Unbroken Line

Modern government systems have developed around three key building blocks that work together. First, money gets concentrated into central banks and clearing systems. Second, computer systems and automation take over more decisions. Third, moral arguments about fairness and justice are used to justify and control these systems.

This pattern — money first, then automation, then ethics — runs from 19th-century socialist thinkers right through to today's digital currencies and global institutions. Marx, Engels, Lenin, and Bogdanov each contributed essential pieces to this vision. They imagined centralised credit, universal record-keeping, systematic modelling, and moral justification for it all.

The same pattern connects 19th-century texts to 21st-century central bank digital currencies (CBDCs), digital IDs, and the UN's proposed Emergency Platform.

Concept

Marx and Engels: The Foundation

The first major issue we need to address is that of the dictatorship of the proletariat1. Marx and Engels described it as a ‘temporal state’, yet they offered no credible exit ramp — no institutions, milestones, or mechanism for its dissolution. The only concrete blueprint they left is the seizure and consolidation of power.

The conclusion here is obvious — they never intended a transition from the dictatorship of the proletariat. The dictatorship is the intended end state.

In this context, the Communist Manifesto2 (1848) lays out a clear political programme. One of its ten main points calls for 'centralisation of credit in the hands of the State, by means of a national bank with State capital and an exclusive monopoly'. This is basically an instruction manual: control the money system, and you control economic life. Engels later sharpened this idea, arguing that centralised planning and administration are necessary companions to industrial capitalism's way of organising labour.

Marx develops his ideas on money more thoroughly in Capital3 (1867–94). In Volume II4, he maps out producer-consumer pairs and circuits of production and reproduction, showing how each producer's output becomes another's input in interconnected chains. His key analytical move — introduced in Volume I5 — is distinguishing between two circuits of exchange: C-M-C (Commodity-Money-Commodity), where people sell something to buy what they need, and M-C-M' (Money-Commodity-Money'), where money is used to acquire more money.

Marx's theoretical framework privileged C-M-C as the ‘natural’ form whilst treating M-C-M' as a capitalist distortion. That inversion creates a blind spot: it effectively recasts money’s store-of-value function as illegitimate surplus6, even though most people routinely save for emergencies or future purchases. It also assumes away the uncertainty behind why people hold cash — what Hayek later called the ‘pretense of knowledge’7. It’s trivial to shoot down Marx’s ideas in this ‘temporary’ state, not least through enterprise spending such as research and development not typically guaranteed a long-term return.

In Volume III8, Marx analysed the credit system as a form of social coordination across enterprises — essentially a proto-planning mechanism. Despite these limitations, Marx's coordination analysis proved prescient. For Marx, getting rid of money didn't mean eliminating coordination — it meant replacing prices with a managed system based on 'socially necessary labour time'. He imagined: 'The producers may, for instance, receive paper tokens entitling them to withdraw from the social supplies a quantity corresponding to their labour-time. These tokens are not money. They do not circulate'. Workers would receive certificates corresponding to the socially necessary labour time they contributed, and could exchange these for goods requiring equivalent labour time to produce9.

However, this preserves money’s coordinating role while making it less functional and more bureaucratic. Central authorities would need to estimate what constitutes 'socially necessary labour time' for different types of work, determine exchange rates between labour time and various goods, and continually measure how much labour actually goes into production. Rather than prices emerging from decentralised market interactions, everything becomes a central planning calculation. The 'direct ledger system' Marx envisioned is actually more indirect than money — requiring layers of bureaucratic estimation between workers and consumption, while eliminating money's flexibility and store-of-value function that enables efficient resource allocation over time.

Hence, money is not eliminated; it returns in a more rigid, centrally planned form, dependent on continuous monitoring of the labour market.

This same pattern appears in Technocracy Inc's energy certificates10, which likewise cannot circulate or accumulate — non-transferable ration tickets tied to energy units rather than labour time. Both systems identified money's ability to circulate and store value as the core problem, replacing it with rigid certificates that preserve coordination whilst eliminating the dynamic features that enable complex economic relationships over time. Despite different theoretical foundations (labour theory vs energy accounting), both converged on the same anti-circulation approach to economic coordination.

The broader logic behind both Marx's vouchers and Technocracy's certificates is crucial: if money is abolished, then every material flow must be surveilled to maintain coordination. Without price signals to coordinate production, central authorities must track all inputs and outputs directly. This leads directly to Leontief's input-output tables (1936), which mathematically model exactly these material flows between economic sectors. That same logic underpins PPBS and today's circular economy frameworks, where every emission, input, and output is logged, tracked, and managed through digital systems.

The implication here is this — by replacing the traditional unit of account (money) with labour-time bookkeeping, the onus shifts to a system that, by necessity of coordination, requires full, system-wide monitoring of all inputs — any of which can become scarce. A failure to track even a single material could interrupt the producer–consumer relationships outlined in Capital.

This logically leads to a situation where all materials are monitored continuously. Failure to do so means any producer–consumer relationship could break down at any time. Consequently, the system tends toward comprehensive, system-wide monitoring of material flows.

In this context, the Grundrisse suddenly becomes important. In the ‘Fragment on Machines’, Marx sketches a tendency toward extensive automation that progressively optimises out the middle classes. Consequently, by logical deduction from Marx’s own material, the envisaged end state of communism implies a regime of blanket, always-on global surveillance, which again aligns with the technocratic vision.

There’s another crucial factor: in a ‘circular’ system, material isn’t eliminated; it’s transformed and dispersed, changing the cost of recovery. In effect we face three resource types:

Renewables (such as grown food).

Non-renewables whose fundamental form remains intact (metals that can be recycled, albeit with potential losses)

Non-renewables whose state changes (such as fossil fuels burned into dispersed byproducts).

The odd one out is the state-changing non-renewable: once combusted, it cannot be restored to its original state without massive energy and inputs, so the loop can’t truly be closed. And that’s where we, yet again, find alignment with Technocracy, Inc’s energy certificate.

The Automation Vision

In the Grundrisse11 (1857–58), Marx added the automation element that would prove prophetic. In his famous 'Fragment on Machines'12, he observed that 'the creation of real wealth comes to depend less on labour time and on the amount of labour employed than on the power of the agencies set in motion during labour time'.

Marx envisioned a future where machinery and technology absorb not just manual labour, but the knowledge and skills that define middle-class work. He wrote that knowledge becomes 'general intellect' embedded directly into the machines themselves. The craftsman's knowledge goes into machine programming, the manager's coordination gets replaced by algorithmic systems, the professional's expertise becomes artificial intelligence. This process essentially optimises the middle classes out of production.

Marx also anticipated how this 'general intellect' would become concentrated in the hands of those who control the technological apparatus. As human knowledge gets encoded into systems, it becomes the property of whoever owns those systems rather than the workers who originally possessed the knowledge. This creates a new form of dependency where vast populations become reliant on technological infrastructures they neither own nor fully understand. The social knowledge that was once distributed across communities gets centralised into technical systems controlled by a small number of institutions.

As machines absorb human labour in this way, the regulation of value by labour-time is progressively undermined. When production is largely automated, the classical labour-time regulator no longer operates in the same way. Coordination must therefore shift from market prices to conscious accounting and automated feedback systems — basically predicting cybernetics and systems theory. Without labour time as the measure, everything must be planned and monitored directly through technological surveillance. Marx foresaw that this transformation would require new mechanisms of social control, as traditional market relations become inadequate for managing an economy where human labour plays a diminishing role in wealth creation.

Consequently, Marx’s envisaged communist end state is, in effect, a surveillance state in alignment with the Technate, where coordination requires comprehensive, continuous monitoring of material flows, or producer–consumer linkages risks breaking down over time.

Lenin: Making It Political

Lenin turned this vision into explicit politics and made universal bookkeeping — which in practice entails a blanket surveillance state — and control the essence of socialist governance. He understood that Marx's theoretical insights about money, automation, and coordination needed to become practical mechanisms of political control. In ‘The State and Revolution’13 (1917), he declared: 'Accounting and control — that is mainly what is needed for the "smooth working", for the proper functioning of the first phase of communist society'. For Lenin, this wasn't administrative detail — it was the fundamental technology of socialist transformation.

This marked a crucial shift from Marx's analysis to Lenin's implementation strategy. Where Marx had focused on understanding capitalism's internal contradictions, Lenin designed the practical apparatus for replacing it. He made book-keeping the political essence of socialism itself, arguing that whoever controlled the flows of information controlled society. In The Impending Catastrophe and How to Combat It14 (1917), he wrote: 'socialism is merely state-capitalist monopoly which is made to serve the interests of the whole people and has to that extent ceased to be capitalist monopoly'. The implication is clear: socialism is not the opposite of state capitalism but its perfected form — retooled to serve the ‘common good’ under different management.

Lenin grasped the political implications that Marx only implied. Once prices and markets were displaced, only systematic surveillance of inputs and outputs could maintain social order. Universal record-keeping wasn't just helpful — it was the essence of socialist governance. In a complex industrial society, he saw that political power rests with those who can track, measure, and coordinate the flows of materials, labour, and information. Lenin thus translated Marx's economic analysis into a blueprint for political control through a monopoly on information.

And this information would then require interpretation and enforcement — tasks for which the vanguard party15 and the Cheka16 proved instrumental.

Bogdanov: The Systems Thinker

Bogdanov completed this theoretical quartet and provided the crucial bridge between Marx's economic analysis and modern systems theory. In Tektology17 (1913–22), he took Marx's producer-consumer pairs and extended them into a comprehensive analysis of supply chains — and then went much further. He portrayed society as an organism of flows, substitutions, and feedback loops, where every element could be understood in terms of its organisational relationships. Where Marx saw circuits of capital moving between producers and consumers, Bogdanov generalised this to circuits of organisation flowing through all social systems — economic, political, biological, and technological. His insight was that the same organisational principles governed everything from cellular metabolism to industrial production to social coordination.

Bogdanov's 'universal organisational science' became an early template for Soviet planning and later systems theory, anticipating cybernetics decades before Norbert Wiener18 coined the term. He argued that all systems — whether human bodies, economies, or societies — operate through the same basic principles of regulation, feedback, and adaptive organisation. In his hands, Marx's ledger concept evolved into something far more sophisticated: society's nervous system. Information flows would coordinate social activity much as the nervous system coordinates biological activity.

This wasn't just record-keeping — it was the active regulation of social metabolism through information feedback loops. His ideas circulated among Bolshevik intellectuals and foreshadowed elements of Gosplan’s approach; they also prefigured themes later developed in General Systems Theory (Bertalanffy, Boulding, Jantsch), cybernetics, and modern management science.

But for Bogdanov, control by force alone was undesirable. Thus, his Proletkult19 developments sought to integrate a common ethic into the broad masses through culture. This meant that arts, media, music, film, and literature should all instill the same shared values.

But that ethic still had to come from somewhere. To that end, he developed empiriomonism20 — ultimately a collectively subjective interpretation of available facts. In short, a collectivist interpretation of material reality. And that interpretation would arrive through the administrators of socialist mediation between opposing forces in society.

Thus, Empiriomonism distils value from available material facts, Proletkult communicates it to the masses, and Tektology organises all aspects of nature, including human society itself.

Administratively, this was realised under Lenin’s New Economic Policy (1921–28): the Communist Party mediated between state and private production through licensing, quotas, and state-bank credit, with pricing and procurement supervised by Gosplan/VSNKh. Private ‘NEPmen’ operated only under party oversight and ledger-based control — an administrative market subordinated to bookkeeping and surveillance rather than autonomous exchange.

The Ethical Framework

Marx's Critique of the Gotha Programme21 (1875) set the ethical pillar: in the lower stage of communism, distribution runs on labour-time vouchers rather than money:

He receives a certificate from society that he has furnished such-and-such an amount of labor (after deducting his labor for the common funds); and with this certificate, he draws from the social stock of means of consumption as much as the same amount of labor cost. The same amount of labor which he has given to society in one form, he receives back in another.

As previously discussed, these vouchers do not circulate or accumulate and cannot form capital — a shift from market pricing to direct social accounting, which presupposes central monitoring of labour inputs.

The higher stage would transcend even this direct exchange, operating according to the famous principle: 'from each according to his ability, to each according to his needs'. This represents not just economic reorganisation but moral transformation — society moves beyond the 'narrow horizon of bourgeois right' to ‘genuine’ cooperation.

But Marx was clear that this transition required material abundance created by the lower stage's systematic coordination. The ethical imperative thus becomes the legitimating principle of allocation, providing moral justification for what was essentially a vast surveillance and coordination apparatus — especially during times of scarcity observed in practice.

This pattern — using moral language to justify systemic control — anticipates precisely the role that justice, equity, and sustainability would later play in technocratic governance. Ethics wouldn't constrain the system from outside; it would become the system's internal logic, embedded in its allocation algorithms and eligibility criteria.

Timing Matters

The publication history of the Grundrisse itself reveals something significant about the relationship between theory and practice. Marx's most systematic exploration of automation and cybernetic coordination lay dormant for over eighty years, remaining largely unknown even to most Marxists. It appeared only in 1939–41, published by the Marx-Engels Institute in Moscow after the Bank for International Settlements (1930) had created a permanent clearing house for central banks, and precisely as the Second World War distracted global attention from institutional developments.

The timing is telling — Marx's most 'cybernetic' text, focused on circuits, automation, and general intellect, surfaced precisely as global institutions began embedding systematic coordination via Operations Research22.

The theoretical framework preceded its institutional realisation by nearly a century. Marx's most prescient insights about automated coordination remained hidden while the practical infrastructure was being built. The theoretical sequence is therefore clear: Capital (money as proto-ledger and input-output analysis), Grundrisse (automation displacing labour time and enabling surveillance), Lenin and Bogdanov (record-keeping and systematic flows as the essence of politics), and Critique (ethics as distributive legitimacy and moral justification).

Together, these texts foreshadow the full architecture that would eventually emerge: centralised money, automated systems, and moralised enforcement. Each pillar reinforces the others, creating a self-sustaining system in which financial control, technological coordination, and ethical legitimation operate as a unified apparatus of governance.

Practice

The institutional history followed exactly the same sequence.

Money Came First

London's Bankers' Clearing House23 in the late 18th century pioneered multilateral netting, allowing banks to settle their mutual obligations through a central mechanism rather than bilateral exchanges. This created the template for systematic financial coordination. Peel's Bank Charter Act24 (1844) then consolidated note-issuing power exclusively in the Bank of England, effectively fusing state authority with monetary finality and establishing the principle that ultimate settlement required state validation.

The Federal Reserve25 (1913) centralised US credit by creating a network of regional banks under federal coordination, giving the central authority power over the money supply and interest rates. The Bank for International Settlements26 (1930) extended this logic internationally, providing central banks with a supranational clearing hub and forum for coordinated monetary policy. Bretton Woods27 (1944) unified global exchange rates under the dollar-gold system, making the Federal Reserve the de facto coordinator of international monetary relations.

The Nixon Shock28 (1971) completed the transformation by removing the last link to physical commodities, making money purely a matter of administrative decision. Settlement became pure ledger entry validated by institutional authority rather than commodity backing. The principle was now established: whoever controlled the final settlement mechanism essentially wrote the constitution of economic life, determining what counted as valid money and valid transactions.

Then Came Automation

Bogdanov's Tektology provided the conceptual language for understanding society as ‘interdependent’, interconnected systems. Bertalanffy’s General Systems Theory29 developed a similar organisational framework, while Leontief’s input–output analysis30 (1936) made intersectoral flows mathematically computable — the first systematic method for tracking how outputs in one sector become inputs in others.

This operationalised Marx's logic that without money, every material input and output must be directly tracked — the same principle now driving the circular economy31. By the 1960s, systems analysis3233 had entered government through RAND Corporation34, which developed mathematical approaches to military strategy, logistics, and resource allocation during the Cold War.

The Planning-Programming-Budgeting System35 (PPBS), pioneered by Defense Secretary McNamara36, turned governance into engineering by applying RAND's methods to civilian administration. Money, manpower, materials, and mission outputs became measurable and comparable through systematic cost-benefit analysis. PPBS required every government programme to justify its existence through quantified objectives and performance metrics, essentially replacing political debate with technical optimisation.

Yet, JFK drew a crucial line. He declined to endorse creating a centralised National Information/Data Center37, and — during the Cuban Missile Crisis — he rejected pre-emptive air strikes urged by the Air Force and analytical planning circles, choosing a naval quarantine instead and keeping McNamara’s systems analysis subordinate to political judgment. After his assassination in November 1963, the National Data Center proposal moved forward under the Bureau of the Budget38, and in August 1965 LBJ mandated PPBS government-wide39 — the very expansion Kennedy had not undertaken.

McNamara then systematically exported this approach: first through the World Bank, where he served as president from 1968-198140, then to the UN system, where it evolved into Results-Based Management41 frameworks that now govern global administration. What Kennedy resisted — systems analysis on a broad scale — became the operating grammar of global governance. His death marked a political hinge point between democratic discretion and technocratic management.

From there, automation globalised through key intellectual bridges. Kenneth Boulding’s ‘Economics of the Coming Spaceship Earth’42 (1966) popularised the idea of planetary limits and the need for systematic resource management, framing Earth as a closed system requiring conscious coordination — logically tending toward surveillance of key materials, an effort that evolved into the circular economy in 1990 (Pearce & Turner43).

Erich Jantsch developed evolutionary systems planning — the idea that governance must be recursive and adaptive, constantly adjusting based on feedback loops and environmental changes44. The Club of Rome created the first true planetary dashboard with their global modelling (Limits to Growth45, 1972), applying systems analysis to Earth itself and demonstrating how computer models could simulate global resource constraints.

Together, Boulding's Spaceship Earth, Jantsch's evolutionary systems, and the Club of Rome's planetary modelling provided the conceptual bridge from PPBS-style national systems management to Earth System Governance46 (global systems management). They reframed Earth itself as a system to be managed through technical coordination — turning McNamara’s government engineering into planetary management.

Digital databases and identity systems in the late 20th century tied individual people to centralised ledgers, making every citizen trackable through interconnected government and financial systems. Today, ISO 2002247 embeds machine-readable metadata into every payment transaction, whilst digital ID systems bind financial activities directly to verified identities. Central Bank Digital Currencies (CBDCs) place the control point at settlement, enabling programmed rules — spending caps, purpose codes, geofencing, eligibility scores — to execute automatically. Even if the base unit is branded ‘non-programmable’, controls can operate at the wallet, scheme, or settlement-rule layer.

The record-keeping society became instantaneous and programmable, with Jantsch's evolutionary feedback systems and the Club of Rome's planetary modelling providing the intellectual framework that justified the UN's Emergency Platform48 as the logical culmination of Earth system governance — a global control system capable of managing planetary ‘shocks’ through real-time surveillance and coordination of money, resources, and human behaviour during times of crisis… real or not.

Finally, Ethics

Marx's distributive maxim reappears in modern form as ESG criteria (Environmental, Social, Governance), carbon accounting, biodiversity credits, and One Health frameworks. Each provides moral legitimacy — equity, stewardship, justice — whilst functioning as technical eligibility conditions that determine access to capital, services, and participation. ESG scores now determine which companies receive investment, which projects get funding, and which activities are deemed socially acceptable. Carbon accounting systems measure and price every emission, creating markets in atmospheric management. Biodiversity credits commodify nature conservation, allowing environmental destruction to be offset through ledger entries. One Health frameworks integrate human, animal, and environmental health into unified monitoring systems that can justify interventions across all three domains.

These frameworks are migrating from aspirational guidelines into hard technical requirements embedded within identity, payment, and settlement infrastructure. COVID-19 normalised health passes as digital gates to economic and social participation, demonstrating how quickly moral imperatives could become executable code. QR codes and vaccine passports showed how ethical compliance could be automated at the point of transaction — no human judgement required, just algorithmic verification of moral status.

Climate and sustainability metrics now guide capital allocation through automated systems that screen investments, loans, and business partnerships based on environmental scores. Banks increasingly refuse financing for projects that fail climate criteria, not through human decision but through algorithmic pre-screening. Ethics is no longer aspirational — it's executable in code, embedded directly in the financial infrastructure that mediates economic life. The moral vision that Marx articulated as ‘to each according to his needs’ has become a programmable reality, except that ‘needs’ are now defined by technocratic algorithms rather than democratic deliberation.

On the cultural–ethical side, Hans Küng’s Global Ethic49 project and David Tàbara’s cultural frameworks50 for sustainability transitions supply the codified value scripts that contemporary systems operationalise — modern counterparts to Proletkult’s role in mass ethical formation.

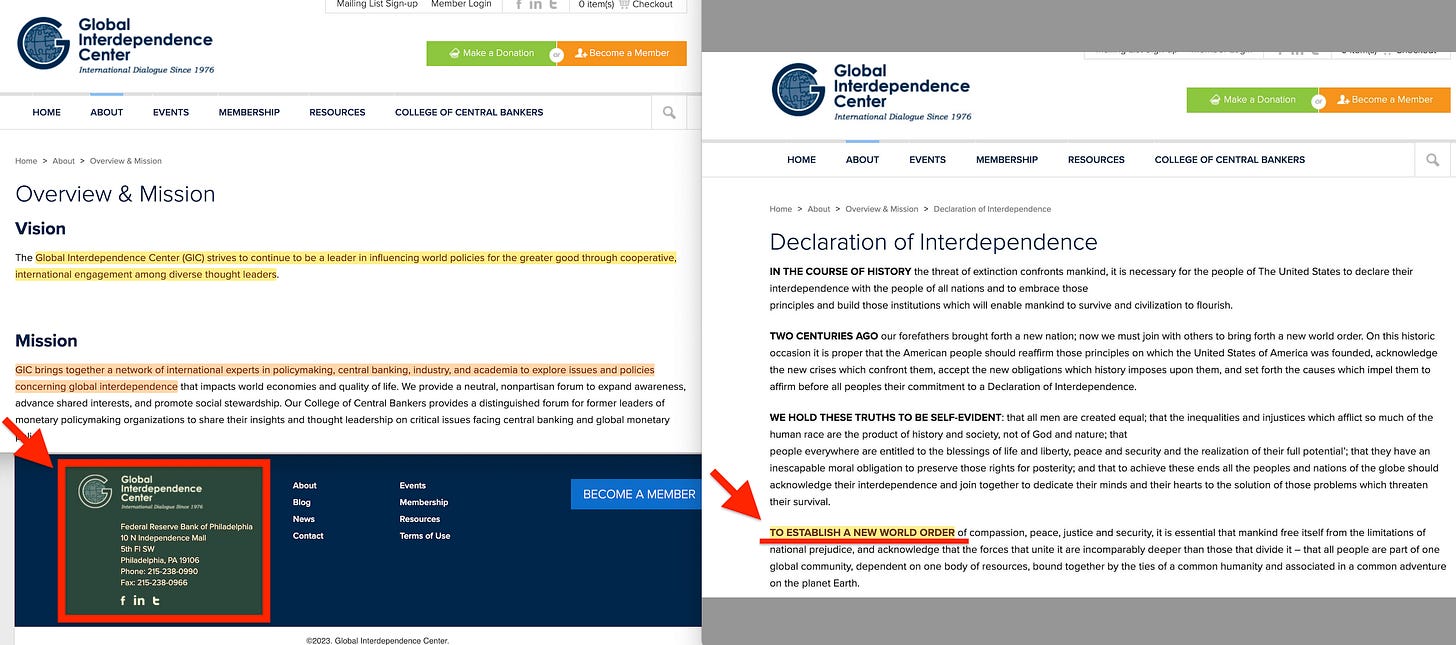

Reality

The three pillars converge in the UN Secretary-General's proposed Emergency Platform (2023), outlined in the policy brief ‘Strengthening the International Response to Complex Global Shocks’51. Designed to manage 'complex global shocks' — pandemics, climate disasters, cyber attacks, supply chain disruptions — the Platform would concentrate coordinating authority at the international level, bypassing traditional diplomatic processes during declared emergencies commonly predicted by ‘black box’ global modelling52. The proposal envisions a standing global authority with pre-positioned powers to coordinate responses across sovereign boundaries, essentially creating a planetary control room that would activate during crises.

The argument is entirely systematic: modern crises cascade through interconnected global systems faster than deliberative politics can respond. Traditional governance — parliaments, legislatures, democratic consultation — operates too slowly for supply chain failures, viral outbreaks, or climate emergencies that spread through digital networks at electronic speed. The Platform's advocates argue that complex systems require systems-level responses, making democratic deliberation not just inefficient but dangerous during emergencies.

Yet, it’s a platform ripe for abuse. The ‘black box’ model template in essence diffuses responsibility when predictions are wrong, creating a large accountability gap that no one is prepared to shoulder. Most damning of all, the public has barely been told: no mainstream politician, scientist, or policy adviser appears to have warned openly about this trajectory.

Its mechanics represent the three pillars fused into a unified architecture. The monetary rail, built on Central Bank Digital Currencies and instant payment systems, can be designed to enforce behavioural controls directly at the point of settlement. During emergencies, spending could be restricted to essential goods, limited to specific geographical areas, or conditional on compliance with health, climate, or security protocols. No human enforcement needed — the money itself becomes programmable based on emergency criteria.

The systems layer combines digital identity verification with descendants of PPBS global modelling systems to make all social and economic flows visible and trackable in real time. Digital IDs linked to financial accounts, health records, carbon footprints, and mobility data would feed into global dashboards monitoring everything from resource consumption to population movements. AI models trained on decades of systems analysis would hypothetically predict crisis cascades and recommend interventions before human decision-makers could even understand what was happening.

Yet, there’s no accountability anywhere in the system, creating a major risk of abuse.

The ethical imperative provides moral legitimacy for these interventions through established frameworks of equity, sustainability, and health. Emergency measures become not authoritarian impositions but moral necessities; ‘protecting the vulnerable, preserving the planet, ensuring public health’. Opposition becomes not political disagreement but moral failing, selfish, ‘anti-science’ individualism allegedly threatening collective survival.

In the Emergency Platform, money, automation, and ethics become one seamless architecture — a cybernetic constitution where technical capability, financial control, and moral authority operate as integrated functions of the same system. It represents the logical endpoint of the theoretical journey from Marx's vision of systematic coordination to its full institutional realisation as global governance.

Unbroken Line

From Marx and Engels through Lenin and Bogdanov to CBDCs and the UN Emergency Platform, the theoretical spine remains completely intact across 175 years of development. What began as 19th-century analysis of capitalism's contradictions has become the operational blueprint for 21st-century global governance.

The money pillar…

… traces an unbroken line from centralised credit control to programmable settlement. Marx's analysis of banking in Capital identified credit systems as proto-universal book-keeping that already coordinated production across enterprises. Engels showed how socialised production made state centralisation inevitable. This theoretical foundation enabled the practical progression: London's clearing houses, central banks, the Federal Reserve, BIS supranational coordination, Bretton Woods global monetary management, and finally the Nixon Shock's complete separation from commodity backing. Today's Central Bank Digital Currencies represent the perfection of this logic — money as pure administrative ledger entry, programmable in real time according to policy objectives.

The automation pillar…

… evolved from Marx's insights about technological displacement through systematic theoretical development. In Capital, Marx’s producer–consumer pairs anticipate Leontief’s input–output analysis, while the ‘Fragment on Machines’ foresees automation absorbing middle-class expertise. Bogdanov’s Tektology generalised these insights into a universal organisational science of interconnected feedback systems, later developed into Systems Analysis.

Lenin translated this into political practice through systematic accounting and control. Leontief mathematicised the flows, making them computationally tractable. PPBS operationalised them for government management. Digital identity systems tied individuals to the tracked flows. The progression culminates in today's real-time surveillance systems where every transaction, movement, and choice feeds into algorithmic coordination mechanisms.

The ethical pillar…

… transforms Marx's distributive vision into technocratic legitimation. The Critique's principle of 'to each according to his needs' promised moral allocation beyond market mechanisms. This same moral energy now drives ESG frameworks, One Health integration, and planetary justice narratives — except that 'needs' are determined by algorithmic assessment rather than democratic deliberation. Climate metrics, health scores, and social credit systems embed moral judgements directly into economic infrastructure, making ethical compliance a prerequisite for participation.

Each stage…

… reinforces the others in accelerating feedback loops. Centralised money makes systematic coordination technically feasible by providing a universal unit of account and control mechanism. Automation displaces market coordination with algorithmic models that can process vastly more information than human decision-makers. Ethics legitimises the resulting purpose-gating by framing systemic control as moral necessity. Settlement sovereignty becomes programmable morality — with ethical imperatives no longer external constraints imposed on economic activity but through CBDCs embedded directly in the unit of account itself.

What Marx, Engels, Lenin, and Bogdanov theorised as the technical requirements of post-capitalist coordination — and what Kennedy briefly recognised and resisted as the death of democratic discretion — has become the architecture of contemporary governance. It operates as a cybernetic constitution where ledgers, machines, and morals converge into unified control mechanisms.

The proposed Emergency Platform represents the logical culmination: a de facto apex ledger that validates not only financial transactions but the purposes of life itself, determining who can participate in economic and social activity based on algorithmic assessment of their compliance with programmed ethical criteria.

This emergency framework points toward the true endpoint: Inclusive Capitalism where every transaction is guided by per-transaction conditional scoring, with moral criteria directly embedded into each economic interaction.

Every purchase, payment, and financial decision is evaluated in real time against programmed ethical criteria — carbon footprint, social impact scores, health compliance, geographic restrictions, temporal limits… purpose codes.

Cui Bono?

The ultimate conclusion is that Marx, Engels, Lenin, and Bogdanov — despite their critique of capitalism — describe mechanisms that, in practice, enpower central banks rather than abolish them. What appears as theoretical opposition to centralised financial power becomes its institutional blueprint.

Money is never truly eliminated. Marx’s labour-time vouchers are non-transferable credits — functionally akin to issuer liabilities stripped of circulation and store-of-value functions. They still require an issuing authority to calculate labour equivalence, validate distribution, and maintain the ledger. That authority in effect functions as a monopolistic clearing house — precisely the role central banks already occupy. The vouchers don’t eliminate the need for monetary infrastructure; they make it more centralised and comprehensive.

Visibility expands beyond money. Once circulation is blocked, coordination must come from direct surveillance of inputs and outputs. This is Leontief's logic in mathematical form: every material flow must be measured, accounted for, and balanced. By managing the apex ledger, central banks become the only institution with visibility not just into financial accounts but into the entire metabolism of society — production, consumption, emissions, energy, labour. What was once fragmented across multiple institutions gets consolidated into a single monitoring system.

The architecture collapses into one node. Engels' call for ‘centralisation of credit’, Lenin's demand for ‘accounting and control’, and Bogdanov's vision of society as an information system all presume a single universal validator. For bankers, this is not a threat but an opportunity: political ideologies may shift, but the necessity of a monopoly ledger remains. Every transaction, every allocation decision, every compliance check must ultimately flow through the same central infrastructure.

Money persists as programmable credit. Even in Marx's scheme, the voucher system preserves the basic money function — a unit of account allocating access to goods. The abolition of commodity money does not abolish money itself; it transforms it into administrative entries on a master ledger. This is exactly what central banks have operationalised via clearing houses and fiat issuance, and what CBDC architectures extend — programmability at the wallet/scheme/settlement-rule layer. The technical infrastructure remains identical; only the criteria for allocation change.

Surveillance becomes legitimacy. Where once central banks' role was to guarantee liquidity and solvency, under this architecture they are cast as guarantors of justice. By validating — or enforcing eligibility via — ESG thresholds, carbon limits, labour-time equivalences, or health compliance, the bank's balance sheet becomes the mechanism through which moral criteria are enforced. Central banks thus shift from neutral technicians to moral arbiters of economic life, with vastly expanded authority justified by ethical imperatives.

What appears in Marx as a theoretical critique of money ends up making central banks indispensable. Abolishing circulation and markets only multiplies the scope of what must be centrally observed and recorded. The central bank’s remit expands from monetary policy to comprehensive social metabolism — a surveillance system not of one sector, but of society as a whole. The socialist critique of capitalism becomes the technical specification for its most sophisticated form of control.

Bogdanov’s vision of the ‘integral man’ completes this transformation. He envisioned individuals as integrated nodes within a larger organisational, ‘human super-organism’53, where social coordination operates like biological circulation — information and resources flowing through networks to coordinate collective activity. This biological metaphor becomes literal in the central-banking architecture, where central banks function as the heart of the circulatory system, pumping financial flows through digital networks that connect every individual to the organisational whole.

The circulation Bogdanov theorised as social coordination becomes the mechanism through which central banks monitor and control the entire social metabolism. Digital IDs, payment systems, and real-time transaction monitoring create pathways by which every economic action circulates via centrally monitored channels, transforming autonomous individuals into components of a managed system in which their role within the super-organism is both visible and controllable.

It’s a trajectory inviting comparison with the Fabian Society’s In Tandem54: its effect is to shift fiscal-policy power from the elected government’s Treasury to the Bank of England precisely when the Bank can engineer the ‘exception’ — for example, by running ultra-tight policy (rate hikes, balance-sheet contraction, liquidity withdrawal) that drives growth and credit creation below zero, triggers funding stress, and forces fiscal capitulation. If such Bank-made strains coincide with a ‘black-box’ modelled crisis, the UN Emergency Platform can even be activated in parallel.

From Marx and Engels through Lenin and Bogdanov, the line runs unbroken — with central banks reaping the rewards Marx once sowed55.

The content is free, access to links is for paying subscribers.