Sovereignty by Latency

The Bank for International Settlements — the central bank of central banks — is building a unified ledger for the global financial system1. BIS General Manager Agustín Carstens has described the architecture extensively in speeches and Innovation Hub reports, and one of its core features is conditional execution: payments and contracts that automatically trigger when certain conditions are met2.

This perhaps sounds like efficiency, but conditional execution at the wholesale layer creates a major problem that the official documentation treats as out of scope: the end of reversibility.

Find me on Telegram: https://t.me/escapekey

Find me on Gettr: https://gettr.com/user/escapekey

Bitcoin 33ZTTSBND1Pv3YCFUk2NpkCEQmNFopxj5C

Ethereum 0x1fe599E8b580bab6DDD9Fa502CcE3330d033c63c

First, two examples to illustrate the fundamental mechanism:

A regional hospital’s funding disbursement is made conditional on real-time compliance attestations from an approved auditing feed — standard practice in performance-based contracting3. The payment triggers, releasing funds to the hospital, which pays suppliers, who pay workers, who pay rents — all within seconds.

Three months later, a court finds the attestation requirement exceeded the agency’s statutory authority. The original transaction was invalid, but its financial progeny — the hospital’s solvency, the supplier’s payroll, the rents paid — have already hardened into irreversible facts.A carbon border adjustment charges an importer based on embedded emissions data. The payment clears, triggering a cascade: customs release, warehouse fees, distribution contracts, retail payments, consumer purchases — each conditional on the last.

A tribunal later determines the emissions calculation methodology was flawed and the charge unlawful, but the goods have sold, the supply chain has been paid, and thousands of downstream transactions exist only because the original levy cleared. The tribunal can rule correctly while remaining powerless to reverse what the cascade has propagated.

How Conditional Execution Works

The wholesale layer of banking is where the large transactions happen4 — central banks settling with each other, commercial banks clearing payments between institutions, major financial actors moving billions daily. This is the infrastructure underneath retail banking, and when it changes, everything built on top changes too.

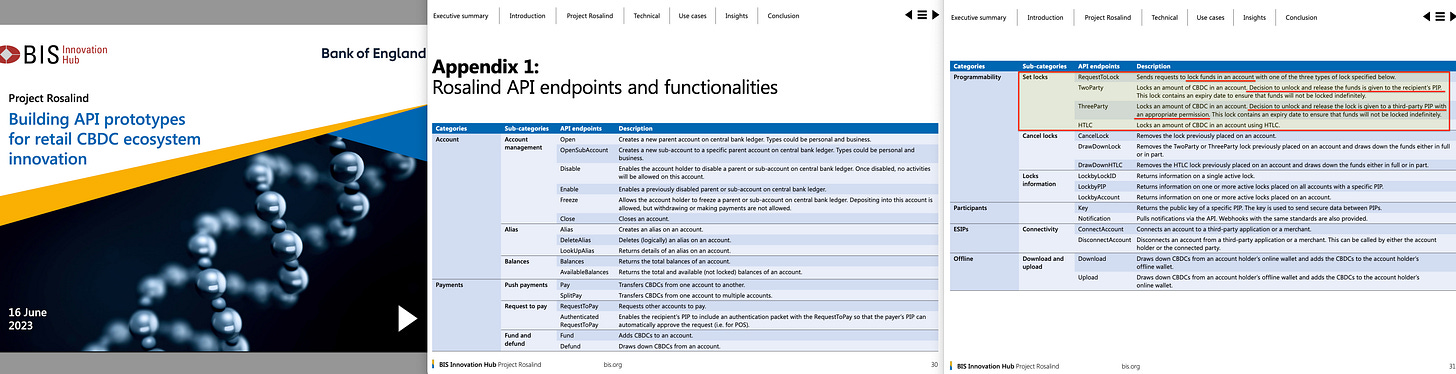

The key innovation is that conditional transactions can be chained. A payment executes only when certain conditions are met5, and its completion becomes a condition for the next transaction, whose completion becomes a condition for others. Finance becomes programmable6 — sequences of if-then logic executing automatically without human intervention. The industry calls these ‘smart contracts’7, though they are automated rather than intelligent, executing blindly based on coded conditions without context, equity, or even the spirit of the law.

The chaining creates irreversibility. When Transaction A executes, it triggers Transaction B (conditional on A), which triggers C, D, and E (conditional on B), which trigger F through K — each layer spawning the next, dependencies multiplying exponentially. Within hours, the dependency tree has exploded into millions of interconnected state changes, all existing only because A occurred.

When a court, three months later, rules that Transaction A was invalid, reversing it means reversing every transaction that branched from it. The downstream structure was built on a foundation the court now says never legitimately existed, but that structure has already propagated across the entire system, and unwinding it is virtually impossible.

The Architecture as Designed

The BIS Innovation Hub8 papers describe this explicitly: programmable payments9, smart contracts10, atomic settlement11, conditional logic12 executing at machine speed across the wholesale layer.

The efficiency gains are real — settlement risk drops, counterparty exposure shrinks, and liquidity moves faster. But risk transfers — it does not disappear. When a cascade based on an invalid transaction cannot be unwound, losses are socialised onto institutions, insurance funds, or taxpayers, while ledger integrity is preserved. Risk reduction becomes risk redistribution: away from system operators and onto the public.

The papers do not meaningfully address what happens when someone contests a transaction after the conditional cascade has fired, because by design that scenario is not supposed to occur. And if it’s contested a month down the line, that single transaction could easily lead to millions of transactions executed which were based on a faulty assumption and now have to be reversed. And that is — in practical reality — virtually impossible.

The Historical Lineage

Conditional finance is not new, but its low latency, retail granularity, automation and irreversibility are.

It began with Robert McNamara. At the Pentagon from 1961 to 1968, he implemented PPBS13 — the Planning, Programming, and Budgeting System — tying resource allocation to measurable objectives. When he moved to the World Bank in 196814, he applied the same logic globally: third world nations received conditional aid, with disbursements contingent on structural adjustment targets15. The IMF conditionality16 regime of the 1980s and 1990s extended this further, with loans contingent on policy reforms evaluated quarterly.

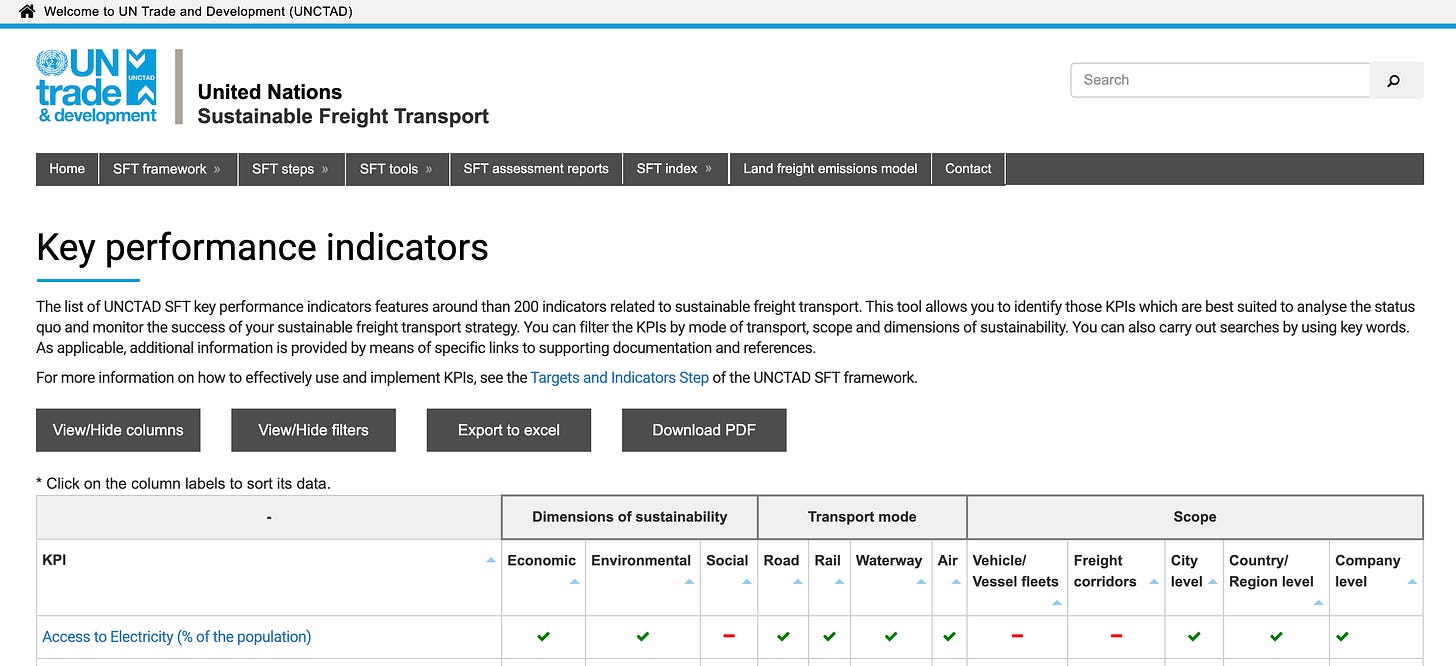

This later developed into Result-Based Management17 utilising Key Performance Indicators18 tied to the SDG Indicator framework19. Same structural logic, but now far more versatile20.

Today, development aid can be made conditional upon recipients achieving specific SDG targets, with indicators21 existing to quantify progress in each one. Funding can be granted upon the condition of, say, improved health and environmental outcomes; the data points are already in place to verify compliance.

PPBS was programmable finance before computers could execute it. Humans evaluated compliance, made disbursement decisions, and could be negotiated with. The conditionality had slack — political, interpretive, and temporal. A government could miss targets, renegotiate terms, and buy time.

But Carstens’s unified ledger removes the slack. The logic remains identical — resources conditional on compliance — but execution is automated and reversibility is gone in practice. Conditions are evaluated by code rather than committees, compliance is binary rather than negotiable, and execution is instantaneous rather than quarterly. What McNamara built required an army of ‘whiz kid’ systems analysts22 and years of evaluation cycles; what the BIS is building executes the same control logic at machine speed, with no window for renegotiation.

The wholesale layer sets conditions for commercial banks, which set conditions for businesses, which set conditions for individuals. When conditional execution is hierarchical and instantaneous, the entire economy becomes programmable from the top down, and the slack that once allowed for politics, judgment, and correction vanishes.

This is governance by clearance: the constitutional question shifts from ‘should we do X?’ (a political question requiring debate) to ‘does entity Y meet criteria Z?’ (a technical question enabling automated denial). If you lack the right attestation, the transaction does not clear.

The implementation need not arrive as visible coercion. It turns into business-facing compliance requirements first, then pricing mechanisms that make non-compliance expensive, then conditional incentives that reward alignment, and finally default conditionality once alternative infrastructure has been retired. By the time restrictions become visible to ordinary users, the systems that might have provided alternatives have already atrophied.

The architecture does not technically prohibit alternatives — it merely withdraws support until alternatives become impractical or expensive.

Why Legal Systems Cannot Address This

Traditional legal systems assume time — time to investigate, deliberate, rule, and enforce. This works when transactions are discrete events that can be individually reversed, and fails when every transaction is conditionally linked to dozens of others, each of which has triggered dozens more.

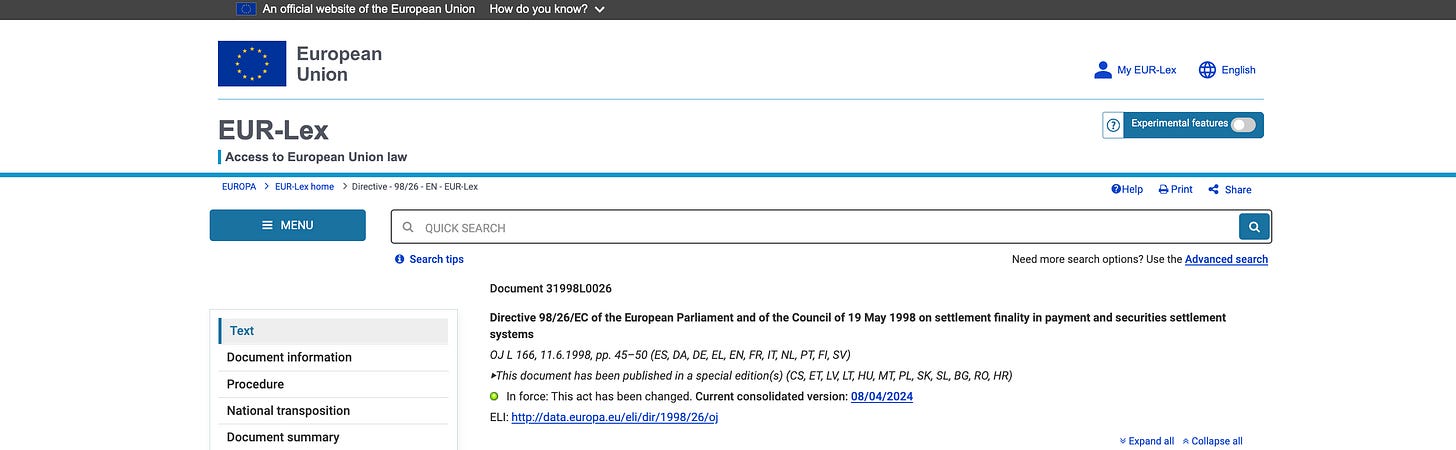

There is precedent: ‘finality’ in existing payment systems like CHAPS23 or Fedwire, where settled payments24 cannot be reversed even if fraudulent25, to prevent systemic collapse26. But old finality was a legal and operational rule applied to discrete payments — a policy choice that could be debated and modified. New finality is mathematical certainty baked into infrastructure, applying to an exponentially growing web of conditional states that lock in simultaneously.

In other words, reversal was already impossible at the wholesale level, but the same mechanics will now extend down to individual retail transactions — only you won’t be considered of systemic importance.

The Latency Gap

Traditional sovereignty meant having the final say — the king, the parliament, the court could reverse decisions, override actions, and restore previous states. Political theorists have long understood that the sovereign is whoever can declare the exception to the normal legal order27, suspending ordinary rules in extraordinary circumstances.

When a system generates irreversible states faster than any legal body can convene to review them, sovereignty shifts from the entity that declares the exception to the entity that designed the conditions for its automatic production. The exception is no longer declared but manufactured continuously by the architecture itself.

This does not overthrow the legal order — it inverts it. Law becomes spectral commentary on actions already solidified in a realm it cannot reach. The court still sits, the judges still rule, and the legal system still functions, but in a temporal zone the financial architecture has already evacuated, issuing judgments about states that hardened into permanence before the gavel fell.

In proposed designs, governance and administrative authority over the unified ledger sit with central banks28 and approved operators, who can design circuit breakers and emergency halts. Political and legal minds will demand these controls, believing sovereignty can be preserved by the ability to halt. But a halt freezes the system in an invalid state without reversing what has already propagated. The power to induce cardiac arrest is not the power to perform surgery, and by the time a committee convenes to debate whether to pull the brake, the explosion is already complete — the ‘emergency’ is a fait accompli observed in retrospect.

The architecture makes external correction either impossible or apocalyptic. Sovereignty belongs to whoever built the system such that the circuit breaker cannot undo what conditional execution has already done.

And this entire apparatus is overseen by an entity that operates beyond the reach of the law: the Bank for International Settlements is contractually exempt from Swiss jurisdiction29.

Anticipatory Authoritarianism

Democratic anticipatory governance rests on four pillars: foresight to identify risks before they materialise, public engagement to contest design choices before they lock in, adaptive management to enable course correction, and circuit breakers to halt malfunctioning systems. The framework assumes governance can see, deliberate, and steer the systems it governs.

This architecture does not abandon anticipatory governance; it captures and inverts it. Foresight requires a buffer between identifying a risk and acting on it, but the combinatorial explosion eliminates that buffer, reducing foresight to retrospective clairvoyance that sees the catastrophe clearly only after it is immutable.

Engagement requires something to be contested before it is final, but if post-hoc contestation is structurally meaningless, public input becomes aesthetic commentary on design choices made years prior. Adaptive management requires the capacity to reverse, adjust, or redirect, but this system is architected against adaptation, its only ‘adaptation’ being pre-programmed branches that execute static logic at high speed.

In 1904, the philosopher Hermann Cohen considered what law would look like if you stripped out sentiment, context, and judgment — just pure logical form executing according to its own internal rules. The architecture being built is Cohen’s vision made real, except hollow: automated execution that follows the letter of its programming with no capacity for the spirit, the exception, or the correction that makes law just rather than merely mechanical.

The result is a system that anticipates through its conditional logic, governs through automatic execution, and pre-empts external governance by operating faster than deliberation while making its outputs irreversible. All possible future states narrow to pathways permitted by the original code, and ‘public engagement’ happened once, in the technical committees that decided the ontological rules — what counts as a valid transaction, condition, and finality. After those decisions were made, the window for politics closed.

This is where proposals like the UN Emergency Platform integrate. The Platform provides the trigger and legitimation layer — the authority to declare ‘black box’ modelled ‘complex global shocks’ that cascade across domains — which central banks and system operators can adopt as reference conditions for the unified ledger’s execution logic. Political authority declares, the ledger executes, and combinatorial explosion forecloses reversal.

The emergency declaration also provides legal cover: once a ‘complex global shock’ is declared, emergency laws suspend normal contestation rights — the very rights that might otherwise challenge the conditional cascades as they propagate. The legal lock buys time while the technical lock hardens, and by the time emergency powers are lifted (if they ever are), the combinatorial explosion has already crystallised into permanent state.

The window for democratic input exists only in the design phase — a brief moment of politics before technological sovereignty activates and governance shifts from steering to interpreting, from deciding to managing consequences. The system still anticipates, still governs, still manages — but for its operators rather than its subjects.

The Political Questions

The BIS papers discuss efficiency, interoperability, programmability, and tokenisation. They treat as out of scope what happens to legal contestability when conditional execution creates combinatorial explosions that cannot be unwound, who holds sovereignty over a system that creates irreversible facts faster than any institution can review them, or what ‘rule of law’ means when law structurally cannot reverse what the system has done.

These are political questions, and they determine who holds power in the emerging financial architecture. The BIS and central banks are technocratic institutions optimising for efficiency, stability, and control, and the pursuit of perfect efficiency in a complex system inherently creates power structures immune to traditional oversight. No one needs to intend this outcome; the design choices produce it as systemic inevitability.

As the cybernetician Stafford Beer observed, the purpose of a system is what it does — not what it claims to do, not what it was designed to do, but what it actually does. By that measure, this system’s purpose is to replace the rule of law with the rule of algorithms preempting the future.

Structural Sovereignty

An institution operating a system where execution is instant, where transactions trigger conditional cascades, where cascades create combinatorial dependencies, where dependencies make rollback computationally impossible, and where legal review arrives only after dependencies have hardened — that institution is structurally sovereign, regardless of what any law formally states.

Formal authority over an irreversible system is the authority to write opinions about things that cannot be changed.

Consider what this means at the wholesale layer through an example:

A major international bank is flagged by an automated sanctions-screening system built into the settlement infrastructure. The flag is wrong — a data error, an overzealous algorithm, a flawed designation — but the system doesn’t wait for verification. It cancels the transaction. Within minutes, it’s all but irreversible.

Within hours, other banks stop settling transactions with the flagged bank, as their clients can’t access their money. Other institutions that depend on the flagged bank start having their own transactions delayed or blocked. The financial network reorganises around this new ‘fact’ — credit lines are cut, emergency loans are called in, clients flee to competitors.

Six months later, a court rules the original flag was unlawful. The designation should never have happened.

But by then, the bank has collapsed — its clients are gone. Other institutions have restructured their entire operations around its absence. The financial system has already absorbed the shock and moved on — billions of transactions have occurred that assumed the flag was valid.

The court can declare the flag was wrong. Actually undoing the damage would require reversing six months of global financial activity, reconstructing relationships that no longer exist, and forcing everyone to pretend the collapse never happened. That ‘fix’ would itself crash the system.

So the choice becomes: accept that an unlawful action destroyed a major bank and disrupted the global economy, or trigger a new crisis trying to undo the old one.

This is sovereignty by latency.

Back to barter, I think! The system is eating its own tail.

Buy your title if hoped it meant I'm sovereign by not participating within the monetary economy but then I realised... not really possible.

It's more try and survive this theft