCLASSIFIED//LES and approved by CID on 17 July 2024, records the final weeks. On 29 July 2019, FBI and SDNY met with Epstein’s attorneys, who ‘in very general terms, discussed the possibility of a resolution of the case, and the possibility of the defendant’s cooperation’165.

A parallel document adds that defence counsel did not make a specific proposal, and that it was suggested they contact SDNY if Epstein was ‘prepared to accept responsibility for his conduct and/or they had a specific proposal for a resolution’166.

Twelve days later, on 10 August 2019, Epstein was found dead in his cell at the Metropolitan Correctional Center167.

A cooperating Epstein would not have been a peripheral witness exposing one connection. He would have been the routing table documenting itself — every introduction, every strategic instruction, every intelligence flow, every career he sequenced, every deal he blocked, mapped from the only position that saw all of them simultaneously.

This was a man credentialed by David Rockefeller, seated on the board of Rockefeller University, admitted to the Council on Foreign Relations and the Trilateral Commission, embedded across three branches of the Rothschild dynasty, in regular correspondence with a former US Treasury Secretary, a former White House Counsel, a former Israeli Prime Minister, a former European Commissioner for Trade, the chair of the Norwegian Nobel Committee, and the President of the UN General Assembly — who had designed the impact investing vehicle with JPMorgan’s most senior executives, specified the tokenised digital currency architecture to Summers, pitched sovereign digital currency to Dubai’s ruler, funded the AI and cryptographic research now deployed by central banks, and placed personnel into the World Bank, the World Economic Forum, NHS Digital, and Goldman Sachs.

Whether he killed himself, was killed, or — as some claim — was moved beyond public reach, the network outcome was identical: the routing table became permanently inaccessible. But it didn't matter.

By 2019, every thread Epstein had been routing was institutionalised:

AI classification was operational at the BIS through Projects AISE, Gaia, and Aurora.

Digital Currency/CBDC development was being coordinated across jurisdictions through Projects Helvetia and Tourbillon.

Impact investing was the standard architecture for development finance, with trillions in capital flowing through impact, ESG, and blended finance frameworks.

The proof of concept — GHIF — had been running since 2012.

The regulatory positions were being staffed: Gensler moved from Epstein’s TBD Sunday schedule to SEC Chairman.

The personnel were placed: Walker was at the World Bank, Ruemmler heading to Goldman Sachs.

The Waddesdon framework was operational, with NGFS scenarios mandated and classification criteria being embedded in EU regulation.

The mechanism Epstein designed with Erdoes, the concept he escalated from social good bonds through social good currency to sovereign digital currency, the research portfolio he assembled — all had been transferred from the informal coordination layer to formal institutional infrastructure.

The switchboard had completed its function. What remained was the risk: a man who had seen the entire construction from the only position that connected all the nodes, whose lawyers had just raised the possibility of cooperation.

The system does not need a switchboard operator once the wiring is in the walls.

What the emails document — read alongside the previous essays — is the construction of a society whose economics have been reengineered around a ‘social good’: a common ethic, with AI as the enforcement mechanism and the Sustainable Development Goals as that ethic.

Impact investing directs capital toward SDG compliance. Programmable money enforces SDG conditions at the transaction level. AI classification determines who is compliant and who is not. The goals provide the ethic. The architecture provides the enforcement. The question is who defined the ethic, who built the enforcement, and whether the two serve the same interest.

The moral authority of the Sustainable Development Goals is the system’s most important asset. Seventeen goals that no decent person can oppose: end poverty, clean water, gender equality, climate action. The emails show that the people positioning themselves behind this moral authority are not who the brochure describes.

This does not necessarily discredit the goals. It raises the question of whether the architecture built in their name serves the goals — or serves the network that operates the architecture. The architecture does not require its builders to understand the full assembly.

The climate scientist perhaps genuinely believes they are preventing catastrophic warming. The AI researcher genuinely believes they are making disclosure more efficient. The central banker genuinely believes programmable payments serve financial inclusion. They need only see their own component.

The people who see the full assembly operate through informal channels that produce no working papers, publish no documentation, and answer to no parliament. And at its centre, for over a decade, sat a Rockefeller-credentialed clearinghouse who served everyone by belonging to no one — until the architecture was built and the clearinghouse became a liability.

The system claims it serves seventeen goals for eight billion people. I’m not quite sure that’s correct.

The purpose of a system is what it does.

Find me on Telegram: https://t.me/escapekey

Find me on Gettr: https://gettr.com/user/escapekey

Bitcoin 33ZTTSBND1Pv3YCFUk2NpkCEQmNFopxj5C

Ethereum 0x1fe599E8b580bab6DDD9Fa502CcE3330d033c63c

unsure why some people want the essay to be about something else - if you want to read about blackmail, then read webb, if you want it to be about eugenics, then you have to go elsewhere because a) there’s no evidence of that in those emails i reviewed and b) eugenics doesn’t explain the system itself

what the essay does is draw direct connections between what epstein was actually up to - setting aside the MSM noise - and what else they were doing while you didn’t watch.

they built a global system of indicator governance, with digital id an eventual requirement, where ‘impact finance’ imposes ‘ethics’ on macro transactions and conditional payment CBDCs will impose at micro.

and that could easily lead to far worse abuses than anything else suggested. in fact, it almost certainly will.

blackmail alone could not have facilitated this outcome. only systems theory could, which incidentally has been a prime focal point of mine.

"...the purpose of a system is what it does."

What he "built", is an individualised, algorithmically enforced panopticon (prison "cell"), for every single one of the 8B+ people on the planet.😐🤫🤔

Let that sit for a moment.

If it wasn't so anti-human and morally repulsive, I'd have to almost give a standing ovation for the vision, meticulous, and long-sighted tenacity.

No wonder the collective "nodes" decided to run with it 100% full steam ahead, after his exit (or perhaps even before...🤔😉).

OUTSTANDING PIECE. For those that have a hard time with the convid and "everything you think you know is a lie", reveal/expose.

Then this is your K.I.S.S. explanation- it literally Cuba Gooding Jr's the hell out if it!!! "Show me the money!?"

#hereitis #followthemoney #showmethe$$$

#donotcomply