Technocracy, Inc.

From BIS to Planetary Control

The most sophisticated revolutions don't announce themselves. They arrive wrapped in the language of justice, equity, and planetary salvation. While critics focus on the visible mechanics of digital currencies or climate policies, a deeper transformation is taking place: the construction of what we might call a ‘moral operating system’ for the global economy.

This system doesn't just control money — it controls the ethical framework through which money operates, making resistance appear not just futile but immoral. Understanding this requires looking beyond individual policies to see the dual-layer architecture at work: every technical control mechanism comes paired with ideological cover that makes it appear beneficial, even liberatory.

The result is a system where algorithmic governance masquerades as social justice, where technocratic control presents itself as inclusive stewardship, and where the elimination of economic freedom is sold as the achievement of equity.

Executive Summary

A global moral operating system is being deployed — one that transforms technocratic dominance into ‘ethical imperative’ through a sophisticated dual-layer architecture. Institutions such as the BIS, OECD, UNFCCC, and IMF are embedding algorithmic constraints within progressive narratives: programmable money is marketed as ‘financial inclusion’, carbon budgets as ‘climate justice’, and well-being metrics as ‘beyond GDP progress’. These mechanisms are rolled out via a recursive deployment cycle — Crisis → Intermediation → Conditionality → Control — where emergency narratives justify expert-led solutions, soft-law frameworks enforce voluntary compliance through economic coercion, and algorithmic enforcement bypasses legislation via smart contracts — systemic replacement of democracy with governance through ‘ethics’.

The brilliance of this model lies in how it weaponises ‘justice’. To question programmable currencies is to defend financial exclusion; to object to carbon CBDCs is to deny ‘planetary responsibility’; to challenge well-being indicators is to oppose ‘human flourishing’. Through this psychological architecture of consent, resistance is reframed as moral failure — pushing all political perspectives into negotiating the design of control rather than its legitimacy.

What emerges is a moral economy: a system where every transaction is ethically scored by unelected systems, and economic freedom exists only within pre-approved bounds. This is not merely a future being debated — it is a future already being coded, fulfilling the century-old blueprint of Technocracy Inc., now repackaged as inclusive capitalism.

The Dual-Layer Architecture

Technical Stack Ideological Cover

BIS → monetary rails ←→ 'Financial inclusion & stability'

OECD → metrics ←→ 'Beyond GDP, well-being for all'

UNFCCC → morality ←→ 'Climate justice & equity'

NGFS/IMF → conditions ←→ 'Sustainable development finance'

Carbon CBDCs ←→ 'Green money for everyone'

Planetary CBDCs ←→ 'Inclusive planetary stewardship'

Moral Economy ←→ 'Inclusive Capitalism achieved'Each layer of technical infrastructure comes with carefully crafted progressive messaging that makes opposition appear morally indefensible. But understanding the architecture alone isn't enough — we must also see the operational cycle that brings it to life.

The Four-Move Playbook

As we saw in ‘The Clearinghouse Protocol’, Beneath the dual-layer structure runs a consistent deployment mechanism — the same four-step cycle that transforms every crisis into expanded technocratic control:

Crisis

Carbon budgets framed as an existential emergency → political licence for extraordinary measures.Intermediation

BIS & partner central banks publish a ‘how-to’ (Mandala1, mBridge, Ubin+2) demonstrating that CBDCs can ingest external compliance or ESG oracles at payment-time.Conditionality

OECD, UNFCCC & others standardise the data formats (Effective-Carbon-Rates tables3, Article 6 Registry4, Nature-positive taxonomies5). Commercial wallets will have to query those feeds before the transaction settles.Control

A government can now say: ‘the retail wallet inherits the same carbon-spend limit that the wholesale rails already apply to banks’. Because the rules sit in the wallets or in the money itself, you never need a new Act of Parliament — just update the oracle or the smart-contract.

This cycle explains how the dual-layer system actually gets deployed: a crisis creates urgency that bypasses normal democratic deliberation. ‘Expert’ intermediation provides ‘solutions’ that appear technical and neutral. ‘Soft law’ conditionality makes compliance appear voluntary and ‘ethical’ while gradually ensuring non-compliance becomes akin to economic suicide. And control, algorithmic or not, leads to automatic enforcement, often invisible to most.

The genius is that each step appears reasonable in isolation, while the cumulative effect is the replacement of democratic governance with algorithmic enforcement of ‘expert’-determined values. It is, in essence, entirely technocratic in nature.

How the Layers Implement the Playbook

Beyond the four ‘moves’, we have seven ‘layers’.

Layer 1: BIS Monetary Rails ↔ ‘Financial Inclusion & Stability’

Historical Background: The Bank for International Settlements was born from crisis in 1930, just as markets collapsed worldwide. Its founding fulfilled Julius Wolf's 1892 vision of an international gold clearing mechanism — a system where national monetary authorities could settle through a central hub rather than bilaterally. This replicated the London Bankers' Clearing House model that had dominated British finance since the 1850s: local banks cleared through larger institutions, which settled through the Bank of England. The BIS simply scaled this hierarchical clearing logic to the global level, with central banks playing the role of local banks and BIS as the ultimate clearing node.

The Technical Reality: The Bank for International Settlements has spent the last decade building programmable money infrastructure. Through projects like mBridge6, Nexus7, and the ‘unified ledger’8, BIS is creating digital rails where every transaction can be automatically screened against policy conditions. Smart contracts embedded in central bank digital currencies can block payments, impose fees, or redirect funds based on predetermined rules9.

The BIS's 2023 blueprint for a ‘unified ledger’ explicitly describes how programmable money can enable ‘arrangements that are currently not practicable’10 — meaning policy controls that bypass traditional democratic processes. Project Genesis11 demonstrated how tokenised bonds can automatically track carbon emissions and adjust payments accordingly. This is money as a policy enforcement mechanism — algorithmic control at the point of sale.

The Ideological Cover: ‘Financial inclusion and stability’. CBDCs are marketed as tools to ‘bank the unbanked’, provide ‘financial stability’, and create ‘inclusive digital payment systems’12. The rhetoric emphasises access, efficiency, and protection of the vulnerable. The UN's digital identity initiatives13 are framed as ensuring ‘no one is left behind’ in the digital economy.

Critics who point out the surveillance and control implications get positioned as defending an exclusionary status quo that leaves billions without access to financial services. Want privacy in payments? You're defending money laundering and tax evasion. Oppose programmable currency? You're opposing financial inclusion for the global poor.

The Neutralisation Effect: Progressive voices find themselves arguing for ‘better’ programmable money rather than opposing programmable money itself. The conversation shifts from ‘should we have algorithmic monetary control'? to ‘how do we make algorithmic monetary control more equitable’? The technical infrastructure gets built while critics debate its parameters.

Layer 2: OECD Metrics ↔ ‘Beyond GDP, Well-being for All’

Historical Background: The OECD evolved from the post-war Organisation for European Economic Cooperation14, but its modern metrics-driven approach traces back to Robert McNamara's Planning-Programming-Budgeting System (PPBS) introduced at the Pentagon in 196115. PPBS represented a revolutionary shift: instead of simply funding departments, it required quantified objectives, performance measures, and systematic evaluation of outcomes against inputs. When McNamara moved to the World Bank in 196816, he globalised this approach through Country Program Papers that conditioned development lending on measurable policy reforms17. The OECD became the methodological clearinghouse for this metrics-based governance18, developing standardised indicators19 that could guide both domestic policy and international coordination20.

The Technical Reality: The OECD has transformed into the global metrics factory, converting abstract concepts like ‘well-being’21, ‘sustainability’22, and ‘social progress’23 into quantified indicators that guide policy and investment. These metrics don't just measure outcomes—they define what outcomes matter.

The OECD's Well-Being Framework explicitly goes ‘beyond GDP’24 to incorporate environmental quality, social connections, and inequality. Countries and corporations that score poorly on these indicators face reduced access to capital, higher borrowing costs, and reputational damage. Through peer reviews, rankings, and investment criteria, OECD metrics create powerful incentives for compliance — without any formal legal authority.

The Ideological Cover: ‘Beyond GDP, well-being for all’. The OECD's expansion beyond economic metrics is positioned as progressive evolution — finally measuring what really matters for human flourishing rather than just economic output. The Better Life Index25, Green Growth indicators26, and Social Progress metrics are framed as tools for creating a more ‘holistic’, human-centered approach to development.

The messaging emphasises scientific objectivity and comprehensive measurement. Who could oppose measuring human well-being? The initiatives are presented as empirical progress beyond crude economism toward sophisticated understanding of what makes life meaningful.

The Neutralisation Effect: Critics of OECD metrics find themselves in the awkward position of appearing to defend narrow economism against broader human welfare. The debate becomes about which indicators to include, not whether expert-designed metrics should determine national priorities. Democratic deliberation about values gets replaced by technical discussions about measurement methodologies.

Opposition appears anti-scientific and reactionary—defending an outdated focus on mere economic growth against enlightened attention to human flourishing and planetary health.

Layer 3: UNFCCC Morality ↔ ‘Climate Justice & Equity’

Historical Background: The climate treaty system emerged from the 1992 Rio Earth Summit27, orchestrated by Maurice Strong — the same figure who had organised the 1972 Stockholm Conference28 that created UNEP and launched the global environmental movement29. The 1992 gathering produced not just the climate convention but also the Convention on Biological Diversity30 and Agenda 2131, creating a comprehensive framework for planetary governance. Strong's genius was recognising that environmental concerns could provide the moral authority for global coordination that traditional economic or political arguments could not. The climate convention established the template: scientific expert panels (IPCC32) would determine planetary boundaries33, UN processes would translate these into moral imperatives, and soft law mechanisms would make these imperatives politically binding — without formal sovereignty transfer.

The Technical Reality: The UN Framework Convention on Climate Change34 provides the moral authority for planetary governance. Through soft law mechanisms like the Paris Agreement35, UNFCCC creates binding ethical frameworks that justify extraordinary coordination measures. Article 2.1(c) mandates ‘making finance flows consistent with a pathway towards low greenhouse gas emissions’, effectively requiring the global financial system to subordinate economic logic to climate goals36.

Carbon budgets37 become moral imperatives that override local democratic preferences. The climate treaty system creates expert-determined planetary boundaries that countries must respect regardless of their citizens' priorities. Climate action becomes a moral obligation that transcends sovereignty.

The Ideological Cover: ‘Climate justice and equity’38. Climate action gets framed not just as environmental necessity but as social justice imperative. The climate movement emphasises how warming disproportionately affects marginalised communities, making opposition to climate policies appear not just environmentally irresponsible but socially regressive.

‘Climate justice’ links planetary boundaries to social equity, creating an unanswerable moral coalition39. Fighting climate change becomes equivalent to fighting racism, colonialism, and inequality. The framework positions climate governance as reparative justice for historically marginalised communities40.

The Neutralisation Effect: Opposition to technocratic climate governance gets reframed as opposition to justice itself. Critics find themselves labeled as defenders of inequality who prioritise short-term comfort over long-term survival of vulnerable populations. The moral urgency makes democratic deliberation appear like a luxury the planet cannot afford.

Any resistance becomes evidence of privilege and moral blindness — the selfish defense of an unsustainable lifestyle against the existential needs of the global poor and future generations.

Layer 4: NGFS/IMF Conditions ↔ ‘Sustainable Development Finance’

Historical Background: The Network for Greening the Financial System41 launched in 2017 with just eight pioneering central banks42, but it replicated the proven template of financial conditionality that the IMF had perfected since the 1970s43. The IMF's structural adjustment programs44 had demonstrated how lending conditions could reshape entire economies without direct political control — countries voluntarily accepted painful reforms to maintain access to capital. The NGFS simply extended this logic to environmental compliance: central banks would ‘voluntarily’ adopt climate stress tests and green supervisory practices45 to maintain credibility with their peers. Meanwhile, the IMF's new Resilience and Sustainability Trust46 explicitly links concessional lending to climate policy implementation, ensuring that the conditioning mechanisms perfected for fiscal and monetary policy now apply to environmental governance.

The Technical Reality: The Network for Greening the Financial System47 and IMF create the conditionality mechanisms48 that enforce compliance with the metrics and moral frameworks established above. Through climate stress tests49, ESG requirements50, and conditional lending, they create a system where access to capital depends on alignment with expert-determined sustainability criteria51.

The NGFS scenarios52 provide ‘scientific’ justification for financial discrimination against carbon-intensive activities. The IMF's Resilience and Sustainability Trust53 explicitly links concessional lending to climate policy implementation. This is financial coercion disguised as risk management — comply with expert climate priorities or lose access to affordable capital.

The Ideological Cover: ‘Sustainable development finance’54. The integration of environmental and social criteria into financial systems gets positioned as responsible stewardship55 — finally accounting for the true costs and risks of economic activity. Climate stress tests are ‘prudent risk management’56, ESG requirements are ‘stakeholder capitalism’57, and conditional lending is ‘development effectiveness’58.

The narrative emphasises fiduciary responsibility and long-term thinking. Financial institutions that integrate climate risks are portrayed as sophisticated and forward-looking, while those that resist appear reckless and short-sighted.

The Neutralisation Effect: Financial institutions that resist ESG integration appear reckless and backward-looking. Critics seem to be advocating for irresponsible lending and investment practices that ignore obvious risks. The technical complexity of financial regulation makes democratic oversight nearly impossible, while the moral framing makes opposition appear ethically indefensible.

Resistance gets characterised as defending failed neoliberal economics against enlightened stakeholder capitalism that serves broader social purposes.

Layer 5: Carbon CBDCs ↔ ‘Green Money for Everyone’

The Technical Reality: Carbon-backed central bank digital currencies59 represent the first implementation of planetary boundary enforcement through money itself60. These systems automatically deduct carbon credits for emissions-intensive purchases, block transactions that exceed individual carbon budgets, or impose real-time carbon pricing.

The Carbon Reserve's ‘Toco’ currency61 and proposals for ‘Carbon QE’62 demonstrate how carbon sequestration can literally become money. Your wallet tracks your planetary impact in real-time63, with spending power determined by algorithmic calculation of your climate compliance. They transform climate policy from external regulation to embedded monetary logic.

The Ideological Cover: ‘Green money for everyone’64. Carbon CBDCs are presented as democratising climate action — giving every individual the tools to automatically contribute to planetary healing through their economic choices. They're positioned as empowerment technologies that make sustainable living effortless and equitable.

The messaging emphasises personal agency and environmental effectiveness. Citizens get framed as climate heroes65 whose daily spending directly funds decarbonisation. Carbon money becomes a tool of individual empowerment rather than systemic control.

The Neutralisation Effect: Opposition appears selfish and environmentally destructive. Critics seem to be defending their right to harm the planet for personal convenience. The individual empowerment framing makes systemic control appear like personal agency, while equity provisions make resistance look like defense of privilege.

Any critique gets positioned as opposing both environmental protection and democratic participation in climate action.

Layer 6: Planetary CBDCs ↔ ‘Inclusive Planetary Stewardship’

Historical Background: The planetary boundaries framework emerged from the Stockholm Resilience Centre in 200966, but its intellectual origins trace back to the systems thinking revolution of the 1960s. Kenneth Boulding's 1966 essay ‘The Economics of the Coming Spaceship Earth’67 first articulated the vision of Earth as a closed system requiring comprehensive resource management. This thinking informed the 1972 ‘Limits to Growth’68 study and eventually crystallised into Johan Rockström's nine quantitative boundaries that humanity must not cross. The framework provided exactly what carbon markets had demonstrated was possible: the conversion of abstract environmental concepts into quantifiable, tradeable units. If carbon could become money, why not biodiversity, water, or soil health69? The technical infrastructure developed for carbon trading proved easily adaptable to any measurable environmental parameter.

The Technical Reality: Multi-boundary CBDCs extend algorithmic control beyond carbon to the full range of planetary boundaries — water, biodiversity, nitrogen, soil, chemicals. Your wallet becomes a real-time planetary health monitor, automatically calculating the ecological impact of every purchase against expert-determined thresholds.

Single.Earth's MERIT tokens70, which tokenise ecosystem services, demonstrate how biodiversity and natural capital71 can become programmable money72. Economic freedom gets subordinated to algorithmic enforcement of planetary boundaries determined by institutions like the Stockholm Resilience Centre.

The Ideological Cover: ‘Inclusive planetary stewardship’73. Multi-boundary money gets framed as the ultimate expression of care ethics — a system that ensures every economic decision considers impacts on all life, future generations, and planetary systems. It's positioned as moving beyond anthropocentric economics to truly inclusive decision-making that represents all stakeholders, including non-human nature.

The narrative emphasises expanded moral consideration and intergenerational responsibility74. Planetary boundary money becomes evidence of humanity's ethical evolution beyond narrow self-interest toward comprehensive care for all life75.

The Neutralisation Effect: Opposition appears as defense of human supremacism and intergenerational selfishness. Critics seem to advocate for a destructive economic system that externalises costs onto vulnerable ecosystems and future generations. The stewardship framing makes algorithmic control appear like expanded moral consideration rather than constrained human agency.

Resistance gets positioned as anthropocentric arrogance that refuses to acknowledge humanity's interdependence with natural systems.

Layer 7: Moral Economy ↔ ‘Inclusive Capitalism Achieved’

Historical Background: The concept of a ‘moral economy’ has ancient roots, but its modern technocratic form emerged from Eduard Bernstein's 1899 revisionist Marxism76, which proposed achieving socialism through gradual reform of capitalism rather than revolution. Bernstein envisioned public-private partnerships guided by ethical imperatives — essentially, market mechanisms serving moral purposes. This template was refined through the Fabian Society's guild socialism77 and eventually institutionalised through Leonard Woolf's ‘International Government’78 (1916), which provided the blueprint for the League of Nations and later the UN system. The final synthesis came through the concept of ‘Inclusive Capitalism’79, promoted by figures like Lynn Forester de Rothschild80 and embraced by institutions from the Vatican81 to the World Economic Forum82. It promised to resolve capitalism's alleged contradictions not by replacing markets but by programming them to serve comprehensive social and environmental objectives83.

The Technical Reality: The full moral economy represents complete integration of algorithmic ethics into economic life84. Every transaction is automatically evaluated against the full range of expert-determined social and environmental criteria. Economic freedom exists only within the parameters of what algorithmic systems determine to be morally acceptable.

Money becomes a comprehensive moral calculator that enforces expert-designed values through spending restrictions, automatic taxes, and behavioral nudges. It's technocratic control presented as moral evolution — the final subordination of market logic to algorithmic ethics.

The Ideological Cover: ‘Inclusive Capitalism achieved’. The moral economy gets positioned as the fulfillment of progressive economic dreams — a system that finally aligns market forces with social and environmental justice85. It's presented as capitalism's evolution beyond its destructive contradictions into a form that serves all stakeholders.

Market freedom gets reframed as the freedom to choose among algorithmically pre-approved moral options. The system appears as capitalism reformed rather than capitalism replaced — the same market mechanisms but finally serving the ‘right’ values.

The Neutralisation Effect: This is the final neutralisation. Opposition to the moral economy becomes opposition to morality itself. Critics are positioned as defending an immoral system of exploitation against one of justice and sustainability. The technical complexity makes the system appear inevitable while the moral framing makes alternatives appear ethically impossible.

Any resistance becomes evidence of moral failure — the selfish refusal to accept that economic freedom must be constrained by social and environmental responsibility.

The Genius of Inclusive Capitalism

Inclusive Capitalism serves as the overarching narrative that ties all these layers together into a coherent story of moral progress. It doesn't just provide cover for individual policies — it creates a complete worldview in which technocratic control appears as the natural evolution of capitalism toward justice and sustainability.

The brilliance lies in how it co-opts every form of potential resistance:

Progressive Resistance gets channeled into demands for ‘better’ algorithmic control rather than opposition to algorithmic control itself. Instead of rejecting programmable money, progressives demand that it be programmed more equitably.

Conservative Resistance gets dismissed as defense of an unsustainable status quo that externalises costs onto future generations and marginalised communities.

Libertarian Resistance gets reframed as selfish individualism that refuses to account for impacts on others.

Democratic Resistance gets portrayed as inefficient populism that lacks the expertise to address complex global challenges.

The result is a system where every pathway of political resistance leads back to accepting the basic architecture while debating its parameters. The technical infrastructure gets built while critics argue about how to make it more inclusive, more sustainable, more equitable — never questioning whether algorithmic governance itself is compatible with human freedom.

The Psychological Architecture of Consent

The dual-layer system creates what we might call ‘manufactured consent’86 for technocratic control. By pairing each technical capability with progressive messaging, it makes opposition psychologically difficult and socially costly.

Moral Confusion: Critics must simultaneously oppose beneficial-sounding goals (inclusion, sustainability, justice) and technical capabilities they may not fully understand.

Social Isolation: Opposition puts individuals at odds with prevailing moral narratives, creating pressure to conform or remain silent.

Cognitive Overload: The complexity of the technical systems makes comprehensive criticism nearly impossible, while the moral framing makes partial criticism appear pedantic.

False Choice Architecture: The system presents itself as the only alternative to obviously harmful status quo arrangements, making opposition appear as defense of inequality and environmental destruction.

The Endgame: When Resistance Becomes Immoral

The final achievement of this dual-layer system is making opposition appear not just impractical but immoral. Once the moral economy is operational, criticism doesn't just challenge a policy — it challenges the ethical foundation of civilisation itself.

Want to oppose carbon CBDCs? You're defending planetary destruction.

Want to question OECD metrics? You're opposing human well-being.

Want to resist algorithmic enforcement of planetary boundaries? You're advocating for intergenerational injustice.

Want to restore democratic control over economic policy? You're defending exclusion and inequality.

This is the ultimate sophistication: a control system that makes resistance psychologically and socially impossible by ensuring that all alternatives appear morally monstrous.

The Historical Precedent

This dual-layer architecture isn't unprecedented. Similar patterns appear throughout history when elites seek to justify major systemic changes:

Colonialism was justified as ‘civilising mission’87 and development aid.

Enclosure movements were presented as agricultural improvement and efficiency88.

Industrial capitalism was sold as progress and liberation from traditional constraints.

Central banking emerged as crisis response and financial stability.

Each transformation paired technical control mechanisms with moral narratives that made resistance appear backward and selfish. The current system represents the perfection of this technique — comprehensive control justified by comprehensive moral concern, enabled by Zimmern’s repivot of the British Empire around economics and international social justice.

Conclusion: The Choice That Isn't

We stand at a crossroads that has been engineered to appear as if only one path is morally acceptable. The choice is presented as: accept algorithmic governance disguised as inclusive capitalism, or defend an immoral system of exploitation and destruction.

But this is a false choice created by architecture itself. The technical infrastructure and ideological cover have been co-designed to make alternatives literally unthinkable. We're asked to choose between technocratic salvation and moral damnation, never questioning whether those are actually the only options.

The real choice is whether we recognise this engineering for what it is: the construction of consent for a system that eliminates economic freedom in the name of justice, that replaces democratic deliberation with algorithmic enforcement, and that makes human agency subordinate to expert-determined definitions of planetary and social good.

Understanding the dual-layer architecture is the first step toward imagining genuine alternatives — systems that could address real global challenges without sacrificing human agency to algorithmic control, that could promote justice without eliminating freedom, that could protect the planet without enslaving its people to the moral calculations of unelected experts.

The ‘moral operating system’ wants us to believe there is no alternative.

Our task is to prove it wrong.

The Historical Blueprint: Technocracy's enduring legacy

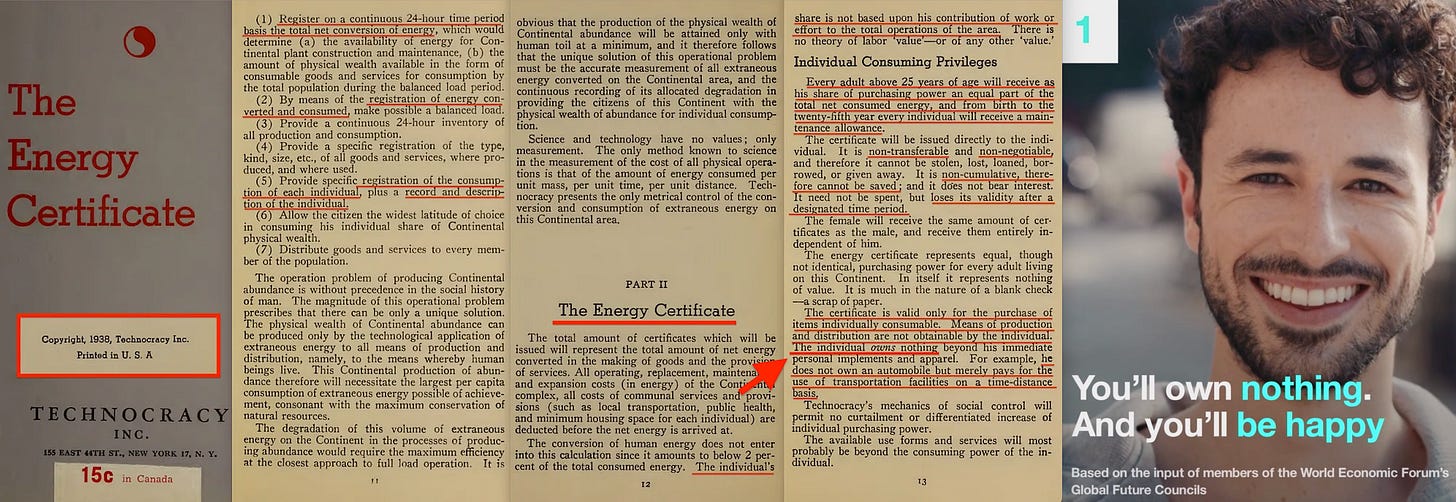

But perhaps we shouldn't be surprised by any of this. In 1936, Technocracy, Inc. proposed an ‘energy certificate’89 — a radical reimagining of money based on energy units rather than gold or fiat currency. The document made one thing patently clear:

The individual owns nothing.

Meanwhile, their ‘Study Course’90 outlined a specific bidirectional chemical reaction — the convertibility of carbon from solid (or liquid) state to gaseous through combustion, causing emission. The reaction runs in reverse through sequestration. In other words, by burning fossil fuels for energy, we emit carbon dioxide, while the growing of trees or other biodiversity sequesters it, working to remove it from the atmosphere.

This, in effect, translates into the mechanics of the energy certificate. However, should we focus on the dynamics of carbon emission and sequestration rather than energy output, it becomes clear that the energy certificate is simply the other side of the coin from carbon-backed CBDCs.

The study course was written by M. King Hubbert91 — a scarcity narrative perfectly aligned with technocratic logic that scarce resources require expert management for optimal allocation92.

What we're witnessing isn't the organic emergence of climate-conscious finance. It's the implementation of a technocratic vision nearly a century in the making — one that explicitly understood that controlling energy (and by extension, carbon) meant controlling human economic activity at the most fundamental level.

The ‘inclusive capitalism’ narrative isn't hiding a new form of control. It's providing progressive cover for one of the oldest technocratic dreams: a society where individual economic freedom disappears into algorithmic optimisation for collective goals, where ownership becomes obsolete, and where human agency gets subordinated to expert-designed systems.

The energy certificate has finally arrived — deployed through our ‘Four-Move Playbook‘; Crisis → Intermediation → Conditionality → Control.

Carbon budgets framed as existential emergency create political license for extraordinary measures. Central banks and expert institutions provide the technical ‘solutions’ through programmable money infrastructure. International bodies standardise the data formats that wallets must query before transactions settle. And governments inherit algorithmic enforcement without needing new legislation — just update the oracle or smart contract.

All managed by 'expert' mediators, cloaked in care.